[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Marvin Labs [@marvin_labs](/creator/twitter/marvin_labs) on x XXX followers Created: 2025-07-18 20:22:32 UTC $SCHW 2Q-2025: Record numbers, but is growth sustainable as funding model shifts? * Adjusted EPS: $1.14, up XX% vs 2Q-2024 ($0.66). * Revenue: Grew XX% year-over-year. * Core net new assets: $80.3B, up XX% from prior year. * Total client assets: $10.76T, up XX% year-over-year. * Account openings: 1.1M new accounts, up XX% vs 2Q-2024. * Reduced high-cost bank funding by $10.4B to $27.7B at quarter end. * Capital returns of $2.8B through redemptions and buybacks. Margin expansion appears linked to asset and account growth, but reduced reliance on higher-cost bank funding could signal operational restraint or evolving liquidity needs. Earnings call scheduled for today at 09:30 am EDT.  XX engagements  **Related Topics** [$277b](/topic/$277b) [$104b](/topic/$104b) [$1076t](/topic/$1076t) [$803b](/topic/$803b) [eps](/topic/eps) [$schw](/topic/$schw) [charles schwab](/topic/charles-schwab) [stocks financial services](/topic/stocks-financial-services) [Post Link](https://x.com/marvin_labs/status/1946304601927369112)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Marvin Labs @marvin_labs on x XXX followers

Created: 2025-07-18 20:22:32 UTC

Marvin Labs @marvin_labs on x XXX followers

Created: 2025-07-18 20:22:32 UTC

$SCHW 2Q-2025: Record numbers, but is growth sustainable as funding model shifts?

