[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Say No To Trading [@SayNoToTrading](/creator/twitter/SayNoToTrading) on x 6321 followers Created: 2025-07-19 22:32:44 UTC While most people trim winners, whenever possible I only trim losers. Especially if doing so to buy another loser. Don't sell a winner to buy a loser. None of these were red but they were losers (laggards) and I sold/trimmed them this week for $ELV post earnings: Pultegroup $PHM - Too small of a position. Had XXX shares from the April low at $XX (intraday low past XXX years is $88). So never had chance to build it up. LKQ $LKQ - North America's largest recycler of used cars and trucks. They are complimentary, not competitor to $CPRT. Since I've been adding to Copart lately, sold out of much lower quality LKQ. Adobe $ADBE - Search my feed for reasoning. Currently only have XXX out of XXXXX shares I had at peak. First XX% chop was over a year ago. Lennar $LEN - Lower conviction relative to $NVR and $DHI. Masco $MAS - Too small of position, owned years, good return but I'm always looking to upgrade quality. MarketAxess $MKTX - Trimmed XX out of XXX. Continues to lag. Cost basis was $XXX on all so minimal gain. Steris $STE - Similar to Pulte, way too small, only one buy in from a couple years ago at an intraday low. Realty Income $O - Trimmed 2k shares. Built up in early 2010s with adds during Covid. Need to reduce dividend income. American States Water $AWR - Same reasoning, my dividend income has gotten too high. H2O America $HTO - Same Clorox $CLX - Same Charter $CHTR - Important digital infrastructure but no one thinks of it that way. They think of cable TV, but it's not that. Great return but lower conviction. I have brought holding down from XXX to XXX shares over the past couple months. FICO $FICO - Continue to stick with lowest cost only. As you know, these highest cost 10-15 were just acquired past few days at $1480s. You can't see it on the chart yet but $ELV updated PE for 2025 is 9x, assuming their guide of $XX EPS. Forward 2026 *should* be even lower.  XXXXX engagements  **Related Topics** [stocks](/topic/stocks) [$phm](/topic/$phm) [$elv](/topic/$elv) [stocks healthcare](/topic/stocks-healthcare) [pultegroup inc](/topic/pultegroup-inc) [stocks consumer cyclical](/topic/stocks-consumer-cyclical) [Post Link](https://x.com/SayNoToTrading/status/1946699754622382393)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Say No To Trading @SayNoToTrading on x 6321 followers

Created: 2025-07-19 22:32:44 UTC

Say No To Trading @SayNoToTrading on x 6321 followers

Created: 2025-07-19 22:32:44 UTC

While most people trim winners, whenever possible I only trim losers.

Especially if doing so to buy another loser.

Don't sell a winner to buy a loser.

None of these were red but they were losers (laggards) and I sold/trimmed them this week for $ELV post earnings:

Pultegroup $PHM - Too small of a position. Had XXX shares from the April low at $XX (intraday low past XXX years is $88). So never had chance to build it up.

LKQ $LKQ - North America's largest recycler of used cars and trucks. They are complimentary, not competitor to $CPRT. Since I've been adding to Copart lately, sold out of much lower quality LKQ.

Adobe $ADBE - Search my feed for reasoning. Currently only have XXX out of XXXXX shares I had at peak. First XX% chop was over a year ago.

Lennar $LEN - Lower conviction relative to $NVR and $DHI.

Masco $MAS - Too small of position, owned years, good return but I'm always looking to upgrade quality.

MarketAxess $MKTX - Trimmed XX out of XXX. Continues to lag. Cost basis was $XXX on all so minimal gain.

Steris $STE - Similar to Pulte, way too small, only one buy in from a couple years ago at an intraday low.

Realty Income $O - Trimmed 2k shares. Built up in early 2010s with adds during Covid. Need to reduce dividend income.

American States Water $AWR - Same reasoning, my dividend income has gotten too high.

H2O America $HTO - Same

Clorox $CLX - Same

Charter $CHTR - Important digital infrastructure but no one thinks of it that way. They think of cable TV, but it's not that. Great return but lower conviction. I have brought holding down from XXX to XXX shares over the past couple months.

FICO $FICO - Continue to stick with lowest cost only. As you know, these highest cost 10-15 were just acquired past few days at $1480s.

