[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Pavlos D ✈️ [@d_pavlos](/creator/twitter/d_pavlos) on x 17K followers Created: 2025-07-17 05:44:44 UTC $UPST X Hrs $UPST closed at $76.96, up +3.82%, extending its bounce after a short dip from the recent Wave X high at $XXXXX. The rally shows a classic impulsive structure, with the stock now possibly entering a Wave X correction before a final Wave X push higher. 🔑 Key Levels – $UPST (4H) Resistance: $XXXXX (Wave X high) → $85–$88 zone (projected Wave 5) Support: $XXXXX → $XXXXX → $XXXXX → $XXXXX (Fibonacci retracement levels of Wave 3) 🔍 Structure & Outlook $UPST completed a clean Wave X impulse, peaking near $XXXXX. Price is now potentially forming a Wave X correction, which could pull back into the $67–$72 zone. The XXXXX retracement at $XXXXX and the 20/50 MA cluster (~$66–$76) are critical confluence zones for a Wave X low. MACD and RSI are cooling, favoring a pause before the final thrust. 🎯 Wave X Trading Plan (If Wave X Pullback Develops) Setup Zone: Monitor for a pullback into $67.00–$72.00 — this is the ideal Wave X retracement range (0.25–0.382 Fib). Confirmation Trigger: Look for bullish price action off this zone (e.g., bullish engulfing candle, MACD curl-up, or 5-wave micro structure). Wave X Upside Projections: XXXXX extension = $XXXXX (from Wave X to X projection) Potential target zone: $85.00–$88.00 Invalidation: A break below $XXXXX (0.5 Fib) would threaten the Wave X structure. Close below $XXXXX (0.618 Fib) invalidates the impulsive count. Trade Management: Entry near $67–$70, with stop under $XXXXX. Target scale-outs at $XXXXX (prior high), and $85–$88 for extended Wave X. For more insights, visit #UPST #Nasdaq100 #stocks #trading #elliottwave #technicalanalysis #fibonacci #investing #TradeSelliot #stockmarket  XXX engagements  **Related Topics** [$upst](/topic/$upst) [Post Link](https://x.com/d_pavlos/status/1945721310698479856)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Pavlos D ✈️ @d_pavlos on x 17K followers