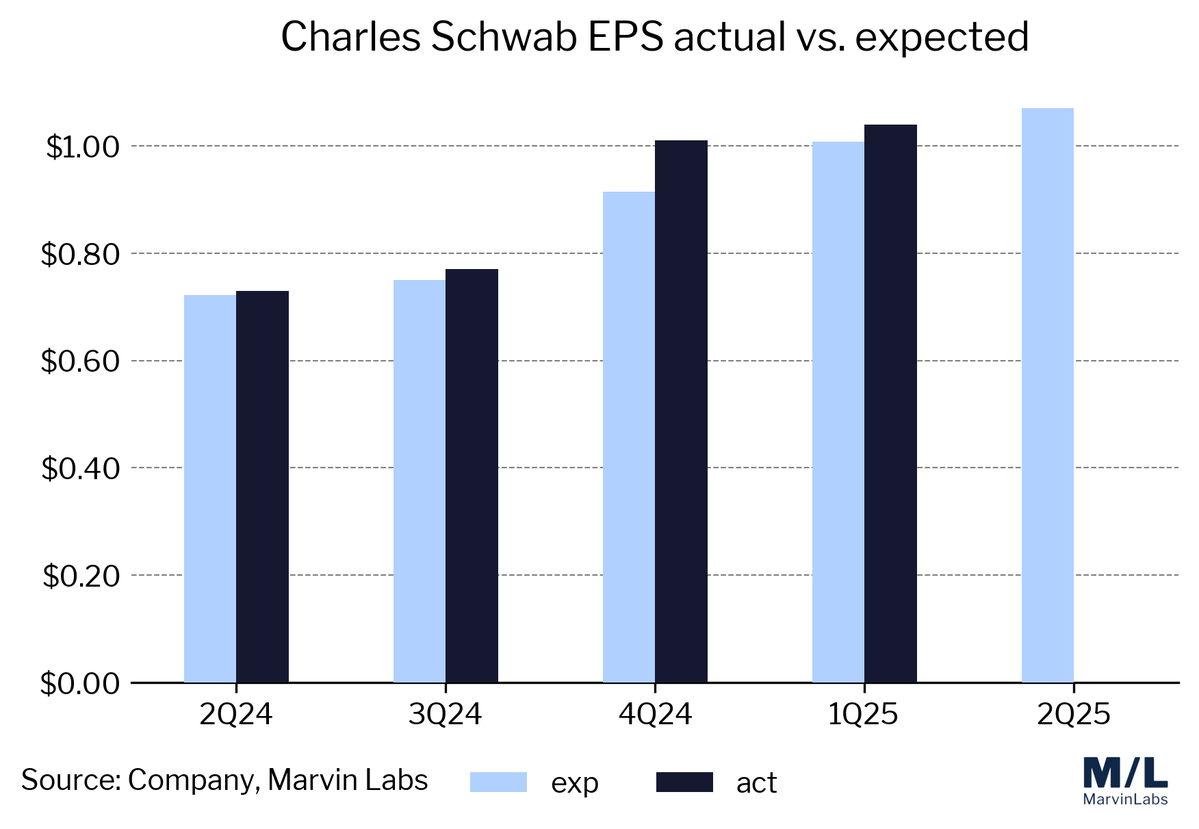

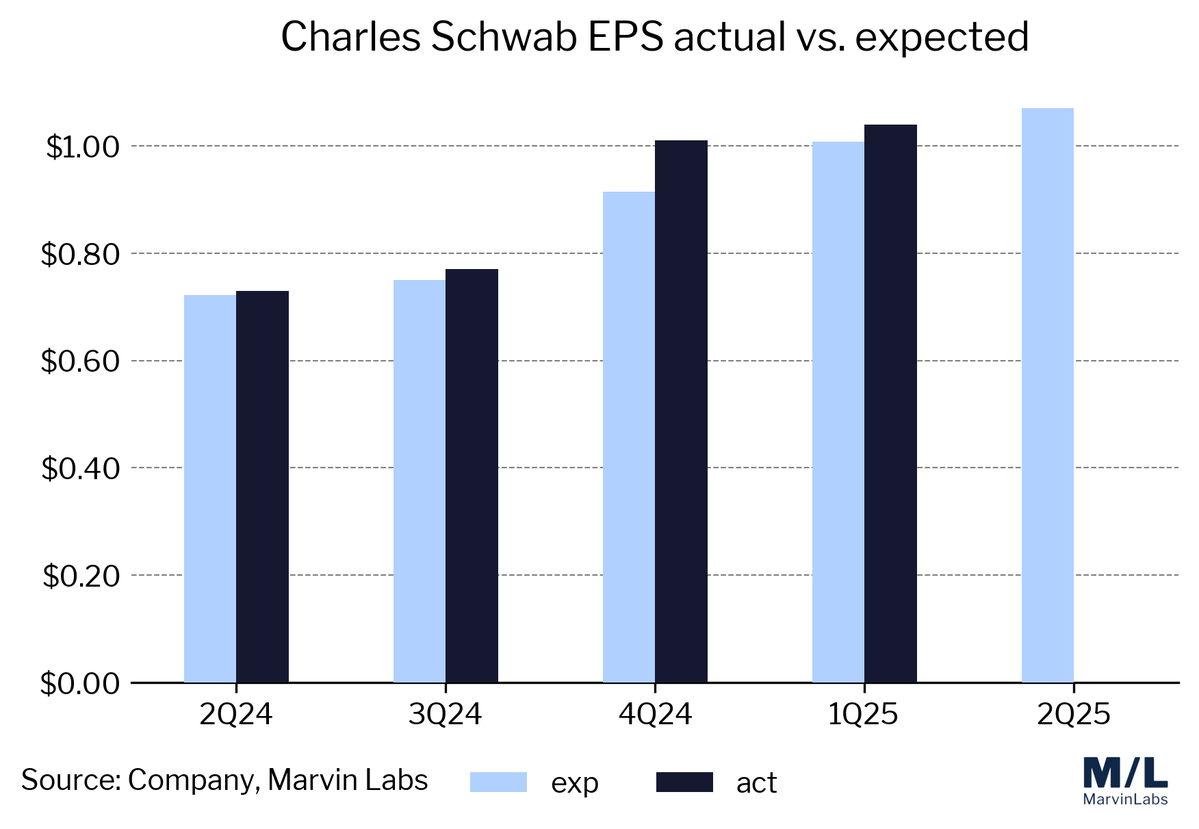

- Adjusted EPS: $1.14, up XX% vs 2Q-2024 ($0.66).

- Revenue: Grew XX% year-over-year.

- Core net new assets: $80.3B, up XX% from prior year.

- Total client assets: $10.76T, up XX% year-over-year.

- Account openings: 1.1M new accounts, up XX% vs 2Q-2024.

- Reduced high-cost bank funding by $10.4B to $27.7B at quarter end.

- Capital returns of $2.8B through redemptions and buybacks.

Margin expansion appears linked to asset and account growth, but reduced reliance on higher-cost bank funding could signal operational restraint or evolving liquidity needs.

Earnings call scheduled for today at 09:30 am EDT.

XX engagements

Related Topics $277b $104b $1076t $803b eps $schw charles schwab stocks financial services