[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  DarwinKnows [@Darwin_Knows](/creator/twitter/Darwin_Knows) on x XXX followers Created: 2025-07-17 15:40:45 UTC General Electric Co (Valuation - Very Expensive) US Large Caps: General Electric Co has a total score of +29 and there are XX alerts. The valuation ratios for General Electric Co indicate that the stock is very expensive. The Forward P/E ratio of XXXXX is significantly higher than the peer average of 19.68, suggesting that investors are overpaying for future earnings. The Enterprise Value to EBITDA ratio of XXXXX is also much higher than the peer average of 13.42, indicating that the market is pricing the company at a premium compared to its earnings before interest, taxes, depreciation, and amortization. The Price to Sales ratio of XXXX is well above the peer average of 3.44, further supporting the notion that the stock is overvalued relative to its sales. Overall, these valuation metrics indicate that the stock is very expensive, aligning with a negative outlook for potential investors. #DarwinKnows #GeneralElectric #GE $GE #FreeTrialAvailable #AskDarwin #StockToWatch  XX engagements  **Related Topics** [$ge](/topic/$ge) [stocks industrials](/topic/stocks-industrials) [stocks defense](/topic/stocks-defense) [Post Link](https://x.com/Darwin_Knows/status/1945871300955930989)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

DarwinKnows @Darwin_Knows on x XXX followers

Created: 2025-07-17 15:40:45 UTC

DarwinKnows @Darwin_Knows on x XXX followers

Created: 2025-07-17 15:40:45 UTC

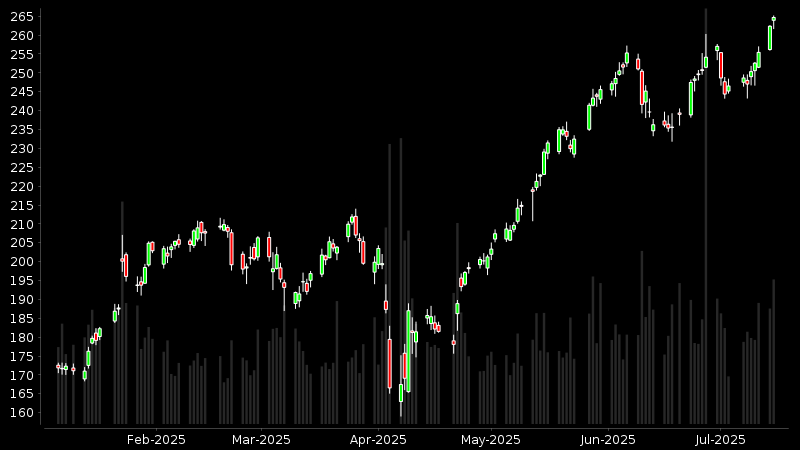

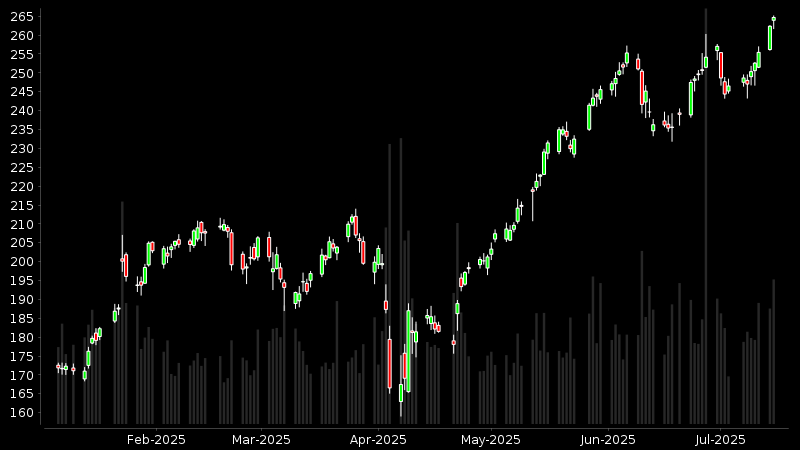

General Electric Co (Valuation - Very Expensive)

US Large Caps: General Electric Co has a total score of +29 and there are XX alerts.

The valuation ratios for General Electric Co indicate that the stock is very expensive. The Forward P/E ratio of XXXXX is significantly higher than the peer average of 19.68, suggesting that investors are overpaying for future earnings. The Enterprise Value to EBITDA ratio of XXXXX is also much higher than the peer average of 13.42, indicating that the market is pricing the company at a premium compared to its earnings before interest, taxes, depreciation, and amortization. The Price to Sales ratio of XXXX is well above the peer average of 3.44, further supporting the notion that the stock is overvalued relative to its sales. Overall, these valuation metrics indicate that the stock is very expensive, aligning with a negative outlook for potential investors.

#DarwinKnows #GeneralElectric #GE $GE

#FreeTrialAvailable #AskDarwin #StockToWatch

XX engagements

Related Topics $ge stocks industrials stocks defense