[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Wealth Counter - NISM Certified RA (Stock Market) [@Wealth_Counter](/creator/twitter/Wealth_Counter) on x 4100 followers Created: 2025-07-19 08:55:49 UTC Union Bank of India – #UnionBank QoQ: Muted | YoY: Good Broadly steady performance on a sequential basis with marginal revenue softness, while profit remained healthy YoY. Asset quality held stable with GNPA easing YoY and provisioning moderately improved, reflecting steady control over slippages. Revenue: XXXXXX (QoQ: -1.4%, YoY: +3.6%) Financing Profit: XXX (QoQ: Turnaround from loss, YoY: +157.1%) Financing Margin: X% (Flat QoQ, YoY: X pp) Net Profit: XXXXX (QoQ: -17.5%, YoY: +13.6%) Gross NPA: XXX% (QoQ: +0.4 pp, YoY: -XXXX pp) Net NPA: XXXX% (QoQ: -XXXX pp, YoY: -XXXX pp) PCR (Provisions / GNPA): XXXXX / XXXXXX ≈ XXXX% While the sequential profit dipped, the overall trend remains encouraging with asset quality discipline and earnings support from stable financing spreads.  XXX engagements  **Related Topics** [india](/topic/india) [bank of](/topic/bank-of) [stocks](/topic/stocks) [alternative investment](/topic/alternative-investment) [Post Link](https://x.com/Wealth_Counter/status/1946494171419697253)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Wealth Counter - NISM Certified RA (Stock Market) @Wealth_Counter on x 4100 followers

Created: 2025-07-19 08:55:49 UTC

Wealth Counter - NISM Certified RA (Stock Market) @Wealth_Counter on x 4100 followers

