[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Frans Bakker [@FransBakker9812](/creator/twitter/FransBakker9812) on x 7053 followers Created: 2025-07-17 07:02:15 UTC $IREN - $NBIS A Nuanced Comparison "We believe that as the market moves to next-gen GPUs (e.g., Blackwell), the complexity of managing compute density, thermal issues etc. may constrain the emergence of new competitors." ~Goldman Sachs Equity Research, 7/14/2025. Three days ago, Goldman Sachs released a research report on Nebius, issuing a Buy rating and setting a price target of $XX. Around the same time, @IREN_Ltd published their GPU Buyers Guide on the Iren Cloud website. A lot has already been said about both companies, and I’m not here to add more fuel to the fire. But after reading the Goldman report, I’m more convinced than ever that these two companies aren’t fishing from the same pond — at least not yet. What this means is that $IREN can focus on scaling its infrastructure while gradually building out its software stack. Nebius, on the other hand, is expanding its TAM while continuing to mature on the infrastructure side. In my view, IREN is positioning itself to serve a more sophisticated enterprise segment — one that values control, bare-metal performance, and customization. Nebius, meanwhile, is catering to enterprise clients seeking one-click clusters and a tightly integrated, user-friendly ecosystem. I asked GPT🤖 to help me write an in-depth comparison between the two, and honestly, I think the result speaks for itself. Judge for yourself, but I think, as Goldman said, "it's not a winner takes all market." X. Vertical Full-Stack Integration: IREN’s integration is broader in scope than Nebius’s – spanning power, construction, hardware, and operations – but not as deep (yet) on the software/cloud services side. However, from an enterprise compute infrastructure perspective, IREN’s end-to-end control is a significant moat. Its ability to offer “flexible, end-to-end solutions across the AI infrastructure stack” – from data hall to cloud API – is unique. For large enterprise or institutional customers, this means IREN can serve as a one-stop partner to deploy AI capacity. For example, if a Fortune XXX company wants a dedicated AI cluster due to compliance or to avoid multi-tenant environments, IREN can build and manage that cluster on renewable-powered sites with the latest GPUs. That’s something a standard cloud provider or smaller competitor likely cannot do with the same ease or cost efficiency. In this sense, IREN’s vertical integration forms a defensible moat in the enterprise segment – it requires massive power assets, data center expertise, and capital to replicate. Few competitors (aside from perhaps other ex-crypto miners or cloud infrastructure specialists like CoreWeave) have this combination of assets. Goldman’s commentary on Nebius noted the importance of financing such capital-intensive build-outs ; IREN’s existing 810MW of operational data centers and cash flow from mining give it a head start that newcomers would struggle to match. X. Technical/Software Moat: This is where IREN currently lags Nebius. Nebius’s software platform and curated AI services create a moat around ease-of-use and customer lock-in. IREN does not yet provide a comparably rich cloud software ecosystem; its focus is on providing the infrastructure building blocks (GPUs, power, environment) and support. This means that, at least today, IREN’s offering might appeal more to larger or more sophisticated enterprise customers – those who have the resources to handle some integration themselves or who prefer tailor-made solutions over off-the-shelf cloud services. For such customers, not having a hundred pre-built services is fine; they might integrate IREN’s GPUs into their own IT stack or use third-party software (e.g. open-source MLOps tools). Smaller startups, however, might find Nebius’s plug-and-play platform more convenient if they lack an ops team. Thus, in the startup and developer ecosystem, Nebius has a stronger moat due to its software. IREN will need to mitigate this by possibly partnering for software solutions or gradually rolling out more cloud features as its AI business matures. If IREN can, for instance, develop an easy web portal for managing GPU instances, or partner with an MLOps service so that customers can train and deploy models with minimal fuss, it would bolster its moat on the service layer. Given IREN’s strategic moves (e.g. working with Dell’s AI Factory, likely collaborating with NVIDIA’s cloud software stack), it seems aware of this need. X. Cost and Performance Moat: As discussed, IREN’s cost advantage is formidable and likely sustainable – it is underpinned by physical assets (cheap power, land rights) not easily acquired by competitors. This translates to a pricing moat if leveraged properly. In