[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Kaff 📊 [@Kaffchad](/creator/twitter/Kaffchad) on x 25.1K followers Created: 2025-07-17 15:40:42 UTC .@rezervemoney’s LST has been spitting out ~240% APR for over a month straight, and somehow, that’s just scratching the surface. Right now, even with just ~$1.2M TVL, it’s already generating over $2.2M in annualized revenue. The real alpha is in stacking $RZR, staking it as $sRZR, and helping grow DeFi’s first fair-launched, BTC-backed digital vault from the ground up. Not familiar with it? Rezerve is a reserve currency protocol natively deployed on @SonicLabs. Unlike most of DeFi’s VC-riddled launches, this one came with no seed rounds, no team allocations, no airdrops, and zero insider unlocks. Every $RZR in circulation was minted by users under the same rules. At its core, Rezerve’s mission is to accumulate XXXXX $BTC into its treasury and become crypto’s on-chain vault for digital gold. All while routing XXX% of protocol revenue back to stakers. 📌 The protocol-earned real revenue comes from: – Trading fees on protocol-owned LPs – Harberger taxes from stakers – Lending returns from idle reserves – Bond sales (entry at a discount) – External DEX bribes (Pendle...) And all of this flows to stakers automatically every X hours. When you stake $RZR, you mint $sRZR, a rebasing token that compounds yield every epoch. But there’s a twist: You declare your stake’s value and pay a X% annual tax on it (Harberger-style). That tax becomes protocol revenue, and rebases are paid out based on that and other income. So you’re taxed, but you’re also the one earning from it. Game theory locked in. And for those hunting deeper entries, bond windows let you mint $RZR at a discount (5–20%) by depositing stables or BTC LPs. The protocol takes that collateral and adds it straight to the treasury, growing the $BTC stack and boosting future staking yield. You can even stake bond tranches mid-vesting to auto-compound right away. And $lstRZR, the LST yielding 240%+ APR is liquid. You can trade it instantly across @beets_fi, @CurveFinance, @ShadowOnSonic, and @Equalizer0x or sell future yields on @spectra_finance and @pendle_fi for upfront cash. So whether you’re farming, bonding, or just stacking $sRZR, every move strengthens the treasury and sends real cashflow back to stakers. And maybe, just maybe, you’ll be part of the protocol that hits XXXXX $BTC before the world realizes what it is. → Start here: → Stake here:  XXXXX engagements  **Related Topics** [token](/topic/token) [$srzr](/topic/$srzr) [staking](/topic/staking) [$rzr](/topic/$rzr) [$22m](/topic/$22m) [$12m](/topic/$12m) [Post Link](https://x.com/Kaffchad/status/1945871287899021694)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Kaff 📊 @Kaffchad on x 25.1K followers

