[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Stock.Logging [@stock_logging](/creator/twitter/stock_logging) on x XXX followers Created: 2025-07-17 08:22:34 UTC Definitely two valid concerns you pointed out – and I fully agree. I briefly addressed both in my follow-up tweet but to add a bit more color on both points: → One-off gains: - You’re absolutely right here. There were several positive one-off effects last year: ◾Earn-out reduction following the acquisition of Zelto (Overseas Business). ◾Change in consolidation method for the subsidiary Japan AI: Instead of fully consolidating Japan AI’s revenue and expenses, only Geniee’s proportional share of profit or loss is now recorded under Equity in Earnings of Affiliates. The stake in Japan AI was therefore revalued, and since the new valuation exceeded the book value previously recorded, a one-time gain was recognized. - There were also some one-off effects in prior years. Starting this year, however, reported profit should reflect the company’s underlying earnings much more accurately, as shown in the first picture. The expected normalized profit of JPY 2.45b is almost equal to the expected operating profit of JPY 2.75b. Note: normalized profit doesn’t include Japan AI’s losses, which should explain the difference between JPY 2.45b and JPY 2.75b. That’s why I consider the single digit forward P/E for FY 2025 as meaningful. → High goodwill: - True, not great at all. However, management considers the risk of impairment rather low (see chart 2). The Ad Platform and Overseas Business segments (the latter representing most of the goodwill from the Zelto acquisition) will be consolidated starting FY2025. - Quick explanation: According to the company’s presentation, goodwill and related tangible assets are grouped into Cash-Generating Units (CGUs) – the smallest identifiable units that generate independent cash flows. In an impairment test, the CGU’s book value is compared to its discounted future operating cash flows. If cash flows are below the book value, impairment is required. - Until 2024, Zelto was treated as a standalone CGU, meaning cash flow forecasts were based solely on Zelto’s own operations. - From 2025 onward, cash flows will be assessed on a segment-wide basis (domestic + international), meaning stronger markets can offset weaker ones. I hope both explanations are helpful to you.  XXX engagements  **Related Topics** [japan](/topic/japan) [acquisition](/topic/acquisition) [Post Link](https://x.com/stock_logging/status/1945761027070599641)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Stock.Logging @stock_logging on x XXX followers

Created: 2025-07-17 08:22:34 UTC

Stock.Logging @stock_logging on x XXX followers

Created: 2025-07-17 08:22:34 UTC

Definitely two valid concerns you pointed out – and I fully agree. I briefly addressed both in my follow-up tweet but to add a bit more color on both points:

→ One-off gains:

- You’re absolutely right here. There were several positive one-off effects last year:

◾Earn-out reduction following the acquisition of Zelto (Overseas Business). ◾Change in consolidation method for the subsidiary Japan AI: Instead of fully consolidating Japan AI’s revenue and expenses, only Geniee’s proportional share of profit or loss is now recorded under Equity in Earnings of Affiliates. The stake in Japan AI was therefore revalued, and since the new valuation exceeded the book value previously recorded, a one-time gain was recognized.

- There were also some one-off effects in prior years. Starting this year, however, reported profit should reflect the company’s underlying earnings much more accurately, as shown in the first picture. The expected normalized profit of JPY 2.45b is almost equal to the expected operating profit of JPY 2.75b. Note: normalized profit doesn’t include Japan AI’s losses, which should explain the difference between JPY 2.45b and JPY 2.75b. That’s why I consider the single digit forward P/E for FY 2025 as meaningful.

→ High goodwill:

