[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Jonaso [@Jonasoeth](/creator/twitter/Jonasoeth) on x 5841 followers Created: 2025-07-17 08:13:57 UTC Aave 2025: The Leading Bitcoin Use Case in DeFi @Aave has long been recognized as the flagship DeFi protocol on Ethereum, consistently ranking top X lending about TVL, Active loan, Revenue and Fees. → But in 2025, Aave isn’t just Ethereum DeFi. It’s also Bitcoin DeFi. Today, over XX% of Aave’s total supply, approximately $8B, comes from Bitcoin LSTs. This makes Aave the most popular destination for Bitcoin in DeFi. Top X Bitcoin Assets Supplied on Aave: • WBTC @WrappedBTC | $5,6B • cbBTC @coinbase | $2B • BTC.b @BorderlessBTCb | $380M • tBTC @tBTC_project | $213M • LBTC @Lombard_Finance | $205M Instead of selling your Bitcoin, use it as collateral on Aave to borrow stablecoins and earn more yield. Aave is likely to become the central liquidity layer for this new wave of capital → first Ethereum, now Bitcoin. What’s next? Tokenized stocks are coming. → Just use Aave  XXXXX engagements  **Related Topics** [$8b](/topic/$8b) [tvl](/topic/tvl) [lending](/topic/lending) [protocol](/topic/protocol) [bitcoin](/topic/bitcoin) [coins layer 1](/topic/coins-layer-1) [coins bitcoin ecosystem](/topic/coins-bitcoin-ecosystem) [coins pow](/topic/coins-pow) [Post Link](https://x.com/Jonasoeth/status/1945758860238860596)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Jonaso @Jonasoeth on x 5841 followers

