[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Triple Net Investor [@TripleNetInvest](/creator/twitter/TripleNetInvest) on x 115.4K followers Created: 2025-07-17 14:45:08 UTC Opendoor's $open stock is ripping and has been all the rage on X and WSB - it's more than 3x over the last couple weeks But anyone in real estate will tell you that their iBuying model is fundamentally broken - here’s why: - Opendoor is in the home flipping biz, disguised as a tech company Home flipping is hyper-local. Pricing depends on block-by-block nuances: school zones, curb appeal, sunlight, noise, neighbor’s dog etc. Algorithms miss these. Knowledgeable flippers and agents don’t - Flawed pricing model w/ no real advantage Opendoor relies on AVMs (automated valuation models) that almost always over/underprice homes. A 2–3% pricing error can erase all margin in already low-margin business. This has been the case more often than not - Scaling local expertise is nearly impossible Real estate is about trust and relationships with contractors, architects, the city, brokers, inspectors etc. Flipping homes profitably requires local expertise and deep market knowledge - High fixed costs, low-frequency sales Real estate isn’t like software. People move every 10-20 years. No repeat usage, no network effects, no retention - Massive inventory risk Holding physical homes means exposure to price swings, carry costs, maintenance, taxes, and illiquidity. When rates spike or demand dries up, they bleed cash - No moat Anyone with capital and a contractor can flip homes. Zillow tried, lost hundreds of millions, and shut down its iBuying unit. There’s no defensible edge here Final Thoughts Opendoor tried to turn a local service business into a national tech platform Anyone in real estate will tell you that what they tried to do was not disruption, it was absolute delusion With that said, if Opendoor does somehow crack the code in iBuying, then claims of a 100x from the bottom is definitely in the picture - you might truly see a company worth hundreds of billions of dollars someday But per my earlier points, this is a business that just simply cannot be scaled profitably - it's just a dream and will almost certainly be a money losing endeavor  XXXXXX engagements  **Related Topics** [all the](/topic/all-the) [coins real estate](/topic/coins-real-estate) [rage](/topic/rage) [investment](/topic/investment) [$open](/topic/$open) [open opendoor technologies inc](/topic/open-opendoor-technologies-inc) [Post Link](https://x.com/TripleNetInvest/status/1945857306392133997)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Triple Net Investor @TripleNetInvest on x 115.4K followers

