[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  OMIMI [@Decentralpapi](/creator/twitter/Decentralpapi) on x 13.7K followers Created: 2025-07-19 02:23:32 UTC Many individuals believe that Bitcoin owners do not prioritize yield. DeFi would never receive BTC. Then LBTC made $X billion in TVL in XX days. What changed? Let's look at the playbook @Lombard_Finance used and why it's now the model for Bitcoin DeFi. 🧵👇🏽 ➠ LBTC came with a trigger: → Yield-bearing → Multi-chain from the start → Supported by a security consortium made up of top institutions It wasn't trying to copy ETH DeFi. It built on BTC's strengths. ➠ Adoption came quickly after. → XX days to reach $1B TVL → $X billion or more in new cash → Works on XX or more chains It became the crypto token that grew the fastest and paid out the most. That's not luck; it's a signal. Then something else took place: The big protocols began to lean toward Bitcoin. Aave, Morpho, Pendle, Maple, and EigenLayer all started looking into how to connect with BTC. Why? LBTC made Bitcoin useful in DeFi. ➠ Think about how this is reflexive: More connections → More ways to get yield → More demand for liquidity → More BTC connections This is how ecosystems grow. With speed. Lombard's roadmap had LBTC as Phase X. It showed that BTC is more than just a store of value. It becomes DeFi fuel when the appropriate infrastructure is in place. The real question is If Bitcoin capital is finally moving, who is in the best position to lead it? @Lombard_Finance already gave that answer with LBTC. Here is official page for full roadmap. You will see why Phase X was only the first step.  XXXXX engagements  **Related Topics** [playbook](/topic/playbook) [tvl](/topic/tvl) [bitcoin](/topic/bitcoin) [coins layer 1](/topic/coins-layer-1) [coins bitcoin ecosystem](/topic/coins-bitcoin-ecosystem) [coins pow](/topic/coins-pow) [Post Link](https://x.com/Decentralpapi/status/1946395450342518785)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

OMIMI @Decentralpapi on x 13.7K followers

Created: 2025-07-19 02:23:32 UTC

OMIMI @Decentralpapi on x 13.7K followers

Created: 2025-07-19 02:23:32 UTC

Many individuals believe that Bitcoin owners do not prioritize yield. DeFi would never receive BTC.

Then LBTC made $X billion in TVL in XX days.

What changed?

Let's look at the playbook @Lombard_Finance used and why it's now the model for Bitcoin DeFi.

🧵👇🏽

➠ LBTC came with a trigger: → Yield-bearing → Multi-chain from the start → Supported by a security consortium made up of top institutions

It wasn't trying to copy ETH DeFi. It built on BTC's strengths.

➠ Adoption came quickly after.

→ XX days to reach $1B TVL → $X billion or more in new cash → Works on XX or more chains

It became the crypto token that grew the fastest and paid out the most. That's not luck; it's a signal.

Then something else took place:

The big protocols began to lean toward Bitcoin.

Aave, Morpho, Pendle, Maple, and EigenLayer all started looking into how to connect with BTC.

Why? LBTC made Bitcoin useful in DeFi.

➠ Think about how this is reflexive:

More connections → More ways to get yield → More demand for liquidity → More BTC connections

This is how ecosystems grow. With speed.

