[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  SCHD STAN | Craig [@SCHDETF](/creator/twitter/SCHDETF) on x 19.4K followers Created: 2025-07-17 19:54:47 UTC UPDATE: STAN’S CORE GROWTH DIVIDEND FUND (#SCGD) Haven’t shared an update on this little M1 portfolio within my portfolio since March — few things have changed. 📌 Original Plan ▪️ $VOO (Core) XX% ▪️ $SCHG (Growth) XX% ▪️ $SCHD (Dividends) XX% 🔄 Update: $VOO is out. $CGDV and $FDVV are in. 📌 New Allocation ▪️ $CGDV (Core) XX% ▪️ $SCHG (Growth) XX% ▪️ $SCHD (Dividends) XX% ▪️ $FDVV (Dividends) XX% I still love $VOO but it’s already my biggest holding and I DCA into the S&P XXX every two weeks. So I’d rather use this portfolio to build up some quality alternatives. ✅ Why $CGDV? Feels like a VOO alternative— S&P-like, but with a tilt toward quality dividend payers. ✅ Why $FDVV? One of my largest div ETFs. Nice balance of growth + yield with decent downside protection. Both $CGDV and $FDVV aim to participate in upside while softening the drawdowns. $SCHD stays—still the best combo of: ▪️ Value ▪️ Starting yield ▪️ Dividend growth ▪️ Stability ▪️ Downside protection ▪️ Long-term upside $SCHG also stays—excellent way to capture pure growth across all sectors. I launched the #SCGD portfolio on Feb X with $XXX and planned to DCA $250/month. Paused in April to go manual — to take full advantage of the tariff dip in my main portfolio. Today, I picked up $CGDV and added to the $FDVV position I started on July X. Here’s where it stands so far: ⬇️  XXXXX engagements  **Related Topics** [$fdvv](/topic/$fdvv) [$cgdv](/topic/$cgdv) [$schd](/topic/$schd) [$schg](/topic/$schg) [$voo](/topic/$voo) [Post Link](https://x.com/SCHDETF/status/1945935229858017585)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

