[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Dimitry Nakhla | Babylon Capital® [@DimitryNakhla](/creator/twitter/DimitryNakhla) on x 14.6K followers Created: 2025-07-19 18:19:37 UTC A quality valuation analysis on $MELI 🧘🏽♂️ •NTM P/E Ratio: 43.76x •2-Year Mean: 49.08x As you can see, $MELI appears to be trading near fair value Going forward, investors can receive ~12% MORE in earnings per share 🧠*** Before we get into valuation, let’s take a look at why $MELI is a great business BALANCE SHEET✅ •Cash & Short-Term Inv: $8.07B •Long-Term Debt: $2.80B $MELI has a strong balance sheet, a BBB- S&P Credit Rating & 45x FFO Interest Coverage RETURN ON CAPITAL🆗➡️✅ •2020: XXX% •2021: XXX% •2022: XXXX% •2023: XXXX% •2024: XXXX% •LTM: XXXX% RETURN ON EQUITY🆗➡️✅ •2020: (0.1%) •2021: XXX% •2022: XXXX% •2023: XXXX% •2024: XXXX% •LTM: XXXX% $MELI has strong and improved return metrics, highlighting the financial efficiency of the business REVENUES✅ •2019: $2.30B •2024: $20.78B •CAGR: XXXXX% FREE CASH FLOW✅ •2019: $314.29M •2024: $7.05B •CAGR: XXXXX% NORMALIZED EPS✅ •2019: ($3.71) •2024: $XXXXX SHARE BUYBACKS❌ •2019 Shares Outstanding: 48.69M •LTM Shares Outstanding: 50.70M MARGINS🆗➡️✅ •LTM Gross Margins: XXXX% •LTM Operating Margins: XXXX% •LTM Net Income Margins: XXX% ***NOW TO VALUATION 🧠 As stated above, investors can expect to receive ~12% MORE in EPS Using Benjamin Graham’s 2G rule of thumb, $MELI has to grow earnings at a XXXXX% CAGR over the next several years to justify its valuation Today, analysts anticipate 2025 - 2027 EPS growth over the next few years to be more than the (24.54%) required growth rate: 2025E: $XXXXX (31.2% YoY) 2026E: $XXXXX (35.8% YoY) 2027E: $XXXXX (33.7% YoY) $MELI has an ok track record of meeting analyst estimates ~2 years out, but let’s assume $MELI ends 2027 with $XXXXX in EPS & see its CAGR potential assuming different multiples 40x P/E: $3590💵 … ~17.6% CAGR 38x P/E: $3410💵 … ~15.1% CAGR 36x P/E: $3231💵 … ~12.6% CAGR 34x P/E: $3033💵 … ~10.0% CAGR As you can see, $MELI appears to have attractive return potential IF we assume >36x earnings (a multiple justified by its growth rate & moat) $MELI boasts an expansive growth trajectory, fueled