North America, the only other players with similar scale of cheap power are perhaps some cloud hyperscalers and other mining-to-AI converts. If AI demand continues to outstrip supply (as evidenced by cloud GPU shortages in 2023-2024), enterprises will gravitate to whoever can deliver capacity quickly and affordably. IREN’s “time-to-power” advantage – a 3GW pipeline of sites ready to energize – is a key differentiator in an era where securing 100+ MW for AI can take years. This is analogous to Nebius’s advantage of already having scale and capital: both reduce time-to-market for new capacity. In effect, IREN’s moat in NA could become being the fastest and cheapest to offer large-scale GPU compute. Goldman’s bull case for Nebius assumes a rapid expansion and capturing of market share because it can scale at lower cost. The same logic can apply to IREN in NA: if it can deploy thousands of GPUs ahead of slower-moving incumbents, it can lock in enterprise clients who sign multi-year deals for that capacity. In cloud infrastructure, early deployment and customer acquisition can create a network effect (clients build workflows around your cloud, making them less likely to switch later). X. Reputation and Enterprise Appeal: Nebius benefits from being a pure-play AI cloud with a pedigree (Yandex’s credibility in tech). IREN, coming from the crypto space, has to prove itself to enterprise customers as a reliable AI partner. That said, IREN has taken steps to bolster credibility: it’s a NASDAQ listed company, it has brought on experienced personnel (e.g., a new Chief Capital Officer from traditional finance ), and it’s actively publicizing its AI successes (case studies with Dell/NVIDIA, etc.). Moreover, IREN can point to its performance as a “green” infrastructure provider – using XXX% renewables – which could be attractive for enterprises with sustainability goals . Overcoming the perception risk (i.e., “Are they just a miner dabbling in AI?”) will be important. Yet, one could argue IREN’s hybrid model (Bitcoin mining + AI) is actually a strength: it implies diversified revenue and resilience. Indeed, analysts have noted that IREN’s mining operations make it one of the world’s largest and lowest-cost Bitcoin producers, providing robust cash flows to support its AI venture . An enterprise signing with IREN might take comfort that the provider isn’t solely dependent on AI startups for revenue – it has other businesses to backstop stability. This contrasts with Nebius, which as a pure AI cloud is unprofitable currently and relies on investor funding until the AI compute market matures. If an enterprise is assessing long-term partnerships, IREN’s overall financial footing (no debt, existing cash funded GPU purchases) could be a plus. X. Competitive Landscape in NA: It’s also worth comparing how extrapolating Nebius’s thesis to IREN must account for competition. Nebius operates in a niche largely defined by a few European players; Goldman sees Nebius’s main peers as other AI infrastructure startups (possibly companies like CoreWeave, LambdaLabs, etc.) and of course the big cloud companies. In North America, IREN will go up against CoreWeave, which has grown rapidly as a specialized GPU cloud (and has attracted large funding and marquee customers). CoreWeave similarly touts a vertically integrated approach and has partnerships with major cloud buyers. Additionally, U.S. hyperscalers (AWS, Azure, Google) are investing heavily in AI hardware – though often they themselves are constrained by power and/or GPU supply. The bullish case for Nebius is partly that hyperscalers can’t meet all the specialized demand, leaving room for players like Nebius. The same is true in NA: AWS and others have long waitlists for B200/B300 instances, and enterprises are exploring alternatives. IREN’s competitive advantage here is its huge power capacity ready for expansion – for example, Oracle Cloud has been searching for multi-100MW sites to host AI infrastructure , a need IREN could potentially fill via partnership or colocation. In fact, IREN’s press releases mention interest from “AI native enterprises, cloud operators and hyperscalers” in its new capacity . This suggests IREN might even supply capacity to hyperscalers (similar to how CoreWeave has deals with major cloud providers) – a scenario where IREN’s role is more wholesale provider than retail cloud. Such relationships, if secured, would greatly strengthen IREN’s moat (long-term contracts, guaranteed utilization). In conclusion, IREN Cloud shows strong potential to build a Nebius-like moat in the enterprise AI compute market, albeit via a somewhat different route. Nebius set the template of a full-stack, AI focused cloud that excels in cost and software; IREN brings full-stack infrastructure with cost leadership and is quickly adding the pieces to become a full-fledged