[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  DarwinKnows [@Darwin_Knows](/creator/twitter/Darwin_Knows) on x XXX followers Created: 2025-07-18 21:47:30 UTC Applied Materials Inc (Valuation - Fair Value) US Large Caps: Applied Materials Inc has a total darwin score of +26 and there are X alerts. The valuation ratios for Applied Materials Inc suggest that the stock is fairly valued. The Forward P/E ratio of XXXXX indicates that investors are paying a reasonable price for the company's earnings compared to its peers. The Enterprise Value to Revenue ratio of XXXX is lower than the peer average of 6.51, which implies that the market is valuing the company's revenue generation at a reasonable multiple. The Price to Sales ratio of XXXX further supports this assessment, as it is below the peer average of XXXX. Given these factors, Applied Materials Inc appears to be trading at a fair value, making it an attractive option for investors. #DarwinKnows #AppliedMaterials #AMAT $AMAT #FreeTrialAvailable #AskDarwin #StockToWatch  XX engagements  **Related Topics** [caps](/topic/caps) [$amat](/topic/$amat) [stocks technology](/topic/stocks-technology) [Post Link](https://x.com/Darwin_Knows/status/1946325986456580296)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

DarwinKnows @Darwin_Knows on x XXX followers

Created: 2025-07-18 21:47:30 UTC

DarwinKnows @Darwin_Knows on x XXX followers

Created: 2025-07-18 21:47:30 UTC

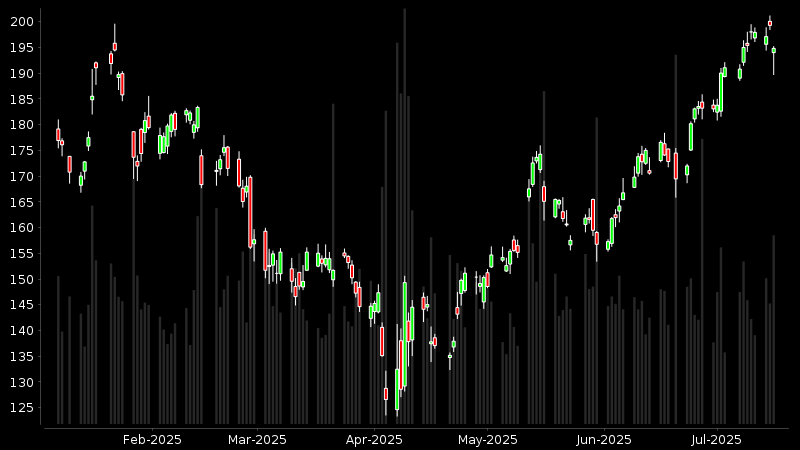

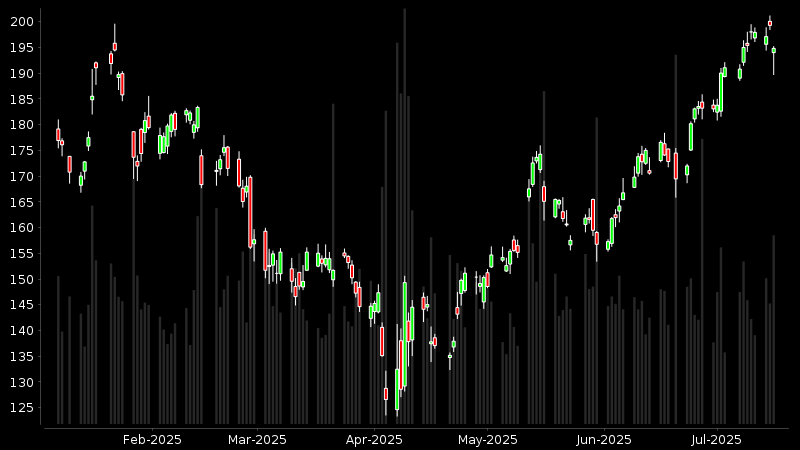

Applied Materials Inc (Valuation - Fair Value)

US Large Caps: Applied Materials Inc has a total darwin score of +26 and there are X alerts.

The valuation ratios for Applied Materials Inc suggest that the stock is fairly valued. The Forward P/E ratio of XXXXX indicates that investors are paying a reasonable price for the company's earnings compared to its peers. The Enterprise Value to Revenue ratio of XXXX is lower than the peer average of 6.51, which implies that the market is valuing the company's revenue generation at a reasonable multiple. The Price to Sales ratio of XXXX further supports this assessment, as it is below the peer average of XXXX. Given these factors, Applied Materials Inc appears to be trading at a fair value, making it an attractive option for investors.

#DarwinKnows #AppliedMaterials #AMAT $AMAT

#FreeTrialAvailable #AskDarwin #StockToWatch

XX engagements

Related Topics caps $amat stocks technology