by powerful network effects that should drive sustained momentum Key factors contributing to its promising outlook include 🔑 X. Margin expansion X. Unparalleled access to Latin America's burgeoning economy X. Network effects & scale economies shared that produce self-reinforcing dynamics ensuring long-term competitiveness, among other things Those buying $MELI today at $2413💵 are buying it for a slightly better than fair price, with little margin of safety — these growth rates have to be revised down substantially for $MELI to miss the mark, even if the company grows earnings at XX% CAGR over the next X years, shareholders will likely end up with a decent return I consider $MELI a strong buy closer to $2250💵 (~7% below today’s price) where I can reasonably expect ~12% CAGR while assuming a conservative 34x end multiple, ensuring a larger margin of safety #stocks #investing ___ 𝐃𝐈𝐒𝐂𝐋𝐎𝐒𝐔𝐑𝐄‼️: 𝐓𝐡𝐢𝐬 𝐢𝐬 𝐍𝐎𝐓 𝐈𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭 𝐀𝐝𝐯𝐢𝐜𝐞. 𝐁𝐚𝐛𝐲𝐥𝐨𝐧 𝐂𝐚𝐩𝐢𝐭𝐚𝐥® 𝐚𝐧𝐝 𝐢𝐭𝐬 𝐫𝐞𝐩𝐫𝐞𝐬𝐞𝐧𝐭𝐚𝐭𝐢𝐯𝐞𝐬 𝐦𝐚𝐲 𝐡𝐚𝐯𝐞 𝐩𝐨𝐬𝐢𝐭𝐢𝐨𝐧𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐬𝐞𝐜𝐮𝐫𝐢𝐭𝐢𝐞𝐬 𝐝𝐢𝐬𝐜𝐮𝐬𝐬𝐞𝐝 𝐢𝐧 𝐭𝐡𝐢𝐬 𝐭𝐰𝐞𝐞𝐭. 𝐓𝐡𝐞 𝐢𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐜𝐨𝐧𝐭𝐚𝐢𝐧𝐞𝐝 𝐢𝐧 𝐭𝐡𝐢𝐬 𝐭𝐰𝐞𝐞𝐭 𝐢𝐬 𝐢𝐧𝐭𝐞𝐧𝐝𝐞𝐝 𝐟𝐨𝐫 𝐢𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧𝐚𝐥 𝐩𝐮𝐫𝐩𝐨𝐬𝐞𝐬 𝐨𝐧𝐥𝐲 𝐚𝐧𝐝 𝐬𝐡𝐨𝐮𝐥𝐝 𝐧𝐨𝐭 𝐛𝐞 𝐜𝐨𝐧𝐬𝐭𝐫𝐮𝐞𝐝 𝐚𝐬 𝐢𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭 𝐚𝐝𝐯𝐢𝐜𝐞 𝐭𝐨 𝐦𝐞𝐞𝐭 𝐭𝐡𝐞 𝐬𝐩𝐞𝐜𝐢𝐟𝐢𝐜 𝐧𝐞𝐞𝐝𝐬 𝐨𝐟 𝐚𝐧𝐲 𝐢𝐧𝐝𝐢𝐯𝐢𝐝𝐮𝐚𝐥 𝐨𝐫 𝐬𝐢𝐭𝐮𝐚𝐭𝐢𝐨𝐧. 𝐏𝐚𝐬𝐭 𝐩𝐞𝐫𝐟𝐨𝐫𝐦𝐚𝐧𝐜𝐞 𝐢𝐬 𝐧𝐨 𝐠𝐮𝐚𝐫𝐚𝐧𝐭𝐞𝐞 𝐨𝐟 𝐟𝐮𝐭𝐮𝐫𝐞 𝐫𝐞𝐬𝐮𝐥𝐭𝐬. 𝐈𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐜𝐨𝐧𝐭𝐚𝐢𝐧𝐞𝐝 𝐢𝐧 𝐭𝐡𝐢𝐬 𝐭𝐰𝐞𝐞𝐭 𝐡𝐚𝐬 𝐛𝐞𝐞𝐧 𝐨𝐛𝐭𝐚𝐢𝐧𝐞𝐝 𝐟𝐫𝐨𝐦 𝐬𝐨𝐮𝐫𝐜𝐞𝐬 𝐛𝐞𝐥𝐢𝐞𝐯𝐞𝐝 𝐭𝐨 𝐛𝐞 𝐫𝐞𝐥𝐢𝐚𝐛𝐥𝐞, 𝐛𝐮𝐭 𝐢𝐬 𝐧𝐨𝐭 𝐠𝐮𝐚𝐫𝐚𝐧𝐭𝐞𝐞𝐝 𝐚𝐬 𝐭𝐨 𝐜𝐨𝐦𝐩𝐥𝐞𝐭𝐞𝐧𝐞𝐬𝐬 𝐨𝐫 𝐚𝐜𝐜𝐮𝐫𝐚𝐜𝐲.  XXXXX engagements  **Related Topics** [$280b](/topic/$280b) [debt](/topic/debt) [longterm](/topic/longterm) [$807b](/topic/$807b) [balance sheet](/topic/balance-sheet) [quarterly earnings](/topic/quarterly-earnings) [$meli](/topic/$meli) [stocks consumer cyclical](/topic/stocks-consumer-cyclical) [Post Link](https://x.com/DimitryNakhla/status/1946636056968708578)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Dimitry Nakhla | Babylon Capital® @DimitryNakhla on x 14.6K followers

