[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Eugene Ng [@EugeneNg_VCap](/creator/twitter/EugeneNg_VCap) on x 24.5K followers Created: 2025-07-18 15:05:27 UTC Netflix $NFLX 2Q25 Earnings - Rev $11.1b +16% ↗️🟢 - GP $5.8b +31% ↗️🟢 margin XX% +606 bps ✅ - EBIT $3.8b +45% ↗️🟢 margin XX% +684 bps ✅ - Net Inc $3.1b +46% ↗️🟢 margin XX% +575 bps ✅ - OCF $2.4b +88% ⤴️🟢 margin XX% +837 bps ✅ - FCF $2.3b +87% ⤴️🟢 margin XX% +778 bps ✅ Biz Metrics - UCAN $4.9b +14% ↗️🟢 - EMEA $3.4b +7% ↗️🟡 - LATAM $1.3b +5% ↗️🟡 - APAC $1.3b +16% ↗️🟢 3Q25 Mgmt Guide - Rev $11.5b +17% ↗️🟢 - EBIT $3.6b +25% ↗️🟢 margin XX% +184 bps ✅ - Net Inc $3b +26% ↗️🟢 margin XX% +178 bps ✅ FY25 Mgmt Guide (unchanged) - FY25 Rev $45.2b +16% ↗️🟢 (raised) - FY25 EBIT margin XXXX% ↗️🟢 (raised) - FY25 FCF $8b +16% ↗️🟢 X | Strength in underlying business, strong H2 slate will continue strong momentum, resulting in raise But the good news is we're also seeing strength in our underlying business. We've got healthy member growth, and that even picked up nicely at the end of Q2, a bit more than we expected. And we think that will carry through with our strong back half slate. So we're reflecting that in our latest forecast. X | Strong revenue growth function of more members, higher subscription pricing and increased ad revenue, favourable FX drove much of the beat Our Q2 revenue increased by XX% YoY (17% FXN). YoY revenue growth was primarily a function of more members, higher subscription pricing and increased ad revenue. All regions experienced healthy year-over-year revenue growth, with each region posting double-digit FXN increases. UCAN revenue growth accelerated YoY to XX% vs. X% in Q1’25 due to the full quarter impact of price changes. Revenue was slightly above our guidance due primarily to favorable F/X impact, net of hedging. Member growth was ahead of our forecast, although this occurred late in the quarter, limiting the impact on Q2 revenue. X | No change in user metrics, remain stable and industry leading, engagement remains healthy Similar to last quarter, we're carefully watching consumer sentiment in the broader economy. But at this point, really nothing significant to note in the metrics and the indicators that we get directly through the business. Those are retention that remains stable and industry-leading. There have been no significant shifts in plan mix or planned take rate and the price changes we've done since the last quarter have been in line with expectations. Engagement also remains healthy. X | Netflix provides a lot of value relative to price and is usually resilient during weaker economic times So things all look stable from those indicators and big picture, entertainment in general, and Net ix speci c have been historically pretty resilient and tougher economic times. We also think that we are an incredible entertainment value, not only compared to traditional entertainment, but if you think about other streaming competitors, when we start at $XXXX in the United States and you think about all of the entertainment you get, we have a belief and expectation that the demand for not only entertainment, but for us, speci cally will remain strong. X | Ad sales is seeing strong growth off small base, and the incremental revenues are flowing largely to the bottom, pushing profit margins higher And we're also seeing nice momentum in ad sales. Still off a pretty small base, but good growth, and it's on pace to roughly double our revenue in the year, and it's a bit ahead of beginning of year expectations. So when we carry all that through to operating margin, our operating expenses are essentially unchanged, which is part of your question. So they're basically unchanged forecast to forecast. So we're largely owing through the expected higher revenues to pro t margins. So that's why our updated target full year reported margin is up X point from XX% to XX% and that 50bps increase in FX neutral margin is really just that revenue lift from stronger membership growth in ads relative to prior forecast owing through the margin. X | Expect content expenses to ramp in Q3 and Q4 alongside higher marketing expenses to support the heavier H2 content slate Well, this is really mostly timing. So thanks, Barton. As a reminder, we primarily manage the full year margins, and we expect our content expenses will ramp in Q3 and Q4. We've got many of our biggest new and returning titles and live events in the back half of the year. We've also -- Q4 is typically and generally almost always is a heavier lm slate. I'm sure we'll talk about -- I expect we'll talk about more of this on the call. We'll also be marketing to support that heavier slate, and we're continuing to aggressively build out our ad sales infrastructure and capabilities through the year. X | Closed a large majority of ad deals with the major ad agencies, to 2X the ad business, excited about Netflix’s highly attentive and engaged audience Yes. As we noted in the letter, our U.S. upfront, it's nearly complete. We've closed a large majority of deals with the major agencies. Those results have generally been in line or slightly better than our targets and consistent with our goal to roughly double the ads business this year. And what are advertisers excited about, growing scale is something we denitely hear. Also, a highly attentive and engaged audience. So bigger audience, but also an audience that's more engaged relative to our peers X | Completed the rollout of Netflix’s own ads tech stack, making it easier for advertisers to buy, driving programmatic buying higher We've completed the rollout of our own ads tech stack, the Netflix ad suite to all of our ad markets now. So we're fully on our own stack around the world at this point. That rollout was generally smooth across all countries. We see good performance metrics across all countries and the early results are in line with our expectations. Now we're in this phase of learning and improving quickly based on the fact that being live everywhere means that you get a bunch of feedback about what we can do better, which is great. As we mentioned before, the most immediate benefit from this rollout is just making it easier for advertisers to buy on Netflix. We hear that benefit, that ease from direct feedback talking to advertisers. They tell us that it's easier. We see it in our overall sales performance. We've seen an increased programmatic buying. X | Focused on improved targeting, measurement, and leveraging