[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  camilo [@AscendedYield](/creator/twitter/AscendedYield) on x 12.2K followers Created: 2025-07-18 10:36:45 UTC Composition of growth matters. We know that economic growth this year will be driven by public spending, so then we have to compare the yields we paying to borrow and reconcile that with the forecasts. If we are paying XXX% for XX year gilts and we are scraping X% GDP growth, it seems like a bad thing. As shown in the chart, a large portion of UK sovereign debt is maturing in the next few years. This means the government will have to refinance at today’s elevated yields, even as GDP growth hovers near 1%.  XXXXX engagements  **Related Topics** [debt](/topic/debt) [gdp](/topic/gdp) [gdp growth](/topic/gdp-growth) [Post Link](https://x.com/AscendedYield/status/1946157185341554888)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

camilo @AscendedYield on x 12.2K followers

Created: 2025-07-18 10:36:45 UTC

camilo @AscendedYield on x 12.2K followers

Created: 2025-07-18 10:36:45 UTC

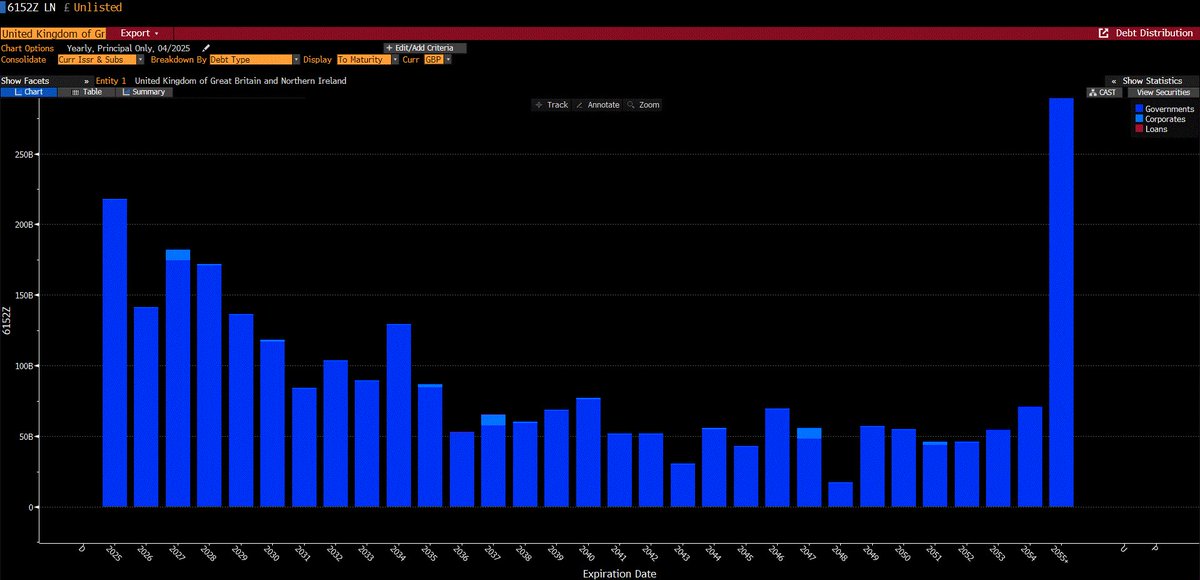

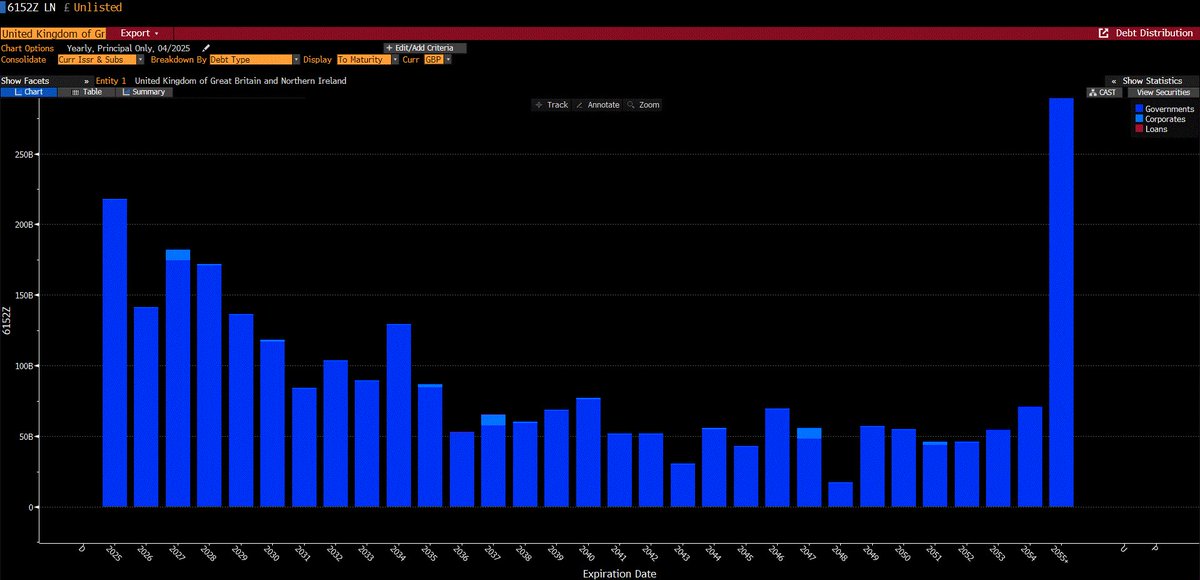

Composition of growth matters. We know that economic growth this year will be driven by public spending, so then we have to compare the yields we paying to borrow and reconcile that with the forecasts.

If we are paying XXX% for XX year gilts and we are scraping X% GDP growth, it seems like a bad thing.

As shown in the chart, a large portion of UK sovereign debt is maturing in the next few years. This means the government will have to refinance at today’s elevated yields, even as GDP growth hovers near 1%.

XXXXX engagements

Related Topics debt gdp gdp growth