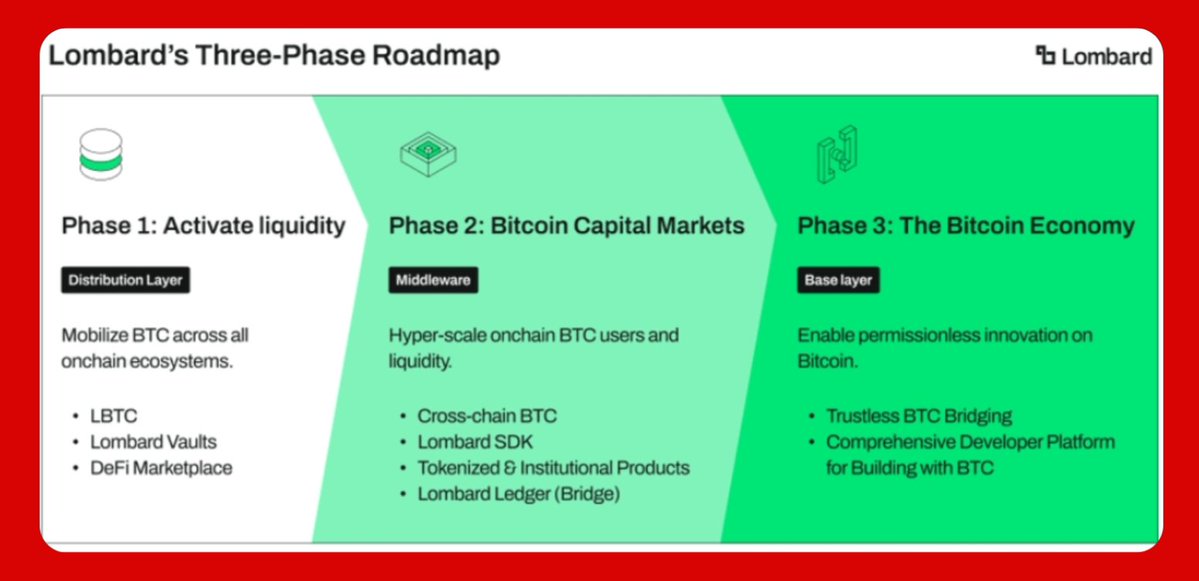

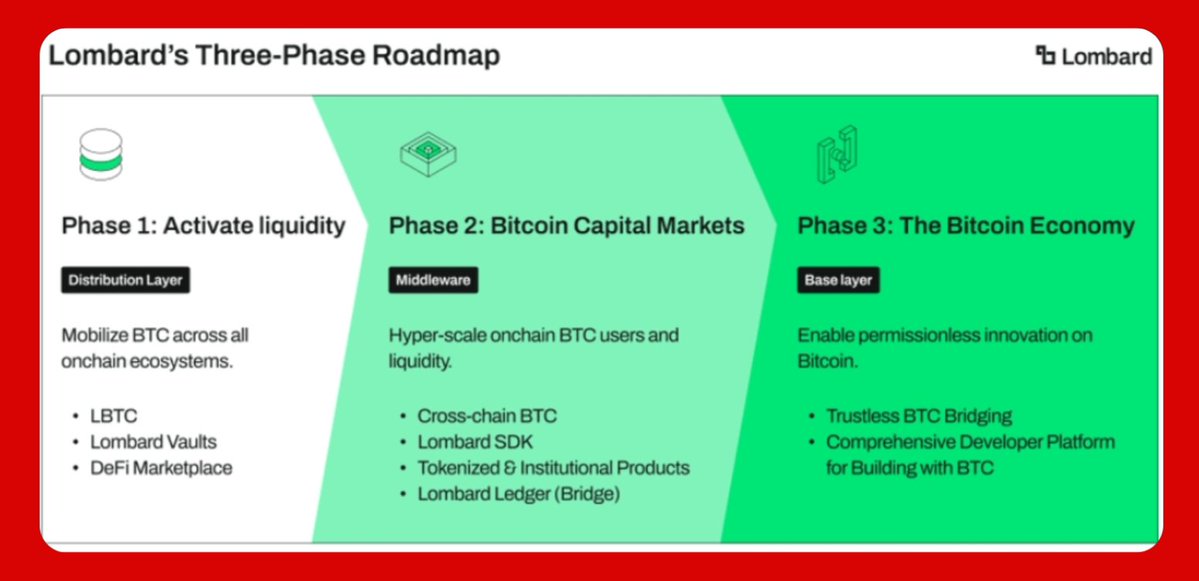

Lombard's roadmap had LBTC as Phase X. It showed that BTC is more than just a store of value. It becomes DeFi fuel when the appropriate infrastructure is in place.

The real question is

If Bitcoin capital is finally moving, who is in the best position to lead it?

@Lombard_Finance already gave that answer with LBTC.

Here is official page for full roadmap.

You will see why Phase X was only the first step.

XXXXX engagements

Related Topics playbook tvl bitcoin coins layer 1 coins bitcoin ecosystem coins pow