[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Dividend Growth Investor [@DividendGrowth](/creator/twitter/DividendGrowth) on x 227.1K followers Created: 2025-07-19 22:30:04 UTC Investing every month in S&P XXX regardless of valuation, and reinvesting dividends, has worked in building wealth over any XX year period since 1871 Valuations didn't really matter, because they never really got out of hand until the 1990s It doesn't really matter in the long run if you buy stocks at XX or XX times earnings, as those tend to average out over a long accumulation period. Heck, even the occasional XX times earnings is just a blip in the radar after XX years. Valuations don't really matter, untill they do however If valuations are permanently elevated when you invest, your margin of safety is lower and your forward returns could be reduced. By "high valuations", I would say anything over XX - XX times forward earnings would be very high, and it would reduce forward returns. As I mentioned above, the invest every month without checking valuations worked, precisely because valuations were moderate. However, this ignore fundamentals and valuations mentality would not work as well if we get to really extreme valuation levels. This model of just invest every month in an index no matter what basically failed to work in Japan in 1990 - 2023. That's because valuations were high in 1990 (at about XX - XXX times earnings), dividend yields were low (below 0.50%) and earnings growth was actually flat in the 1990s to early 2000s to add insult to injury. This model also didn't work as well in the US between 1999 - 2015, during the so called lost decade for stocks. It delivered returns for those who kept investing for XX decades even if you started in 1999. However, most of the returns came after a painful XX year period of no returns but two large 50%+ bear markets. A lot of people tell you to "just keep buying", and they are roughly right. However, you need to understand why it worked, and what circumstances could cause this to stop working  XXXXXX engagements  **Related Topics** [accumulation](/topic/accumulation) [stocks](/topic/stocks) [rating agency](/topic/rating-agency) [investment](/topic/investment) [dividend yield](/topic/dividend-yield) [$spy](/topic/$spy) [Post Link](https://x.com/DividendGrowth/status/1946699083403423922)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Dividend Growth Investor @DividendGrowth on x 227.1K followers

Created: 2025-07-19 22:30:04 UTC

Dividend Growth Investor @DividendGrowth on x 227.1K followers

Created: 2025-07-19 22:30:04 UTC

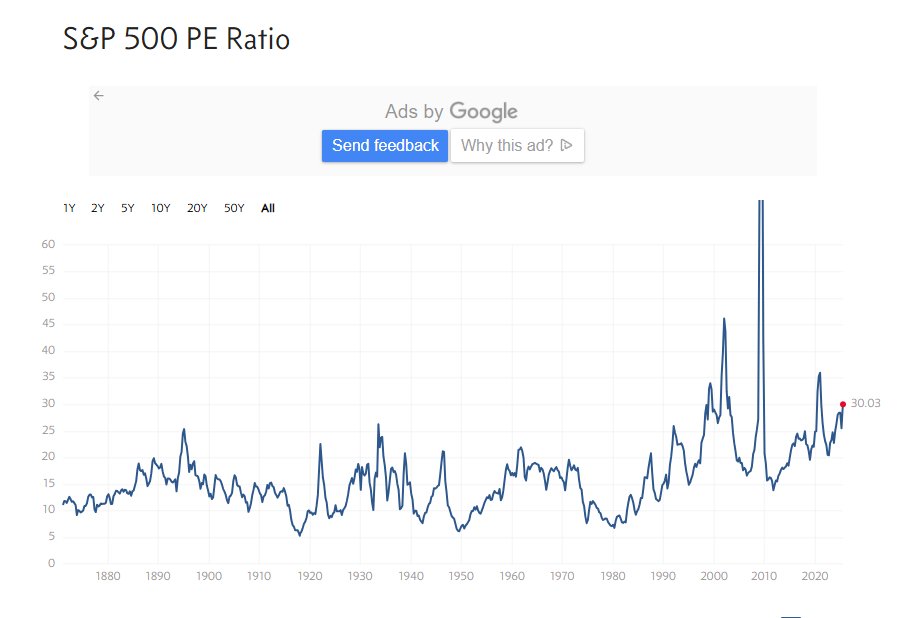

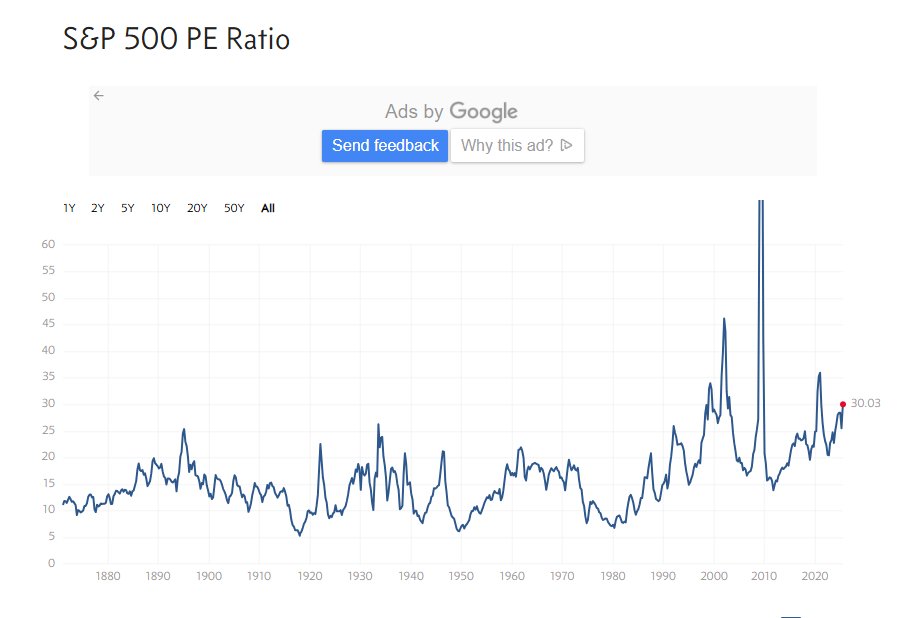

Investing every month in S&P XXX regardless of valuation, and reinvesting dividends, has worked in building wealth over any XX year period since 1871

Valuations didn't really matter, because they never really got out of hand until the 1990s

It doesn't really matter in the long run if you buy stocks at XX or XX times earnings, as those tend to average out over a long accumulation period. Heck, even the occasional XX times earnings is just a blip in the radar after XX years.

Valuations don't really matter, untill they do however

If valuations are permanently elevated when you invest, your margin of safety is lower and your forward returns could be reduced.

By "high valuations", I would say anything over XX - XX times forward earnings would be very high, and it would reduce forward returns.

As I mentioned above, the invest every month without checking valuations worked, precisely because valuations were moderate.

However, this ignore fundamentals and valuations mentality would not work as well if we get to really extreme valuation levels.

This model of just invest every month in an index no matter what basically failed to work in Japan in 1990 - 2023. That's because valuations were high in 1990 (at about XX - XXX times earnings), dividend yields were low (below 0.50%) and earnings growth was actually flat in the 1990s to early 2000s to add insult to injury.

This model also didn't work as well in the US between 1999 - 2015, during the so called lost decade for stocks. It delivered returns for those who kept investing for XX decades even if you started in 1999. However, most of the returns came after a painful XX year period of no returns but two large 50%+ bear markets.

A lot of people tell you to "just keep buying", and they are roughly right. However, you need to understand why it worked, and what circumstances could cause this to stop working

XXXXXX engagements

Related Topics accumulation stocks rating agency investment dividend yield $spy