SCHD STAN | Craig @SCHDETF on x 19.4K followers

Created: 2025-07-17 19:54:47 UTC

SCHD STAN | Craig @SCHDETF on x 19.4K followers

Created: 2025-07-17 19:54:47 UTC

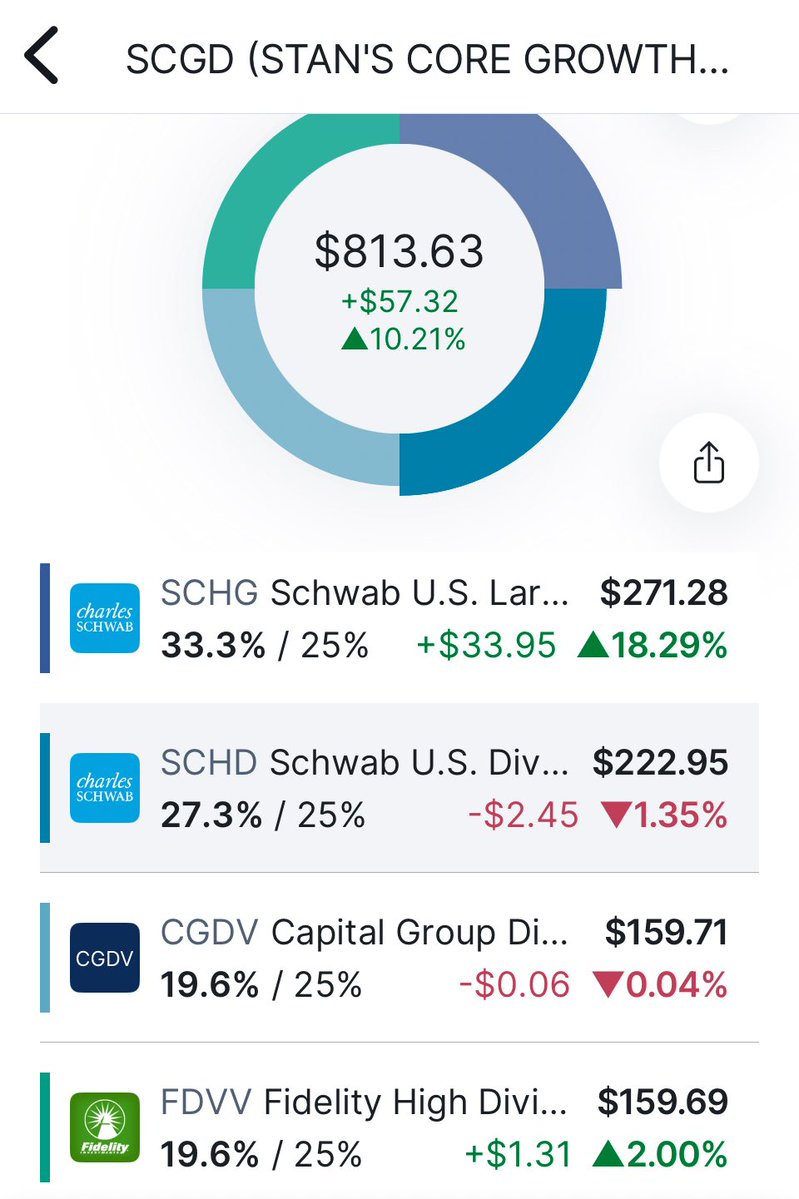

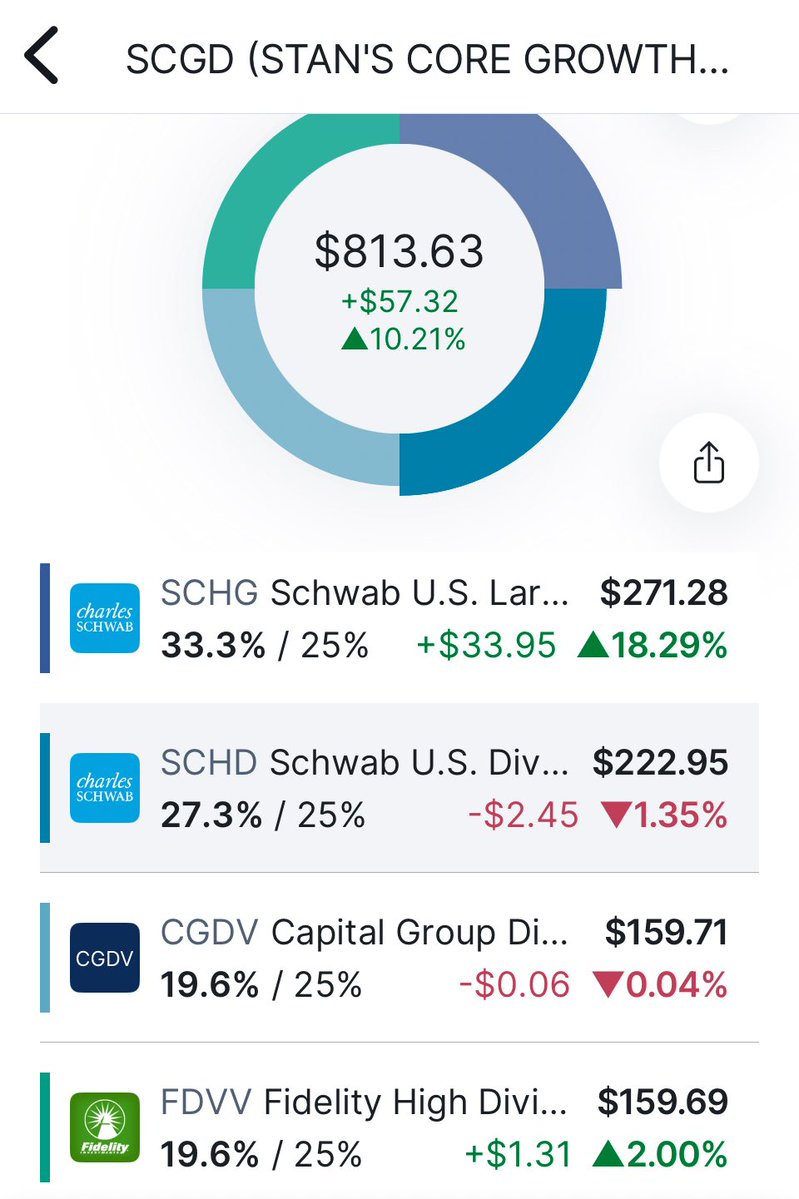

UPDATE: STAN’S CORE GROWTH DIVIDEND FUND (#SCGD)

Haven’t shared an update on this little M1 portfolio within my portfolio since March — few things have changed.

📌 Original Plan ▪️ $VOO (Core) XX% ▪️ $SCHG (Growth) XX% ▪️ $SCHD (Dividends) XX%

🔄 Update: $VOO is out. $CGDV and $FDVV are in.

📌 New Allocation ▪️ $CGDV (Core) XX% ▪️ $SCHG (Growth) XX% ▪️ $SCHD (Dividends) XX% ▪️ $FDVV (Dividends) XX%

I still love $VOO but it’s already my biggest holding and I DCA into the S&P XXX every two weeks. So I’d rather use this portfolio to build up some quality alternatives.

✅ Why $CGDV? Feels like a VOO alternative— S&P-like, but with a tilt toward quality dividend payers.

✅ Why $FDVV? One of my largest div ETFs. Nice balance of growth + yield with decent downside protection.

Both $CGDV and $FDVV aim to participate in upside while softening the drawdowns.

$SCHD stays—still the best combo of: ▪️ Value ▪️ Starting yield ▪️ Dividend growth ▪️ Stability ▪️ Downside protection ▪️ Long-term upside

$SCHG also stays—excellent way to capture pure growth across all sectors.

I launched the #SCGD portfolio on Feb X with $XXX and planned to DCA $250/month.

Paused in April to go manual — to take full advantage of the tariff dip in my main portfolio.

Today, I picked up $CGDV and added to the $FDVV position I started on July X.

Here’s where it stands so far: ⬇️

XXXXX engagements