[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Gearbox ⚙️🧰 Protocol [@GearboxProtocol](/creator/twitter/GearboxProtocol) on x 53.8K followers Created: 2025-07-19 18:53:20 UTC DEX liquidity remains the biggest bottleneck for scaling assets in lending markets. Borrow limits are often restricted to just 2–3x of an asset’s DEX liquidity. While LPing underperforms holding the spot asset by 3.8%, on average. Scaling liquidity, and by extension, lending markets, thus, remains an expensive and inefficient challenge for most assets. To unlock institutional-scale lending, even for low-liquidity assets, onchain credit must break free from DEX dependence. And that’s exactly what Gearbox Permissionless does. How? 💡 ⚙️ Bypassing DEXes: Credit at the Contracts Gearbox uses smart contract wallets called Credit Accounts, that let users borrow up to 40x their collateral to create leveraged positions. By programming these CAs to interact directly with an asset’s contracts, Gearbox bypasses DEXes entirely. Enabling deep leverage on LSTs, LRTs, and other contract-native assets. • Opening a position mints the required asset with leverage by depositing allowed collateral into the minting contract. • Closing it requires redeeming the asset for the underlying tokens. This eliminates slippage and DEX fees for borrowers while unlocking major scaling benefits for institutions, curators, and DeFi at large. ⏫ Multifold Scale: Higher Borrow Limits Without dependence on DEX liquidity, borrow limits are no longer constrained by AMM depth. Instead, they’re based on how much the minting contract can support, enabling far greater capital flow without slippage or trading fee. The max borrow limit for every account leveraging DVstETH is 6.6K WETH despite X DEX liquidity. A leverage position of that size will still be executed without slippage or DEX fees, an evolution of lending onchain. 🥞 40X+ Leverage: Highest LTVs in DeFi Traditional lending protocols set LTVs based on volatile DEX liquidity. Gearbox flips this model: because liquidity is deeper and more stable at the contract level, LTVs can be significantly higher. This enables users to borrow more against their assets and achieve higher capital efficiency. And this comes to life with Gearbox Permissionless, an institutional-grade lending stack that brings onchain real world lending frameworks with better • Cost Efficiency • Scale • And security All while eliminating the inefficiencies of legacy AMM-based lending design. Experience onchain credit that scales with DVstETH soon.⚙️🧰  XXXXX engagements  **Related Topics** [protocol](/topic/protocol) [gearbox protocol](/topic/gearbox-protocol) [coins lending borrowing](/topic/coins-lending-borrowing) [Post Link](https://x.com/GearboxProtocol/status/1946644541727003069)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Gearbox ⚙️🧰 Protocol @GearboxProtocol on x 53.8K followers

Created: 2025-07-19 18:53:20 UTC

Gearbox ⚙️🧰 Protocol @GearboxProtocol on x 53.8K followers

Created: 2025-07-19 18:53:20 UTC

DEX liquidity remains the biggest bottleneck for scaling assets in lending markets. Borrow limits are often restricted to just 2–3x of an asset’s DEX liquidity. While LPing underperforms holding the spot asset by 3.8%, on average.

Scaling liquidity, and by extension, lending markets, thus, remains an expensive and inefficient challenge for most assets.

To unlock institutional-scale lending, even for low-liquidity assets, onchain credit must break free from DEX dependence. And that’s exactly what Gearbox Permissionless does. How? 💡

