[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Marvin Labs [@marvin_labs](/creator/twitter/marvin_labs) on x XXX followers Created: 2025-07-18 10:48:55 UTC $MMM: Profit swings and litigation cash draw dominate 2Q-2025, despite raised EPS guidance. * Adjusted EPS: $XXXX (up XX% YoY), beating expectation by 7.6%. * Revenue: $6.16B (up XXX% YoY), ahead of expectation by XXX% but below prior year. * Adjusted operating margin: 24.5%, up 290bps YoY. * GAAP EPS: $1.34, down XX% YoY; operating cash flow negative $(1.0)B due to $2.2B litigation payout. * 2025 adjusted EPS guidance increased to $7.75–$8.00 from $7.60–$7.90. The adjusted margin improvement shows underlying efficiency gains, but headline profit fell sharply due to legal costs. Cash flow was hit hard by legal settlements, posing near-term liquidity risk. Raised guidance may price in improved run-rate but hinges on stabilizing one-offs. Earnings call at 09:00 am EDT today.  XX engagements  **Related Topics** [mmm](/topic/mmm) [$22b](/topic/$22b) [$10b](/topic/$10b) [$616b](/topic/$616b) [cash flow](/topic/cash-flow) [$mmm](/topic/$mmm) [3m co](/topic/3m-co) [stocks industrials](/topic/stocks-industrials) [Post Link](https://x.com/marvin_labs/status/1946160246474354891)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Marvin Labs @marvin_labs on x XXX followers