Created: 2025-07-17 14:45:08 UTC

Triple Net Investor @TripleNetInvest on x 115.4K followers

Created: 2025-07-17 14:45:08 UTC

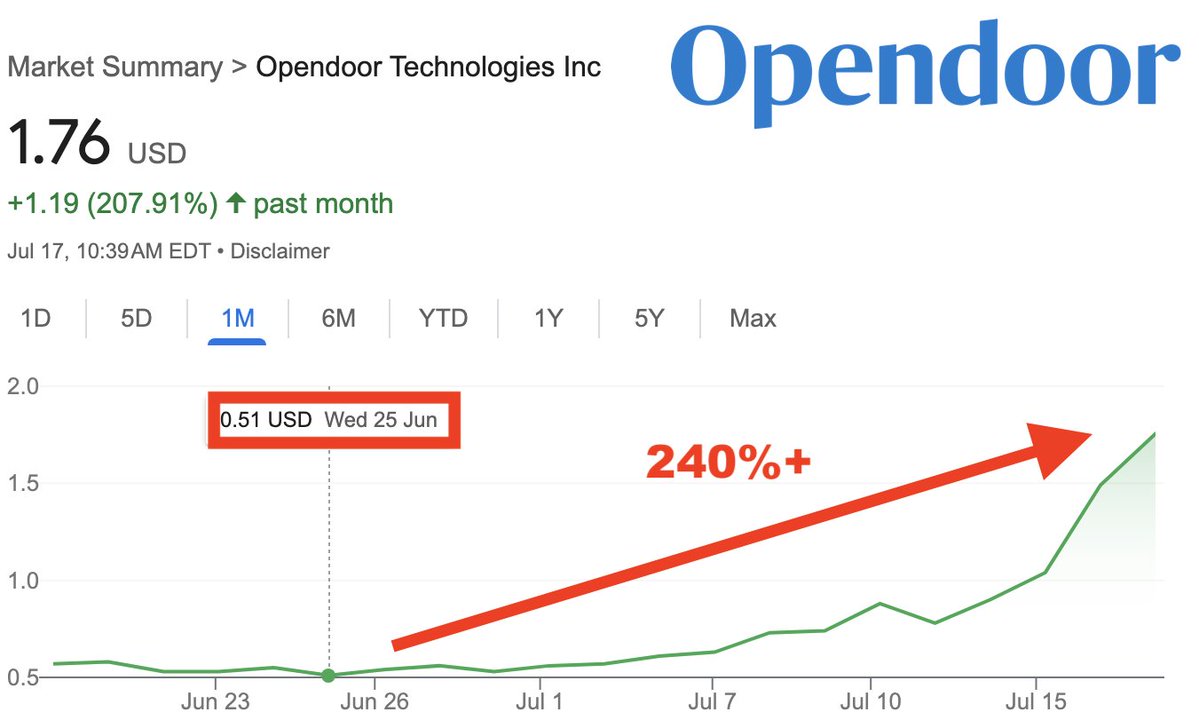

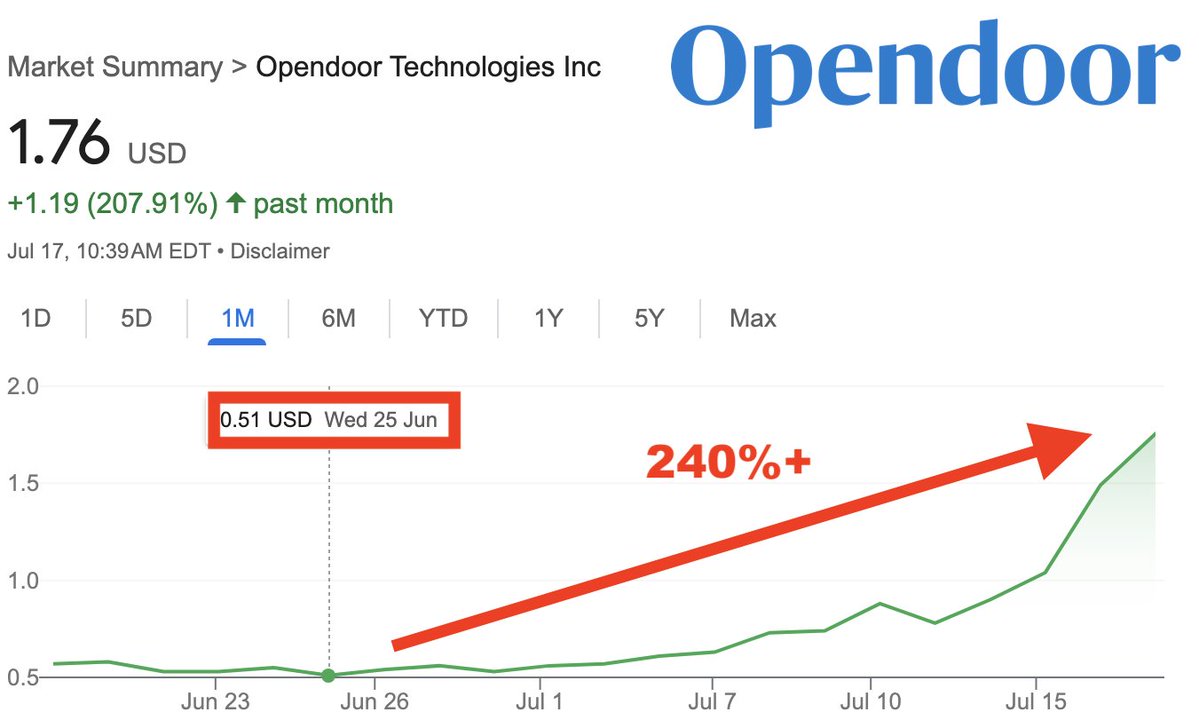

Opendoor's $open stock is ripping and has been all the rage on X and WSB - it's more than 3x over the last couple weeks

But anyone in real estate will tell you that their iBuying model is fundamentally broken - here’s why:

- Opendoor is in the home flipping biz, disguised as a tech company

Home flipping is hyper-local. Pricing depends on block-by-block nuances: school zones, curb appeal, sunlight, noise, neighbor’s dog etc. Algorithms miss these. Knowledgeable flippers and agents don’t

- Flawed pricing model w/ no real advantage

Opendoor relies on AVMs (automated valuation models) that almost always over/underprice homes. A 2–3% pricing error can erase all margin in already low-margin business. This has been the case more often than not

- Scaling local expertise is nearly impossible

Real estate is about trust and relationships with contractors, architects, the city, brokers, inspectors etc. Flipping homes profitably requires local expertise and deep market knowledge

- High fixed costs, low-frequency sales

Real estate isn’t like software. People move every 10-20 years. No repeat usage, no network effects, no retention

- Massive inventory risk

Holding physical homes means exposure to price swings, carry costs, maintenance, taxes, and illiquidity. When rates spike or demand dries up, they bleed cash

- No moat

Anyone with capital and a contractor can flip homes. Zillow tried, lost hundreds of millions, and shut down its iBuying unit. There’s no defensible edge here

Final Thoughts

Opendoor tried to turn a local service business into a national tech platform

Anyone in real estate will tell you that what they tried to do was not disruption, it was absolute delusion

With that said, if Opendoor does somehow crack the code in iBuying, then claims of a 100x from the bottom is definitely in the picture - you might truly see a company worth hundreds of billions of dollars someday

But per my earlier points, this is a business that just simply cannot be scaled profitably - it's just a dream and will almost certainly be a money losing endeavor

XXXXXX engagements

Related Topics all the coins real estate rage investment $open open opendoor technologies inc