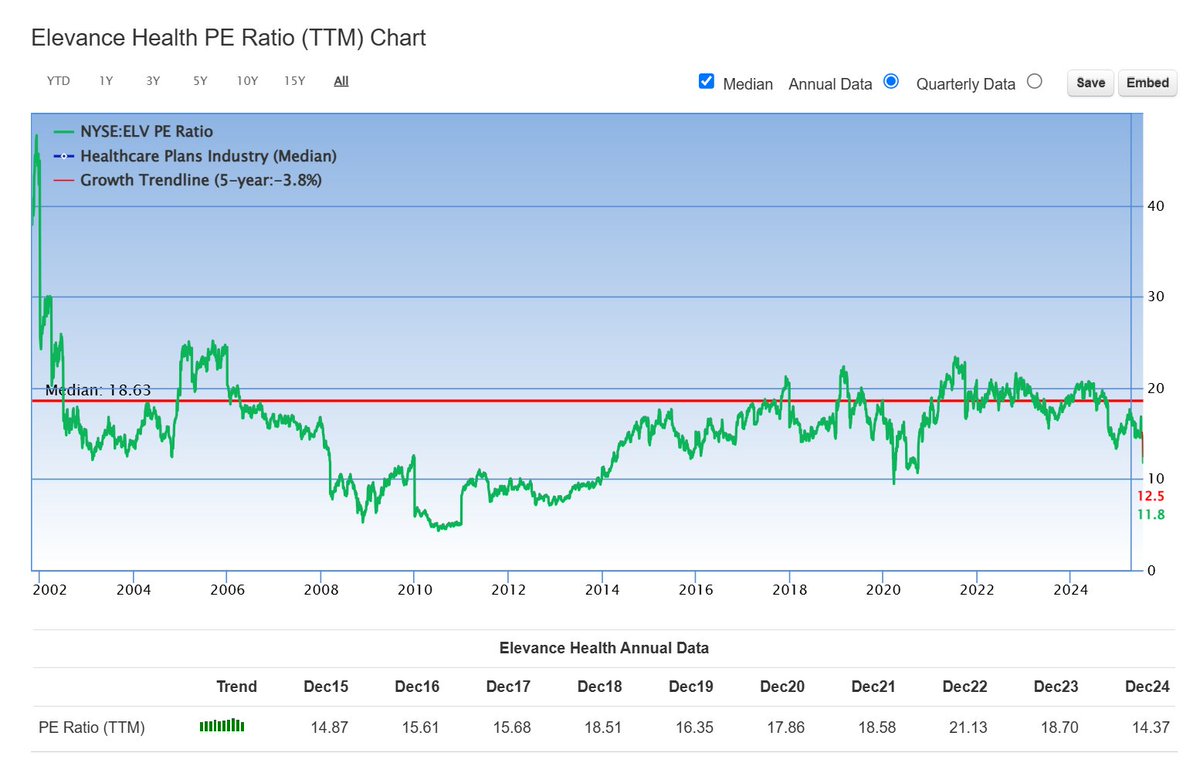

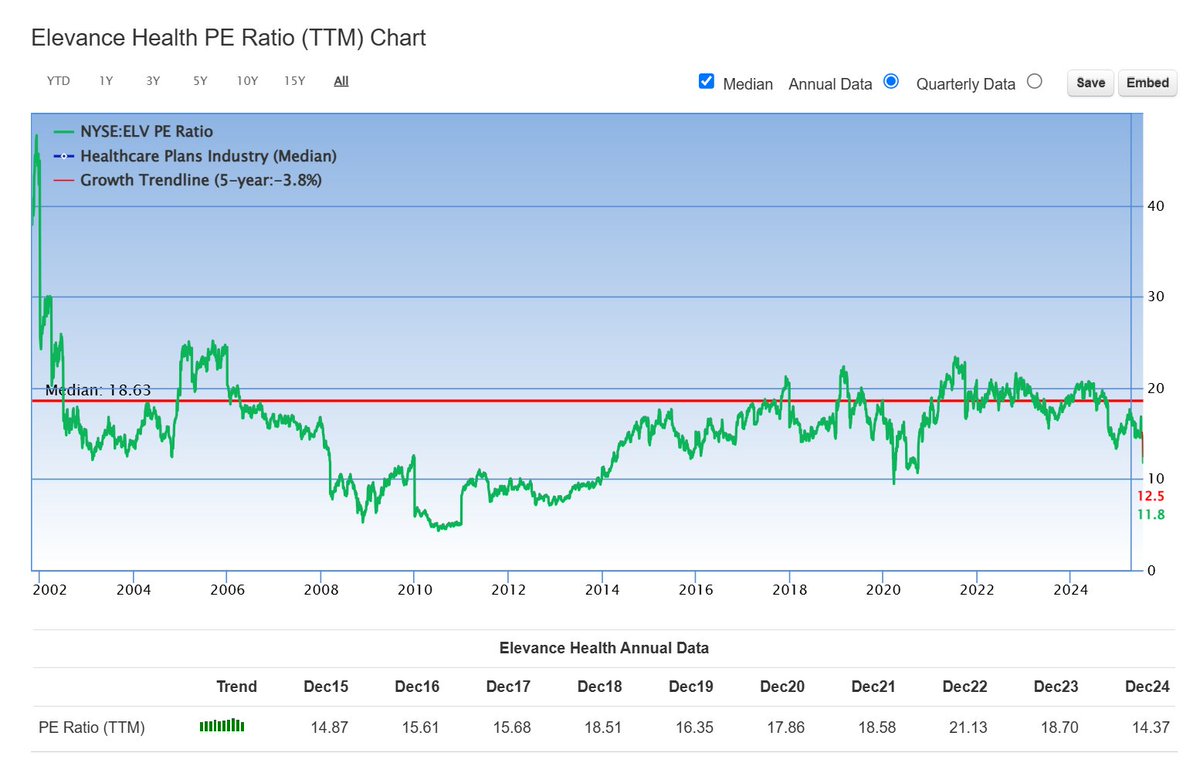

You can't see it on the chart yet but $ELV updated PE for 2025 is 9x, assuming their guide of $XX EPS. Forward 2026 should be even lower.

XXXXX engagements

Related Topics stocks $phm $elv stocks healthcare pultegroup inc stocks consumer cyclical