[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  ProlificWilly [@Speedwhale_](/creator/twitter/Speedwhale_) on x 2139 followers Created: 2025-07-19 19:25:18 UTC Portal to Bitcoin ($PTB): Tokenomics Built to Burn Most DeFi tokens rely on hype. @PortaltoBitcoin built $PTB to disappear. Here’s how one of the most aggressive token burn models in crypto works and why volume, not vibes, determines PTB’s future 🧵👇 X. The Burn Model 🔁 Every swap through Portal incurs a XXX% fee 🔥 XXX% of that fee is used to buy and burn PTB ❌ No staking ❌ No DAO voting ❌ No treasury hoarding ✅ Just permanent supply reduction every epoch X. Why This Matters The more users swap through the Portal SDK, the more PTB gets destroyed. That means real usage drives demand, not speculation. Deflation isn't a promise it's a mechanism. X. The Math Behind the Burn 🧮 Monthly token emission: 26.18M PTB 💰 Burn potential depends on: • PTB market price • Monthly swap volume • Product adoption Here’s what burn looks like at different swap volumes: $500M volume: → $1.5M used to buy PTB → Burns 25M tokens at $XXXX → Burns 7.5M at $XXXX X. Deflation Threshold If Portal reaches ~$873M in monthly swap volume, 💥 Token burns fully offset new emissions → PTB becomes deflationary → Without external manipulation or incentives This is rare in DeFi. X. How Portal Compares 🔹 Aave: Redeems tokens, but doesn’t burn 🔹 dYdX: Distributes for staking 🔹 Jupiter: Locks tokens for X years 🔸 Portal: Destroys supply permanently. Every swap. Every epoch. Conclusion Portal isn’t just a bridge it’s a deflation engine. If swap volume grows, PTB’s value is designed to concentrate, not inflate. 🧠 It’s tokenomics as protocol logic not as a marketing afterthought. What % of emissions do you think Portal will burn each epoch? Let’s discuss  XXXXX engagements  **Related Topics** [coins interoperability](/topic/coins-interoperability) [coins dao](/topic/coins-dao) [staking](/topic/staking) [token](/topic/token) [$ptb](/topic/$ptb) [bitcoin](/topic/bitcoin) [coins layer 1](/topic/coins-layer-1) [coins bitcoin ecosystem](/topic/coins-bitcoin-ecosystem) [Post Link](https://x.com/Speedwhale_/status/1946652589057019958)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

ProlificWilly @Speedwhale_ on x 2139 followers

Created: 2025-07-19 19:25:18 UTC

ProlificWilly @Speedwhale_ on x 2139 followers

Created: 2025-07-19 19:25:18 UTC

Portal to Bitcoin ($PTB): Tokenomics Built to Burn

Most DeFi tokens rely on hype. @PortaltoBitcoin built $PTB to disappear.

Here’s how one of the most aggressive token burn models in crypto works and why volume, not vibes, determines PTB’s future 🧵👇

X. The Burn Model

🔁 Every swap through Portal incurs a XXX% fee 🔥 XXX% of that fee is used to buy and burn PTB ❌ No staking ❌ No DAO voting ❌ No treasury hoarding ✅ Just permanent supply reduction every epoch

X. Why This Matters

The more users swap through the Portal SDK, the more PTB gets destroyed. That means real usage drives demand, not speculation.

Deflation isn't a promise it's a mechanism.

