[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Kakashii [@kakashiii111](/creator/twitter/kakashiii111) on x 17.1K followers Created: 2025-07-18 17:09:48 UTC Nvidia Presents the Cloud Credits Boom NVIDIA’s cloud credits method began in the second half of 2022, when they announced partnerships with “cloud service providers” to offer cloud-based infrastructure for training AI models—just in time for ChatGPT’s launch and the AI FOMO frenzy. Why Did Nvidia Come Up With This? Nvidia realized their own cloud services might not make money quickly and would require significant time and investment to grow. So, by partnering with cloud companies, Nvidia lets these companies join the AI party by scoring GPUs without needing to come up with the cash. How Does the Cloud Credits System Work? Nvidia “sells” these GPUs to the cloud companies, but instead of getting paid cash right away, Nvidia receives something called cloud credits. These credits allow Nvidia to “buy” services from those cloud providers later. When Nvidia “sells” GPUs to cloud providers and gets cloud credits instead of cash, it essentially means Nvidia is recording a receivable or an asset—a kind of IOU or prepaid balance with those partners. These credits represent Nvidia’s right to use services from the cloud providers later—like a trade or barter arrangement, not immediate cash income. Accounting Perspective From an accounting point of view, Nvidia books revenue from the GPU “sale”, but simultaneously it creates an obligation to consume cloud services in return. Then, the credits become an obligation for Nvidia because they must eventually “pay” for services by using those credits. It’s not pure profit until the services are actually consumed or settled. This approach helps Nvidia show revenue growth now, while cash flow or actual costs get balanced over time as cloud services are used. What Is the Scale of Nvidia’s Use of This? In just XXX years, these cloud credits jumped from $XXX billion to over $XX billion per quarter—a 10x surge (!). That’s the NVIDIA magic: a clever way to fuel the AI narrative by looping capital through cloud partners while booking revenue on the other end.  XXXXXX engagements  **Related Topics** [money](/topic/money) [fomo](/topic/fomo) [coins ai](/topic/coins-ai) [$nvda](/topic/$nvda) [stocks technology](/topic/stocks-technology) [Post Link](https://x.com/kakashiii111/status/1946256097888858380)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Kakashii @kakashiii111 on x 17.1K followers