advertiser and 3P data sources to improve ads personalization, introducing interactivity in H2 Long term, being on our own stack that improves the speed of our execution to deliver this pretty significant road map of features that we have in front of us. It's things like improved targeting and measurement. There's also leveraging advertiser and third-party data sources, which we definitely hear demand for as well. And it will ultimately allow us to improve the ad experience for our members, which is critically important. So that means better adds personalization. So the ads that I see are increasingly different from the ads that say, Ted would see, and they're more relevant for each of us, which is good for us as users and it's good for the brands. We're also going to be introducing interactivity in the second half of the year. So that's exciting. XX | Household engagement flat, management is aware and want to increase it So total view hours did grow a bit in the first half '25, and that's despite a particularly back half-weighted slate. But to your point on engagement on a per member basis, we've mostly been focused for the last few years on measuring engagement on what we call an owner household basis. So this takes out the borrower e ect, and we obviously think this is the best way to assess our engagement per member because it removes the tricky comparison impacts from paid sharing. So that metric, per owner household engagement has been relatively steady over the past XXX years. Throughout the rollout of paid sharing and amidst increasing competition for TV time is more viewing moves to streaming and gets this on-demand benefit. So we're glad to have held that normalized engagement level, but we clearly also want to increase it. And to that end, we're optimistic and expect that our engagement growth in the second half of this year will be better than in the first half given our strong second half slate. XX | Because no single title drives >1% of total viewing, Netflix is not in the business of generating big one-off hits, but rather a steady pipeline of shows and films, quality at scale Yes, I'll take that. And thank you, Doug. On the rst part of your question, we're denitely riding this long-term trend of linear to streaming and that has a natural adoption curve, but we can accelerate our growth with big hits. But as you said, each one of them, even in success, is going to drive about X% of total viewing. So you need a lot more than just a big hit every once in a while. So to your point, it's not about the single hit. So what it is, is about a steady drumbeat of shows and lms and soon enough, games, that our members really love and continue to expect from us. So like by way of example, we had XX individual shows nominated for Emmys this year. So that's what quality at scale looks like. XX | Users want more variety, more breadth of content, TF1 partnership is to expand their offering Perhaps to start with the rationale for the partnership. You would think with that long list of amazing titles that Ted just rattled o , we would have enough to satisfy every person on the planet. But it turns out, we actually consistently hear from our members that they want more. They want more variety, more breadth of content. XX | Sports is a subcomponent of their live strategy, focused on big breakthrough events, live remains small of viewing hours, but has outsized positive impacts around acquisition and retention Remember, sports are a subcomponent of our live strategy but our live strategy goes beyond sports alone. Our live strategy and our sports strategy are unchanged. We remain focused on ownable big breakthrough events that -- because our audiences really love them. Anything we chase in the event space or in the sports space has got to make economic sense as well. We bring a lot to the table and the deals that we make ought to reect that. So live is a relatively small part of the total content spend, and we've got about XXX billion view hours. So it's a pretty small part of view ours as well right now. But that being said, not all view hours are equal. And what we've seen with live is it has its outsized positive impacts around conversation around acquisition, and we suspect around retention. And so right now, we're very excited where we sit. We're very excited with the existing strategy. XX | With producing original content in house, working with others allows Netflix to scale, rather than merely backfilling Today, we still have shows that are produced by others: Universal, 20th Television, which is Disney, Paramount, Lionsgate, Warner Television. There's lots of available infrastructure to produce TV, and that is true of live events and sports as well. When we do more and more, we may choose to bring some of that in-house. We've already produced a few, and we're just as likely to continue to use partners with existing production infrastructure and work to make sure that those productions are bespoke and do they feel like they could only be on Net ix. So you shouldn't think about the mix partnerships and self-producing as a -- we think about it as a scaling tool, not back lling some lack of ability in some area of the company. XX | Open to evolve their consumer facing model, but a few important principles remain I would say we remain open to evolving our consumer-facing model. I think we've got a few principles, important principles that we're carrying with us that I don't see changing significantly. One is we want to provide members choice, right? So how do we have a different set of plans at di erent price points with different features. It allows folks to opt into what the -- is the right Net ix for them. XX | Seeing better performance from new UI interface to support a wider breadth of entertainment But now that we've actually rolled out this new UI to the first large wave of TV devices, we're actually seeing performance that's better than what we saw in our prelaunch testing. And to some degree, that's expected because we made some improvements based on the results of that testing phase. So it's exciting to see that those delivered actually better results. Bluntly, the previous experience was designed for the Netflix of XX years ago, and the business has evolved considerably since then. We got a wider breadth of entertainment options. XX | Allowing Netflix to leverage real-time recommendations that respond dynamically Add to that, we saw the opportunity to leverage newer