[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  bad robot [@foxenflask](/creator/twitter/foxenflask) on x 3218 followers Created: 2025-07-17 16:28:13 UTC Took a look at GameStop fundamentals vs. Top X public $BTC giants fundamentals COMBINED(MicroStrategy, Marathon, Riot, CleanSpark, Metaplanet) on a trailing twelve month basis. $GME blows them away in revenue, positive cash flow, net income, and cash on hand. The top X BTC PubCos obviously dominate in pure Bitcoin exposure: $85bn vs $0.58bn for GameStop, but are collectively unprofitable and burning cash. With over XXX public companies buying Bitcoin now, something that I always look to first when a new BTC PubCo enters the arena is Bitcoin Dependency. GME is a traditional business with a BTC kicker, while the others are mostly pure Bitcoin proxies with high operational risks. The risk/reward profiles couldn’t be more different. The investment vehicles couldn't be more different. GME offers a traditional business that's producing hundreds of millions of dollars in profits and compounding investment returns that act as a cushion + has a BTC kicker, while the others are leveraged bets on BTC with huge upside, and big downside risk if markets turn + they don't have any significant traditional business that's dependably cashflowing or cash reserves in general to fall back on. I'm not saying any of this is bad, just that there is no such thing as cookie cutter. One size barely ever fits all. $MSTR $MARA $RIOT $CLSK $MTPLF  XXXXXX engagements  **Related Topics** [gme](/topic/gme) [$058bn](/topic/$058bn) [$85bn](/topic/$85bn) [cash flow](/topic/cash-flow) [$btc](/topic/$btc) [robot](/topic/robot) [$gme](/topic/$gme) [stocks consumer cyclical](/topic/stocks-consumer-cyclical) [Post Link](https://x.com/foxenflask/status/1945883247793070173)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

bad robot @foxenflask on x 3218 followers

Created: 2025-07-17 16:28:13 UTC

bad robot @foxenflask on x 3218 followers

Created: 2025-07-17 16:28:13 UTC

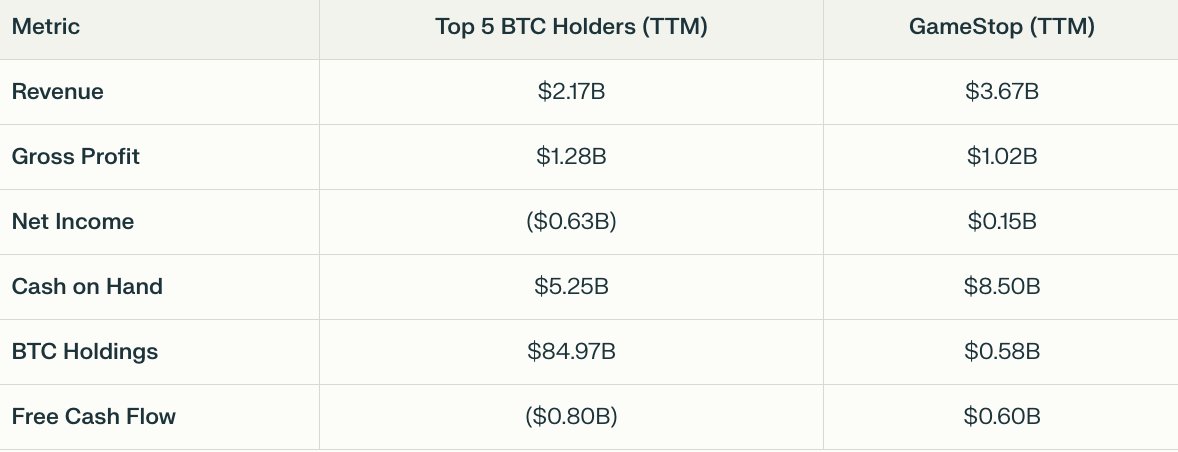

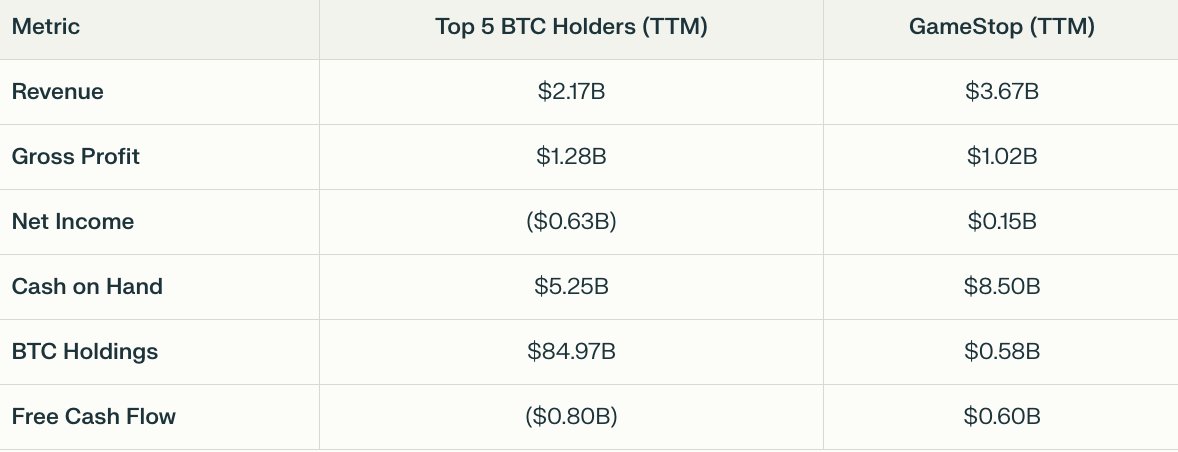

Took a look at GameStop fundamentals vs. Top X public $BTC giants fundamentals COMBINED(MicroStrategy, Marathon, Riot, CleanSpark, Metaplanet) on a trailing twelve month basis. $GME blows them away in revenue, positive cash flow, net income, and cash on hand. The top X BTC PubCos obviously dominate in pure Bitcoin exposure: $85bn vs $0.58bn for GameStop, but are collectively unprofitable and burning cash.

With over XXX public companies buying Bitcoin now, something that I always look to first when a new BTC PubCo enters the arena is Bitcoin Dependency. GME is a traditional business with a BTC kicker, while the others are mostly pure Bitcoin proxies with high operational risks. The risk/reward profiles couldn’t be more different. The investment vehicles couldn't be more different.

GME offers a traditional business that's producing hundreds of millions of dollars in profits and compounding investment returns that act as a cushion + has a BTC kicker, while the others are leveraged bets on BTC with huge upside, and big downside risk if markets turn + they don't have any significant traditional business that's dependably cashflowing or cash reserves in general to fall back on. I'm not saying any of this is bad, just that there is no such thing as cookie cutter. One size barely ever fits all.

$MSTR $MARA $RIOT $CLSK $MTPLF

XXXXXX engagements

Related Topics gme $058bn $85bn cash flow $btc robot $gme stocks consumer cyclical