[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  DeFi Mago [@defi_mago](/creator/twitter/defi_mago) on x 57.8K followers Created: 2025-07-17 13:17:08 UTC Just found a sneaky-good @SonicLabs points farm - and it’s a positive APR loop with point multipliers • You're farming yield + Sonic points by looping pegged tokens • wOS/OS/Sonic all tied to $S, so minimal price risk • And every loop prints 12x Sonic + 2x Silo points per $ per day 🧑🍳 How it works: Basically, we’re looping between wOS and $S using Silo (market ID 54), and earning yield + points on each step. ─────── Step-by-step: 1️⃣ Wrap your $S to $wOS on @OriginProtocol → Earn XXXX% APY just for holding 2️⃣ Go to @SiloFinance → Markets → Find wOS · S market (ID 54) 3️⃣ Deposit your wOS (Lending APR 0.6%) → Borrow more $S at XXX% borrow APR 4️⃣ Repeat the wrap → deposit → borrow loop 🌀 ─────── All assets are pegged to $S → minimal depeg risk You're in positive APR territory even before points But always loop responsibly. APRs can shift, and liquidation still exists.  XXXXXX engagements  **Related Topics** [farming](/topic/farming) [loop](/topic/loop) [apr](/topic/apr) [soniclabs](/topic/soniclabs) [sonic](/topic/sonic) [coins layer 1](/topic/coins-layer-1) [Post Link](https://x.com/defi_mago/status/1945835159724695879)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