technologies like real-time recommendations that respond dynamically to what you need from us in that specific moment. So the Net ix you get on a Tuesday night is different from the Net ix you get on a Sunday afternoon. But all of those rationales together and what we're seeing in terms of the performance of far, we're very confident that we've got a much better platform in this new user experience to build from to continue to improve, and that will help us meet the needs of the business over the years to come. XX | Want to work with best creatives globally Look, we want to be in business with the best creatives on the planet, regardless of where they come from. Some of them are here in Hollywood, others are in Korea, some are in India and some are creators distribute only on social media platforms and most of them have not yet been discovered. So for those creators doing great work, we have phenomenal distribution, desirable monetization, brilliant discovery in our UI and a hungry audience waiting to be entertained. XX | Working with a wide set of content creators make sense and some selected larger YouTube podcasters could make sense And we largely agree with you and believe that working with a wide set of content creators makes a lot of sense for us. And as you said, if I'm remembering it right, not everything on YouTube will fit on Netflix, and we couldn't agree with that more. But there are some creators on YouTube like Ms. Rachel that are a great t. If you saw on the engagement report, she's had XX million views in the first half of 2025 on Net ix. So she clearly works on Net ix. And we're really excited about the Sidemen and Pop the Balloon, and a wide variety of creators and video podcasters that might be a good t for us, and particularly if they're doing great work and looking for different ways to connect with audiences. XX | Netflix remains focused on gaining more of the XX% share outside of Netflix and YouTube And back to your specific question, it's worth remembering there's about XX% of total TV view share that neither Net ix or YouTube are winning right now. We think that represents a huge opportunity for which we are competing aggressively and we aim to grow our share…The vast majority of our money and attention is focused on that 80%. XX | Netflix used GenAI with AI-powered VFX to show buildings collapsing in Bueno Aires in El Eternaut, completed 10X faster, and at cheaper costs, first GenAI final footage to appear in Netflix original series or film Well, let me start with GenAI. We remain convinced that AI represents an incredible opportunity to help creators make lms and series better, not just cheaper. They're AIpowered creator tools. So this is real people doing real work with better tools. Our creators are already seeing the bene ts in production through pre-visualization and shot planning work and certainly, visual e ects. It used to be that only big budget projects would have access to advanced visual e ects like de-aging. Remember, last quarter, we talked about Pedro Paramo. That's just no longer the case. And this year, we had El Eternaut. It's a very big hit show for us from Argentina. And in that production, we leveraged virtual production and AI-powered VFX. And there was a shot in the show that the creators wanted to show building collapsing of Buenos Aires. So our Eyeline team partnered with their creative team. Using AI powered tools, they were able to achieve an amazing result with remarkable speed and in fact, that VFX sequence was completed 10x faster than it could have been completed with visual -- traditional VFX tools and workflows. And also, the cost of it just wouldn't have been feasible for a show on that budget. So that sequence actually is the very first GenAI nal footage to appear on screen in a Netflix original series or film. So the creators were thrilled with the result. We were thrilled with the result. And more importantly, the audience was thrilled with the result. So I think these tools are helping creators expand the possibilities of storytelling on screen, and that is endlessly exciting. XX | See opportunities for AI to help with personalization and recommendations, piloting conversational UI And maybe to cover a few of the other areas. The member experience is a place where we feel like there's tons of opportunity to leverage these new generative technologies to improve the experience. We've been in the personalization and recommendation business for X decades, but yet we see a tremendous room and opportunity to make it even better by leveraging some of the more newer generative techniques. We're also rolling out, have piloted right now a conversational experience that uses, allows our members to basically have a sort of natural language discussion with our user interface thing. XX | Not interested in owning legacy media networks, prefer to grow it organically and investing aggressively And maybe to cover a few of the other areas. The member experience is a place where we feel like there's tons of opportunity to leverage these new generative technologies to improve the experience. We've been in the personalization and recommendation business for X decades, but yet we see a tremendous room and opportunity to make it even better by leveraging some of the more newer generative techniques. We're also rolling out, have piloted right now a conversational experience that uses, allows our members to basically have a sort of natural language discussion with our user interface thing. ➡️ Key Takeaway on Netflix: Netflix continues grow very strongly driven by a mix of paid sub growth and increasing pricing over time as they deliver more value to their customers. Content spend operating leverage continues to drives EBIT profit margins higher over time, which means earnings will grow faster than topline revenue growth. Optimistic to watch Netflix executing its ad strategy thoughtful where the adding of ad subs bottomline accretive in expanding its customer segment meaningful as incremental cost of adding a subscriber is low versus the ad revenues it can generate from its ad subs.  XXXXX engagements  **Related Topics** [$13b](/topic/$13b) [$34b](/topic/$34b) [$49b](/topic/$49b) [$23b](/topic/$23b) [$24b](/topic/$24b) [$31b](/topic/$31b) [$38b](/topic/$38b) [$58b](/topic/$58b) [Post Link](https://x.com/EugeneNg_VCap/status/1946224805826769164)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Eugene Ng @EugeneNg_VCap on x 24.5K followers

