[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  pennyether [@penny_ether](/creator/twitter/penny_ether) on x 9961 followers Created: 2025-07-18 17:12:15 UTC $MARA - Going back to my roots for a moment and calling out red flags. This was off-the-dome, so I probably forgot some stuff (feel free to comment). Happy to hear counter-arguments to any of these -- other than "they have a big HODL". Financials: - Heavy reliance on ATM. That money does not appear to be put to good use. It's spent to patch up a massive leaking tanker, and concurrently to grow the size of this leaking tanker. (Would potentially be a turn-around story if they weren't already massive and weren't already overvalued.) - Industry-high cash hashcost of around $XX (Q1). Total cash burn was around $170m in Q1. Since they HODL, this all must get funded via ATM or debt. Peers are in mid/low $30's, $IREN is below $XX. Expressed as $/KWH (eg, agnostic of fleet J/TH), they are trailing as well. - The above hashcost excludes other cash expenses which seemingly contribute $X towards the bottom line: R&D, "other non-operating income", "taxes other than on income". (totalled $22m in Q1) - I don't know how they pay so much for ASICs, but they do. End of 2023, $862m cost basis on mining rigs. End of 2024, $1,706m. So they spent $843m to increase EH/s from XXXX to XXXX. That's $30/TH/s, or $30m / EH/s. - For reference, at XXX EH/s difficulty, X EH/s produces around XX BTC per month. Call it $1.8m/month, at a cost of ($43 x XXXXX x 30) = ~$1.3m/month.. so around $500k/month cashflow on a $30m investment. (Economics of this are subject to hashprice, but the halving will cut BTC mined in half.) - Still a heavy reliance on hosting (45% of BTC mined, in Q1). This is improving, but it's at a cost to buy (high downtime) infra. More ATM usage, just to get inline with peers. - EV/EBITDA: Going off of 346m shares (Feb), $2.225b in debt (or 82m shares), and XXXXXX BTC, their EV is around $3b. So you're paying $3b for mining operations. At hashcost of around $40, hashprice of around $60, and around XX EH/s (generously)... that's around $365m of cashflow per year at present conditions. So, you're paying for ~8 years of cashflow, should hashprice stay where it's at now (it will almost certainly decay across those X years). - The above isn't including the additional shares to be printed to expand the fleet (higher EV), nor the additional EH/s they'll get from the fleet (higher EBITDA)... but do you really want to pay a premium for larger scale version of these economics? - Where is 2PIC revenue? - Quite generous stock-based compensation. Operations: - Massive downtime. "Energized EH/s" is their preferred metric... They stopped reporting average operational EH/s nearly a year ago (I wonder why?). - But, average EH/s can be deduced from BTC mined. Since Jan 2024, they've averaged XXXX% in missing hashrate. In Q2 they'll have missed out on ~$30m of revenue for not operating at "energized EH/s" levels. - The "average operational EH/s" I compute is based on BTC mined. As a result of running their own pool, there is volatility to be expected (luck factor). But, apparently they've had "10% luck" -- a fact they are ironically proud of -- so actually their operational EH/s is lower than deduced. - Operating their own mining pool contributes practically nothing to top line revenue. I estimate they accrued an additional $1.1m of revenue in 2024, over the network average tx fees. That amounts to XXX% of additional revenue. Smoke and mirrors: - Incessant attempts of "Ivory Tower" positioning, a spaghetti-against-the-wall approach to being relevant in adjacent narratives, and they are not transparent. - No analyst questions in earnings calls. They appear to be "fireside chats" and the question/responses seem canned. - No interviews. Unless you count management and board members interviewing each other. (I don't.) - Persistent spam of PR's and tweets about non-core business prospects, loosely related narratives, or just crap. When it is business related, little to no disclosure or remarks of potential financial impact. - Coattail riding of Saylor, Trump, and whomever is visibly bullish on "energy", "AI", "USA", "Bitcoin". Same for any narratives which are popular (BTC Treasury, AI, Power, etc). - No disclosure of large ASIC purchase orders, or fleet. - At its core, $MARA just mines BTC at high cost... they are not any more suited to benefit from these themes than their peers, and in most cases are less suited. Other: - In the coming months, there's a good chance they will not mine the most BTC. Depends on luck, and how fast they splurge on hitting their XX EH/s target (possibly by paying for hosting, which would mean worse financials in their 10Qs). Summary of Business Model: (Trust me, I minored in astronomy.) ------------ Disclaimer: I bought some Sept $20P, and am short the stock -- mostly as a hedge against my other BTC-related positions.  XXXXXX engagements  **Related Topics** [money](/topic/money) [atm](/topic/atm) [reliance](/topic/reliance) [hodl](/topic/hodl) [$mara](/topic/$mara) [stocks financial services](/topic/stocks-financial-services) [stocks bitcoin treasuries](/topic/stocks-bitcoin-treasuries) [Post Link](https://x.com/penny_ether/status/1946256715118485711)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

