[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Say No To Trading [@SayNoToTrading](/creator/twitter/SayNoToTrading) on x 6263 followers Created: 2025-07-17 05:04:08 UTC Tomorrow $UNH bulls may (or may not) get some relief. $ELV reports AM. I have about $500k in the name going into the print. If less bad than feared, it could be the tide which lifts all boats. Elevance has higher Medicaid exposure, nearly double UNH's as a %, but nowhere near the high levels of Molina $MOH and Centene $CNC (which I also own). ELV's primary focus are commercial plans, under Blue Cross Blue Shield licenses in most states. $UNH derives much more revenue from Medicare (40% from CMS) but has broader diversification with Optum and Optum Rx. In short, anything govt isn't great at moment, so the XX% of premiums coming from commercial for $ELV *might* buoy the bad from govt side. As previously mentioned, I did around $5-6M of volume in $ELV last year. I only held onto my lowest cost shares in the $360s coming into 2025, which were the 3+ year intraday low at the time. As I also told you, I successfully cycled those out earlier this month to reduce cost basis by a few bucks per share, hence you only see July 2025 dates as oldest. In actuality, owned much longer but $X or so higher. As such, throughout the 2025 healthcare carnage, I remained green on this position until very recently; until start of this month. The reason I have been hesitant on buying much lately is because even though its ~40% off the 52-week high, $ELV didn't have that waterfall decline we had with $UNH and $CNC. It obviously had a steep decline, but more gradual rather than falling knife panic. I feel more comfortable buying falling knife stocks, after people get really scared. I like having that initial de-risking done, rapidly. I did say I about a week ago I paused adds until after earnings, but couldn't resist adding XXX shares this Monday at $XXX. Whether that was a mistake or not, will find out in a few hours. But guess what? Even if $ELV gets ugly, my conviction continues to be just more $UNH over doubling-down on ELV. For me personally, I really feel it's the best risk-reward in healthcare and possibly the market right now.  XXX engagements  **Related Topics** [500k](/topic/500k) [$moh](/topic/$moh) [tide](/topic/tide) [$500k](/topic/$500k) [$unh](/topic/$unh) [stocks healthcare](/topic/stocks-healthcare) [$elv](/topic/$elv) [molina healthcare inc](/topic/molina-healthcare-inc) [Post Link](https://x.com/SayNoToTrading/status/1945711091411222900)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Say No To Trading @SayNoToTrading on x 6263 followers

Created: 2025-07-17 05:04:08 UTC

Say No To Trading @SayNoToTrading on x 6263 followers

Created: 2025-07-17 05:04:08 UTC

Tomorrow $UNH bulls may (or may not) get some relief.

$ELV reports AM. I have about $500k in the name going into the print.

If less bad than feared, it could be the tide which lifts all boats.