Created: 2025-07-18 15:05:27 UTC

Eugene Ng @EugeneNg_VCap on x 24.5K followers

Created: 2025-07-18 15:05:27 UTC

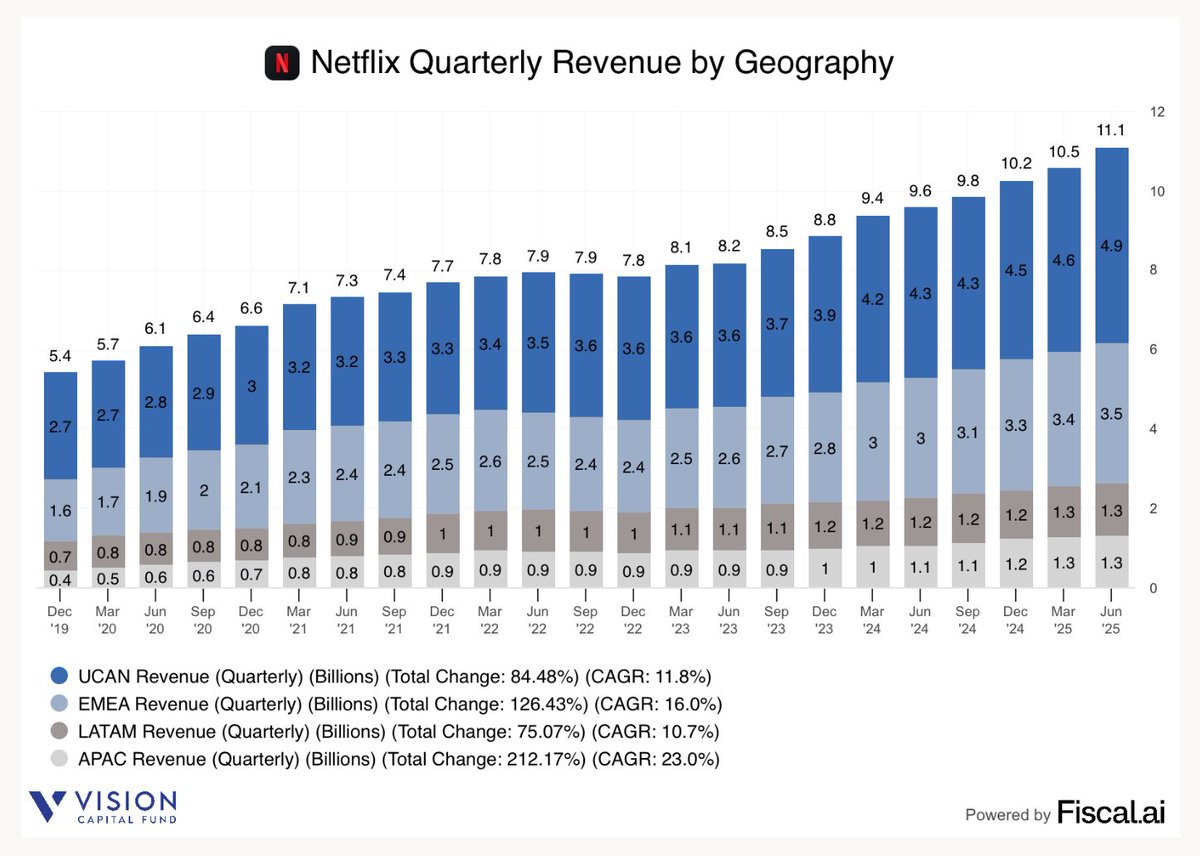

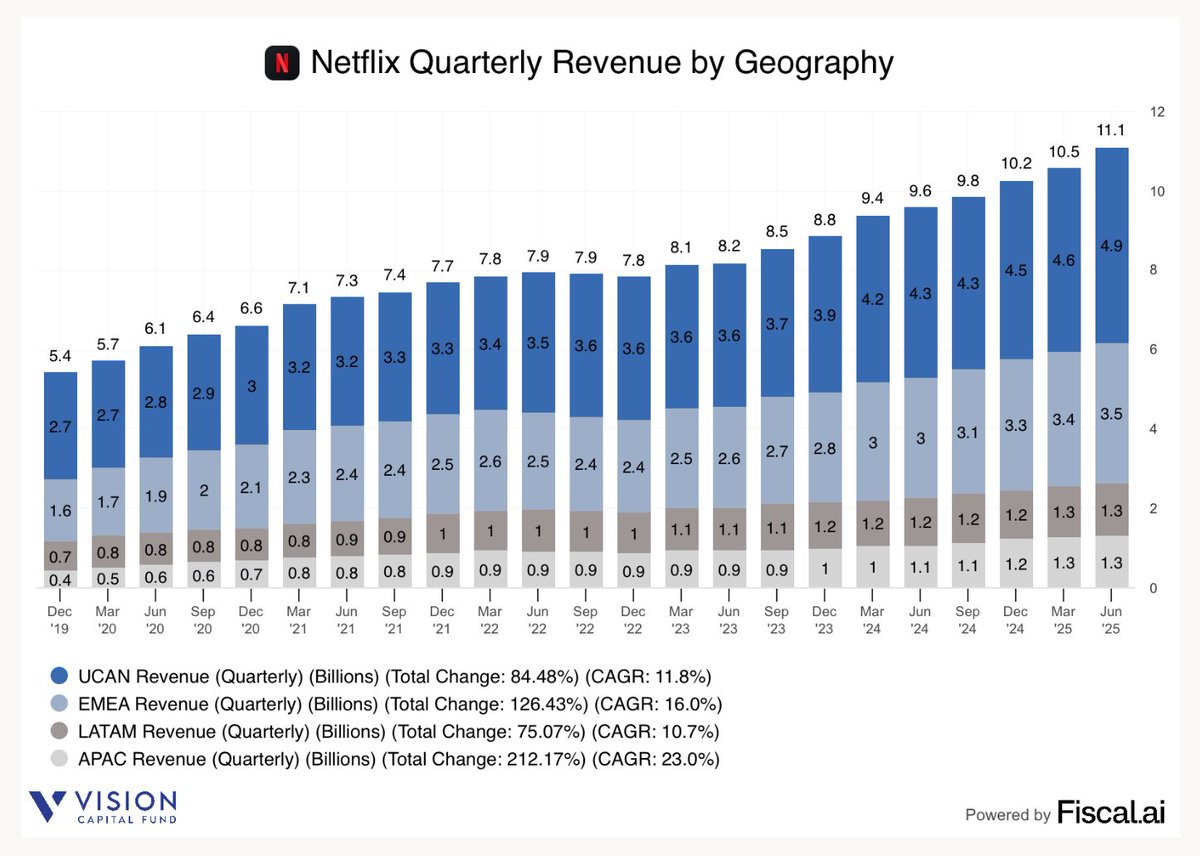

Netflix $NFLX 2Q25 Earnings

- Rev $11.1b +16% ↗️🟢

- GP $5.8b +31% ↗️🟢 margin XX% +606 bps ✅

- EBIT $3.8b +45% ↗️🟢 margin XX% +684 bps ✅

- Net Inc $3.1b +46% ↗️🟢 margin XX% +575 bps ✅

- OCF $2.4b +88% ⤴️🟢 margin XX% +837 bps ✅

- FCF $2.3b +87% ⤴️🟢 margin XX% +778 bps ✅

Biz Metrics

- UCAN $4.9b +14% ↗️🟢

- EMEA $3.4b +7% ↗️🟡

- LATAM $1.3b +5% ↗️🟡

- APAC $1.3b +16% ↗️🟢

3Q25 Mgmt Guide

- Rev $11.5b +17% ↗️🟢

- EBIT $3.6b +25% ↗️🟢 margin XX% +184 bps ✅

- Net Inc $3b +26% ↗️🟢 margin XX% +178 bps ✅

FY25 Mgmt Guide (unchanged)

- FY25 Rev $45.2b +16% ↗️🟢 (raised)

- FY25 EBIT margin XXXX% ↗️🟢 (raised)

- FY25 FCF $8b +16% ↗️🟢

X | Strength in underlying business, strong H2 slate will continue strong momentum, resulting in raise

But the good news is we're also seeing strength in our underlying business. We've got healthy member growth, and that even picked up nicely at the end of Q2, a bit more than we expected. And we think that will carry through with our strong back half slate. So we're reflecting that in our latest forecast.

