[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Jason Shuman [@JasonrShuman](/creator/twitter/JasonrShuman) on x 13K followers Created: 2025-07-18 16:10:06 UTC We’re in inning X of the vertical AI battle. And we're not even scratching the surface. Let’s do some math: Say a Vertical AI startup goes from $X to $5M ARR in 12–18 months. ACV = $60K That’s ~83 customers In a market with, say, XXXXXXX qualified targets (e.g. law firms, HVAC contractors, medtech reps, etc)… That’s XXXX% market penetration. Not even X basis point. Now look at X TAM scenario models in the image: -$2B TAM - 33K Target Accounts - .25% market penetration -$10B TAM - 166K Target Accounts - .05% market penetration -$30B+ TAM - $500K Target Accounts - .017% market penetration Even the fastest-growing vertical AI companies have barely scratched the surface. These aren’t crowded markets—they’re uncontested beachheads. In most markets the incumbents haven’t caught up. Most buyers are still in their first-ever AI pilot. And usage is only getting stickier with agents, workflows, and proprietary data loops...products are also getting better by the day This is the opening chapter of a 10-year transformation where: Vertical AI becomes the OS of every services industry The best products own data and the orchestration of high impact, daily workflows And the wedge is often: “We Sell You Revenue” There’s a reason you’re seeing $5M ARR companies command $100-300M+ valuations. The Series A firms don't look at it as froth. They see it as the power law. And it’s inning X.  XXXXX engagements  **Related Topics** [medtech](/topic/medtech) [$60k](/topic/$60k) [$5m](/topic/$5m) [coins ai](/topic/coins-ai) [Post Link](https://x.com/JasonrShuman/status/1946241074277818656)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Jason Shuman @JasonrShuman on x 13K followers

Created: 2025-07-18 16:10:06 UTC

Jason Shuman @JasonrShuman on x 13K followers

Created: 2025-07-18 16:10:06 UTC

We’re in inning X of the vertical AI battle. And we're not even scratching the surface.

Let’s do some math:

Say a Vertical AI startup goes from $X to $5M ARR in 12–18 months.

ACV = $60K That’s ~83 customers In a market with, say, XXXXXXX qualified targets (e.g. law firms, HVAC contractors, medtech reps, etc)…

That’s XXXX% market penetration. Not even X basis point.

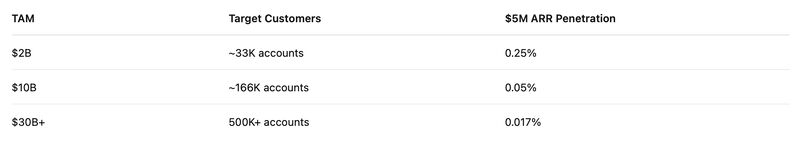

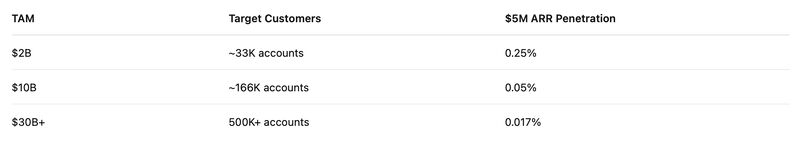

Now look at X TAM scenario models in the image: -$2B TAM - 33K Target Accounts - .25% market penetration -$10B TAM - 166K Target Accounts - .05% market penetration -$30B+ TAM - $500K Target Accounts - .017% market penetration

Even the fastest-growing vertical AI companies have barely scratched the surface. These aren’t crowded markets—they’re uncontested beachheads.

In most markets the incumbents haven’t caught up. Most buyers are still in their first-ever AI pilot. And usage is only getting stickier with agents, workflows, and proprietary data loops...products are also getting better by the day

This is the opening chapter of a 10-year transformation where:

Vertical AI becomes the OS of every services industry The best products own data and the orchestration of high impact, daily workflows And the wedge is often: “We Sell You Revenue”

There’s a reason you’re seeing $5M ARR companies command $100-300M+ valuations.

The Series A firms don't look at it as froth. They see it as the power law. And it’s inning X.

XXXXX engagements