[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Sergey [@SergeyCYW](/creator/twitter/SergeyCYW) on x 6349 followers Created: 2025-07-17 14:58:03 UTC Semiconductor industry continues a robust trajectory with global sales projected to reach $XXXXX billion in 2025, reflecting XXXX% growth from 2024. Current market size reached $XXX billion in 2024, with expectations of $XXX billion in 2025. Long-term projections indicate the market will exceed $X trillion by 2030, requiring only a XXX% compound annual growth rate (CAGR) between 2025 and 2030. forecasts XXXX% growth in 2025 and XXXX% in 2026. From 2021 to 2026, analysts forecast a XXX% CAGR for total sales. Alternative projections suggest a XXX% CAGR through 2029, with market expansion of $XXXXX billion during that period. AI is now the leading revenue driver in semiconductors, ahead of automotive. Data centers and cloud follow, fueled by surging AI workload demand. Development cycles accelerate 30–40% through AI-driven RTL synthesis and verification. Among public Semiconductor companies, analysts expect the strongest 2026 revenue growth from $MU at +31%, $MRVL at +28%, $NVDA at +26, $ARM at +22%, and $AVGO at +21%. Mid-tier expectations are set for $AMD at +18%, $TSM at +17%, $ADI at +13%, $SNPS at +12%, and $ASML at +9%. Lower growth forecasts include $AMAT at +6%, $INTC at +5%, $KLAC at +3%, $LRCX at +3%, and $QCOM at +2%. Next, we will analyze valuation multiples relative to expected growth, and examine competitive advantages. A short 🧵👇  XXXXX engagements  **Related Topics** [compound](/topic/compound) [longterm](/topic/longterm) [$0981hk](/topic/$0981hk) [Post Link](https://x.com/SergeyCYW/status/1945860557577576811)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Sergey @SergeyCYW on x 6349 followers

Created: 2025-07-17 14:58:03 UTC

Sergey @SergeyCYW on x 6349 followers

Created: 2025-07-17 14:58:03 UTC

Semiconductor industry continues a robust trajectory with global sales projected to reach $XXXXX billion in 2025, reflecting XXXX% growth from 2024.

Current market size reached $XXX billion in 2024, with expectations of $XXX billion in 2025. Long-term projections indicate the market will exceed $X trillion by 2030, requiring only a XXX% compound annual growth rate (CAGR) between 2025 and 2030.

forecasts XXXX% growth in 2025 and XXXX% in 2026. From 2021 to 2026, analysts forecast a XXX% CAGR for total sales. Alternative projections suggest a XXX% CAGR through 2029, with market expansion of $XXXXX billion during that period.

AI is now the leading revenue driver in semiconductors, ahead of automotive. Data centers and cloud follow, fueled by surging AI workload demand. Development cycles accelerate 30–40% through AI-driven RTL synthesis and verification.

