[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Gab [@GabGrowth](/creator/twitter/GabGrowth) on x 14.4K followers Created: 2025-07-17 12:03:11 UTC 8/ The Risks and the Bear Case Geopolitical Tension: Taiwan remains a key geographical flashpoint. While partially mitigated through new fabs in other countries, Taiwan remains crucial, and a Chinese invasion would be considered an existential crisis. Customer Concentration: Apple alone makes up ~20% of TSMC’s revenue. Nvidia makes up ~15% of revenue and will likely become a much larger percentage over the coming decade. Capital Intensity: With TSMC spending $30-$35B in CAPEX a year, a temporary slowdown will lead to a significant drop in profitability. Samsung and Intel: While both are currently far behind, these are capable businesses with huge ambitions and a massive cash pile. AI Bubble Risk: If AI demand normalises faster than expected, growth rates could stall big time.  XX engagements  **Related Topics** [countries](/topic/countries) [taiwan](/topic/taiwan) [$nvda](/topic/$nvda) [stocks technology](/topic/stocks-technology) [Post Link](https://x.com/GabGrowth/status/1945816549086187762)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Gab @GabGrowth on x 14.4K followers

Created: 2025-07-17 12:03:11 UTC

Gab @GabGrowth on x 14.4K followers

Created: 2025-07-17 12:03:11 UTC

8/ The Risks and the Bear Case

Geopolitical Tension: Taiwan remains a key geographical flashpoint. While partially mitigated through new fabs in other countries, Taiwan remains crucial, and a Chinese invasion would be considered an existential crisis.

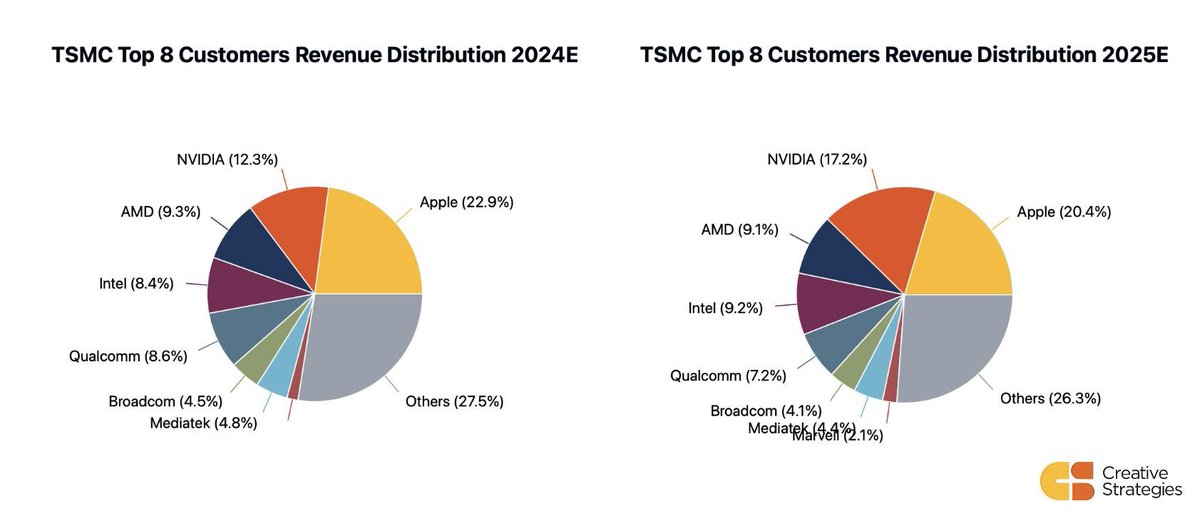

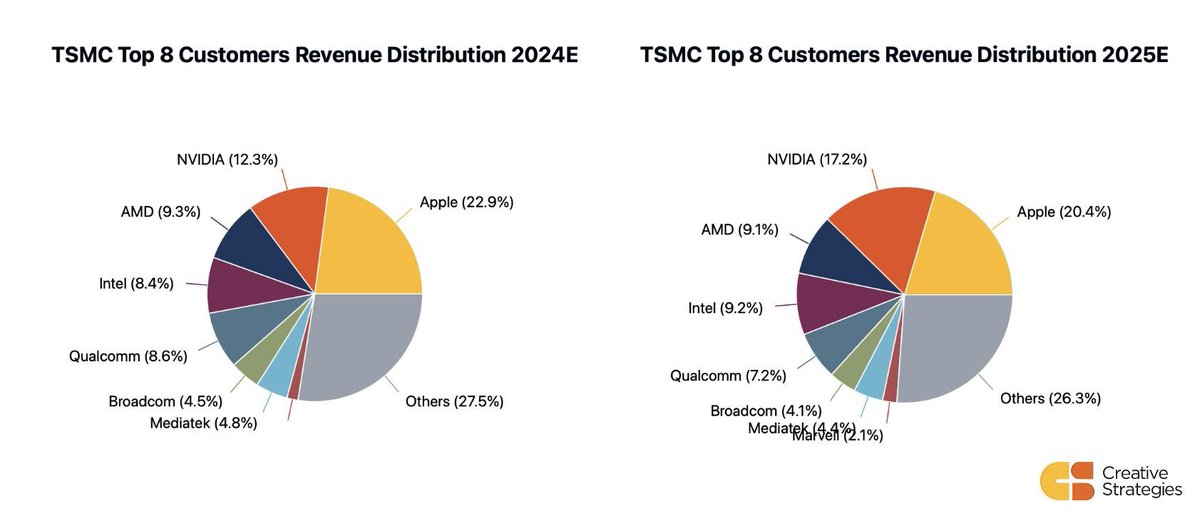

Customer Concentration: Apple alone makes up ~20% of TSMC’s revenue. Nvidia makes up ~15% of revenue and will likely become a much larger percentage over the coming decade.

Capital Intensity: With TSMC spending $30-$35B in CAPEX a year, a temporary slowdown will lead to a significant drop in profitability.

Samsung and Intel: While both are currently far behind, these are capable businesses with huge ambitions and a massive cash pile.

AI Bubble Risk: If AI demand normalises faster than expected, growth rates could stall big time.

XX engagements

Related Topics countries taiwan $nvda stocks technology