Created: 2025-07-17 15:40:42 UTC

Kaff 📊 @Kaffchad on x 25.1K followers

Created: 2025-07-17 15:40:42 UTC

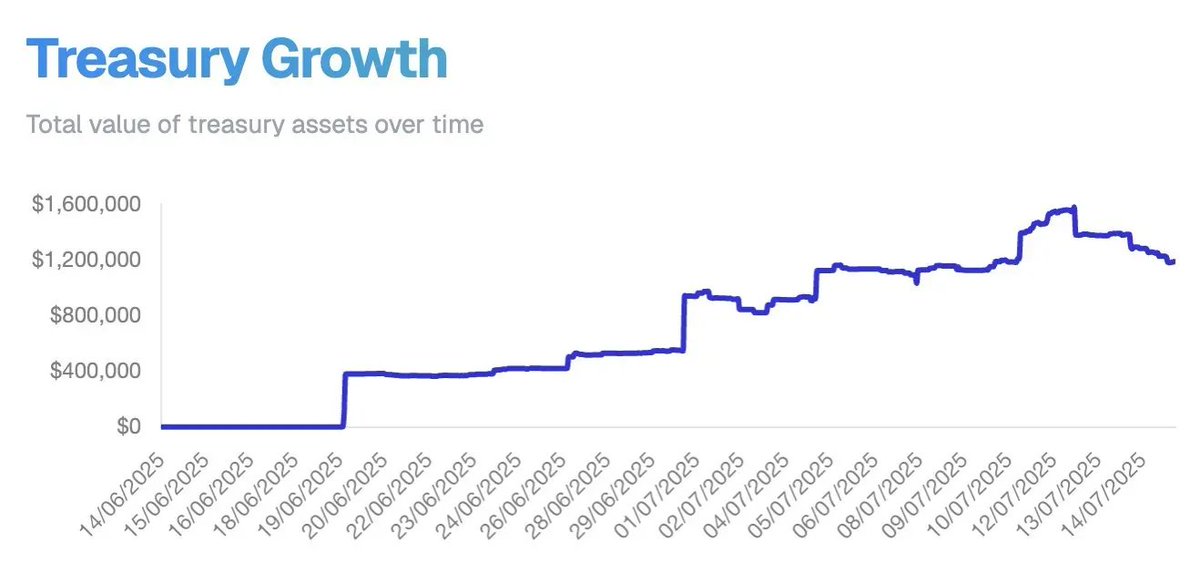

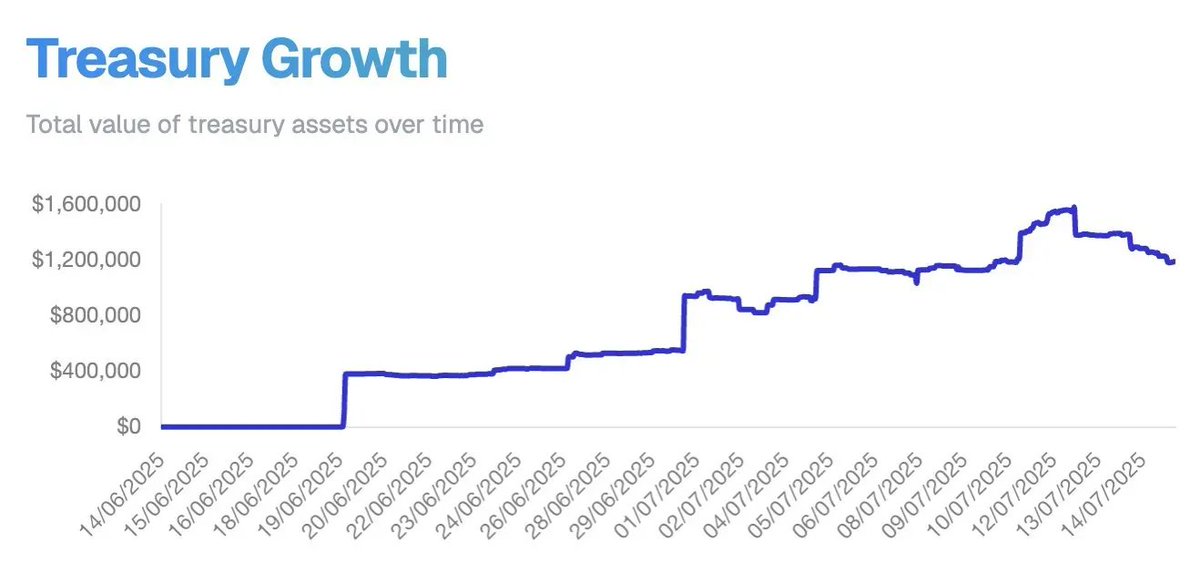

.@rezervemoney’s LST has been spitting out ~240% APR for over a month straight, and somehow, that’s just scratching the surface.

Right now, even with just ~$1.2M TVL, it’s already generating over $2.2M in annualized revenue.

The real alpha is in stacking $RZR, staking it as $sRZR, and helping grow DeFi’s first fair-launched, BTC-backed digital vault from the ground up.

Not familiar with it?

Rezerve is a reserve currency protocol natively deployed on @SonicLabs.

Unlike most of DeFi’s VC-riddled launches, this one came with no seed rounds, no team allocations, no airdrops, and zero insider unlocks.

Every $RZR in circulation was minted by users under the same rules.

At its core, Rezerve’s mission is to accumulate XXXXX $BTC into its treasury and become crypto’s on-chain vault for digital gold. All while routing XXX% of protocol revenue back to stakers.

📌 The protocol-earned real revenue comes from:

– Trading fees on protocol-owned LPs

– Harberger taxes from stakers

– Lending returns from idle reserves

– Bond sales (entry at a discount)

– External DEX bribes (Pendle...)

And all of this flows to stakers automatically every X hours.

When you stake $RZR, you mint $sRZR, a rebasing token that compounds yield every epoch. But there’s a twist:

You declare your stake’s value and pay a X% annual tax on it (Harberger-style).

That tax becomes protocol revenue, and rebases are paid out based on that and other income.

So you’re taxed, but you’re also the one earning from it. Game theory locked in.

And for those hunting deeper entries, bond windows let you mint $RZR at a discount (5–20%) by depositing stables or BTC LPs.

The protocol takes that collateral and adds it straight to the treasury, growing the $BTC stack and boosting future staking yield.

You can even stake bond tranches mid-vesting to auto-compound right away.

And $lstRZR, the LST yielding 240%+ APR is liquid. You can trade it instantly across @beets_fi, @CurveFinance, @ShadowOnSonic, and @Equalizer0x or sell future yields on @spectra_finance and @pendle_fi for upfront cash.

So whether you’re farming, bonding, or just stacking $sRZR, every move strengthens the treasury and sends real cashflow back to stakers.

And maybe, just maybe, you’ll be part of the protocol that hits XXXXX $BTC before the world realizes what it is.

→ Start here:

→ Stake here:

XXXXX engagements