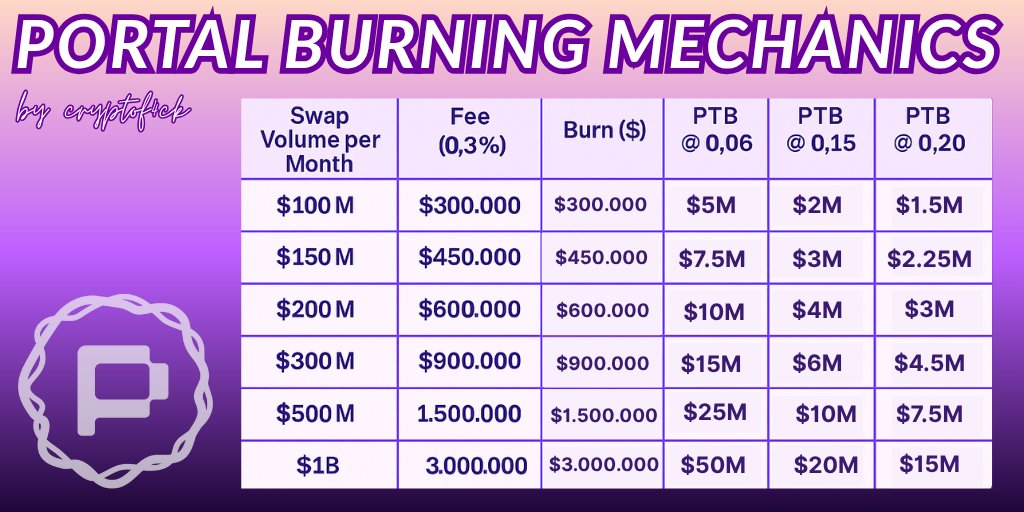

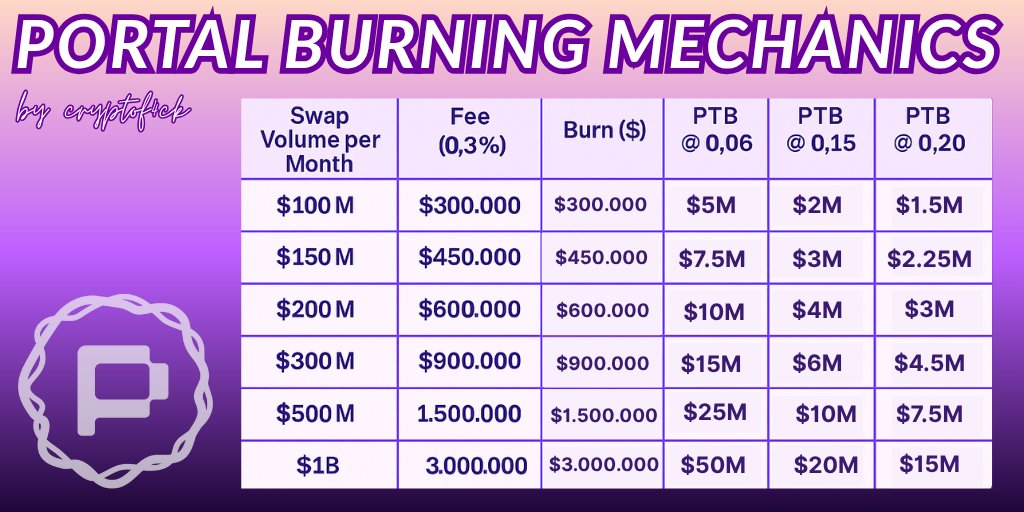

X. The Math Behind the Burn

🧮 Monthly token emission: 26.18M PTB 💰 Burn potential depends on:

• PTB market price • Monthly swap volume • Product adoption

Here’s what burn looks like at different swap volumes:

$500M volume: → $1.5M used to buy PTB → Burns 25M tokens at $XXXX → Burns 7.5M at $XXXX

X. Deflation Threshold

If Portal reaches ~$873M in monthly swap volume, 💥 Token burns fully offset new emissions → PTB becomes deflationary → Without external manipulation or incentives

This is rare in DeFi.

X. How Portal Compares

🔹 Aave: Redeems tokens, but doesn’t burn 🔹 dYdX: Distributes for staking 🔹 Jupiter: Locks tokens for X years 🔸 Portal: Destroys supply permanently. Every swap. Every epoch.

Conclusion

Portal isn’t just a bridge it’s a deflation engine.

If swap volume grows, PTB’s value is designed to concentrate, not inflate.

🧠 It’s tokenomics as protocol logic not as a marketing afterthought.

What % of emissions do you think Portal will burn each epoch?

Let’s discuss

XXXXX engagements

Related Topics coins interoperability coins dao staking token $ptb bitcoin coins layer 1 coins bitcoin ecosystem