Created: 2025-07-17 05:44:44 UTC

Pavlos D ✈️ @d_pavlos on x 17K followers

Created: 2025-07-17 05:44:44 UTC

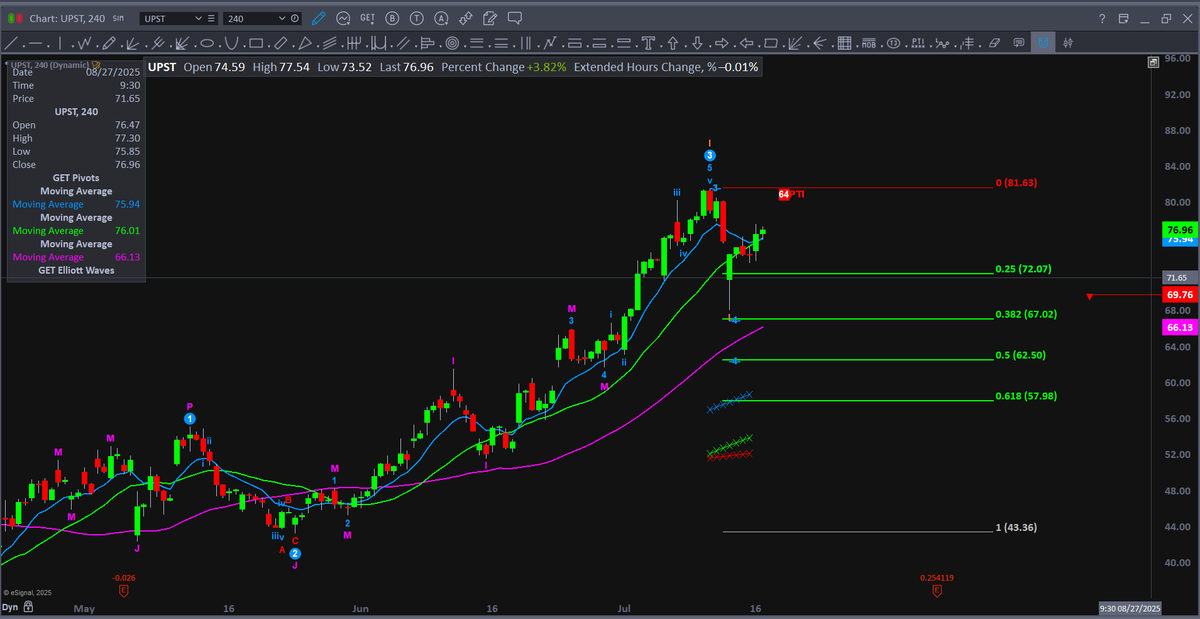

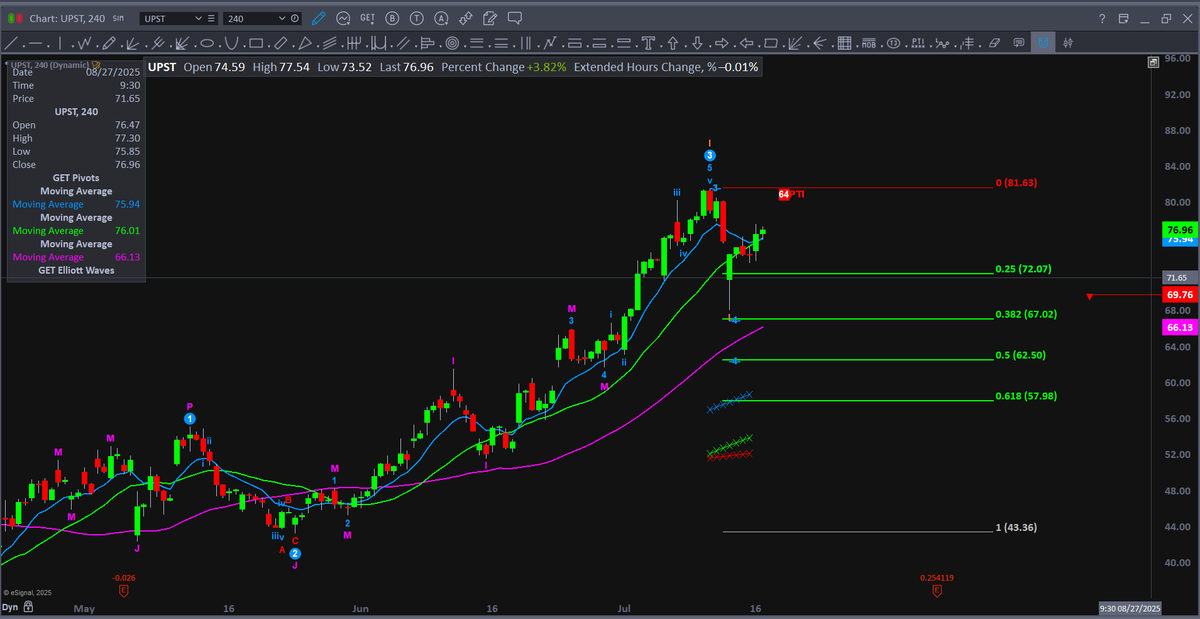

$UPST X Hrs

$UPST closed at $76.96, up +3.82%, extending its bounce after a short dip from the recent Wave X high at $XXXXX. The rally shows a classic impulsive structure, with the stock now possibly entering a Wave X correction before a final Wave X push higher.

🔑 Key Levels – $UPST (4H) Resistance: $XXXXX (Wave X high) → $85–$88 zone (projected Wave 5) Support: $XXXXX → $XXXXX → $XXXXX → $XXXXX (Fibonacci retracement levels of Wave 3)

🔍 Structure & Outlook $UPST completed a clean Wave X impulse, peaking near $XXXXX. Price is now potentially forming a Wave X correction, which could pull back into the $67–$72 zone. The XXXXX retracement at $XXXXX and the 20/50 MA cluster (~$66–$76) are critical confluence zones for a Wave X low. MACD and RSI are cooling, favoring a pause before the final thrust.

🎯 Wave X Trading Plan (If Wave X Pullback Develops) Setup Zone: Monitor for a pullback into $67.00–$72.00 — this is the ideal Wave X retracement range (0.25–0.382 Fib). Confirmation Trigger: Look for bullish price action off this zone (e.g., bullish engulfing candle, MACD curl-up, or 5-wave micro structure). Wave X Upside Projections: XXXXX extension = $XXXXX (from Wave X to X projection) Potential target zone: $85.00–$88.00

Invalidation: A break below $XXXXX (0.5 Fib) would threaten the Wave X structure. Close below $XXXXX (0.618 Fib) invalidates the impulsive count.

Trade Management: Entry near $67–$70, with stop under $XXXXX. Target scale-outs at $XXXXX (prior high), and $85–$88 for extended Wave X.

For more insights, visit

#UPST #Nasdaq100 #stocks #trading #elliottwave #technicalanalysis #fibonacci #investing #TradeSelliot #stockmarket

XXX engagements

Related Topics $upst