DeFi Mago @defi_mago on x 57.8K followers

Created: 2025-07-17 13:17:08 UTC

DeFi Mago @defi_mago on x 57.8K followers

Created: 2025-07-17 13:17:08 UTC

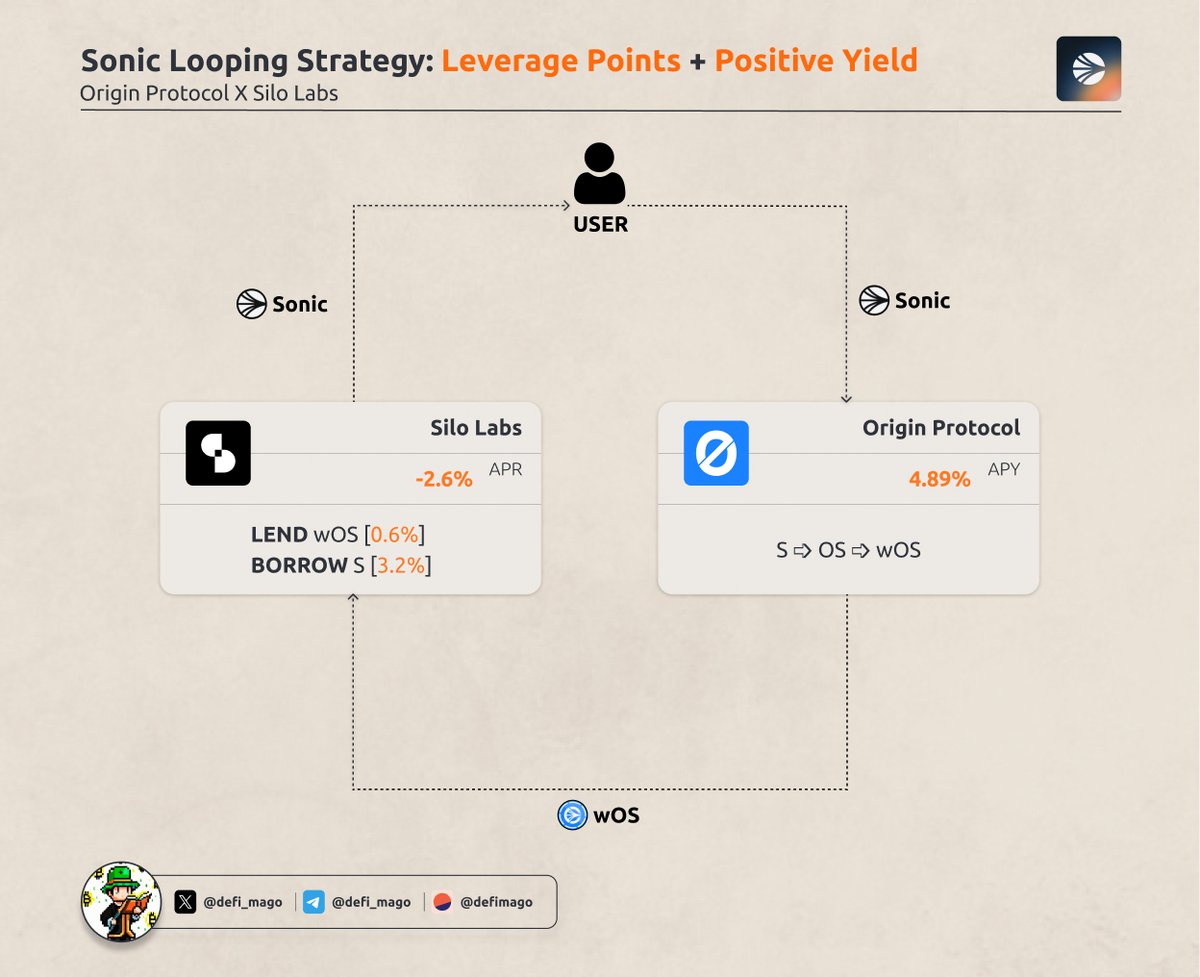

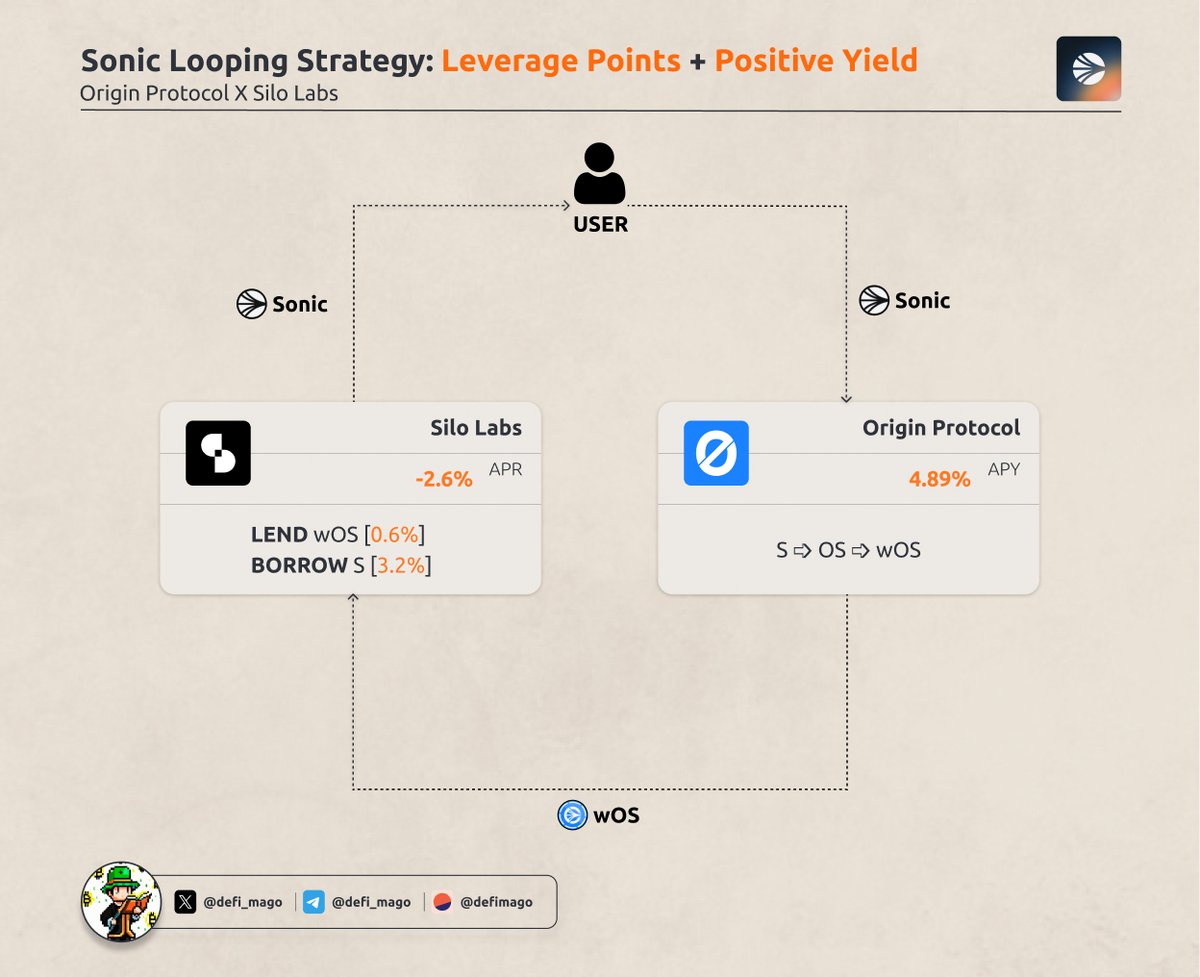

Just found a sneaky-good @SonicLabs points farm - and it’s a positive APR loop with point multipliers

• You're farming yield + Sonic points by looping pegged tokens

• wOS/OS/Sonic all tied to $S, so minimal price risk

• And every loop prints 12x Sonic + 2x Silo points per $ per day 🧑🍳

How it works:

Basically, we’re looping between wOS and $S using Silo (market ID 54), and earning yield + points on each step.

───────

Step-by-step:

1️⃣ Wrap your $S to $wOS on @OriginProtocol → Earn XXXX% APY just for holding

2️⃣ Go to @SiloFinance → Markets → Find wOS · S market (ID 54)

3️⃣ Deposit your wOS (Lending APR 0.6%) → Borrow more $S at XXX% borrow APR

4️⃣ Repeat the wrap → deposit → borrow loop 🌀

───────

All assets are pegged to $S → minimal depeg risk

You're in positive APR territory even before points

But always loop responsibly. APRs can shift, and liquidation still exists.

XXXXXX engagements

Related Topics farming loop apr soniclabs sonic coins layer 1