[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Jukan [@Jukanlosreve](/creator/twitter/Jukanlosreve) on x 22.6K followers Created: 2025-07-17 00:42:44 UTC SK Hynix, Downgraded to Neutral (Goldman Sachs) - Investment opinion has been downgraded from Buy to Neutral, with a target price of KRW 310,000, representing approximately X% upside potential from the current stock price. - The long-term growth potential of the HBM market itself is positive, but from 2026 onwards, oversupply and intensified competition are expected to exert downward pressure on prices. - It is highly probable that HBM prices will record their first decline in 2026. Customer bargaining power is strengthening, and SK Hynix, with its high proportion of GPU-bound HBM, is vulnerable to price defense. - In 2025, strong demand for HBM and general-purpose memory will lead to upward revisions in earnings. However, the 2026 earnings outlook has been lowered under the premise that HBM average selling prices (ASPs) will fall by a double-digit percentage. - The 2026 operating profit forecast is calculated to be approximately XX% lower than the consensus, predicting negative growth unlike market expectations (17% annual growth). - SK Hynix's stock price has risen XX% year-to-date, outperforming KOSPI (which rose 33%). It is assessed that the short-term valuation burden has increased. - Currently trading at a 12-month forward P/B of 1.8x (historical average 1.3x), it is judged that the risk and reward are nearly balanced. - HBM demand is still predominantly driven by GPUs, but ASICs (application-specific AI chips) are rapidly increasing, leading the overall growth trend. 2026 HBM demand growth is expected to be XX% for GPUs and XX% for ASICs. Within GPUs, the transition from B300 to Rubin shows limited increase in HBM content, leading to a slowdown in GPU contribution growth. ASIC families like TPU and Trainium are seeing rapid increases in HBM content, leading to strong demand growth momentum. - On the HBM supply side, total industry production capacity is expected to expand to 485K WPM (wafer per month) level by the end of 2026, with supply likely to exceed demand. Supply growth rate is revised up to 48%, while demand growth is expected at 38%. 2026 HBM ASP is projected to decrease by approximately XX% year-on-year. Scenario-based Outlook: Base Scenario: HBM3E ASP drop of 30%, HBM4 premium of 45%, HBM margin of 59%, operating profit of KRW XX trillion (19% lower than consensus). Bull Case Scenario: Samsung Electronics' delayed entry to key customers, HBM3E ASP drop of 10%, HBM4 premium of 55%, margin of 65%, operating profit of KRW XX trillion (at consensus level). Bear Case Scenario: Samsung Electronics' early entry, HBM3E ASP drop of 35%, HBM4 premium of 35%, margin of 50%, operating profit of KRW XX trillion (29% lower than consensus). Q2 2025 earnings are revised upward to around KRW X trillion in operating profit, expected to meet expectations due to stronger demand compared to the previous quarter.  XXXXX engagements  **Related Topics** [south korean won](/topic/south-korean-won) [investment](/topic/investment) [$000660ks](/topic/$000660ks) [goldman sachs](/topic/goldman-sachs) [stocks financial services](/topic/stocks-financial-services) [Post Link](https://x.com/Jukanlosreve/status/1945645307859276068)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Jukan @Jukanlosreve on x 22.6K followers

Created: 2025-07-17 00:42:44 UTC

Jukan @Jukanlosreve on x 22.6K followers

Created: 2025-07-17 00:42:44 UTC

SK Hynix, Downgraded to Neutral (Goldman Sachs)

Investment opinion has been downgraded from Buy to Neutral, with a target price of KRW 310,000, representing approximately X% upside potential from the current stock price.

