[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  jan dekkers [@jan_dekkers](/creator/twitter/jan_dekkers) on x 1148 followers Created: 2025-07-18 21:26:46 UTC Here’s a look at the latest institutional investors adding (or boosting) positions in $NIO as of filings through July 18, 2025: 🔹 X. Ping Capital Management Inc. IPO'd a new stake of XXXXXX NIO shares (~$305,000) in Q1 2025 . 🔹 X. Jones Financial Companies LLLP Increased its position by XXXXX% in Q4 2024, adding XXXXX shares. It now holds XXXXX shares (~$33,000) . 🔹 X. Xponance Inc. Took a new position in Q1 2025 worth about $XXXXXX . 🔹 X. Sava Infond d.o.o. Established a new stake in Q4 2024 (~$44,000) . 🔹 X. Annex Advisory Services LLC Took a new position in Q1 2025 worth around $XXXXXX . 🔹 X. May Hill Capital LLC Also added a new stake in Q1 2025, valued at roughly $XXXXXX . 🔹 X. SG Americas Securities LLC More than doubled its holdings (+104.8%) in Q4 2024, adding XXXXXXX shares to reach a total of XXXXXXXXX shares (~$5 million) . 🔹 X. Citigroup Became the 4th-largest institutional holder by adding XXXX million shares in Q1 2025—now totaling $XX million) . 🔹 X. UBS Group AG Holds the largest institutional stake in NIO. Increased its ownership by ~70% in Q1 to a record level . In summary: Fresh Significant Positions: Ping Capital, Xponance, Sava Infond, Annex Advisory, May Hill. Sizeable Increases: Jones Financial, SG Americas Securities, Citigroup, and UBS. These moves demonstrate heightened institutional confidence in NIO, with some adding noteworthy new stakes and others scaling up existing positions significantly  XXXXX engagements  **Related Topics** [nio](/topic/nio) [stocks](/topic/stocks) [$nio](/topic/$nio) [Post Link](https://x.com/jan_dekkers/status/1946320765823193423)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

