[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Milad 🐜 [@0xMiladx0](/creator/twitter/0xMiladx0) on x 4325 followers Created: 2025-07-19 02:22:39 UTC 1/ Token issuance on MemeX isn’t arbitrary it follows a structured allocation and economic logic grounded in the MRC-20 standard. Here’s a look at how token creators on @MemeX_MRC20 define their microeconomies 🧵👇 2/ 📦 Token Allocation (Template) — Total Supply: 1B — Bonding Curve Sale: 745M — Liquidity Pool (LP): 200M — Proof of Meme (PoM): 50M — Reserved: 5M Note: This is a model, not MemeX’s own allocation. It reflects how creators can structure their token economies within the ecosystem. 3/ 🔄 Bonding Curve Mechanics To complete the curve, XXXXXX $M is required. Once the curve is filled: – XX% of tokens allocated to LP – #MemeX used during the sale is pooled – Liquidity is seeded on EverySwap – LP tokens are burned (permanently locked) – Platform fees are deducted prior 4/ 🔥 High gas cost for the final buyer? The protocol offsets this by paying back XXX $M to the last participant on the curve a small but fair user-alignment mechanism. 5/ 💸 Fees Breakdown – X% buy/sell fee – After the curve closes and liquidity is live, each in-app trade incurs a XXX MemeX flat fee This adds predictability, not slippagebased variance. 6/ 🧩 Wallets & Compatibility MemeX and MRC-20 tokens are fully integrated with EVM compatible wallets bringing Web3-native portability to a Telegram native UX. This bridges composability with ease of use.  XXXXX engagements  **Related Topics** [5m](/topic/5m) [1b](/topic/1b) [memex](/topic/memex) [token](/topic/token) [Post Link](https://x.com/0xMiladx0/status/1946395229214388538)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Milad 🐜 @0xMiladx0 on x 4325 followers

Created: 2025-07-19 02:22:39 UTC

Milad 🐜 @0xMiladx0 on x 4325 followers

Created: 2025-07-19 02:22:39 UTC

1/ Token issuance on MemeX isn’t arbitrary it follows a structured allocation and economic logic grounded in the MRC-20 standard. Here’s a look at how token creators on @MemeX_MRC20 define their microeconomies 🧵👇

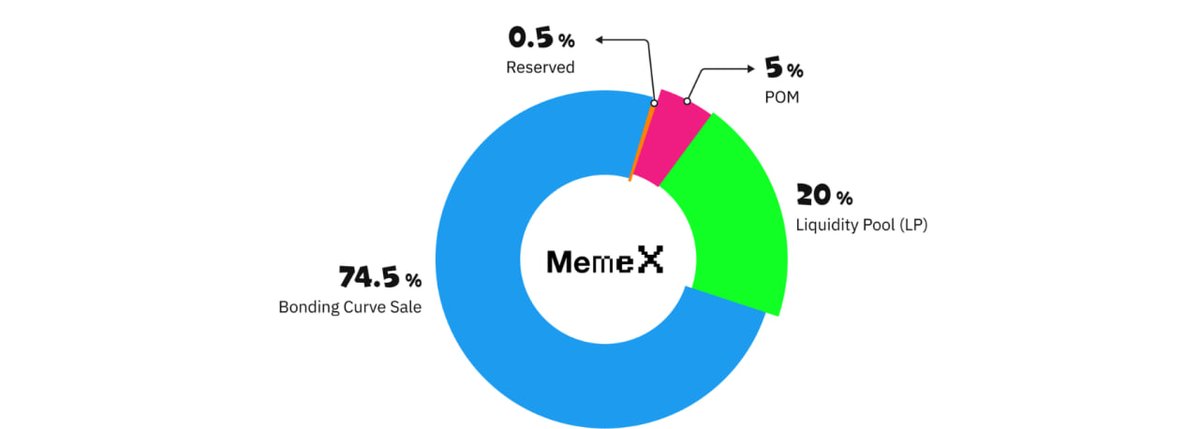

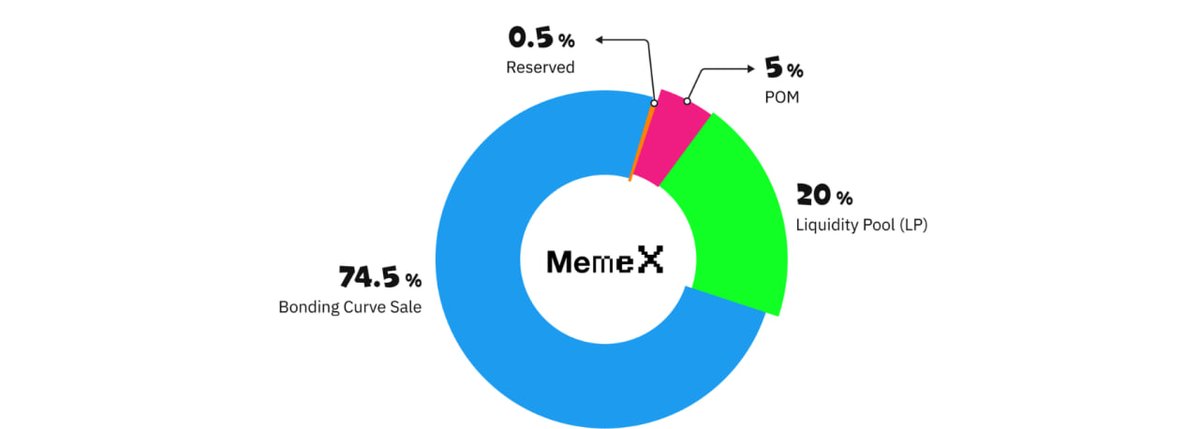

2/ 📦 Token Allocation (Template) — Total Supply: 1B — Bonding Curve Sale: 745M — Liquidity Pool (LP): 200M — Proof of Meme (PoM): 50M — Reserved: 5M

Note: This is a model, not MemeX’s own allocation. It reflects how creators can structure their token economies within the ecosystem. 3/ 🔄 Bonding Curve Mechanics To complete the curve, XXXXXX $M is required. Once the curve is filled: – XX% of tokens allocated to LP – #MemeX used during the sale is pooled – Liquidity is seeded on EverySwap – LP tokens are burned (permanently locked) – Platform fees are deducted prior 4/ 🔥 High gas cost for the final buyer? The protocol offsets this by paying back XXX $M to the last participant on the curve a small but fair user-alignment mechanism. 5/ 💸 Fees Breakdown – X% buy/sell fee – After the curve closes and liquidity is live, each in-app trade incurs a XXX MemeX flat fee This adds predictability, not slippagebased variance.

6/ 🧩 Wallets & Compatibility MemeX and MRC-20 tokens are fully integrated with EVM compatible wallets bringing Web3-native portability to a Telegram native UX.

This bridges composability with ease of use.

XXXXX engagements