X | Strong revenue growth function of more members, higher subscription pricing and increased ad revenue, favourable FX drove much of the beat

Our Q2 revenue increased by XX% YoY (17% FXN). YoY revenue growth was primarily a function of more members, higher subscription pricing and increased ad revenue. All regions experienced healthy year-over-year revenue growth, with each region posting double-digit FXN increases. UCAN revenue growth accelerated YoY to XX% vs. X% in Q1’25 due to the full quarter impact of price changes. Revenue was slightly above our guidance due primarily to favorable F/X impact, net of hedging. Member growth was ahead of our forecast, although this occurred late in the quarter, limiting the impact on Q2 revenue.

X | No change in user metrics, remain stable and industry leading, engagement remains healthy

Similar to last quarter, we're carefully watching consumer sentiment in the broader economy. But at this point, really nothing significant to note in the metrics and the indicators that we get directly through the business. Those are retention that remains stable and industry-leading. There have been no significant shifts in plan mix or planned take rate and the price changes we've done since the last quarter have been in line with expectations. Engagement also remains healthy.

X | Netflix provides a lot of value relative to price and is usually resilient during weaker economic times

So things all look stable from those indicators and big picture, entertainment in general, and Net ix speci c have been historically pretty resilient and tougher economic times. We also think that we are an incredible entertainment value, not only compared to traditional entertainment, but if you think about other streaming competitors, when we start at $XXXX in the United States and you think about all of the entertainment you get, we have a belief and expectation that the demand for not only entertainment, but for us, speci cally will remain strong.

X | Ad sales is seeing strong growth off small base, and the incremental revenues are flowing largely to the bottom, pushing profit margins higher

And we're also seeing nice momentum in ad sales. Still off a pretty small base, but good growth, and it's on pace to roughly double our revenue in the year, and it's a bit ahead of beginning of year expectations. So when we carry all that through to operating margin, our operating expenses are essentially unchanged, which is part of your question. So they're basically unchanged forecast to forecast. So we're largely owing through the expected higher revenues to pro t margins. So that's why our updated target full year reported margin is up X point from XX% to XX% and that 50bps increase in FX neutral margin is really just that revenue lift from stronger membership growth in ads relative to prior forecast owing through the margin.

X | Expect content expenses to ramp in Q3 and Q4 alongside higher marketing expenses to support the heavier H2 content slate

Well, this is really mostly timing. So thanks, Barton. As a reminder, we primarily manage the full year margins, and we expect our content expenses will ramp in Q3 and Q4. We've got many of our biggest new and returning titles and live events in the back half of the year. We've also -- Q4 is typically and generally almost always is a heavier lm slate. I'm sure we'll talk about -- I expect we'll talk about more of this on the call. We'll also be marketing to support that heavier slate, and we're continuing to aggressively build out our ad sales infrastructure and capabilities through the year.

X | Closed a large majority of ad deals with the major ad agencies, to 2X the ad business, excited about Netflix’s highly attentive and engaged audience

Yes. As we noted in the letter, our U.S. upfront, it's nearly complete. We've closed a large majority of deals with the major agencies. Those results have generally been in line or slightly better than our targets and consistent with our goal to roughly double the ads business this year. And what are advertisers excited about, growing scale is something we denitely hear. Also, a highly attentive and engaged audience. So bigger audience, but also an audience that's more engaged relative to our peers

X | Completed the rollout of Netflix’s own ads tech stack, making it easier for advertisers to buy, driving programmatic buying higher

We've completed the rollout of our own ads tech stack, the Netflix ad suite to all of our ad markets now. So we're fully on our own stack around the world at this point. That rollout was generally smooth across all countries. We see good performance metrics across all countries and the early results are in line with our expectations. Now we're in this phase of learning and improving quickly based on the fact that being live everywhere means that you get a bunch of feedback about what we can do better, which is great. As we mentioned before, the most immediate benefit from this rollout is just making it easier for advertisers to buy on Netflix. We hear that benefit, that ease from direct feedback talking to advertisers. They tell us that it's easier. We see it in our overall sales performance. We've seen an increased programmatic buying.

