[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Sergey [@SergeyCYW](/creator/twitter/SergeyCYW) on x 6334 followers Created: 2025-07-18 11:33:05 UTC Thoughts on Netflix Earnings Report $NFLX: 🟢 Positive •Revenue reached $11.079B in Q2, up +15.9% YoY and +5.1% QoQ, beating estimates by 0.3%. •EPS of $7.19, up YoY and beating estimates by 1.6%. •Operating margin rose to 34.1%, up +6.8 percentage points YoY. •Gross margin expanded to XXXX% (+6.1 pps YoY), and free cash flow margin reached XXXX% (+7.8 pps YoY). •Net margin improved to 28.2%, up +5.7 pps YoY. •Q3 revenue guidance of $11.5B, +17.0% YoY, above consensus by 2.2%. •Ad business on track to double revenue in 2025; global ad tech stack rollout completed. •Netflix Ad Suite fully deployed; stronger-than-expected U.S. upfront results. •Strong member growth, late-quarter acceleration outperformed internal forecasts. •Continued improvement in UI/UX: faster discovery, lower failed sessions, enhanced personalization. •AI-powered production delivered VFX 10x faster at lower cost. •Diluted shares down -XXX% YoY, indicating effective buybacks. 🟡 Neutral •Engagement rose X% YoY, but per-household engagement remained flat; expected to improve in H2. •Games business showing early engagement gains, but remains non-material in revenue. •Live events delivering brand value, though still limited in total viewership share. •Ad-supported tier ($7.99/month) gaining traction without increasing churn, but still small in contribution. •Global content expansion progressing with localized partnerships (e.g., TF1), but scaling impact still in early stages. •Operating expenses flat QoQ; S&M and G&A expenses declined as % of revenue, but R&D held steady. •U.S. TV share declined slightly to XXX% (down -XXX pps YoY), showing stagnation. 🔴 Negative •LATAM revenue growth slower at +8.5% YoY, compared to stronger growth in EMEA and APAC. •Share of TV time in the U.S. remains flat despite heavy investment. •Content dependency risk persists, as even top titles account for just ~1% of viewership each. •Scaling live and games remains a margin challenge; monetization in games deferred. •High competition from free and bundled services continues to pressure engagement.  XXXXX engagements  **Related Topics** [cash flow](/topic/cash-flow) [eps](/topic/eps) [$11079b](/topic/$11079b) [$nflx](/topic/$nflx) [stocks communication services](/topic/stocks-communication-services) [Post Link](https://x.com/SergeyCYW/status/1946171361464095184)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Sergey @SergeyCYW on x 6334 followers