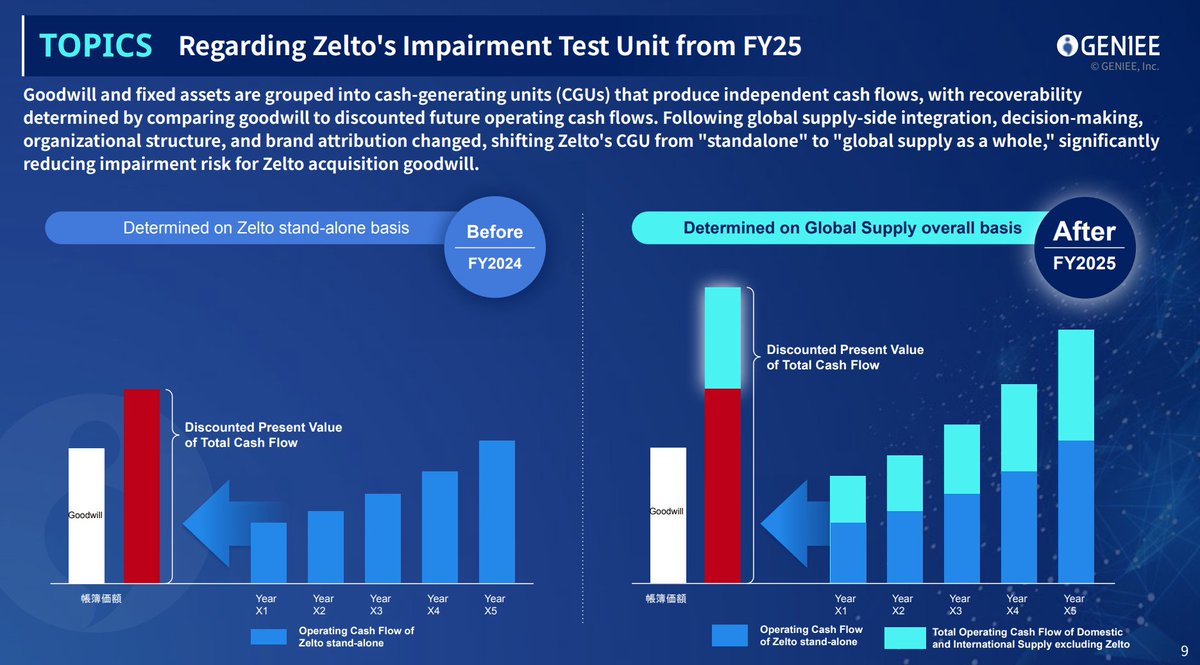

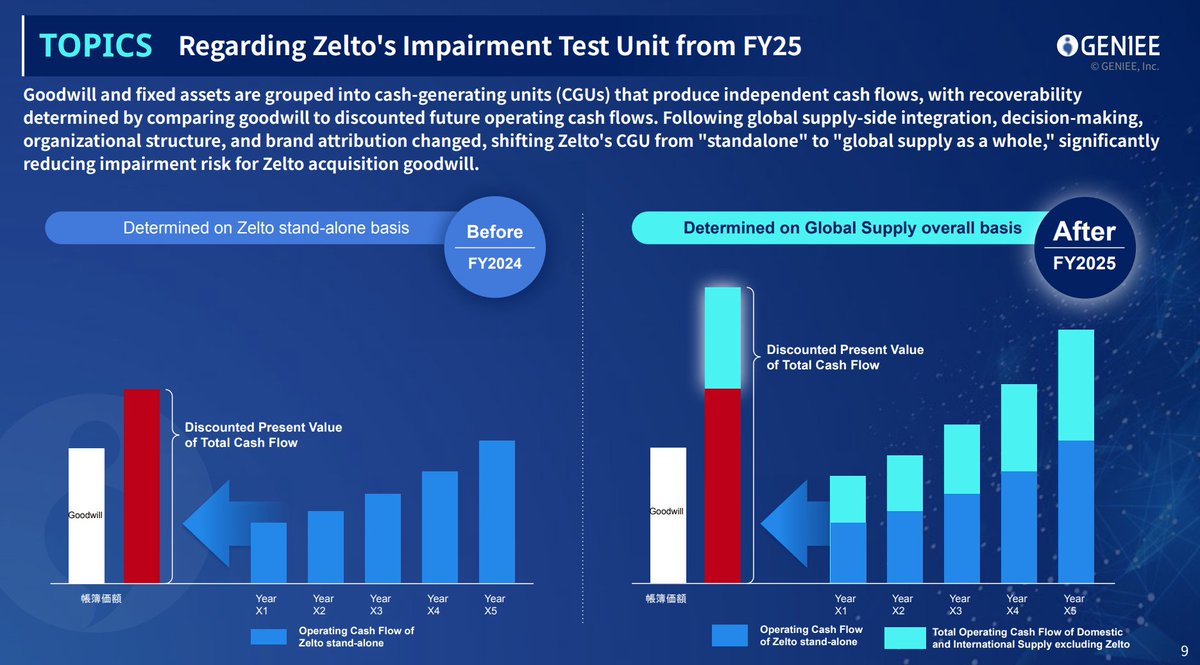

True, not great at all. However, management considers the risk of impairment rather low (see chart 2). The Ad Platform and Overseas Business segments (the latter representing most of the goodwill from the Zelto acquisition) will be consolidated starting FY2025.

Quick explanation: According to the company’s presentation, goodwill and related tangible assets are grouped into Cash-Generating Units (CGUs) – the smallest identifiable units that generate independent cash flows. In an impairment test, the CGU’s book value is compared to its discounted future operating cash flows. If cash flows are below the book value, impairment is required.

Until 2024, Zelto was treated as a standalone CGU, meaning cash flow forecasts were based solely on Zelto’s own operations.

From 2025 onward, cash flows will be assessed on a segment-wide basis (domestic + international), meaning stronger markets can offset weaker ones.

I hope both explanations are helpful to you.

XXX engagements

Related Topics japan acquisition