[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Marvin Labs [@marvin_labs](/creator/twitter/marvin_labs) on x XXX followers Created: 2025-07-17 10:37:09 UTC Growth at $MMC for 2Q-2025 is driven by acquisitions, not underlying performance. * Revenue: $7.0B, up XX% vs 2Q-2024; underlying revenue up only 4%. Headline growth far outpaces organic gains. * Adjusted EPS: $2.72, up XX% vs prior year and modestly above expectations. * Adjusted operating income: $2.1B, up 14%. * Risk & Insurance Services revenue: $4.6B, up XX% (4% underlying) Acquisitions are fueling reported revenue and income, but underlying organic growth remains subdued. Adjusted EPS and operating income rose at a faster pace, giving some margin improvement. Earnings call is scheduled for today at 08:30 am EDT.  XX engagements  **Related Topics** [$46b](/topic/$46b) [insurance](/topic/insurance) [$21b](/topic/$21b) [eps](/topic/eps) [$70b](/topic/$70b) [$mmc](/topic/$mmc) [stocks financial services](/topic/stocks-financial-services) [Post Link](https://x.com/marvin_labs/status/1945794898025705513)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Marvin Labs @marvin_labs on x XXX followers

Created: 2025-07-17 10:37:09 UTC

Marvin Labs @marvin_labs on x XXX followers

Created: 2025-07-17 10:37:09 UTC

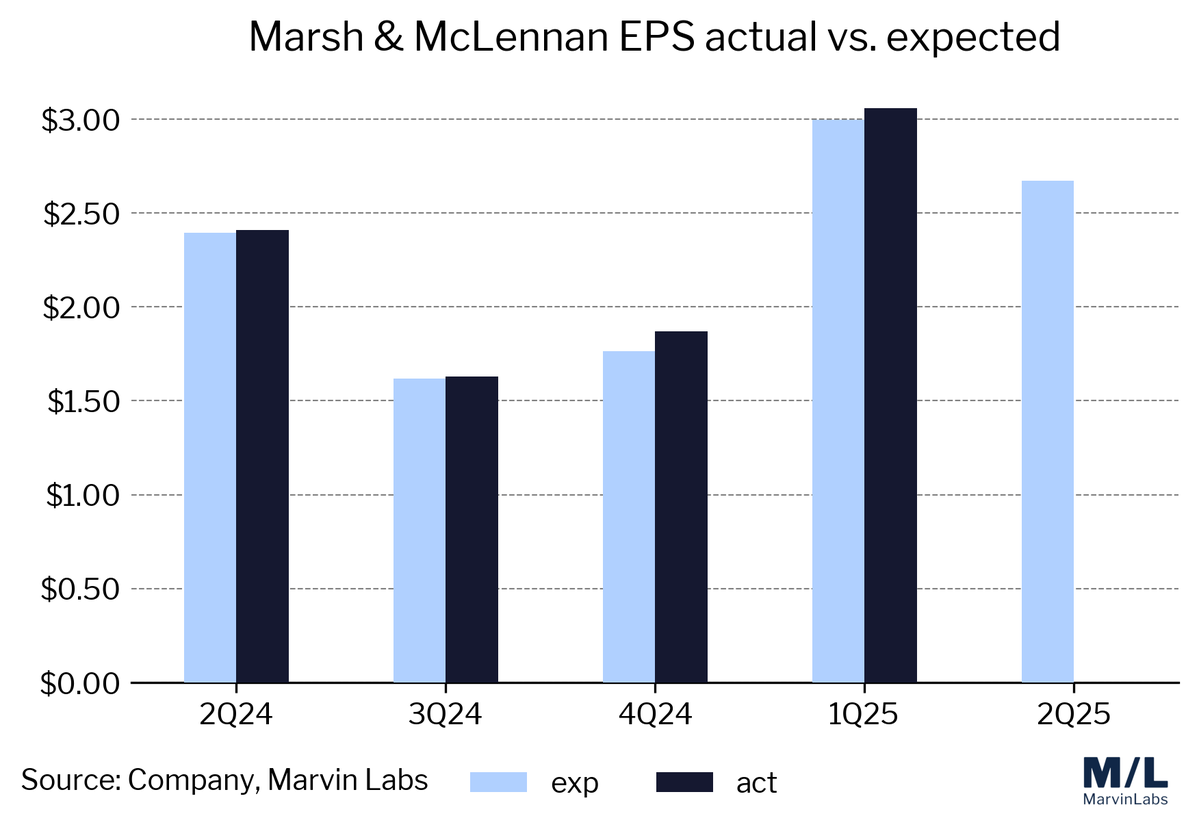

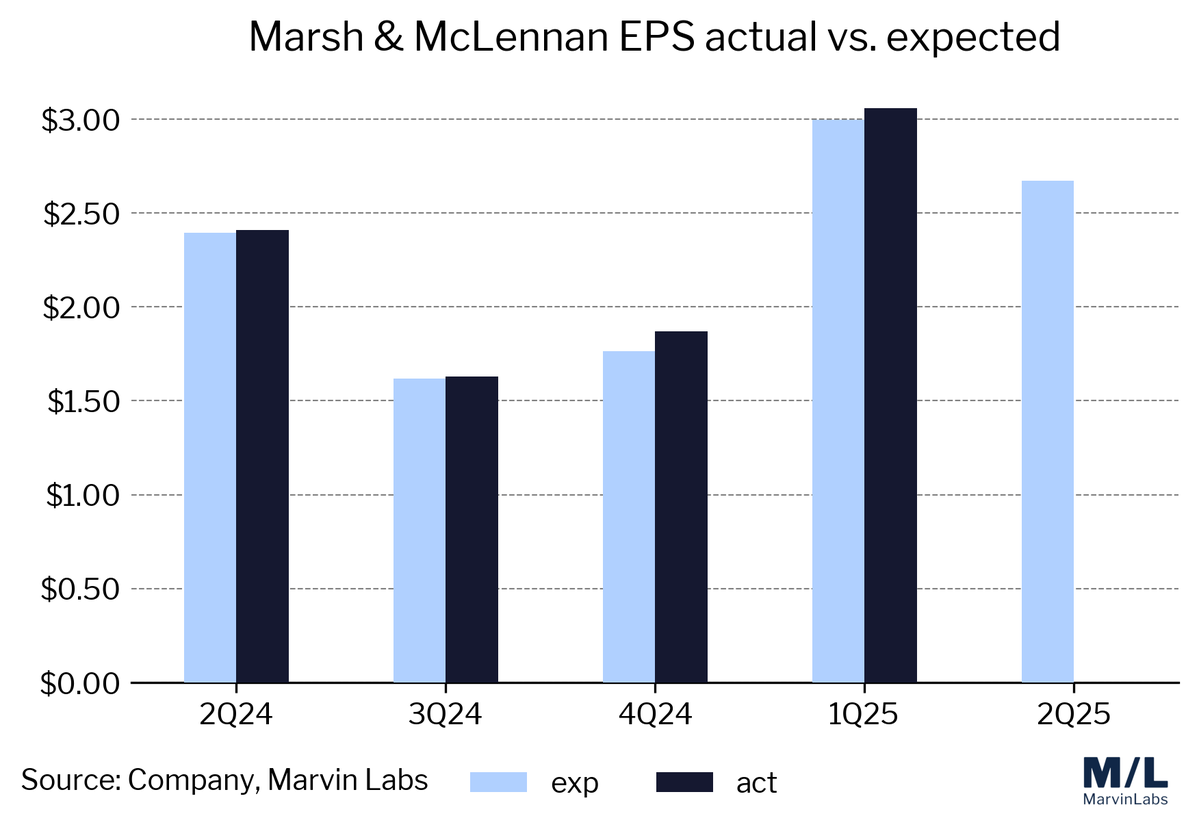

Growth at $MMC for 2Q-2025 is driven by acquisitions, not underlying performance.

- Revenue: $7.0B, up XX% vs 2Q-2024; underlying revenue up only 4%. Headline growth far outpaces organic gains.

- Adjusted EPS: $2.72, up XX% vs prior year and modestly above expectations.

- Adjusted operating income: $2.1B, up 14%.

- Risk & Insurance Services revenue: $4.6B, up XX% (4% underlying)

Acquisitions are fueling reported revenue and income, but underlying organic growth remains subdued. Adjusted EPS and operating income rose at a faster pace, giving some margin improvement.

Earnings call is scheduled for today at 08:30 am EDT.

XX engagements

Related Topics $46b insurance $21b eps $70b $mmc stocks financial services