[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  The Blockchain Advisor™ [@cenaclecapital](/creator/twitter/cenaclecapital) on x 1615 followers Created: 2025-07-19 10:24:48 UTC Saturday morning 7/19/2025 update. BTCTC "RS pair trading" cheat sheet. In descending order strong to weak Relative Strength Buy in X's Buy in O's Sell in X's Sell in O's Executive Summary $MTPLF is the new $MSTR as the numerator $MSTR is paired with $TSLA because option premiums are juicy in both names & selling Cash Secured Puts in the strongest stock pair tilts the success outcome in my favor. If I know a pair trade has stronger relative strength (RS), I'll sell closer in-the-money (ITM) puts with a higher delta (–0.35 to –0.40 versus –0.20 to –0.25) and collect a richer option premium, expecting the outcome to be more favorable in terms of assignment or early profit-taking. This approach takes advantage of the underlying strength by positioning closer to the current price, increasing the likelihood of capturing higher income while still maintaining a favorable risk/reward profile. 👀Buy in X's is a long-term to intermediate hold 👀Buy in O's is a long countertrend rally scalp 👀Sell in X's is a countertrend rally to sell inventory 👀Sell in O's is "avoid for now" Lastly, small cap stocks pair trades have to be taking with a grain of salt since because shares can only get so low, volumes & liquidity is thin, they're easily manipulated, and have less historical data to compare.  XXX engagements  **Related Topics** [mstr](/topic/mstr) [$tsla](/topic/$tsla) [$mstr](/topic/$mstr) [blockchain](/topic/blockchain) [$mtplf](/topic/$mtplf) [stocks bitcoin treasuries](/topic/stocks-bitcoin-treasuries) [strategy](/topic/strategy) [stocks financial services](/topic/stocks-financial-services) [Post Link](https://x.com/cenaclecapital/status/1946516564921946365)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

The Blockchain Advisor™ @cenaclecapital on x 1615 followers

Created: 2025-07-19 10:24:48 UTC

The Blockchain Advisor™ @cenaclecapital on x 1615 followers

Created: 2025-07-19 10:24:48 UTC

Saturday morning 7/19/2025 update.

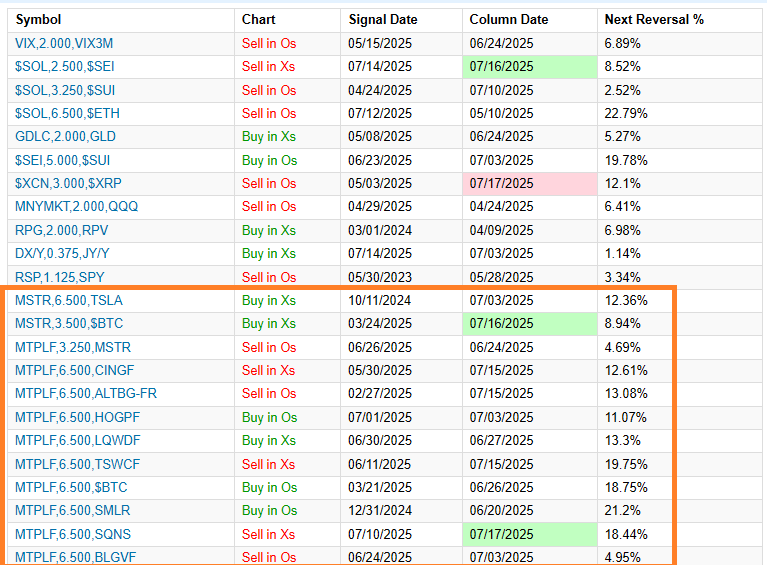

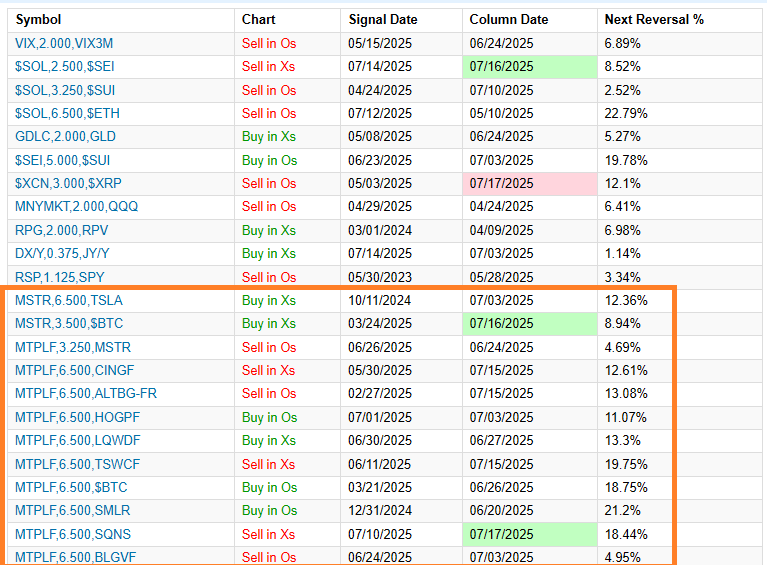

BTCTC "RS pair trading" cheat sheet.

In descending order strong to weak Relative Strength Buy in X's Buy in O's Sell in X's Sell in O's

Executive Summary $MTPLF is the new $MSTR as the numerator

$MSTR is paired with $TSLA because option premiums are juicy in both names & selling Cash Secured Puts in the strongest stock pair tilts the success outcome in my favor.

If I know a pair trade has stronger relative strength (RS), I'll sell closer in-the-money (ITM) puts with a higher delta (–0.35 to –0.40 versus –0.20 to –0.25) and collect a richer option premium, expecting the outcome to be more favorable in terms of assignment or early profit-taking.

This approach takes advantage of the underlying strength by positioning closer to the current price, increasing the likelihood of capturing higher income while still maintaining a favorable risk/reward profile.

👀Buy in X's is a long-term to intermediate hold 👀Buy in O's is a long countertrend rally scalp 👀Sell in X's is a countertrend rally to sell inventory 👀Sell in O's is "avoid for now"

Lastly, small cap stocks pair trades have to be taking with a grain of salt since because shares can only get so low, volumes & liquidity is thin, they're easily manipulated, and have less historical data to compare.

XXX engagements

Related Topics mstr $tsla $mstr blockchain $mtplf stocks bitcoin treasuries strategy stocks financial services