AI cloud service provider. The fundamental tailwinds cited in Goldman’s Nebius thesis – explosive AI demand, inference/training growth, startups seeking specialized infrastructure – apply equally to North America and thus to IREN (also why Nebius is starting to build in the US). If Nebius’s projected growth (from ~$117M to $2.8B revenue in X years) exemplifies the market opportunity, IREN could be on a similar trajectory given its aggressive GPU investments and unique assets. Goldman’s upside case for Nebius is that its “full-stack offering and cost advantages” will allow it to grab outsized share and justify a much higher valuation. By the same token, IREN’s cost advantages (cheap power, efficient data centers) and vertical integration could enable it to capture a significant slice of the NA enterprise compute TAM – especially among customers who value bespoke infrastructure, transparency, and support over one-size-fits-all public clouds. Nebius and IREN Cloud represent a new breed of GPU-centric cloud providers that diverge from traditional hyperscalers by offering integrated, AI-focused solutions. Nebius, as Goldman Sachs highlights, has built a technical moat through full-stack software integration, cost-efficient design, and deep expertise – making it especially suited for AI startups and enterprises that need specialized services. IREN Cloud, while coming from a different origin, is assembling a comparable value proposition for the North American market. Its strengths lie in an extreme vertical integration from power plant to GPU, which translates into lower costs, greater operational control, and flexible offerings ranging from turnkey cloud instances to dedicated on-premise-like installations. IREN’s potential to build a Nebius-style moat in enterprise compute is evident in its moves: securing next-gen GPUs early, leveraging massive renewable power capacity, and offering end-to-end customer solutions. It arguably has a stronger physical moat (energy and infrastructure) than Nebius, and with time and investment, it can narrow the gap on the software and services moat. If Goldman’s bullish case on Nebius is centered on the growth of AI “Neoclouds” and the outsized role of those who can offer integrated, cost-effective AI infrastructure, then much of that thesis can be extrapolated to IREN in its home market. The North American enterprise TAM for cloud compute is enormous and still undersupplied in the AI context – leaving room for IREN to capture meaningful share if it executes well. That said, IREN will need to continue evolving its platform and cultivating trust with enterprise clients. Its competitive advantages – low-cost renewable power, scalability, hardware leadership, and flexible service models – make for a compelling story for enterprises frustrated by high cloud costs or lack of GPU availability. Its disadvantages – a less mature software stack and a shorter track record in cloud services – are challenges that can be addressed through strategic partnerships and delivering successful projects in the coming months. In conclusion, IREN Cloud is technically well-positioned to tap into the North American enterprise AI compute market, offering a mix of capabilities that align closely with enterprise needs: - High performance compute (latest GPUs like Blackwell at scale), - Reliable, efficient infrastructure(self-run data centers with renewable energy and custom cooling), - Cost leadership (vertical integration yielding lower TCO), - Flexible deployment and support (full-stack solutions from bare metal to managed cloud, with expert guidance). By using Nebius as a benchmark, we see that IREN is assembling many of the same ingredients that make Nebius attractive, albeit with a distinct emphasis on physical infrastructure and bespoke services. If Nebius’s success is any indicator, IREN’s vertically integrated approach – sometimes described by management as “building like a cloud provider” despite its mining origins – could indeed carve out a robust niche in the cloud compute landscape. For enterprises in North America, IREN Cloud emerges as a viable alternative to both hyperscalers and international providers like Nebius, combining the full stack ambition of the former with the cost and flexibility advantages of the latter. The coming years will test how effectively IREN can translate its infrastructure strengths into a durable enterprise business, but the foundations of an enterprise-grade technical moat are clearly being laid.  XXXXXX engagements  **Related Topics** [$iren](/topic/$iren) [$nbis](/topic/$nbis) [goldman sachs](/topic/goldman-sachs) [stocks financial services](/topic/stocks-financial-services) [Post Link](https://x.com/FransBakker9812/status/1945740816393424916)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Frans Bakker @FransBakker9812 on x 7053 followers