jan dekkers @jan_dekkers on x 1148 followers

Created: 2025-07-18 21:26:46 UTC

jan dekkers @jan_dekkers on x 1148 followers

Created: 2025-07-18 21:26:46 UTC

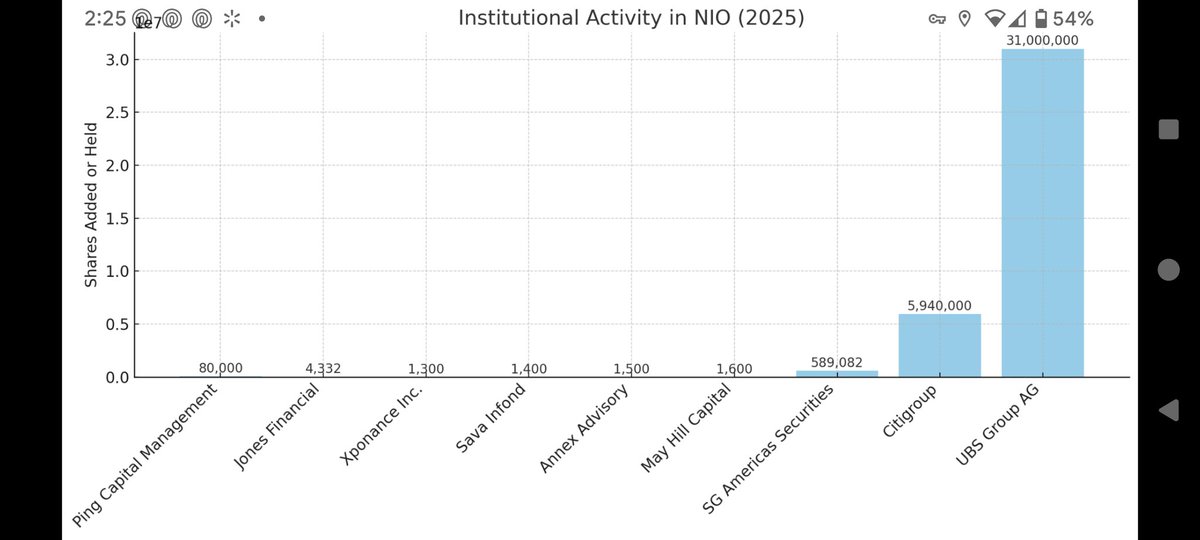

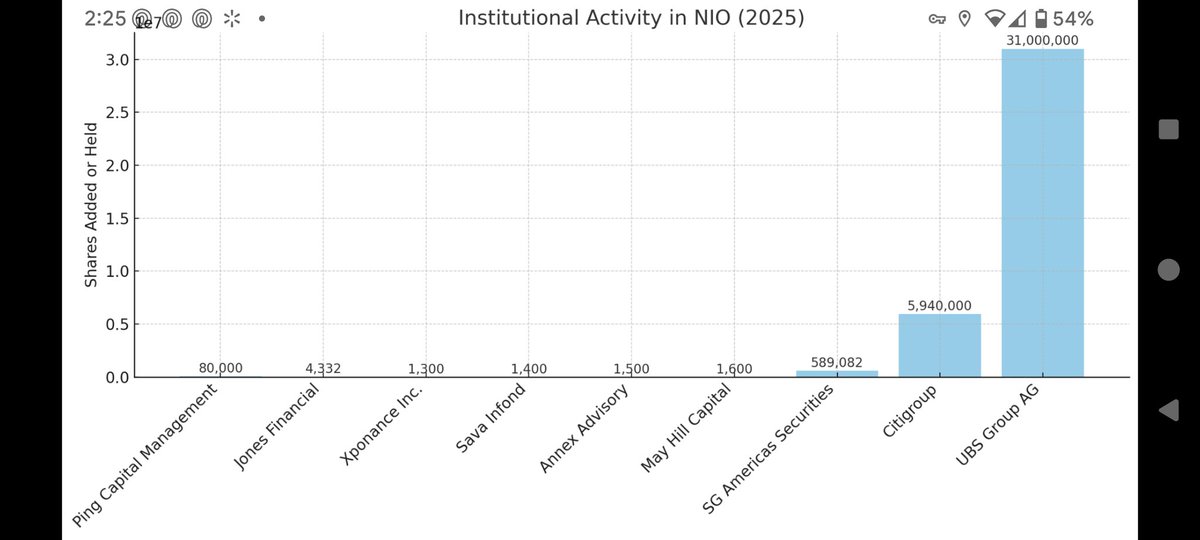

Here’s a look at the latest institutional investors adding (or boosting) positions in $NIO as of filings through July 18, 2025:

🔹 X. Ping Capital Management Inc.

IPO'd a new stake of XXXXXX NIO shares (~$305,000) in Q1 2025 .

🔹 X. Jones Financial Companies LLLP

Increased its position by XXXXX% in Q4 2024, adding XXXXX shares. It now holds XXXXX shares (~$33,000) .

🔹 X. Xponance Inc.

Took a new position in Q1 2025 worth about $XXXXXX .

🔹 X. Sava Infond d.o.o.

Established a new stake in Q4 2024 (~$44,000) .

🔹 X. Annex Advisory Services LLC

Took a new position in Q1 2025 worth around $XXXXXX .

🔹 X. May Hill Capital LLC

Also added a new stake in Q1 2025, valued at roughly $XXXXXX .

🔹 X. SG Americas Securities LLC

More than doubled its holdings (+104.8%) in Q4 2024, adding XXXXXXX shares to reach a total of XXXXXXXXX shares (~$5 million) .

🔹 X. Citigroup

Became the 4th-largest institutional holder by adding XXXX million shares in Q1 2025—now totaling $XX million) .

🔹 X. UBS Group AG

Holds the largest institutional stake in NIO. Increased its ownership by ~70% in Q1 to a record level .

In summary:

Fresh Significant Positions: Ping Capital, Xponance, Sava Infond, Annex Advisory, May Hill.

Sizeable Increases: Jones Financial, SG Americas Securities, Citigroup, and UBS.

These moves demonstrate heightened institutional confidence in NIO, with some adding noteworthy new stakes and others scaling up existing positions significantly

XXXXX engagements