Created: 2025-07-19 08:55:49 UTC

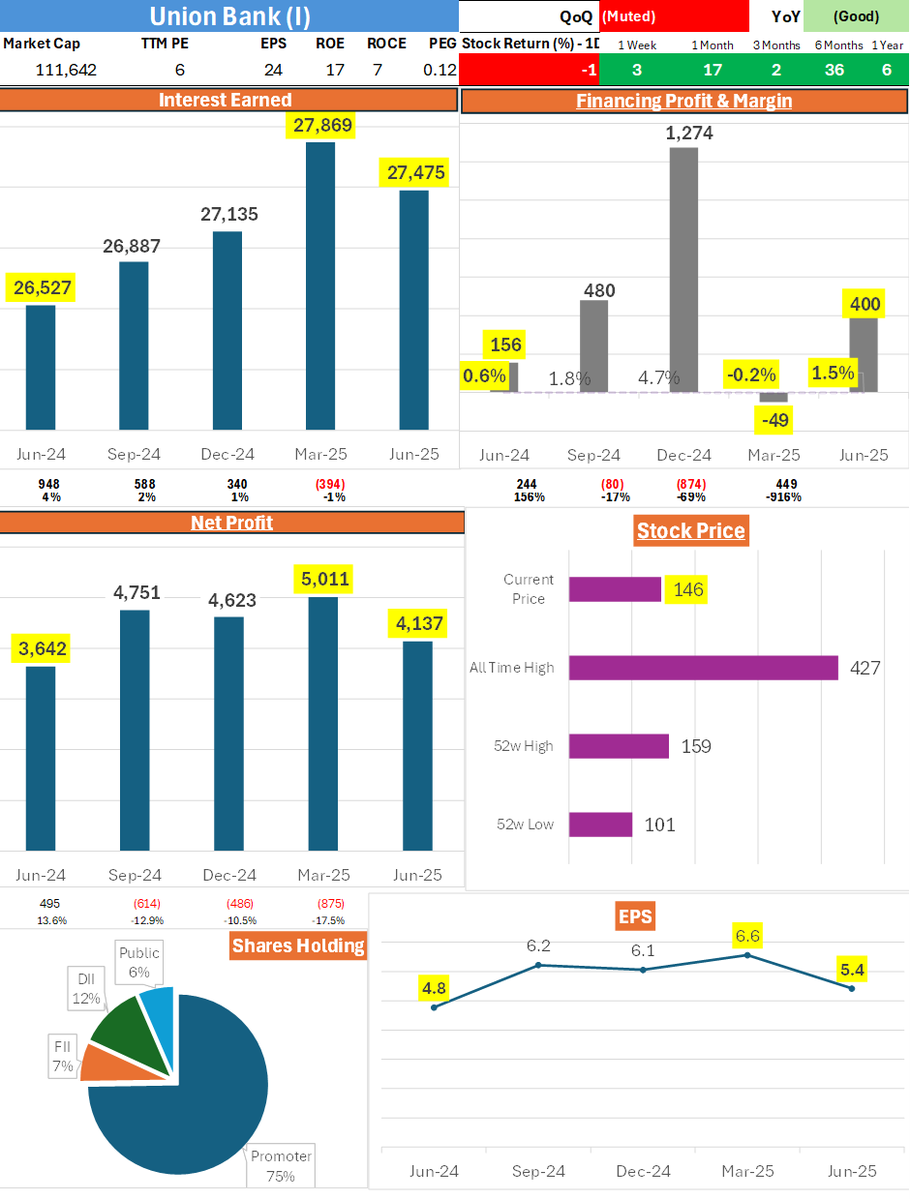

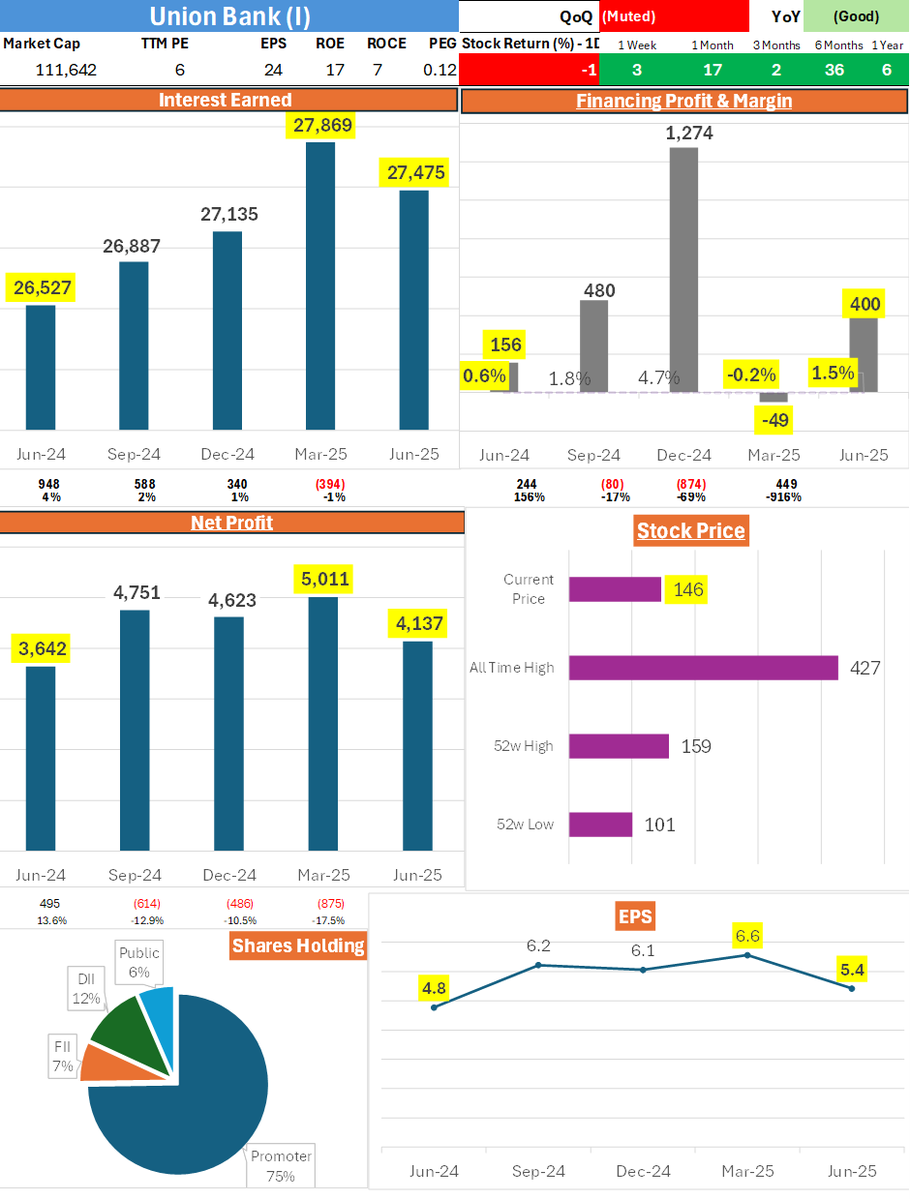

Union Bank of India – #UnionBank QoQ: Muted | YoY: Good

Broadly steady performance on a sequential basis with marginal revenue softness, while profit remained healthy YoY. Asset quality held stable with GNPA easing YoY and provisioning moderately improved, reflecting steady control over slippages.

Revenue: XXXXXX (QoQ: -1.4%, YoY: +3.6%)

Financing Profit: XXX (QoQ: Turnaround from loss, YoY: +157.1%) Financing Margin: X% (Flat QoQ, YoY: X pp)

Net Profit: XXXXX (QoQ: -17.5%, YoY: +13.6%)

Gross NPA: XXX% (QoQ: +0.4 pp, YoY: -XXXX pp) Net NPA: XXXX% (QoQ: -XXXX pp, YoY: -XXXX pp) PCR (Provisions / GNPA): XXXXX / XXXXXX ≈ XXXX%

While the sequential profit dipped, the overall trend remains encouraging with asset quality discipline and earnings support from stable financing spreads.

XXX engagements

Related Topics india bank of stocks alternative investment