pennyether @penny_ether on x 9961 followers

Created: 2025-07-18 17:12:15 UTC

pennyether @penny_ether on x 9961 followers

Created: 2025-07-18 17:12:15 UTC

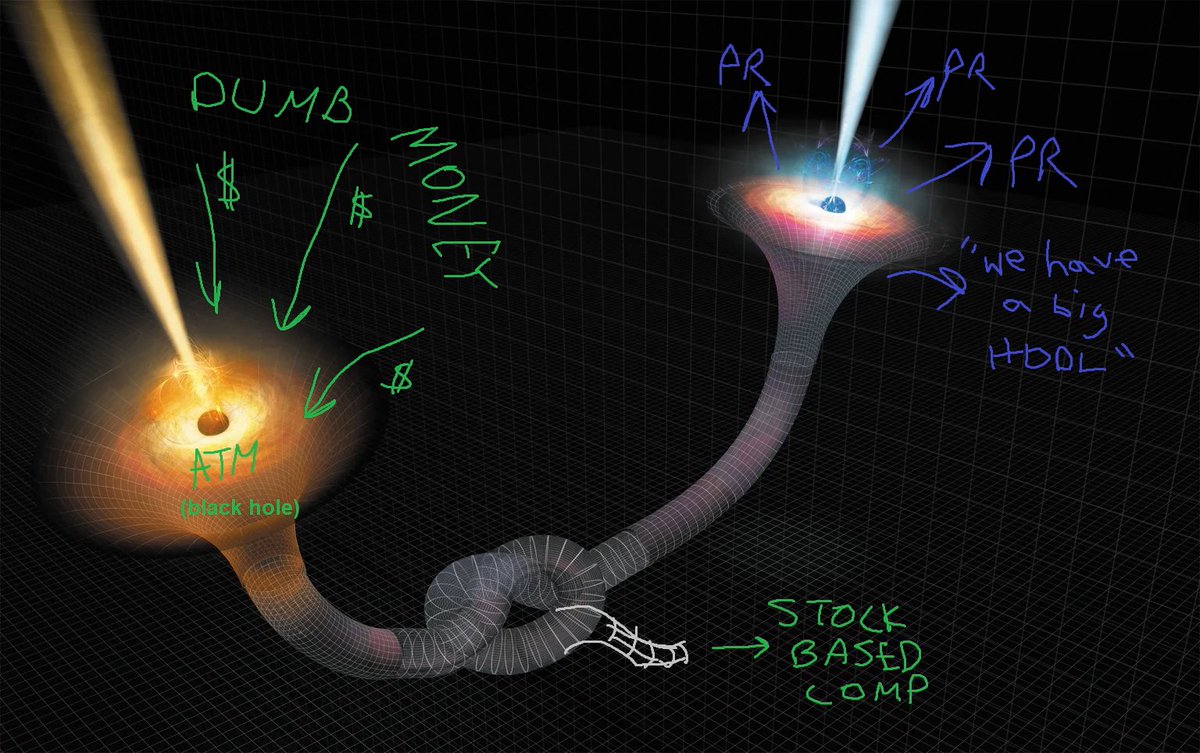

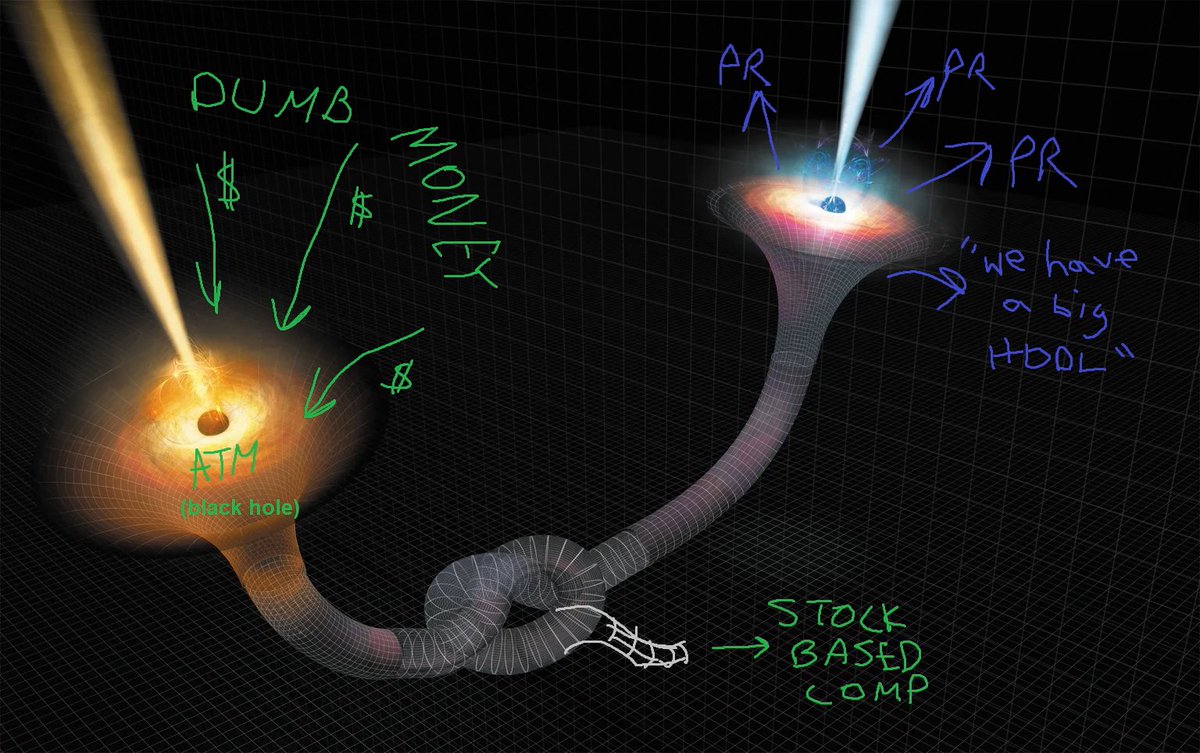

$MARA - Going back to my roots for a moment and calling out red flags. This was off-the-dome, so I probably forgot some stuff (feel free to comment). Happy to hear counter-arguments to any of these -- other than "they have a big HODL".

Financials:

- Heavy reliance on ATM. That money does not appear to be put to good use. It's spent to patch up a massive leaking tanker, and concurrently to grow the size of this leaking tanker. (Would potentially be a turn-around story if they weren't already massive and weren't already overvalued.)

- Industry-high cash hashcost of around $XX (Q1). Total cash burn was around $170m in Q1. Since they HODL, this all must get funded via ATM or debt. Peers are in mid/low $30's, $IREN is below $XX. Expressed as $/KWH (eg, agnostic of fleet J/TH), they are trailing as well.