Created: 2025-07-17 07:02:15 UTC

Frans Bakker @FransBakker9812 on x 7053 followers

Created: 2025-07-17 07:02:15 UTC

$IREN - $NBIS A Nuanced Comparison

"We believe that as the market moves to next-gen GPUs (e.g., Blackwell), the complexity of managing compute density, thermal issues etc. may constrain the emergence of new competitors."

~Goldman Sachs Equity Research, 7/14/2025.

Three days ago, Goldman Sachs released a research report on Nebius, issuing a Buy rating and setting a price target of $XX.

Around the same time, @IREN_Ltd published their GPU Buyers Guide on the Iren Cloud website.

A lot has already been said about both companies, and I’m not here to add more fuel to the fire. But after reading the Goldman report, I’m more convinced than ever that these two companies aren’t fishing from the same pond — at least not yet.

What this means is that $IREN can focus on scaling its infrastructure while gradually building out its software stack.

Nebius, on the other hand, is expanding its TAM while continuing to mature on the infrastructure side.

In my view, IREN is positioning itself to serve a more sophisticated enterprise segment — one that values control, bare-metal performance, and customization.

Nebius, meanwhile, is catering to enterprise clients seeking one-click clusters and a tightly integrated, user-friendly ecosystem.

I asked GPT🤖 to help me write an in-depth comparison between the two, and honestly, I think the result speaks for itself. Judge for yourself, but I think, as Goldman said, "it's not a winner takes all market."

X. Vertical Full-Stack Integration: IREN’s integration is broader in scope than Nebius’s – spanning power, construction, hardware, and operations – but not as deep (yet) on the software/cloud services side.

However, from an enterprise compute infrastructure perspective, IREN’s end-to-end control is a significant moat. Its ability to offer “flexible, end-to-end solutions across the AI infrastructure stack” – from data hall to cloud API – is unique. For large enterprise or institutional customers, this means IREN can serve as a one-stop partner to deploy AI capacity. For example, if a Fortune XXX company wants a dedicated AI cluster due to compliance or to avoid multi-tenant environments, IREN can build and manage that cluster on renewable-powered sites with the latest GPUs. That’s something a standard cloud provider or smaller competitor likely cannot do with the same ease or cost efficiency.

In this sense, IREN’s vertical integration forms a defensible moat in the enterprise segment – it requires massive power assets, data center expertise, and capital to replicate. Few competitors (aside from perhaps other ex-crypto miners or cloud infrastructure specialists like CoreWeave) have this combination of assets.

Goldman’s commentary on Nebius noted the importance of financing such capital-intensive build-outs ; IREN’s existing 810MW of operational data centers and cash flow from mining give it a head start that newcomers would struggle to match.

X. Technical/Software Moat: This is where IREN currently lags Nebius. Nebius’s software platform and curated AI services create a moat around ease-of-use and customer lock-in.

IREN does not yet provide a comparably rich cloud software ecosystem; its focus is on providing the infrastructure building blocks (GPUs, power, environment) and support. This means that, at least today, IREN’s offering might appeal more to larger or more sophisticated enterprise customers – those who have the resources to handle some integration themselves or who prefer tailor-made solutions over off-the-shelf cloud services.

For such customers, not having a hundred pre-built services is fine; they might integrate IREN’s GPUs into their own IT stack or use third-party software (e.g. open-source MLOps tools).

Smaller startups, however, might find Nebius’s plug-and-play platform more convenient if they lack an ops team. Thus, in the startup and developer ecosystem, Nebius has a stronger moat due to its software.

IREN will need to mitigate this by possibly partnering for software solutions or gradually rolling out more cloud features as its AI business matures.

If IREN can, for instance, develop an easy web portal for managing GPU instances, or partner with an MLOps service so that customers can train and deploy models with minimal fuss, it would bolster its moat on the service layer.

Given IREN’s strategic moves (e.g. working with Dell’s AI Factory, likely collaborating with NVIDIA’s cloud software stack), it seems aware of this need.

X. Cost and Performance Moat: As discussed, IREN’s cost advantage is formidable and likely sustainable – it is underpinned by physical assets (cheap power, land rights) not easily acquired by competitors. This translates to a pricing moat if leveraged properly. In North America, the only other players with similar scale of cheap power are perhaps some cloud hyperscalers and other mining-to-AI converts.

If AI demand continues to outstrip supply (as evidenced by cloud GPU shortages in 2023-2024), enterprises will gravitate to whoever can deliver capacity quickly and affordably.

IREN’s “time-to-power” advantage – a 3GW pipeline of sites ready to energize – is a key differentiator in an era where securing 100+ MW for AI can take years.

This is analogous to Nebius’s advantage of already having scale and capital: both reduce time-to-market for new capacity.

In effect, IREN’s moat in NA could become being the fastest and cheapest to offer large-scale GPU compute.

Goldman’s bull case for Nebius assumes a rapid expansion and capturing of market share because it can scale at lower cost.

The same logic can apply to IREN in NA: if it can deploy thousands of GPUs ahead of slower-moving incumbents, it can lock in enterprise clients who sign multi-year deals for that capacity.