Created: 2025-07-19 18:19:37 UTC

Dimitry Nakhla | Babylon Capital® @DimitryNakhla on x 14.6K followers

Created: 2025-07-19 18:19:37 UTC

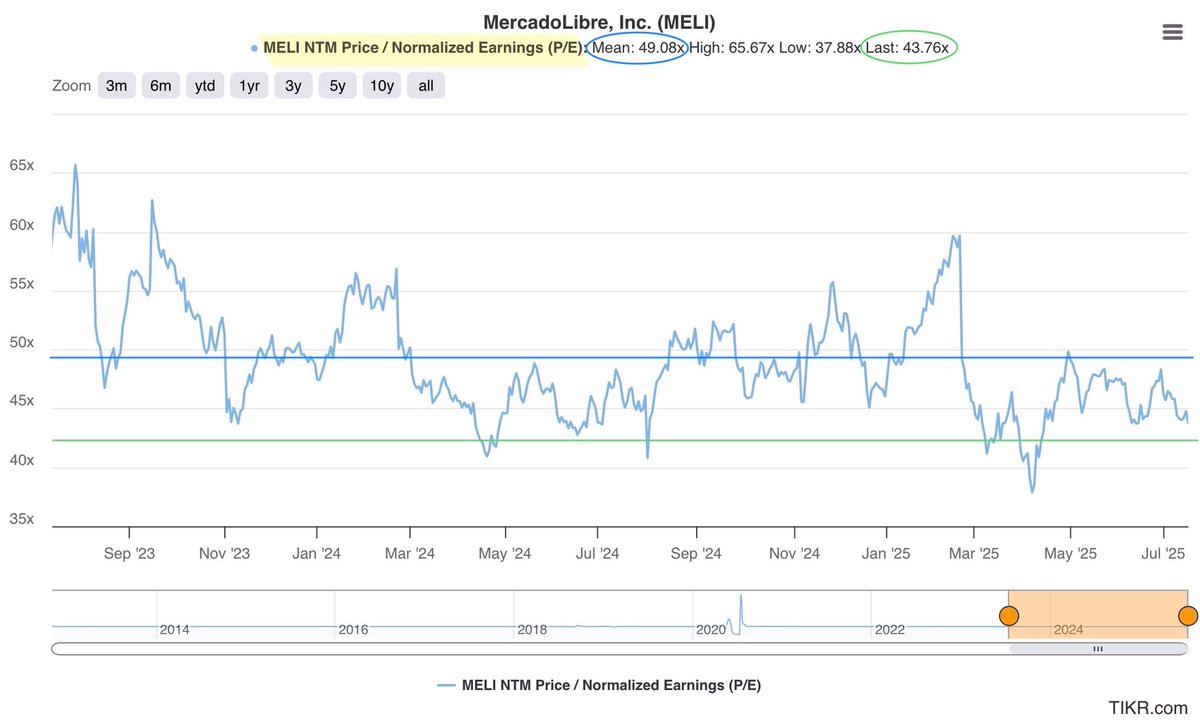

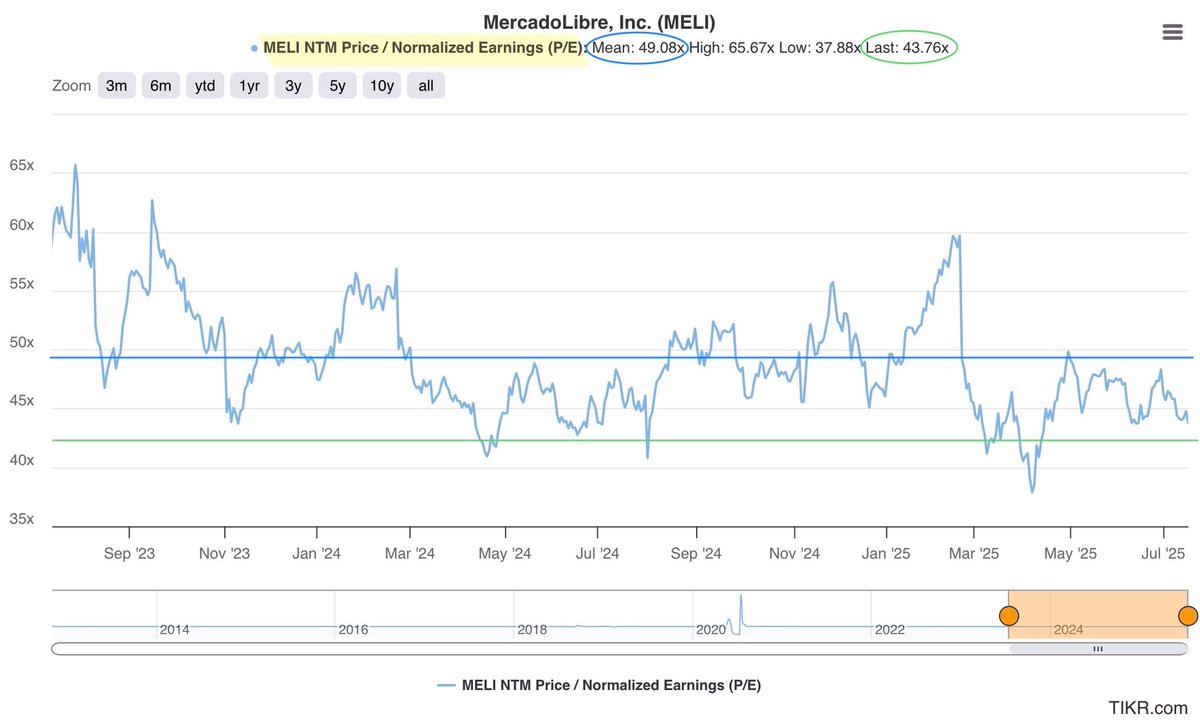

A quality valuation analysis on $MELI 🧘🏽♂️

•NTM P/E Ratio: 43.76x •2-Year Mean: 49.08x

As you can see, $MELI appears to be trading near fair value

Going forward, investors can receive ~12% MORE in earnings per share 🧠***

Before we get into valuation, let’s take a look at why $MELI is a great business

BALANCE SHEET✅ •Cash & Short-Term Inv: $8.07B •Long-Term Debt: $2.80B

$MELI has a strong balance sheet, a BBB- S&P Credit Rating & 45x FFO Interest Coverage

RETURN ON CAPITAL🆗➡️✅ •2020: XXX% •2021: XXX% •2022: XXXX% •2023: XXXX% •2024: XXXX% •LTM: XXXX%

RETURN ON EQUITY🆗➡️✅ •2020: (0.1%) •2021: XXX% •2022: XXXX% •2023: XXXX% •2024: XXXX% •LTM: XXXX%

$MELI has strong and improved return metrics, highlighting the financial efficiency of the business

REVENUES✅ •2019: $2.30B •2024: $20.78B •CAGR: XXXXX%

FREE CASH FLOW✅ •2019: $314.29M •2024: $7.05B •CAGR: XXXXX%

NORMALIZED EPS✅ •2019: ($3.71) •2024: $XXXXX

SHARE BUYBACKS❌ •2019 Shares Outstanding: 48.69M •LTM Shares Outstanding: 50.70M

MARGINS🆗➡️✅ •LTM Gross Margins: XXXX% •LTM Operating Margins: XXXX% •LTM Net Income Margins: XXX%

***NOW TO VALUATION 🧠

As stated above, investors can expect to receive ~12% MORE in EPS

Using Benjamin Graham’s 2G rule of thumb, $MELI has to grow earnings at a XXXXX% CAGR over the next several years to justify its valuation