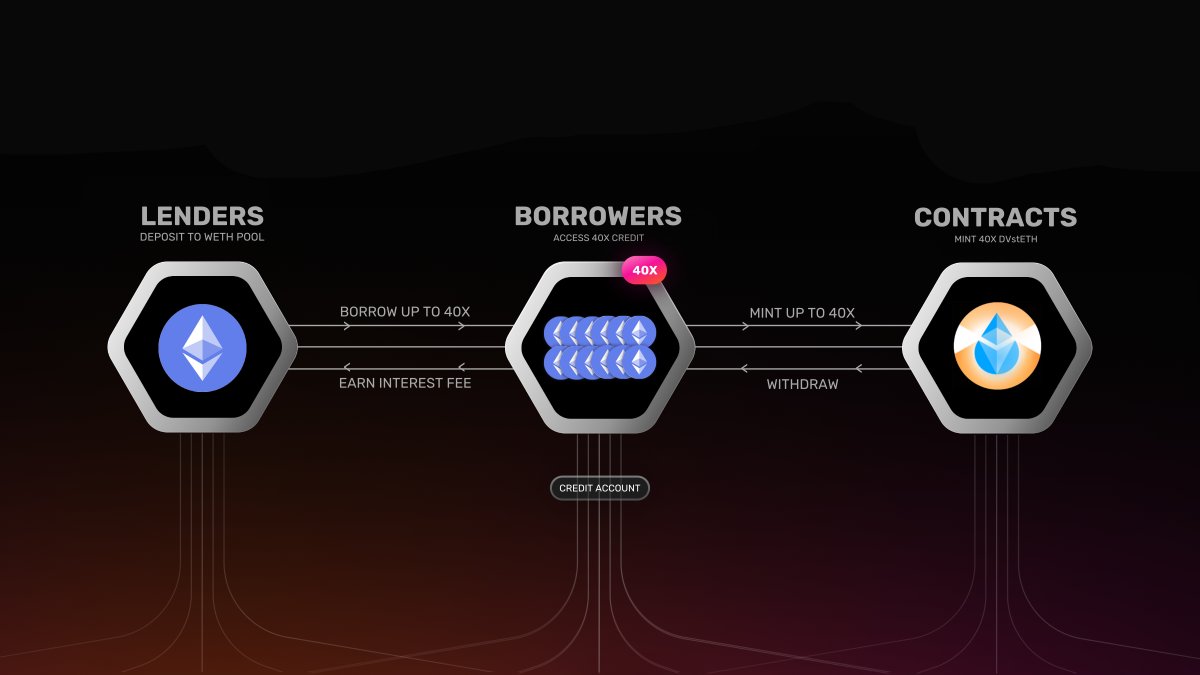

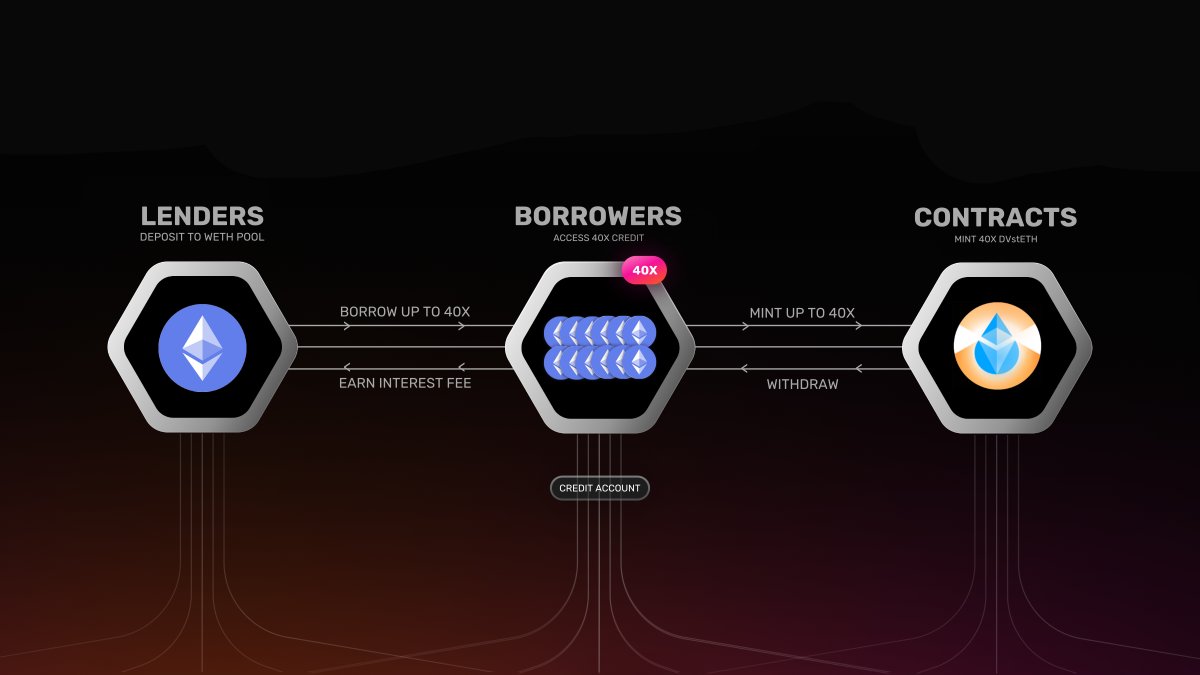

⚙️ Bypassing DEXes: Credit at the Contracts

Gearbox uses smart contract wallets called Credit Accounts, that let users borrow up to 40x their collateral to create leveraged positions. By programming these CAs to interact directly with an asset’s contracts, Gearbox bypasses DEXes entirely. Enabling deep leverage on LSTs, LRTs, and other contract-native assets.

• Opening a position mints the required asset with leverage by depositing allowed collateral into the minting contract. • Closing it requires redeeming the asset for the underlying tokens.

This eliminates slippage and DEX fees for borrowers while unlocking major scaling benefits for institutions, curators, and DeFi at large.

⏫ Multifold Scale: Higher Borrow Limits

Without dependence on DEX liquidity, borrow limits are no longer constrained by AMM depth. Instead, they’re based on how much the minting contract can support, enabling far greater capital flow without slippage or trading fee.

The max borrow limit for every account leveraging DVstETH is 6.6K WETH despite X DEX liquidity. A leverage position of that size will still be executed without slippage or DEX fees, an evolution of lending onchain.

🥞 40X+ Leverage: Highest LTVs in DeFi

Traditional lending protocols set LTVs based on volatile DEX liquidity. Gearbox flips this model: because liquidity is deeper and more stable at the contract level, LTVs can be significantly higher.

This enables users to borrow more against their assets and achieve higher capital efficiency.

And this comes to life with Gearbox Permissionless, an institutional-grade lending stack that brings onchain real world lending frameworks with better

• Cost Efficiency • Scale • And security

All while eliminating the inefficiencies of legacy AMM-based lending design. Experience onchain credit that scales with DVstETH soon.⚙️🧰

XXXXX engagements

Related Topics protocol gearbox protocol coins lending borrowing