X | Focused on improved targeting, measurement, and leveraging advertiser and 3P data sources to improve ads personalization, introducing interactivity in H2

Long term, being on our own stack that improves the speed of our execution to deliver this pretty significant road map of features that we have in front of us. It's things like improved targeting and measurement. There's also leveraging advertiser and third-party data sources, which we definitely hear demand for as well. And it will ultimately allow us to improve the ad experience for our members, which is critically important. So that means better adds personalization. So the ads that I see are increasingly different from the ads that say, Ted would see, and they're more relevant for each of us, which is good for us as users and it's good for the brands. We're also going to be introducing interactivity in the second half of the year. So that's exciting.

XX | Household engagement flat, management is aware and want to increase it

So total view hours did grow a bit in the first half '25, and that's despite a particularly back half-weighted slate. But to your point on engagement on a per member basis, we've mostly been focused for the last few years on measuring engagement on what we call an owner household basis. So this takes out the borrower e ect, and we obviously think this is the best way to assess our engagement per member because it removes the tricky comparison impacts from paid sharing. So that metric, per owner household engagement has been relatively steady over the past XXX years. Throughout the rollout of paid sharing and amidst increasing competition for TV time is more viewing moves to streaming and gets this on-demand benefit. So we're glad to have held that normalized engagement level, but we clearly also want to increase it. And to that end, we're optimistic and expect that our engagement growth in the second half of this year will be better than in the first half given our strong second half slate.

XX | Because no single title drives >1% of total viewing, Netflix is not in the business of generating big one-off hits, but rather a steady pipeline of shows and films, quality at scale

Yes, I'll take that. And thank you, Doug. On the rst part of your question, we're denitely riding this long-term trend of linear to streaming and that has a natural adoption curve, but we can accelerate our growth with big hits. But as you said, each one of them, even in success, is going to drive about X% of total viewing. So you need a lot more than just a big hit every once in a while. So to your point, it's not about the single hit. So what it is, is about a steady drumbeat of shows and lms and soon enough, games, that our members really love and continue to expect from us. So like by way of example, we had XX individual shows nominated for Emmys this year. So that's what quality at scale looks like.

XX | Users want more variety, more breadth of content, TF1 partnership is to expand their offering

Perhaps to start with the rationale for the partnership. You would think with that long list of amazing titles that Ted just rattled o , we would have enough to satisfy every person on the planet. But it turns out, we actually consistently hear from our members that they want more. They want more variety, more breadth of content.

XX | Sports is a subcomponent of their live strategy, focused on big breakthrough events, live remains small of viewing hours, but has outsized positive impacts around acquisition and retention

Remember, sports are a subcomponent of our live strategy but our live strategy goes beyond sports alone. Our live strategy and our sports strategy are unchanged. We remain focused on ownable big breakthrough events that -- because our audiences really love them. Anything we chase in the event space or in the sports space has got to make economic sense as well. We bring a lot to the table and the deals that we make ought to reect that. So live is a relatively small part of the total content spend, and we've got about XXX billion view hours. So it's a pretty small part of view ours as well right now. But that being said, not all view hours are equal. And what we've seen with live is it has its outsized positive impacts around conversation around acquisition, and we suspect around retention. And so right now, we're very excited where we sit. We're very excited with the existing strategy.

XX | With producing original content in house, working with others allows Netflix to scale, rather than merely backfilling

Today, we still have shows that are produced by others: Universal, 20th Television, which is Disney, Paramount, Lionsgate, Warner Television. There's lots of available infrastructure to produce TV, and that is true of live events and sports as well. When we do more and more, we may choose to bring some of that in-house. We've already produced a few, and we're just as likely to continue to use partners with existing production infrastructure and work to make sure that those productions are bespoke and do they feel like they could only be on Net ix. So you shouldn't think about the mix partnerships and self-producing as a -- we think about it as a scaling tool, not back lling some lack of ability in some area of the company.

XX | Open to evolve their consumer facing model, but a few important principles remain

I would say we remain open to evolving our consumer-facing model. I think we've got a few principles, important principles that we're carrying with us that I don't see changing significantly. One is we want to provide members choice, right? So how do we have a different set of plans at di erent price points with different features. It allows folks to opt into what the -- is the right Net ix for them.

XX | Seeing better performance from new UI interface to support a wider breadth of entertainment

But now that we've actually rolled out this new UI to the first large wave of TV devices, we're actually seeing performance that's better than what we saw in our prelaunch testing. And to some degree, that's expected because we made some improvements based on the results of that testing phase. So it's exciting to see that those delivered actually better results.

Bluntly, the previous experience was designed for the Netflix of XX years ago, and the business has evolved considerably since then. We got a wider breadth of entertainment options.