Created: 2025-07-18 17:09:48 UTC

Kakashii @kakashiii111 on x 17.1K followers

Created: 2025-07-18 17:09:48 UTC

Nvidia Presents the Cloud Credits Boom

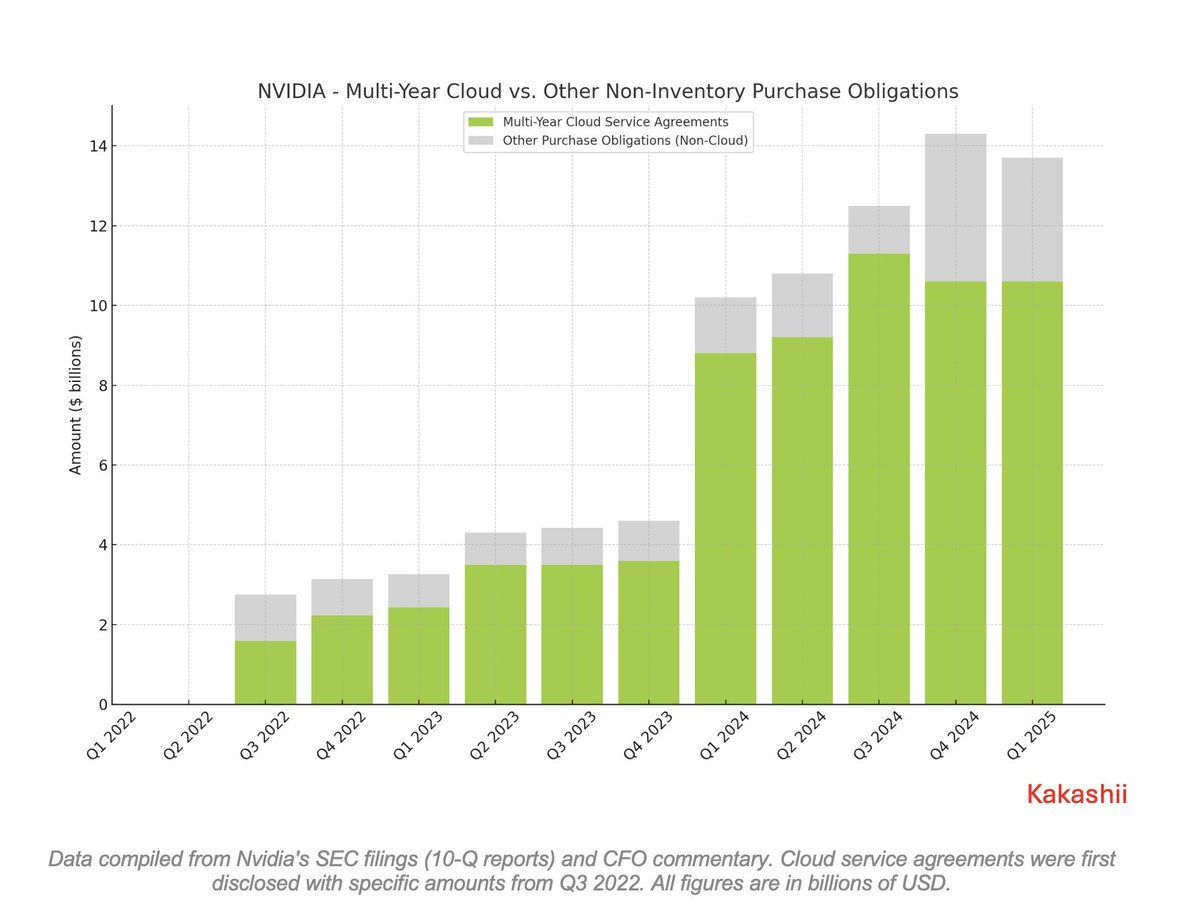

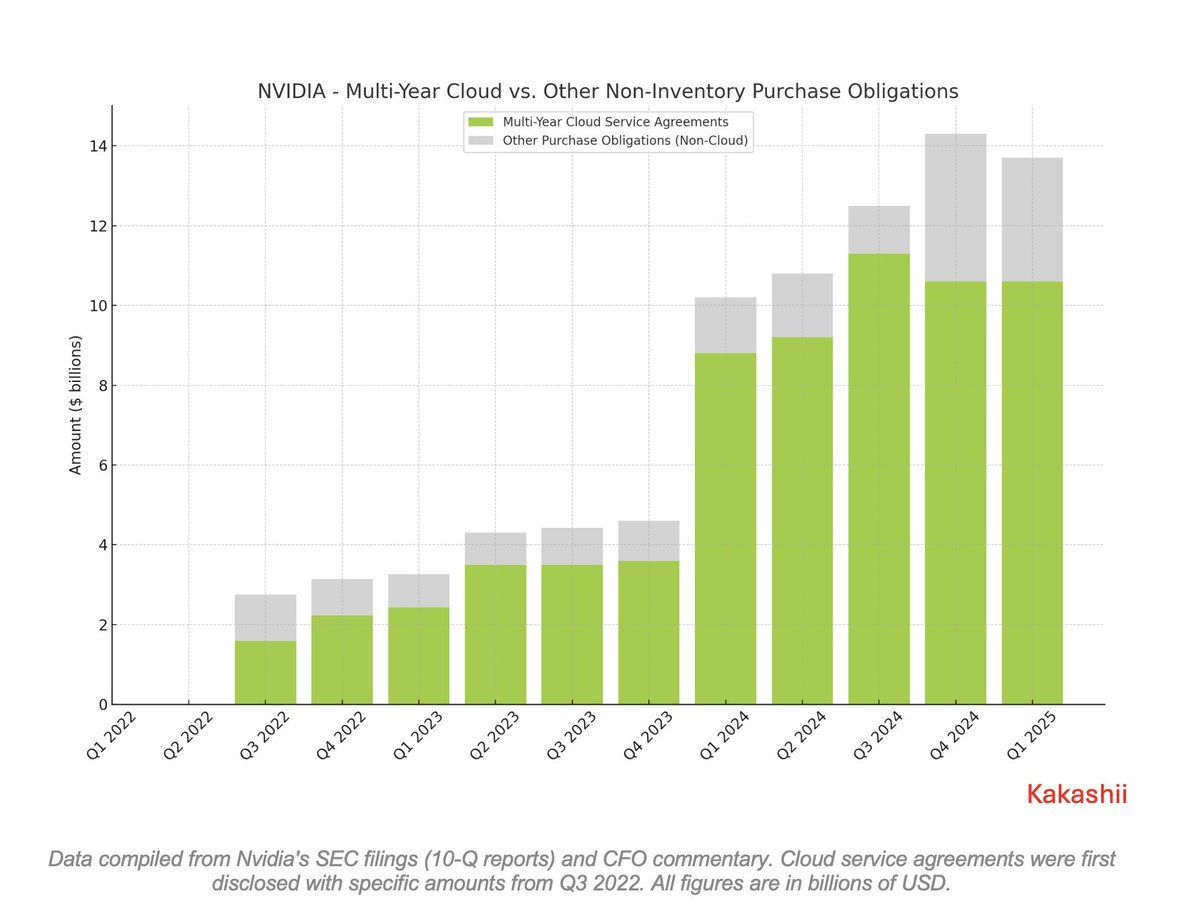

NVIDIA’s cloud credits method began in the second half of 2022, when they announced partnerships with “cloud service providers” to offer cloud-based infrastructure for training AI models—just in time for ChatGPT’s launch and the AI FOMO frenzy.

Why Did Nvidia Come Up With This? Nvidia realized their own cloud services might not make money quickly and would require significant time and investment to grow. So, by partnering with cloud companies, Nvidia lets these companies join the AI party by scoring GPUs without needing to come up with the cash.

How Does the Cloud Credits System Work? Nvidia “sells” these GPUs to the cloud companies, but instead of getting paid cash right away, Nvidia receives something called cloud credits. These credits allow Nvidia to “buy” services from those cloud providers later.

When Nvidia “sells” GPUs to cloud providers and gets cloud credits instead of cash, it essentially means Nvidia is recording a receivable or an asset—a kind of IOU or prepaid balance with those partners.

These credits represent Nvidia’s right to use services from the cloud providers later—like a trade or barter arrangement, not immediate cash income.

Accounting Perspective From an accounting point of view, Nvidia books revenue from the GPU “sale”, but simultaneously it creates an obligation to consume cloud services in return.

Then, the credits become an obligation for Nvidia because they must eventually “pay” for services by using those credits. It’s not pure profit until the services are actually consumed or settled.

This approach helps Nvidia show revenue growth now, while cash flow or actual costs get balanced over time as cloud services are used.

What Is the Scale of Nvidia’s Use of This? In just XXX years, these cloud credits jumped from $XXX billion to over $XX billion per quarter—a 10x surge (!). That’s the NVIDIA magic: a clever way to fuel the AI narrative by looping capital through cloud partners while booking revenue on the other end.

XXXXXX engagements

Related Topics money fomo coins ai $nvda stocks technology