- The above hashcost excludes other cash expenses which seemingly contribute $X towards the bottom line: R&D, "other non-operating income", "taxes other than on income". (totalled $22m in Q1)

- I don't know how they pay so much for ASICs, but they do. End of 2023, $862m cost basis on mining rigs. End of 2024, $1,706m. So they spent $843m to increase EH/s from XXXX to XXXX. That's $30/TH/s, or $30m / EH/s.

- For reference, at XXX EH/s difficulty, X EH/s produces around XX BTC per month. Call it $1.8m/month, at a cost of ($43 x XXXXX x 30) = ~$1.3m/month.. so around $500k/month cashflow on a $30m investment. (Economics of this are subject to hashprice, but the halving will cut BTC mined in half.)

- Still a heavy reliance on hosting (45% of BTC mined, in Q1). This is improving, but it's at a cost to buy (high downtime) infra. More ATM usage, just to get inline with peers.

- EV/EBITDA: Going off of 346m shares (Feb), $2.225b in debt (or 82m shares), and XXXXXX BTC, their EV is around $3b. So you're paying $3b for mining operations. At hashcost of around $40, hashprice of around $60, and around XX EH/s (generously)... that's around $365m of cashflow per year at present conditions. So, you're paying for ~8 years of cashflow, should hashprice stay where it's at now (it will almost certainly decay across those X years).

- The above isn't including the additional shares to be printed to expand the fleet (higher EV), nor the additional EH/s they'll get from the fleet (higher EBITDA)... but do you really want to pay a premium for larger scale version of these economics?

- Where is 2PIC revenue?

- Quite generous stock-based compensation.

Operations:

- Massive downtime. "Energized EH/s" is their preferred metric... They stopped reporting average operational EH/s nearly a year ago (I wonder why?).

- But, average EH/s can be deduced from BTC mined. Since Jan 2024, they've averaged XXXX% in missing hashrate. In Q2 they'll have missed out on ~$30m of revenue for not operating at "energized EH/s" levels.

- The "average operational EH/s" I compute is based on BTC mined. As a result of running their own pool, there is volatility to be expected (luck factor). But, apparently they've had "10% luck" -- a fact they are ironically proud of -- so actually their operational EH/s is lower than deduced.

- Operating their own mining pool contributes practically nothing to top line revenue. I estimate they accrued an additional $1.1m of revenue in 2024, over the network average tx fees. That amounts to XXX% of additional revenue.

Smoke and mirrors:

- Incessant attempts of "Ivory Tower" positioning, a spaghetti-against-the-wall approach to being relevant in adjacent narratives, and they are not transparent.

- No analyst questions in earnings calls. They appear to be "fireside chats" and the question/responses seem canned.

- No interviews. Unless you count management and board members interviewing each other. (I don't.)

- Persistent spam of PR's and tweets about non-core business prospects, loosely related narratives, or just crap. When it is business related, little to no disclosure or remarks of potential financial impact.

- Coattail riding of Saylor, Trump, and whomever is visibly bullish on "energy", "AI", "USA", "Bitcoin". Same for any narratives which are popular (BTC Treasury, AI, Power, etc).

- No disclosure of large ASIC purchase orders, or fleet.

- At its core, $MARA just mines BTC at high cost... they are not any more suited to benefit from these themes than their peers, and in most cases are less suited.

Other:

- In the coming months, there's a good chance they will not mine the most BTC. Depends on luck, and how fast they splurge on hitting their XX EH/s target (possibly by paying for hosting, which would mean worse financials in their 10Qs).

Summary of Business Model:

(Trust me, I minored in astronomy.)

Disclaimer: I bought some Sept $20P, and am short the stock -- mostly as a hedge against my other BTC-related positions.

XXXXXX engagements

Related Topics money atm reliance hodl $mara stocks financial services stocks bitcoin treasuries