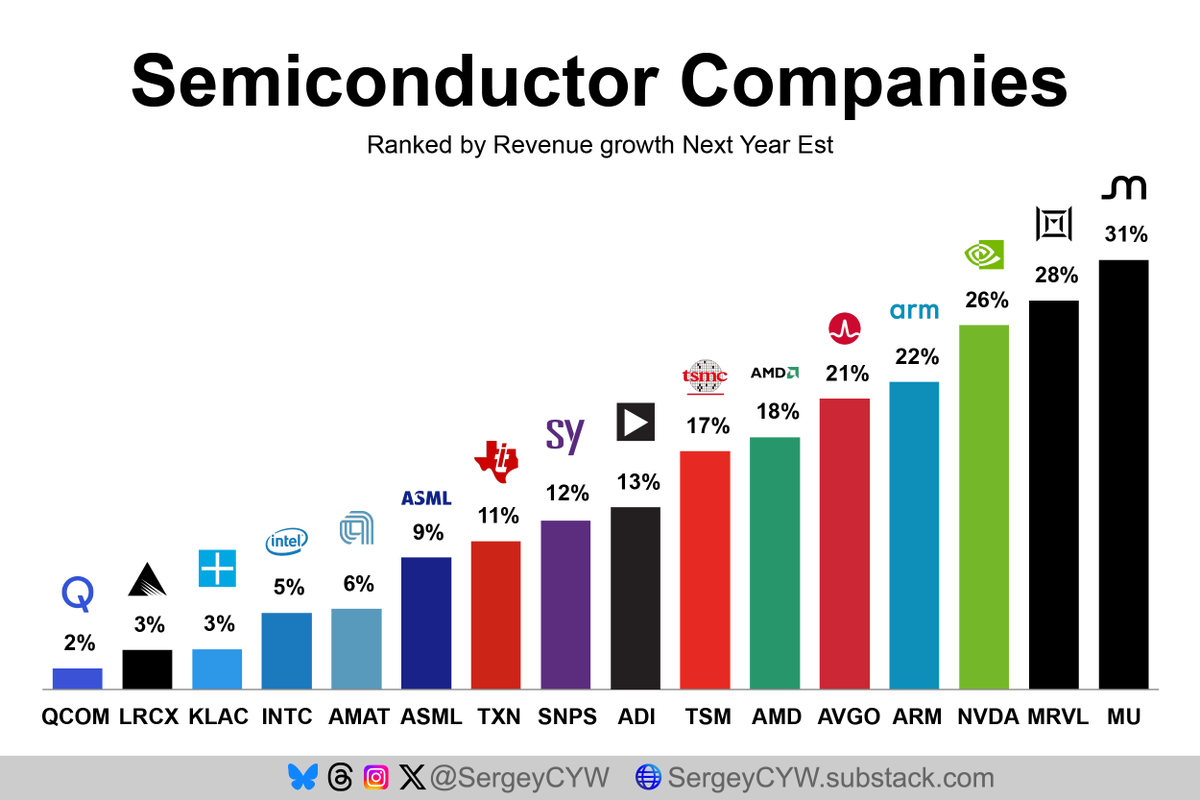

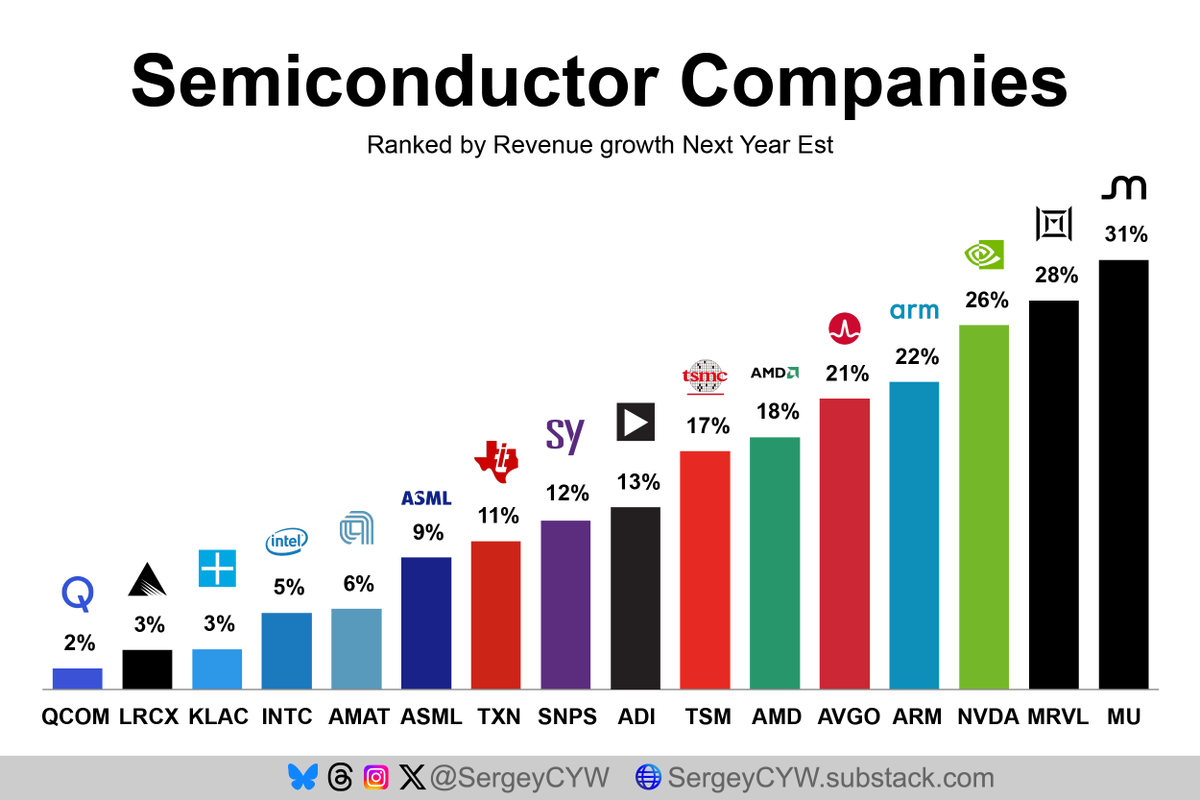

Among public Semiconductor companies, analysts expect the strongest 2026 revenue growth from $MU at +31%, $MRVL at +28%, $NVDA at +26, $ARM at +22%, and $AVGO at +21%.

Mid-tier expectations are set for $AMD at +18%, $TSM at +17%, $ADI at +13%, $SNPS at +12%, and $ASML at +9%.

Lower growth forecasts include $AMAT at +6%, $INTC at +5%, $KLAC at +3%, $LRCX at +3%, and $QCOM at +2%.

Next, we will analyze valuation multiples relative to expected growth, and examine competitive advantages. A short 🧵👇

XXXXX engagements