Today, analysts anticipate 2025 - 2027 EPS growth over the next few years to be more than the (24.54%) required growth rate:

2025E: $XXXXX (31.2% YoY) 2026E: $XXXXX (35.8% YoY) 2027E: $XXXXX (33.7% YoY)

$MELI has an ok track record of meeting analyst estimates ~2 years out, but let’s assume $MELI ends 2027 with $XXXXX in EPS & see its CAGR potential assuming different multiples

40x P/E: $3590💵 … ~17.6% CAGR

38x P/E: $3410💵 … ~15.1% CAGR

36x P/E: $3231💵 … ~12.6% CAGR

34x P/E: $3033💵 … ~10.0% CAGR

As you can see, $MELI appears to have attractive return potential IF we assume >36x earnings (a multiple justified by its growth rate & moat)

$MELI boasts an expansive growth trajectory, fueled by powerful network effects that should drive sustained momentum

Key factors contributing to its promising outlook include 🔑

X. Margin expansion

X. Unparalleled access to Latin America's burgeoning economy

X. Network effects & scale economies shared that produce self-reinforcing dynamics ensuring long-term competitiveness, among other things

Those buying $MELI today at $2413💵 are buying it for a slightly better than fair price, with little margin of safety — these growth rates have to be revised down substantially for $MELI to miss the mark, even if the company grows earnings at XX% CAGR over the next X years, shareholders will likely end up with a decent return

I consider $MELI a strong buy closer to $2250💵 (~7% below today’s price) where I can reasonably expect ~12% CAGR while assuming a conservative 34x end multiple, ensuring a larger margin of safety