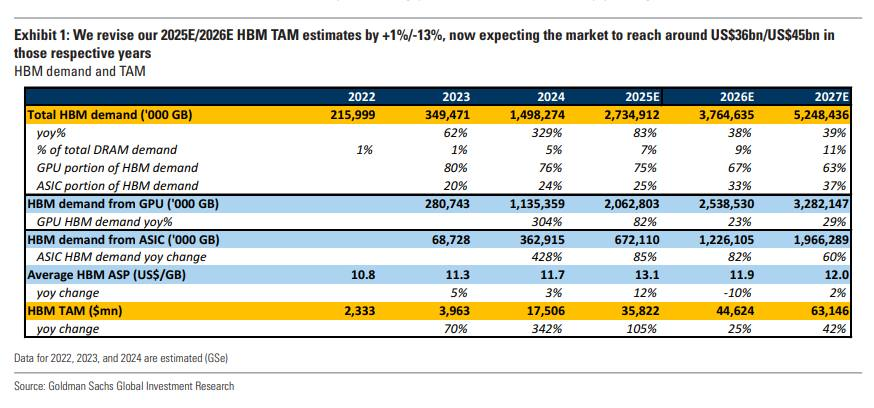

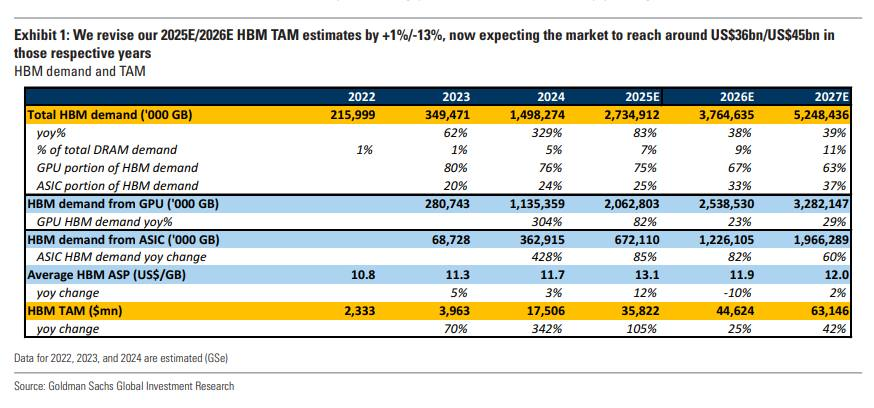

The long-term growth potential of the HBM market itself is positive, but from 2026 onwards, oversupply and intensified competition are expected to exert downward pressure on prices.

It is highly probable that HBM prices will record their first decline in 2026. Customer bargaining power is strengthening, and SK Hynix, with its high proportion of GPU-bound HBM, is vulnerable to price defense.

In 2025, strong demand for HBM and general-purpose memory will lead to upward revisions in earnings. However, the 2026 earnings outlook has been lowered under the premise that HBM average selling prices (ASPs) will fall by a double-digit percentage.

The 2026 operating profit forecast is calculated to be approximately XX% lower than the consensus, predicting negative growth unlike market expectations (17% annual growth).

SK Hynix's stock price has risen XX% year-to-date, outperforming KOSPI (which rose 33%). It is assessed that the short-term valuation burden has increased.

Currently trading at a 12-month forward P/B of 1.8x (historical average 1.3x), it is judged that the risk and reward are nearly balanced.

HBM demand is still predominantly driven by GPUs, but ASICs (application-specific AI chips) are rapidly increasing, leading the overall growth trend. 2026 HBM demand growth is expected to be XX% for GPUs and XX% for ASICs. Within GPUs, the transition from B300 to Rubin shows limited increase in HBM content, leading to a slowdown in GPU contribution growth. ASIC families like TPU and Trainium are seeing rapid increases in HBM content, leading to strong demand growth momentum.

On the HBM supply side, total industry production capacity is expected to expand to 485K WPM (wafer per month) level by the end of 2026, with supply likely to exceed demand. Supply growth rate is revised up to 48%, while demand growth is expected at 38%. 2026 HBM ASP is projected to decrease by approximately XX% year-on-year.

Scenario-based Outlook: Base Scenario: HBM3E ASP drop of 30%, HBM4 premium of 45%, HBM margin of 59%, operating profit of KRW XX trillion (19% lower than consensus). Bull Case Scenario: Samsung Electronics' delayed entry to key customers, HBM3E ASP drop of 10%, HBM4 premium of 55%, margin of 65%, operating profit of KRW XX trillion (at consensus level). Bear Case Scenario: Samsung Electronics' early entry, HBM3E ASP drop of 35%, HBM4 premium of 35%, margin of 50%, operating profit of KRW XX trillion (29% lower than consensus).

Q2 2025 earnings are revised upward to around KRW X trillion in operating profit, expected to meet expectations due to stronger demand compared to the previous quarter.

XXXXX engagements

Related Topics south korean won investment $000660ks goldman sachs stocks financial services