In cloud infrastructure, early deployment and customer acquisition can create a network effect (clients build workflows around your cloud, making them less likely to switch later).

X. Reputation and Enterprise Appeal: Nebius benefits from being a pure-play AI cloud with a pedigree (Yandex’s credibility in tech). IREN, coming from the crypto space, has to prove itself to enterprise customers as a reliable AI partner.

That said, IREN has taken steps to bolster credibility: it’s a NASDAQ listed company, it has brought on experienced personnel (e.g., a new Chief Capital Officer from traditional finance ), and it’s actively publicizing its AI successes (case studies with Dell/NVIDIA, etc.).

Moreover, IREN can point to its performance as a “green” infrastructure provider – using XXX% renewables – which could be attractive for enterprises with sustainability goals .

Overcoming the perception risk (i.e., “Are they just a miner dabbling in AI?”) will be important. Yet, one could argue IREN’s hybrid model (Bitcoin mining + AI) is actually a strength: it implies diversified revenue and resilience.

Indeed, analysts have noted that IREN’s mining operations make it one of the world’s largest and lowest-cost Bitcoin producers, providing robust cash flows to support its AI venture .

An enterprise signing with IREN might take comfort that the provider isn’t solely dependent on AI startups for revenue – it has other businesses to backstop stability.

This contrasts with Nebius, which as a pure AI cloud is unprofitable currently and relies on investor funding until the AI compute market matures.

If an enterprise is assessing long-term partnerships, IREN’s overall financial footing (no debt, existing cash funded GPU purchases) could be a plus.

X. Competitive Landscape in NA: It’s also worth comparing how extrapolating Nebius’s thesis to IREN must account for competition.

Nebius operates in a niche largely defined by a few European players; Goldman sees Nebius’s main peers as other AI infrastructure startups (possibly companies like CoreWeave, LambdaLabs, etc.) and of course the big cloud companies.

In North America, IREN will go up against CoreWeave, which has grown rapidly as a specialized GPU cloud (and has attracted large funding and marquee customers). CoreWeave similarly touts a vertically integrated approach and has partnerships with major cloud buyers.

Additionally, U.S. hyperscalers (AWS, Azure, Google) are investing heavily in AI hardware – though often they themselves are constrained by power and/or GPU supply.

The bullish case for Nebius is partly that hyperscalers can’t meet all the specialized demand, leaving room for players like Nebius.

The same is true in NA: AWS and others have long waitlists for B200/B300 instances, and enterprises are exploring alternatives.

IREN’s competitive advantage here is its huge power capacity ready for expansion – for example, Oracle Cloud has been searching for multi-100MW sites to host AI infrastructure , a need IREN could potentially fill via partnership or colocation.

In fact, IREN’s press releases mention interest from “AI native enterprises, cloud operators and hyperscalers” in its new capacity . This suggests IREN might even supply capacity to hyperscalers (similar to how CoreWeave has deals with major cloud providers) – a scenario where IREN’s role is more wholesale provider than retail cloud.

Such relationships, if secured, would greatly strengthen IREN’s moat (long-term contracts, guaranteed utilization).

In conclusion, IREN Cloud shows strong potential to build a Nebius-like moat in the enterprise AI compute market, albeit via a somewhat different route.

Nebius set the template of a full-stack, AI focused cloud that excels in cost and software; IREN brings full-stack infrastructure with cost leadership and is quickly adding the pieces to become a full-fledged AI cloud service provider.

The fundamental tailwinds cited in Goldman’s Nebius thesis – explosive AI demand, inference/training growth, startups seeking specialized infrastructure – apply equally to North America and thus to IREN (also why Nebius is starting to build in the US).

If Nebius’s projected growth (from ~$117M to $2.8B revenue in X years) exemplifies the market opportunity, IREN could be on a similar trajectory given its aggressive GPU investments and unique assets.

Goldman’s upside case for Nebius is that its “full-stack offering and cost advantages” will allow it to grab outsized share and justify a much higher valuation.

By the same token, IREN’s cost advantages (cheap power, efficient data centers) and vertical integration could enable it to capture a significant slice of the NA enterprise compute TAM – especially among customers who value bespoke infrastructure, transparency, and support over one-size-fits-all public clouds.

Nebius and IREN Cloud represent a new breed of GPU-centric cloud providers that diverge from traditional hyperscalers by offering integrated, AI-focused solutions.