Created: 2025-07-17 08:13:57 UTC

Jonaso @Jonasoeth on x 5841 followers

Created: 2025-07-17 08:13:57 UTC

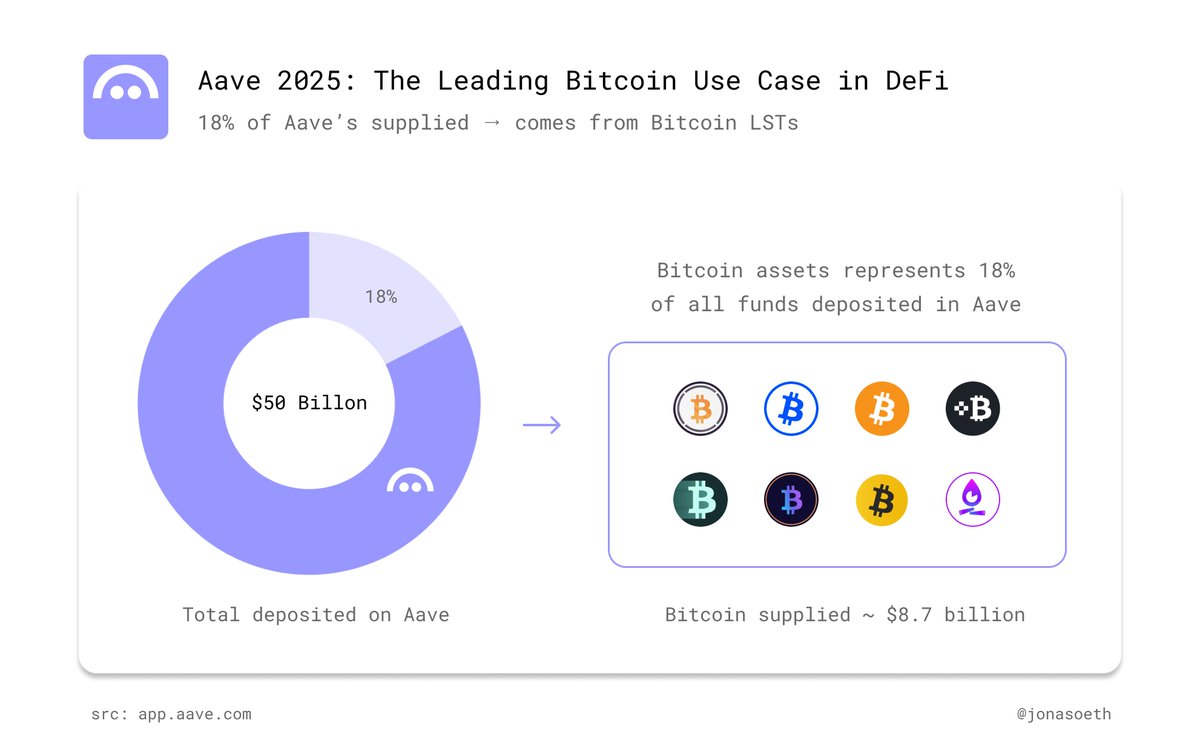

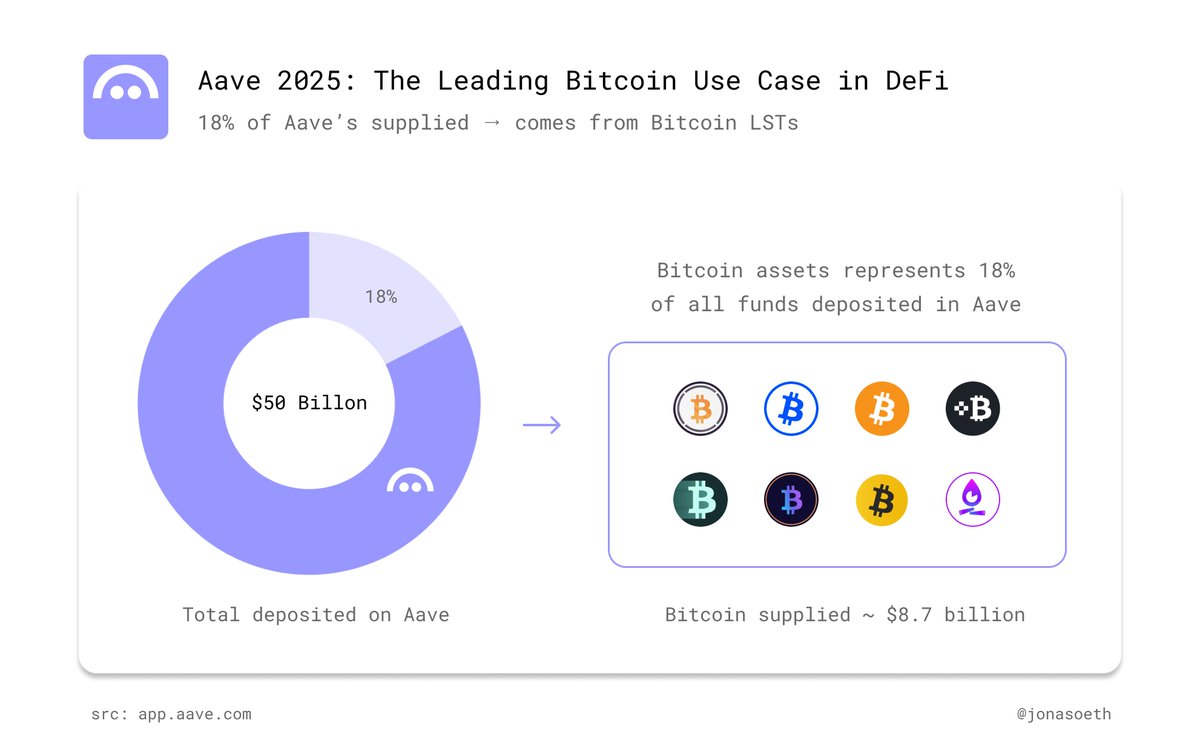

Aave 2025: The Leading Bitcoin Use Case in DeFi

@Aave has long been recognized as the flagship DeFi protocol on Ethereum, consistently ranking top X lending about TVL, Active loan, Revenue and Fees.

→ But in 2025, Aave isn’t just Ethereum DeFi. It’s also Bitcoin DeFi.

Today, over XX% of Aave’s total supply, approximately $8B, comes from Bitcoin LSTs.

This makes Aave the most popular destination for Bitcoin in DeFi.

Top X Bitcoin Assets Supplied on Aave:

• WBTC @WrappedBTC | $5,6B • cbBTC @coinbase | $2B • BTC.b @BorderlessBTCb | $380M • tBTC @tBTC_project | $213M • LBTC @Lombard_Finance | $205M

Instead of selling your Bitcoin, use it as collateral on Aave to borrow stablecoins and earn more yield.

Aave is likely to become the central liquidity layer for this new wave of capital → first Ethereum, now Bitcoin.

What’s next? Tokenized stocks are coming.

→ Just use Aave

XXXXX engagements

Related Topics $8b tvl lending protocol bitcoin coins layer 1 coins bitcoin ecosystem coins pow