[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  明 [@PPLSOPTIMISMCEO](/creator/twitter/PPLSOPTIMISMCEO) on x 11.4K followers Created: 2025-07-18 13:09:17 UTC This is why Chainlink has fundamentally evolved into essential technology to power the modern global financial system. Chainlink Runtime Environment - Replaces legacy systems that run Cobol or Java. This comprises the majority of existing traditional financial systems. This being adopted by SWIFT means that it is now an indispensable aspect of connecting and helping facilitate secured transactions for over XXXXXX banks globally. Automated Compliance Engine - This gives banks who wish to create stablecoins and prime brokers / clearing houses that wish to tokenize stocks a path to update their systems to blockchain based ones with minimal friction. Having compliance out of the box means that more banks and corporations who wish to create stablecoins or have their stocks tokenized and brought on-chain to blockchain based clearing houses e.g. ( $ETH or $XRP ) know that they are meeting mandatory legal requirements. *Coinbase Project Diamond (tokenized stocks for EU) -a partner *Robinhood (tokenized stocks for EU) -another example Stock tokenization represents a XXX trillion dollar market opportunity. Derivatives, exceeding a Quadrillion dollars. United States treasury operations are being revamped by stablecoins. Stablecoin providers are some of the world's largest purchasers of short term low interest treasury notes. These are the primary apparatus for backing stablecoins such as $USDC etc.. Proof of reserves is mandatory for the growing market to meet legal compliance and build trust. Without a price oracle and Chainlink's secured data transmission, there would be no way to verify issued stablecoins are backed by any tangible real world assets. Regarding blockchain operations- Smart contracts alone are insecure and can accomplish far less without Chainlink. Before Ethereum had Chainlink, the network could not support the financial services that it offers today. Over XX% of Ethereum is powered by Chainlink's technology. Source:  XXXXX engagements  **Related Topics** [swift](/topic/swift) [stocks technology](/topic/stocks-technology) [chainlink](/topic/chainlink) [coins defi](/topic/coins-defi) [coins made in usa](/topic/coins-made-in-usa) [coins bsc](/topic/coins-bsc) [coins solana ecosystem](/topic/coins-solana-ecosystem) [coins inj](/topic/coins-inj) [Post Link](https://x.com/PPLSOPTIMISMCEO/status/1946195573218103387)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

