[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Jonaso [@Jonasoeth](/creator/twitter/Jonasoeth) on x 5729 followers Created: 2025-07-18 05:55:46 UTC Tether is to stablecoins what Lombard is to Bitcoin. Bitcoin is the most valuable asset in crypto, with over $XXX trillion in market cap, yet more than XX% of it remains idle, locked in cold wallets and disconnected from the on-chain economy it helped create. Meanwhile, stablecoins like USDT and USDC have become the lifeblood of DeFi, thanks to one key innovation: Tether and Circle built the liquidity layer that turned stablecoins from passive assets into programmable capital. → Lombard is doing the same for Bitcoin. Lombard launched LBTC to prove the market was ready and it worked. • $1B in TVL in just XX days • Over $2B active today • 80%+ deployed into DeFi • Integrated with Aave, Pendle, Morpho, EigenLayer, Berachain, and more • Secured by 14+ leading institutions like Galaxy, OKX, and DCG → But that was only Phase X. _____________________________________________ Now in Phase 2, Lombard is building the middleware layer for Bitcoin capital markets stack from the ground up, cross-chain BTC, SDKs for native BTC in every wallet and app, tokenized yield vaults, and the bridge infrastructure to make BTC liquid everywhere. → While others fragment liquidity, Lombard aggregates it. While others build silos, Lombard builds bridges. _____________________________________________ Phase X sparks true transformation. With BTC liquid and programmable, it enables a full Bitcoin economy, where developers innovate freely without custody barriers, compliance bottlenecks, or trust assumptions. Lombard will deliver ↓ • Open protocols for any developer to build on. • Infrastructure modules for custody, liquidity, and settlement. • Trustless BTC bridges into new and existing ecosystems. _____________________________________________ Lombard is all-in on Bitcoin. Lombard isn’t just launching products, it is building infrastructure that powers liquidity, distribution, and adoption at scale. Lombard will bring all Bitcoin onchain, no matter how or where it’s held. Every holder becomes a user. Every protocol becomes a partner. Every developer becomes a builder. Bitcoin and stablecoins will be the base assets of onchain finance → stablecoins as the unit of account, Bitcoin as the foundation of value. Bitcoin innovation won’t happen on L1. It requires programmability, composability, and scalability, exactly what Lombard is enabling. When Bitcoin becomes programmable, a new era of permissionless financial innovation begins. _____________________________________________ The opportunity in front of us is transformational, unlocking $trillions in economic opportunity. • If BTC adoption simply matches Lido → it unlocks $165B. • If it mirrors Ethereum’s onchain motion → that’s $660B. • If it reaches Ethereum’s total onchain value creation → $1T. And the full potential? A $X trillion Bitcoin economy, built onchain. Legacy finance was built on gold. Onchain finance will be built on Bitcoin. → Lombard is making that future inevitable.  XXXXX engagements  **Related Topics** [market cap](/topic/market-cap) [usdt](/topic/usdt) [onchain](/topic/onchain) [coins wallets](/topic/coins-wallets) [stablecoins](/topic/stablecoins) [bitcoin](/topic/bitcoin) [coins layer 1](/topic/coins-layer-1) [coins bitcoin ecosystem](/topic/coins-bitcoin-ecosystem) [Post Link](https://x.com/Jonasoeth/status/1946086473297777133)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Jonaso @Jonasoeth on x 5729 followers

Created: 2025-07-18 05:55:46 UTC

Jonaso @Jonasoeth on x 5729 followers

Created: 2025-07-18 05:55:46 UTC

Tether is to stablecoins what Lombard is to Bitcoin.

Bitcoin is the most valuable asset in crypto, with over $XXX trillion in market cap, yet more than XX% of it remains idle, locked in cold wallets and disconnected from the on-chain economy it helped create.

Meanwhile, stablecoins like USDT and USDC have become the lifeblood of DeFi, thanks to one key innovation:

Tether and Circle built the liquidity layer that turned stablecoins from passive assets into programmable capital.

→ Lombard is doing the same for Bitcoin.