Created: 2025-07-18 11:33:05 UTC

Sergey @SergeyCYW on x 6334 followers

Created: 2025-07-18 11:33:05 UTC

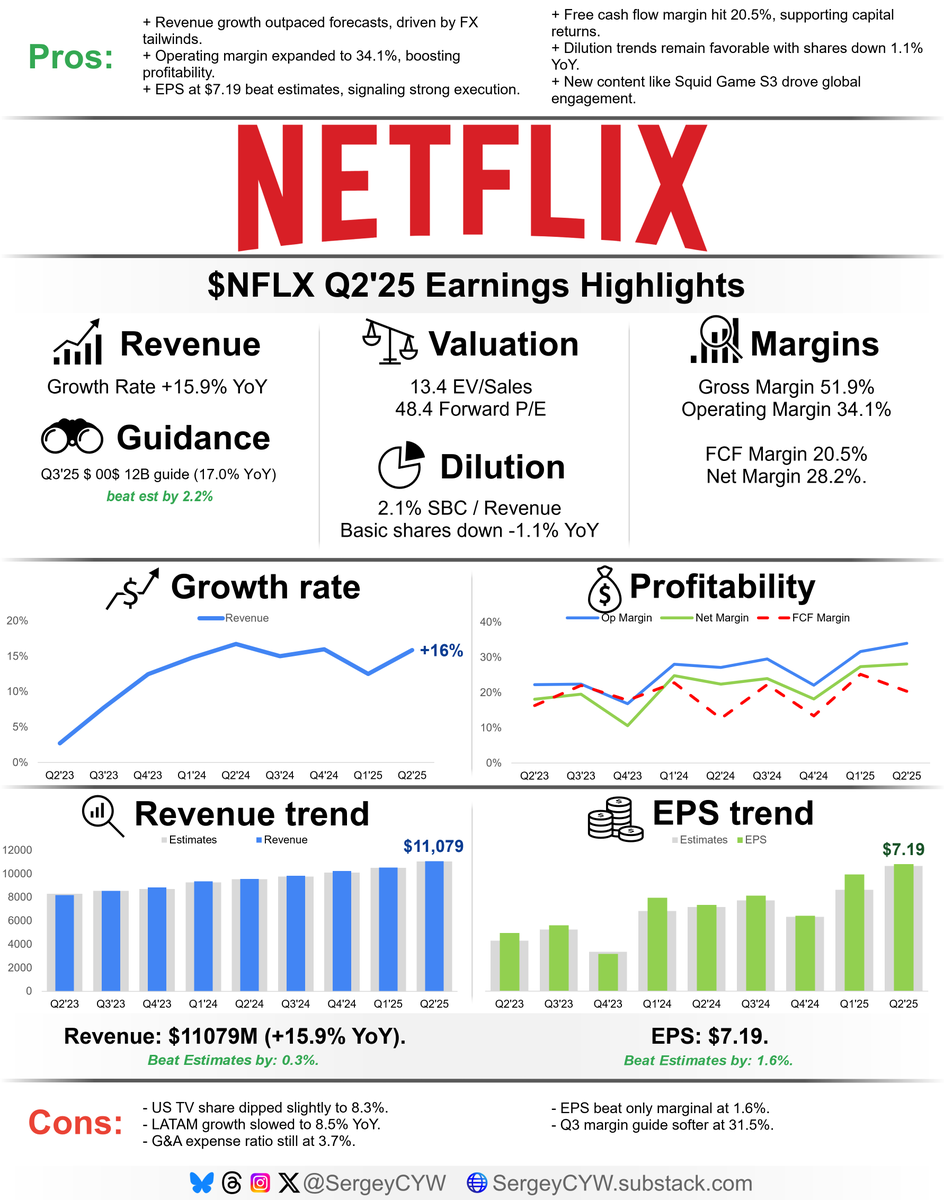

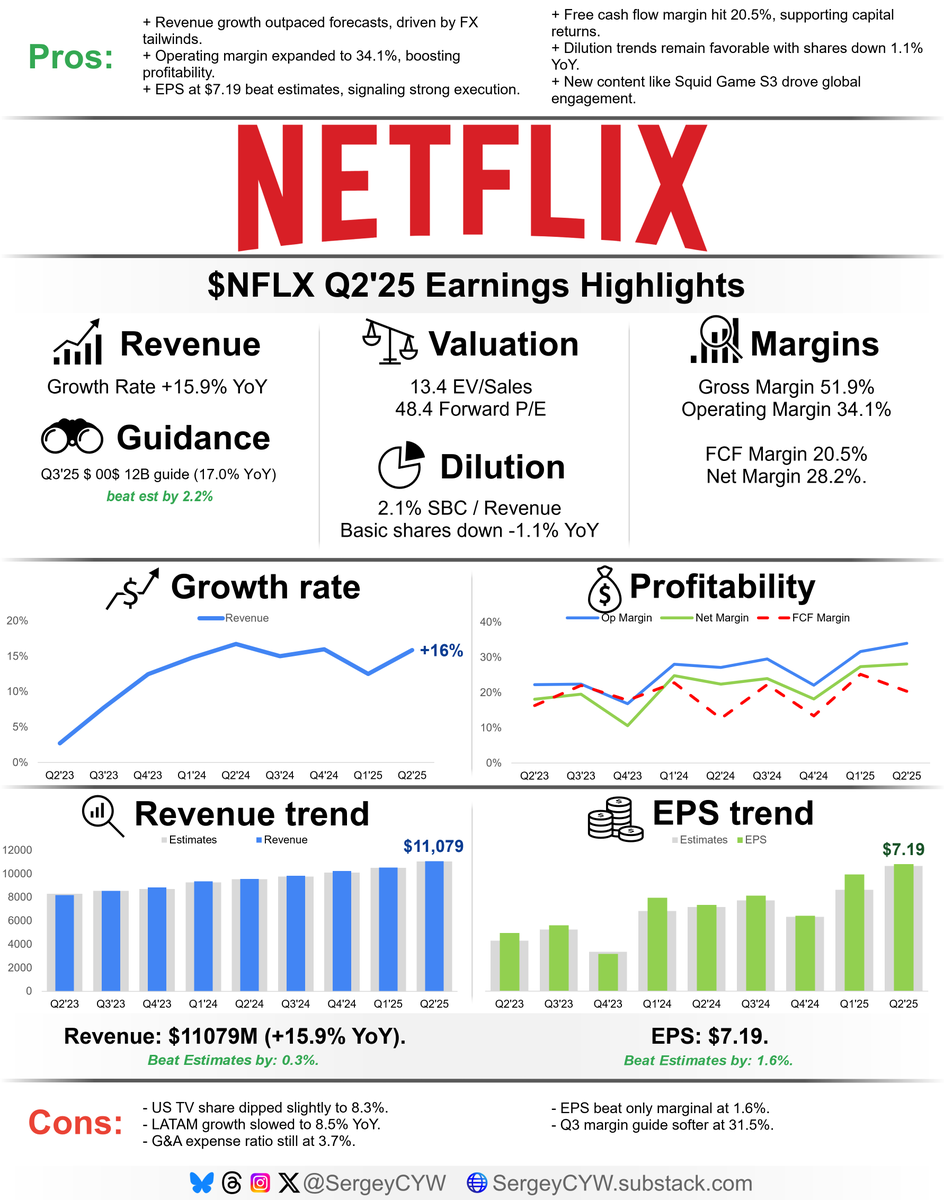

Thoughts on Netflix Earnings Report $NFLX: 🟢 Positive •Revenue reached $11.079B in Q2, up +15.9% YoY and +5.1% QoQ, beating estimates by 0.3%. •EPS of $7.19, up YoY and beating estimates by 1.6%. •Operating margin rose to 34.1%, up +6.8 percentage points YoY. •Gross margin expanded to XXXX% (+6.1 pps YoY), and free cash flow margin reached XXXX% (+7.8 pps YoY). •Net margin improved to 28.2%, up +5.7 pps YoY. •Q3 revenue guidance of $11.5B, +17.0% YoY, above consensus by 2.2%. •Ad business on track to double revenue in 2025; global ad tech stack rollout completed. •Netflix Ad Suite fully deployed; stronger-than-expected U.S. upfront results. •Strong member growth, late-quarter acceleration outperformed internal forecasts. •Continued improvement in UI/UX: faster discovery, lower failed sessions, enhanced personalization. •AI-powered production delivered VFX 10x faster at lower cost. •Diluted shares down -XXX% YoY, indicating effective buybacks.

🟡 Neutral •Engagement rose X% YoY, but per-household engagement remained flat; expected to improve in H2. •Games business showing early engagement gains, but remains non-material in revenue. •Live events delivering brand value, though still limited in total viewership share. •Ad-supported tier ($7.99/month) gaining traction without increasing churn, but still small in contribution. •Global content expansion progressing with localized partnerships (e.g., TF1), but scaling impact still in early stages. •Operating expenses flat QoQ; S&M and G&A expenses declined as % of revenue, but R&D held steady. •U.S. TV share declined slightly to XXX% (down -XXX pps YoY), showing stagnation.

🔴 Negative •LATAM revenue growth slower at +8.5% YoY, compared to stronger growth in EMEA and APAC. •Share of TV time in the U.S. remains flat despite heavy investment. •Content dependency risk persists, as even top titles account for just ~1% of viewership each. •Scaling live and games remains a margin challenge; monetization in games deferred. •High competition from free and bundled services continues to pressure engagement.

XXXXX engagements

Related Topics cash flow eps $11079b $nflx stocks communication services