明 @PPLSOPTIMISMCEO on x 11.4K followers

Created: 2025-07-18 13:09:17 UTC

明 @PPLSOPTIMISMCEO on x 11.4K followers

Created: 2025-07-18 13:09:17 UTC

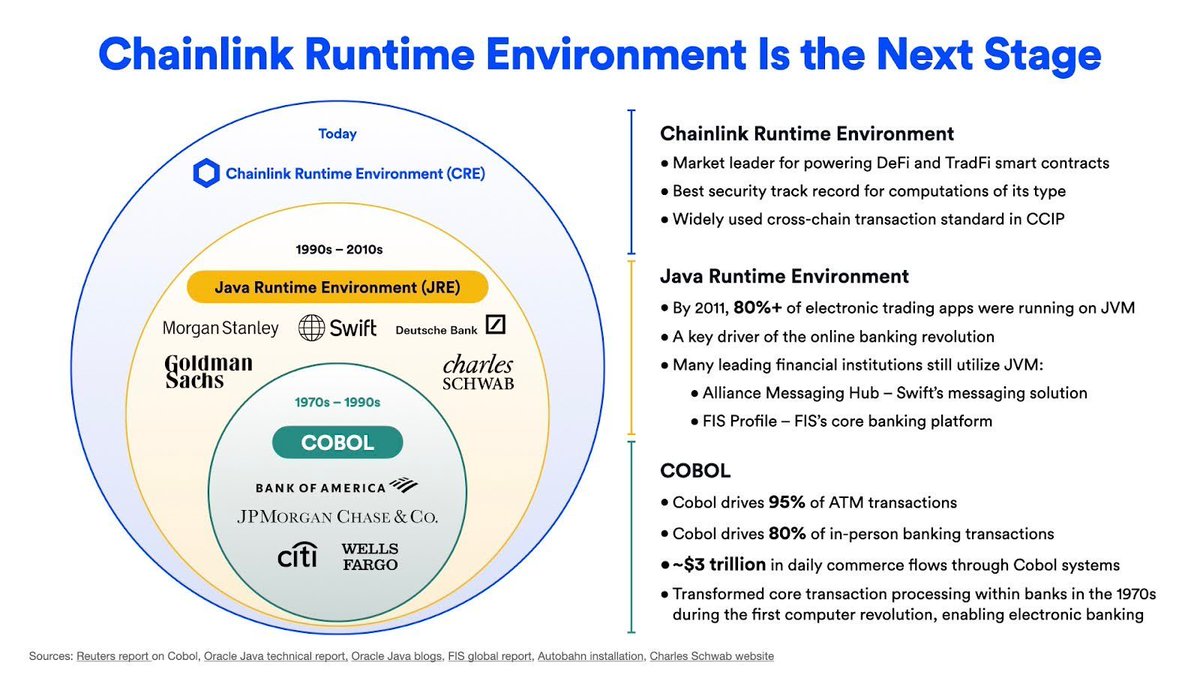

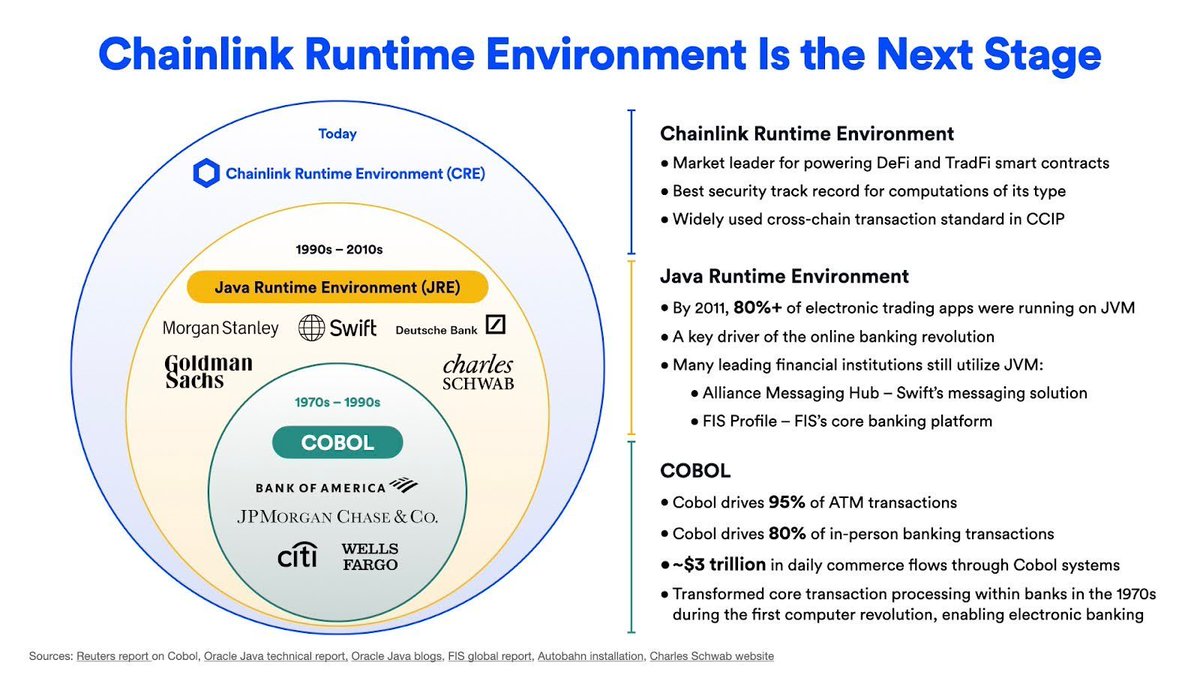

This is why Chainlink has fundamentally evolved into essential technology to power the modern global financial system.

Chainlink Runtime Environment - Replaces legacy systems that run Cobol or Java. This comprises the majority of existing traditional financial systems. This being adopted by SWIFT means that it is now an indispensable aspect of connecting and helping facilitate secured transactions for over XXXXXX banks globally.

Automated Compliance Engine - This gives banks who wish to create stablecoins and prime brokers / clearing houses that wish to tokenize stocks a path to update their systems to blockchain based ones with minimal friction.

Having compliance out of the box means that more banks and corporations who wish to create stablecoins or have their stocks tokenized and brought on-chain to blockchain based clearing houses e.g. ( $ETH or $XRP ) know that they are meeting mandatory legal requirements.

*Coinbase Project Diamond (tokenized stocks for EU) -a partner

*Robinhood (tokenized stocks for EU) -another example

Stock tokenization represents a XXX trillion dollar market opportunity. Derivatives, exceeding a Quadrillion dollars.

United States treasury operations are being revamped by stablecoins. Stablecoin providers are some of the world's largest purchasers of short term low interest treasury notes. These are the primary apparatus for backing stablecoins such as $USDC etc.. Proof of reserves is mandatory for the growing market to meet legal compliance and build trust. Without a price oracle and Chainlink's secured data transmission, there would be no way to verify issued stablecoins are backed by any tangible real world assets.

Regarding blockchain operations- Smart contracts alone are insecure and can accomplish far less without Chainlink. Before Ethereum had Chainlink, the network could not support the financial services that it offers today. Over XX% of Ethereum is powered by Chainlink's technology.

Source:

XXXXX engagements

Related Topics swift stocks technology chainlink coins defi coins made in usa coins bsc coins solana ecosystem coins inj