XX | Allowing Netflix to leverage real-time recommendations that respond dynamically

Add to that, we saw the opportunity to leverage newer technologies like real-time recommendations that respond dynamically to what you need from us in that specific moment. So the Net ix you get on a Tuesday night is different from the Net ix you get on a Sunday afternoon. But all of those rationales together and what we're seeing in terms of the performance of far, we're very confident that we've got a much better platform in this new user experience to build from to continue to improve, and that will help us meet the needs of the business over the years to come.

XX | Want to work with best creatives globally

Look, we want to be in business with the best creatives on the planet, regardless of where they come from. Some of them are here in Hollywood, others are in Korea, some are in India and some are creators distribute only on social media platforms and most of them have not yet been discovered. So for those creators doing great work, we have phenomenal distribution, desirable monetization, brilliant discovery in our UI and a hungry audience waiting to be entertained.

XX | Working with a wide set of content creators make sense and some selected larger YouTube podcasters could make sense

And we largely agree with you and believe that working with a wide set of content creators makes a lot of sense for us. And as you said, if I'm remembering it right, not everything on YouTube will fit on Netflix, and we couldn't agree with that more. But there are some creators on YouTube like Ms. Rachel that are a great t. If you saw on the engagement report, she's had XX million views in the first half of 2025 on Net ix. So she clearly works on Net ix. And we're really excited about the Sidemen and Pop the Balloon, and a wide variety of creators and video podcasters that might be a good t for us, and particularly if they're doing great work and looking for different ways to connect with audiences.

XX | Netflix remains focused on gaining more of the XX% share outside of Netflix and YouTube

And back to your specific question, it's worth remembering there's about XX% of total TV view share that neither Net ix or YouTube are winning right now. We think that represents a huge opportunity for which we are competing aggressively and we aim to grow our share…The vast majority of our money and attention is focused on that 80%.

XX | Netflix used GenAI with AI-powered VFX to show buildings collapsing in Bueno Aires in El Eternaut, completed 10X faster, and at cheaper costs, first GenAI final footage to appear in Netflix original series or film

Well, let me start with GenAI. We remain convinced that AI represents an incredible opportunity to help creators make lms and series better, not just cheaper. They're AIpowered creator tools. So this is real people doing real work with better tools. Our creators are already seeing the bene ts in production through pre-visualization and shot planning work and certainly, visual e ects. It used to be that only big budget projects would have access to advanced visual e ects like de-aging. Remember, last quarter, we talked about Pedro Paramo. That's just no longer the case. And this year, we had El Eternaut. It's a very big hit show for us from Argentina. And in that production, we leveraged virtual production and AI-powered VFX. And there was a shot in the show that the creators wanted to show building collapsing of Buenos Aires.

So our Eyeline team partnered with their creative team. Using AI powered tools, they were able to achieve an amazing result with remarkable speed and in fact, that VFX sequence was completed 10x faster than it could have been completed with visual -- traditional VFX tools and workflows. And also, the cost of it just wouldn't have been feasible for a show on that budget. So that sequence actually is the very first GenAI nal footage to appear on screen in a Netflix original series or film. So the creators were thrilled with the result. We were thrilled with the result. And more importantly, the audience was thrilled with the result. So I think these tools are helping creators expand the possibilities of storytelling on screen, and that is endlessly exciting.

XX | See opportunities for AI to help with personalization and recommendations, piloting conversational UI

And maybe to cover a few of the other areas. The member experience is a place where we feel like there's tons of opportunity to leverage these new generative technologies to improve the experience. We've been in the personalization and recommendation business for X decades, but yet we see a tremendous room and opportunity to make it even better by leveraging some of the more newer generative techniques. We're also rolling out, have piloted right now a conversational experience that uses, allows our members to basically have a sort of natural language discussion with our user interface thing.

XX | Not interested in owning legacy media networks, prefer to grow it organically and investing aggressively

And maybe to cover a few of the other areas. The member experience is a place where we feel like there's tons of opportunity to leverage these new generative technologies to improve the experience. We've been in the personalization and recommendation business for X decades, but yet we see a tremendous room and opportunity to make it even better by leveraging some of the more newer generative techniques. We're also rolling out, have piloted right now a conversational experience that uses, allows our members to basically have a sort of natural language discussion with our user interface thing.

➡️ Key Takeaway on Netflix:

Netflix continues grow very strongly driven by a mix of paid sub growth and increasing pricing over time as they deliver more value to their customers. Content spend operating leverage continues to drives EBIT profit margins higher over time, which means earnings will grow faster than topline revenue growth. Optimistic to watch Netflix executing its ad strategy thoughtful where the adding of ad subs bottomline accretive in expanding its customer segment meaningful as incremental cost of adding a subscriber is low versus the ad revenues it can generate from its ad subs.

XXXXX engagements