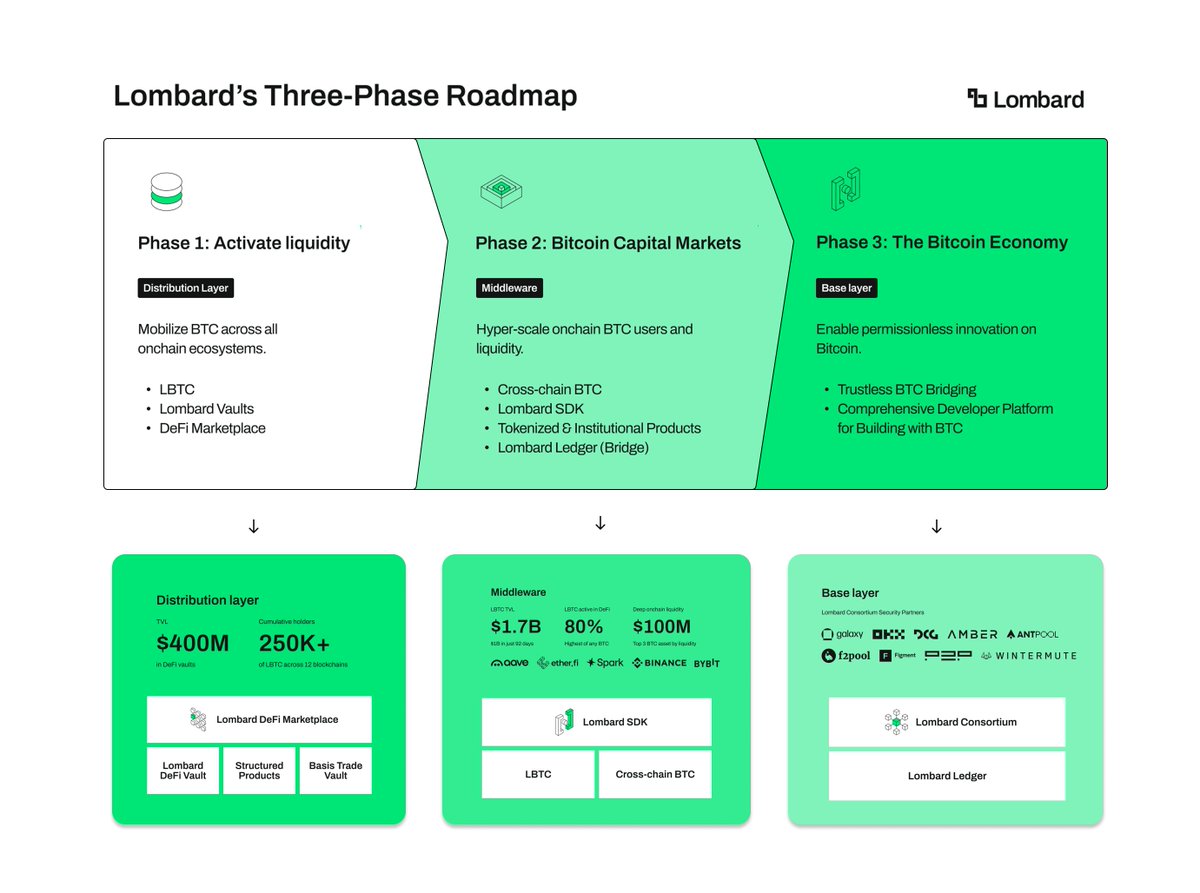

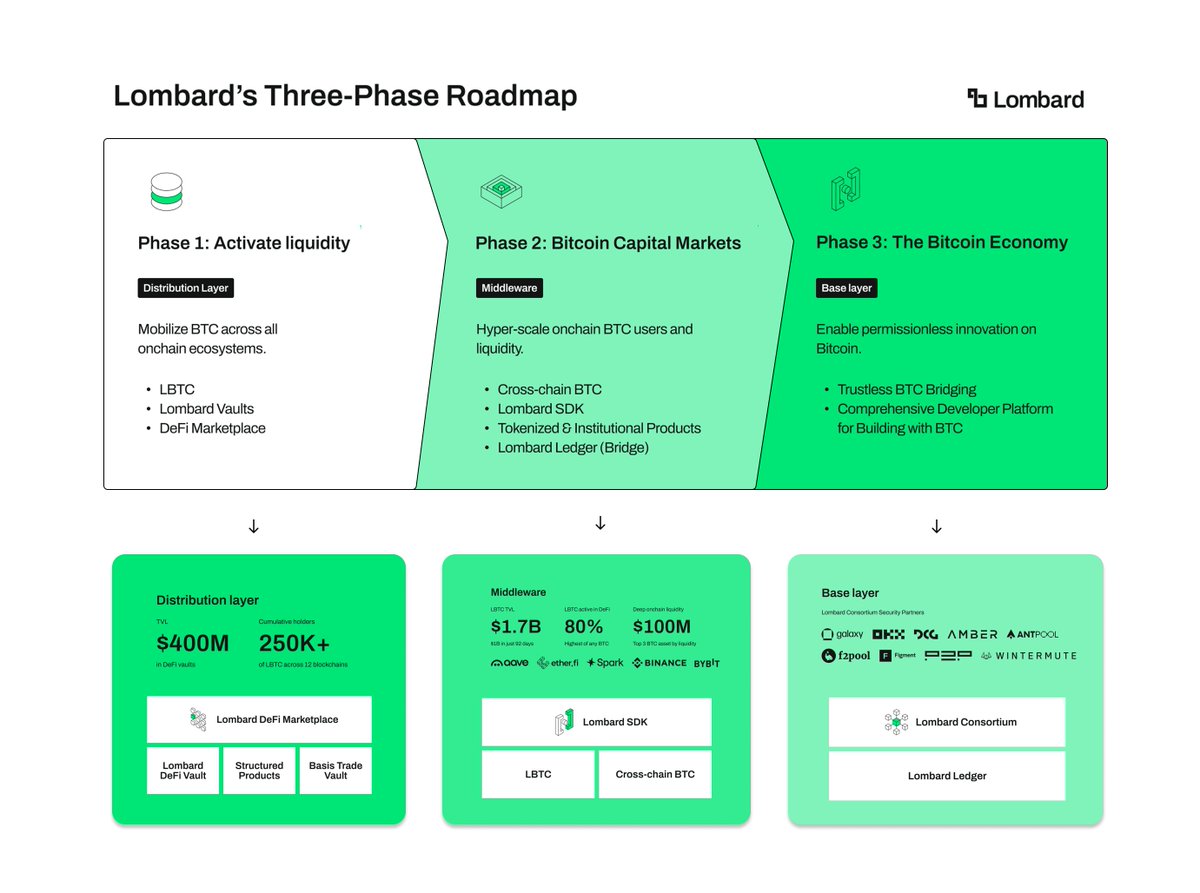

Lombard launched LBTC to prove the market was ready and it worked.

• $1B in TVL in just XX days • Over $2B active today • 80%+ deployed into DeFi • Integrated with Aave, Pendle, Morpho, EigenLayer, Berachain, and more • Secured by 14+ leading institutions like Galaxy, OKX, and DCG

→ But that was only Phase X.

Now in Phase 2, Lombard is building the middleware layer for Bitcoin capital markets stack from the ground up, cross-chain BTC, SDKs for native BTC in every wallet and app, tokenized yield vaults, and the bridge infrastructure to make BTC liquid everywhere.

→ While others fragment liquidity, Lombard aggregates it. While others build silos, Lombard builds bridges.

Phase X sparks true transformation. With BTC liquid and programmable, it enables a full Bitcoin economy, where developers innovate freely without custody barriers, compliance bottlenecks, or trust assumptions.

Lombard will deliver ↓

• Open protocols for any developer to build on. • Infrastructure modules for custody, liquidity, and settlement. • Trustless BTC bridges into new and existing ecosystems.

Lombard is all-in on Bitcoin.

Lombard isn’t just launching products, it is building infrastructure that powers liquidity, distribution, and adoption at scale.

Lombard will bring all Bitcoin onchain, no matter how or where it’s held. Every holder becomes a user. Every protocol becomes a partner. Every developer becomes a builder.

Bitcoin and stablecoins will be the base assets of onchain finance → stablecoins as the unit of account, Bitcoin as the foundation of value.

Bitcoin innovation won’t happen on L1. It requires programmability, composability, and scalability, exactly what Lombard is enabling.

When Bitcoin becomes programmable, a new era of permissionless financial innovation begins.

The opportunity in front of us is transformational, unlocking $trillions in economic opportunity.

• If BTC adoption simply matches Lido → it unlocks $165B. • If it mirrors Ethereum’s onchain motion → that’s $660B. • If it reaches Ethereum’s total onchain value creation → $1T.

And the full potential? A $X trillion Bitcoin economy, built onchain.

Legacy finance was built on gold. Onchain finance will be built on Bitcoin.

→ Lombard is making that future inevitable.

XXXXX engagements

Related Topics market cap usdt onchain coins wallets stablecoins bitcoin coins layer 1 coins bitcoin ecosystem