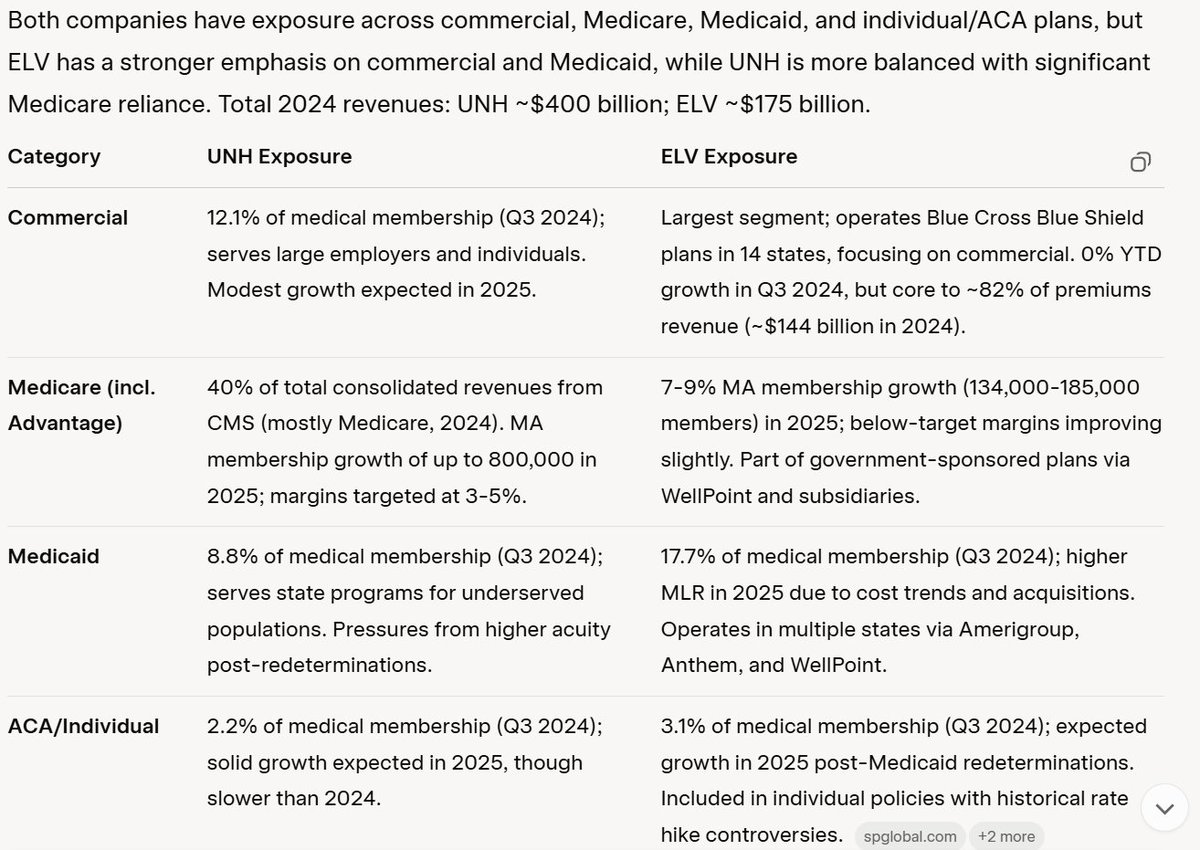

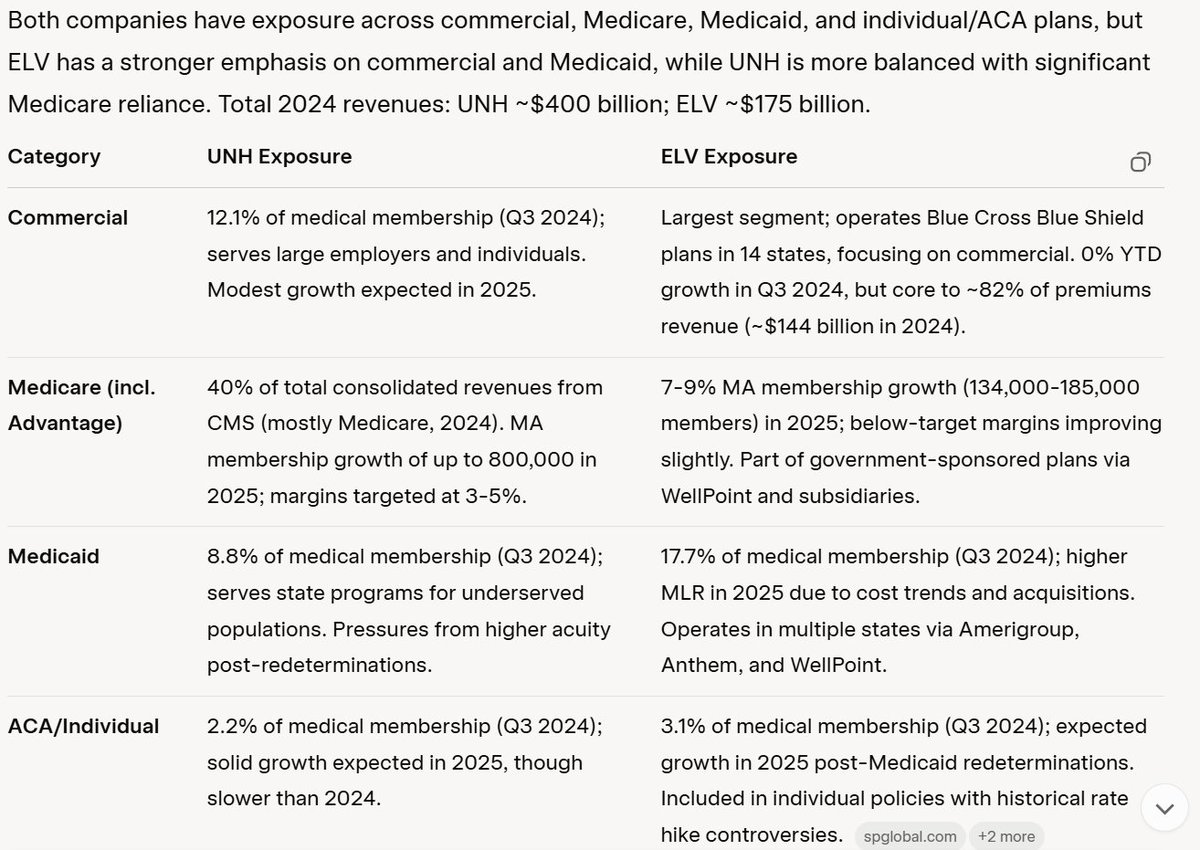

Elevance has higher Medicaid exposure, nearly double UNH's as a %, but nowhere near the high levels of Molina $MOH and Centene $CNC (which I also own).

ELV's primary focus are commercial plans, under Blue Cross Blue Shield licenses in most states.

$UNH derives much more revenue from Medicare (40% from CMS) but has broader diversification with Optum and Optum Rx.

In short, anything govt isn't great at moment, so the XX% of premiums coming from commercial for $ELV might buoy the bad from govt side.

As previously mentioned, I did around $5-6M of volume in $ELV last year. I only held onto my lowest cost shares in the $360s coming into 2025, which were the 3+ year intraday low at the time.

As I also told you, I successfully cycled those out earlier this month to reduce cost basis by a few bucks per share, hence you only see July 2025 dates as oldest. In actuality, owned much longer but $X or so higher.

As such, throughout the 2025 healthcare carnage, I remained green on this position until very recently; until start of this month.

The reason I have been hesitant on buying much lately is because even though its ~40% off the 52-week high, $ELV didn't have that waterfall decline we had with $UNH and $CNC.

It obviously had a steep decline, but more gradual rather than falling knife panic.

I feel more comfortable buying falling knife stocks, after people get really scared. I like having that initial de-risking done, rapidly.

I did say I about a week ago I paused adds until after earnings, but couldn't resist adding XXX shares this Monday at $XXX. Whether that was a mistake or not, will find out in a few hours.

But guess what? Even if $ELV gets ugly, my conviction continues to be just more $UNH over doubling-down on ELV. For me personally, I really feel it's the best risk-reward in healthcare and possibly the market right now.

XXX engagements

Related Topics 500k $moh tide $500k $unh stocks healthcare $elv molina healthcare inc