#stocks #investing

𝐃𝐈𝐒𝐂𝐋𝐎𝐒𝐔𝐑𝐄‼️: 𝐓𝐡𝐢𝐬 𝐢𝐬 𝐍𝐎𝐓 𝐈𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭 𝐀𝐝𝐯𝐢𝐜𝐞. 𝐁𝐚𝐛𝐲𝐥𝐨𝐧 𝐂𝐚𝐩𝐢𝐭𝐚𝐥® 𝐚𝐧𝐝 𝐢𝐭𝐬 𝐫𝐞𝐩𝐫𝐞𝐬𝐞𝐧𝐭𝐚𝐭𝐢𝐯𝐞𝐬 𝐦𝐚𝐲 𝐡𝐚𝐯𝐞 𝐩𝐨𝐬𝐢𝐭𝐢𝐨𝐧𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐬𝐞𝐜𝐮𝐫𝐢𝐭𝐢𝐞𝐬 𝐝𝐢𝐬𝐜𝐮𝐬𝐬𝐞𝐝 𝐢𝐧 𝐭𝐡𝐢𝐬 𝐭𝐰𝐞𝐞𝐭.

𝐓𝐡𝐞 𝐢𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐜𝐨𝐧𝐭𝐚𝐢𝐧𝐞𝐝 𝐢𝐧 𝐭𝐡𝐢𝐬 𝐭𝐰𝐞𝐞𝐭 𝐢𝐬 𝐢𝐧𝐭𝐞𝐧𝐝𝐞𝐝 𝐟𝐨𝐫 𝐢𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧𝐚𝐥 𝐩𝐮𝐫𝐩𝐨𝐬𝐞𝐬 𝐨𝐧𝐥𝐲 𝐚𝐧𝐝 𝐬𝐡𝐨𝐮𝐥𝐝 𝐧𝐨𝐭 𝐛𝐞 𝐜𝐨𝐧𝐬𝐭𝐫𝐮𝐞𝐝 𝐚𝐬 𝐢𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭 𝐚𝐝𝐯𝐢𝐜𝐞 𝐭𝐨 𝐦𝐞𝐞𝐭 𝐭𝐡𝐞 𝐬𝐩𝐞𝐜𝐢𝐟𝐢𝐜 𝐧𝐞𝐞𝐝𝐬 𝐨𝐟 𝐚𝐧𝐲 𝐢𝐧𝐝𝐢𝐯𝐢𝐝𝐮𝐚𝐥 𝐨𝐫 𝐬𝐢𝐭𝐮𝐚𝐭𝐢𝐨𝐧. 𝐏𝐚𝐬𝐭 𝐩𝐞𝐫𝐟𝐨𝐫𝐦𝐚𝐧𝐜𝐞 𝐢𝐬 𝐧𝐨 𝐠𝐮𝐚𝐫𝐚𝐧𝐭𝐞𝐞 𝐨𝐟 𝐟𝐮𝐭𝐮𝐫𝐞 𝐫𝐞𝐬𝐮𝐥𝐭𝐬.

𝐈𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐜𝐨𝐧𝐭𝐚𝐢𝐧𝐞𝐝 𝐢𝐧 𝐭𝐡𝐢𝐬 𝐭𝐰𝐞𝐞𝐭 𝐡𝐚𝐬 𝐛𝐞𝐞𝐧 𝐨𝐛𝐭𝐚𝐢𝐧𝐞𝐝 𝐟𝐫𝐨𝐦 𝐬𝐨𝐮𝐫𝐜𝐞𝐬 𝐛𝐞𝐥𝐢𝐞𝐯𝐞𝐝 𝐭𝐨 𝐛𝐞 𝐫𝐞𝐥𝐢𝐚𝐛𝐥𝐞, 𝐛𝐮𝐭 𝐢𝐬 𝐧𝐨𝐭 𝐠𝐮𝐚𝐫𝐚𝐧𝐭𝐞𝐞𝐝 𝐚𝐬 𝐭𝐨 𝐜𝐨𝐦𝐩𝐥𝐞𝐭𝐞𝐧𝐞𝐬𝐬 𝐨𝐫 𝐚𝐜𝐜𝐮𝐫𝐚𝐜𝐲.

XXXXX engagements

Related Topics $280b debt longterm $807b balance sheet quarterly earnings $meli stocks consumer cyclical