Nebius, as Goldman Sachs highlights, has built a technical moat through full-stack software integration, cost-efficient design, and deep expertise – making it especially suited for AI startups and enterprises that need specialized services.

IREN Cloud, while coming from a different origin, is assembling a comparable value proposition for the North American market. Its strengths lie in an extreme vertical integration from power plant to GPU, which translates into lower costs, greater operational control, and flexible offerings ranging from turnkey cloud instances to dedicated on-premise-like installations.

IREN’s potential to build a Nebius-style moat in enterprise compute is evident in its moves: securing next-gen GPUs early, leveraging massive renewable power capacity, and offering end-to-end customer solutions.

It arguably has a stronger physical moat (energy and infrastructure) than Nebius, and with time and investment, it can narrow the gap on the software and services moat.

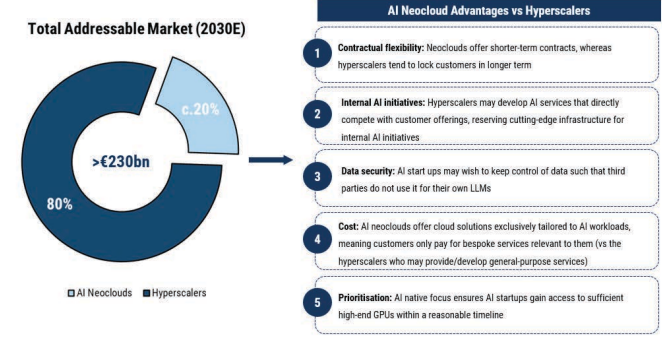

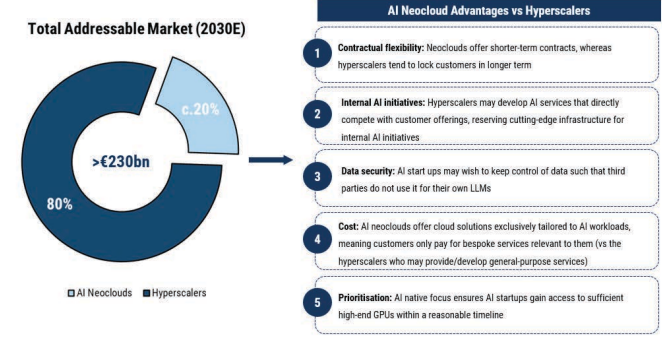

If Goldman’s bullish case on Nebius is centered on the growth of AI “Neoclouds” and the outsized role of those who can offer integrated, cost-effective AI infrastructure, then much of that thesis can be extrapolated to IREN in its home market.

The North American enterprise TAM for cloud compute is enormous and still undersupplied in the AI context – leaving room for IREN to capture meaningful share if it executes well.

That said, IREN will need to continue evolving its platform and cultivating trust with enterprise clients.

Its competitive advantages – low-cost renewable power, scalability, hardware leadership, and flexible service models – make for a compelling story for enterprises frustrated by high cloud costs or lack of GPU availability.

Its disadvantages – a less mature software stack and a shorter track record in cloud services – are challenges that can be addressed through strategic partnerships and delivering successful projects in the coming months.

In conclusion, IREN Cloud is technically well-positioned to tap into the North American enterprise AI compute market, offering a mix of capabilities that align closely with enterprise needs:

- High performance compute (latest GPUs like Blackwell at scale),

- Reliable, efficient infrastructure(self-run data centers with renewable energy and custom cooling),

- Cost leadership (vertical integration yielding lower TCO),

- Flexible deployment and support (full-stack solutions from bare metal to managed cloud, with expert guidance).

By using Nebius as a benchmark, we see that IREN is assembling many of the same ingredients that make Nebius attractive, albeit with a distinct emphasis on physical infrastructure and bespoke services.

If Nebius’s success is any indicator, IREN’s vertically integrated approach – sometimes described by management as “building like a cloud provider” despite its mining origins – could indeed carve out a robust niche in the cloud compute landscape.

For enterprises in North America, IREN Cloud emerges as a viable alternative to both hyperscalers and international providers like Nebius, combining the full stack ambition of the former with the cost and flexibility advantages of the latter.

The coming years will test how effectively IREN can translate its infrastructure strengths into a durable enterprise business, but the foundations of an enterprise-grade technical moat are clearly being laid.

XXXXXX engagements

Related Topics $iren $nbis goldman sachs stocks financial services