[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  CHUL🦋 (rebuild arc) [@thechulprecious](/creator/twitter/thechulprecious) on x 1231 followers Created: 2025-07-18 06:59:30 UTC ETH ETFs Are Closing the Gap with BTC? ETH ETFs recorded $726M in inflows, almost matching Bitcoin’s $799M. This is a first. Historically, $BTC dominated institutional flows, so this shift says something big; institutions are warming up to ETH. Data from @coinglass_com shows ETH ETF AUM climbing, and trading volumes are following market cap gains. Where’s the capital coming from? Much of it is linked to treasury firms raising funds via PIPE deals, a classic TradFi move now funneling liquidity into crypto. What’s interesting is how this aligns with TradFi’s expanding TAM (Total Addressable Market) outlook for DeFi. Look at $CRV, it’s already up 2x. And with ETH ETFs on the table, $LDO (Lido) becomes a key player, controlling XX% of staked $ETH U.S. ETH ETFs currently exclude staking due to SEC restrictions. So, yeah, inflows might be driven by pure ETH exposure for now, but that could change later, we'll see. My take? Track ETH ETF flows today and keep an eye on $LDO’s staking dynamics. This could set the tone for the next phase of liquidity rotation imo. @Defipeniel @YashasEdu @DeFiScribbler @DeFi_Creed @SyntaxFii Would love to hear your take on this. In the meantime stay @boundless_xyz  XXX engagements  **Related Topics** [market cap](/topic/market-cap) [btc eth](/topic/btc-eth) [fund manager](/topic/fund-manager) [$btc](/topic/$btc) [$799m](/topic/$799m) [$726m](/topic/$726m) [arc](/topic/arc) [ethereum](/topic/ethereum) [Post Link](https://x.com/thechulprecious/status/1946102512953516283)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

CHUL🦋 (rebuild arc) @thechulprecious on x 1231 followers

Created: 2025-07-18 06:59:30 UTC

CHUL🦋 (rebuild arc) @thechulprecious on x 1231 followers

Created: 2025-07-18 06:59:30 UTC

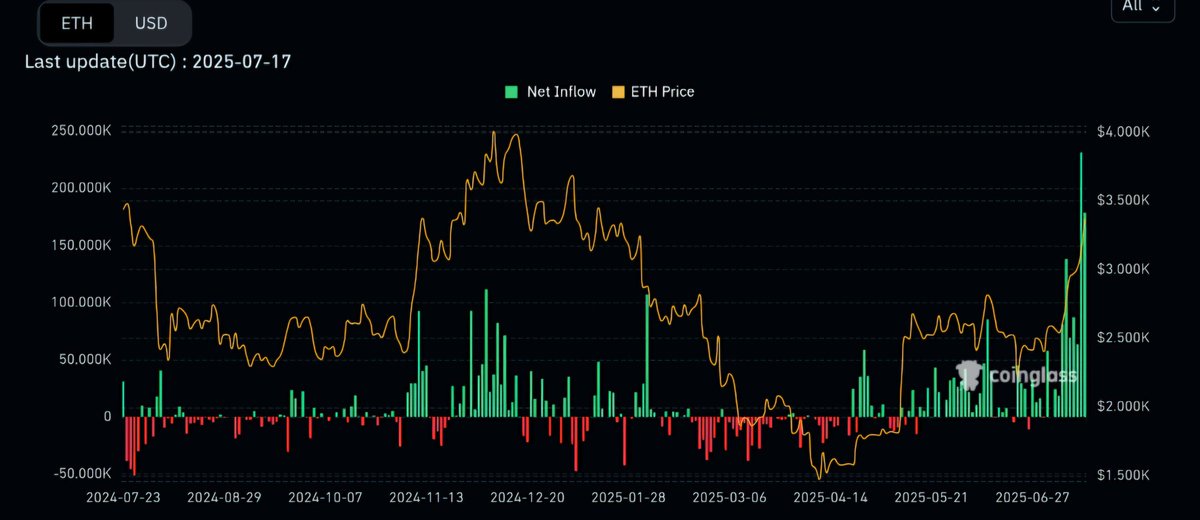

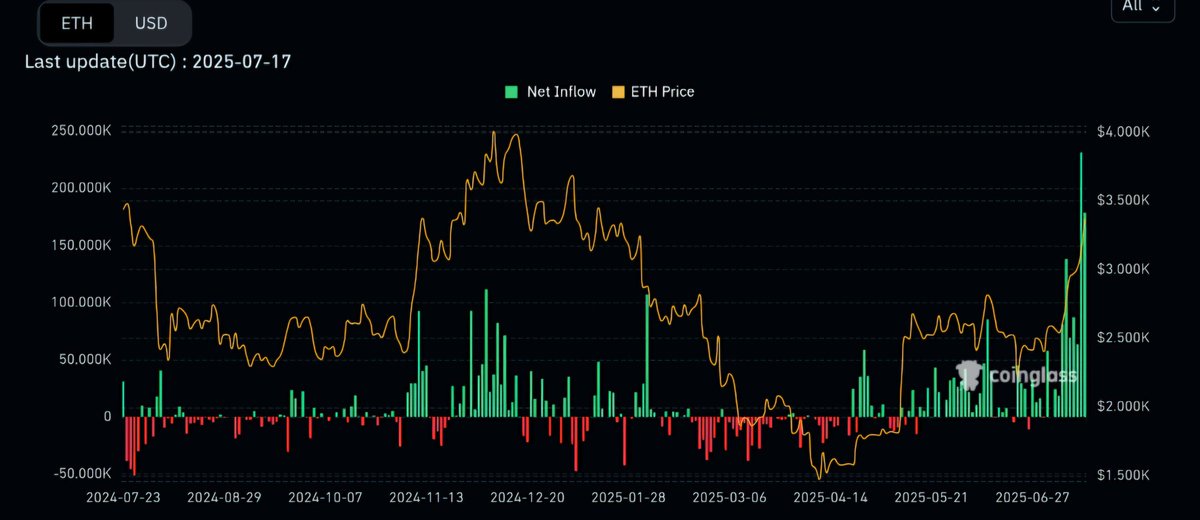

ETH ETFs Are Closing the Gap with BTC?

ETH ETFs recorded $726M in inflows, almost matching Bitcoin’s $799M. This is a first. Historically, $BTC dominated institutional flows, so this shift says something big; institutions are warming up to ETH.

Data from @coinglass_com shows ETH ETF AUM climbing, and trading volumes are following market cap gains.

Where’s the capital coming from?

Much of it is linked to treasury firms raising funds via PIPE deals, a classic TradFi move now funneling liquidity into crypto.

What’s interesting is how this aligns with TradFi’s expanding TAM (Total Addressable Market) outlook for DeFi.

Look at $CRV, it’s already up 2x. And with ETH ETFs on the table, $LDO (Lido) becomes a key player, controlling XX% of staked $ETH

U.S. ETH ETFs currently exclude staking due to SEC restrictions. So, yeah, inflows might be driven by pure ETH exposure for now, but that could change later, we'll see.

My take? Track ETH ETF flows today and keep an eye on $LDO’s staking dynamics. This could set the tone for the next phase of liquidity rotation imo.

@Defipeniel @YashasEdu @DeFiScribbler @DeFi_Creed @SyntaxFii

Would love to hear your take on this.

In the meantime stay @boundless_xyz

XXX engagements

Related Topics market cap btc eth fund manager $btc $799m $726m arc ethereum