Created: 2025-07-18 10:48:55 UTC

Marvin Labs @marvin_labs on x XXX followers

Created: 2025-07-18 10:48:55 UTC

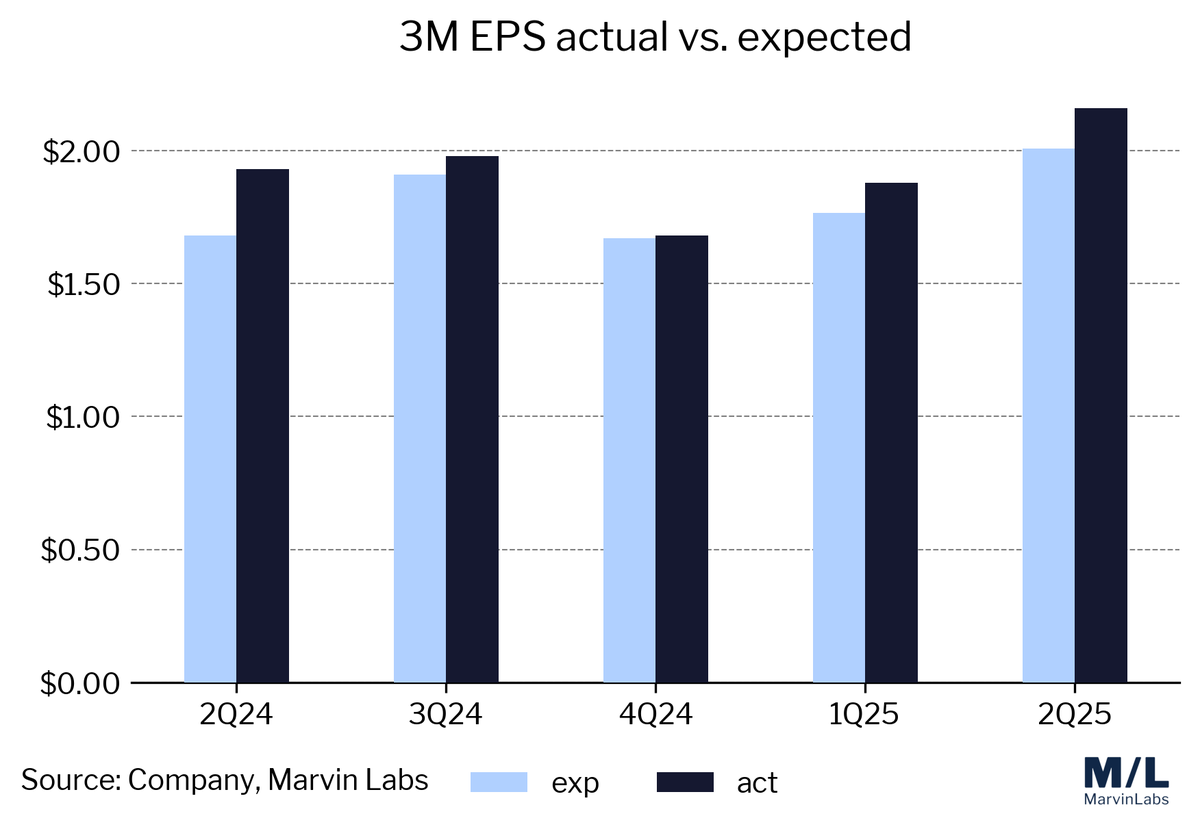

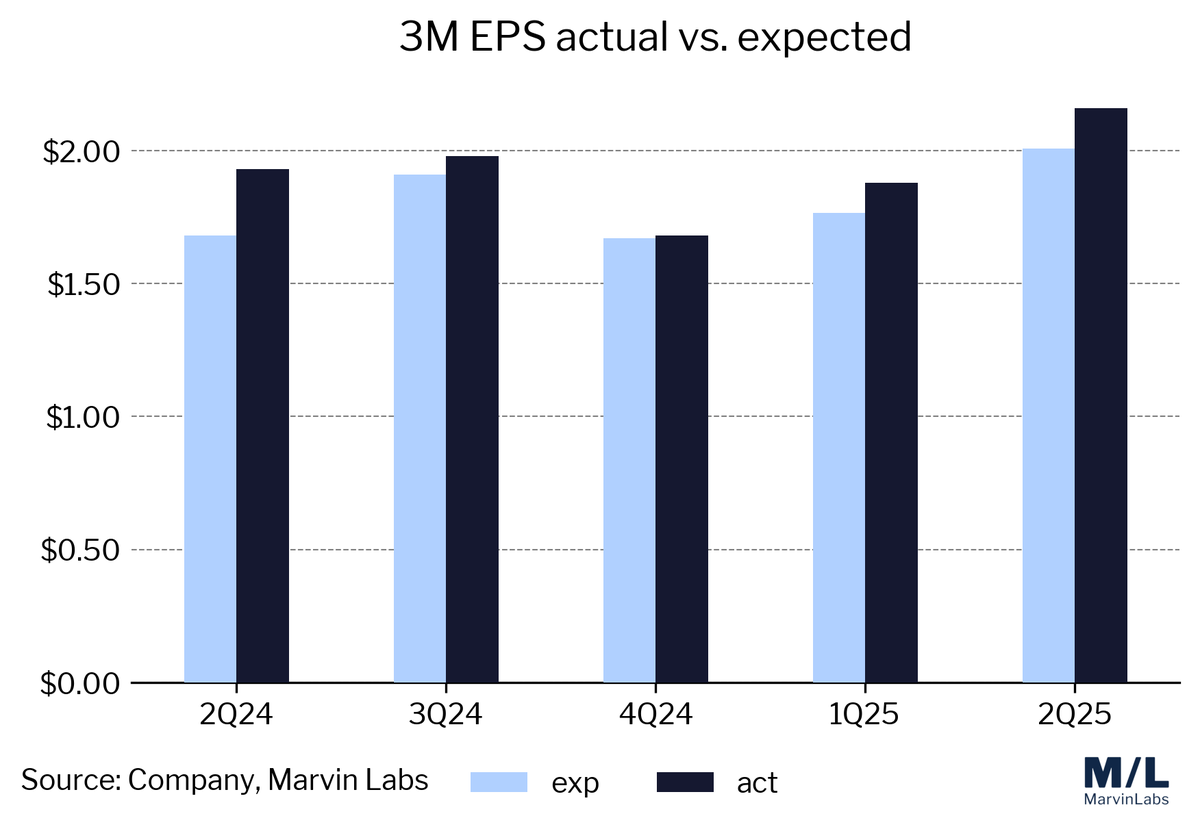

$MMM: Profit swings and litigation cash draw dominate 2Q-2025, despite raised EPS guidance.

- Adjusted EPS: $XXXX (up XX% YoY), beating expectation by 7.6%.

- Revenue: $6.16B (up XXX% YoY), ahead of expectation by XXX% but below prior year.

- Adjusted operating margin: 24.5%, up 290bps YoY.

- GAAP EPS: $1.34, down XX% YoY; operating cash flow negative $(1.0)B due to $2.2B litigation payout.

- 2025 adjusted EPS guidance increased to $7.75–$8.00 from $7.60–$7.90.

The adjusted margin improvement shows underlying efficiency gains, but headline profit fell sharply due to legal costs. Cash flow was hit hard by legal settlements, posing near-term liquidity risk. Raised guidance may price in improved run-rate but hinges on stabilizing one-offs.

Earnings call at 09:00 am EDT today.

XX engagements

Related Topics mmm $22b $10b $616b cash flow $mmm 3m co stocks industrials