[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Jukan [@Jukanlosreve](/creator/twitter/Jukanlosreve) on x 22.7K followers Created: 2025-07-16 20:59:28 UTC Global Data Center Deep Dive: AI Drives Soaring DC Investment, Energy & Approvals Become Key Expansion Barriers Morgan Stanley (E. Kelly, 25/07/15) Morgan Stanley states that the AI investment wave is driving a XX% compound annual growth rate in global data centers. However, factors such as energy supply, approval delays, and building material shortages pose bottlenecks to expansion. Nuclear power and the conversion of Bitcoin mining farms are emerging as important energy solutions, and related sectors and regional assets are expected to benefit significantly. Energy Remains the Primary Constraint, But Approvals and Building Material Supply Are Also Increasingly Important AlphaWise surveys indicate that energy will remain the top obstacle for DC expansion over the next two years, followed by planning permit acquisition, low-carbon building material supply, and cooling technologies. Operators are increasingly focused on data sovereignty and the ability to match green energy sources. DC construction costs are projected to increase by XX% annually over the next two years. AI Drives High Growth in Global DC Construction, U.S. Remains Core, China and Middle East Accelerate Catch-Up Global DC capacity is expected to grow by XX% annually until 2030, with the U.S. contributing over 60%, and projects like Stargate potentially adding 15GW. China's growth rate has increased to 16%, while Middle Eastern regions like the UAE and KSA are projected to grow X to X times. Europe, due to difficulties in obtaining approvals and green energy, is expected to lag but still holds potential. Nuclear Power, Natural Gas, and Bitcoin Mining Farm Conversions Key to Future Energy Supply As AI drives a multiple increase in energy consumption, nuclear power is becoming a focal point for energy supply. The U.S. has eased nuclear energy approval processes, with Three Mile Island restarting to power Microsoft, and Meta signing a 1.1GW nuclear power purchase agreement. New supercomputing centers in France also rely on the country's nuclear energy advantage. AI Wave Drives Hyperscale Capital Expenditures, Some Companies Adjust Guidance Upward Morgan Stanley expects capital expenditures by the four major cloud providers to grow by XX% year-over-year in 2025. Meta has raised its full-year Capex guidance to $64-72 billion, and Nvidia also noted continuous upward revisions in GB200 orders, with AI training and inference demand exceeding expectations. Billions of dollars in AI investments are continually being added in the Middle East. Cross-Industry Beneficiaries Emerge, Multiple Regions and Sectors Poised for Structural Tailwinds Morgan Stanley, through its global DC stock screening model, has identified relevant beneficiaries in X regions and X sectors, including real estate, infrastructure, industrial goods, utilities, energy, technology, and telecommunications. These will benefit from the long-term prosperity of DC investment and AI computing infrastructure construction.  XXXXX engagements  **Related Topics** [compound](/topic/compound) [coins energy](/topic/coins-energy) [investment](/topic/investment) [coins ai](/topic/coins-ai) [morgan stanley](/topic/morgan-stanley) [stocks financial services](/topic/stocks-financial-services) [Post Link](https://x.com/Jukanlosreve/status/1945589120488951954)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Jukan @Jukanlosreve on x 22.7K followers

Created: 2025-07-16 20:59:28 UTC

Jukan @Jukanlosreve on x 22.7K followers

Created: 2025-07-16 20:59:28 UTC

Global Data Center Deep Dive: AI Drives Soaring DC Investment, Energy & Approvals Become Key Expansion Barriers

Morgan Stanley (E. Kelly, 25/07/15)

Morgan Stanley states that the AI investment wave is driving a XX% compound annual growth rate in global data centers. However, factors such as energy supply, approval delays, and building material shortages pose bottlenecks to expansion. Nuclear power and the conversion of Bitcoin mining farms are emerging as important energy solutions, and related sectors and regional assets are expected to benefit significantly.

Energy Remains the Primary Constraint, But Approvals and Building Material Supply Are Also Increasingly Important

AlphaWise surveys indicate that energy will remain the top obstacle for DC expansion over the next two years, followed by planning permit acquisition, low-carbon building material supply, and cooling technologies. Operators are increasingly focused on data sovereignty and the ability to match green energy sources. DC construction costs are projected to increase by XX% annually over the next two years.

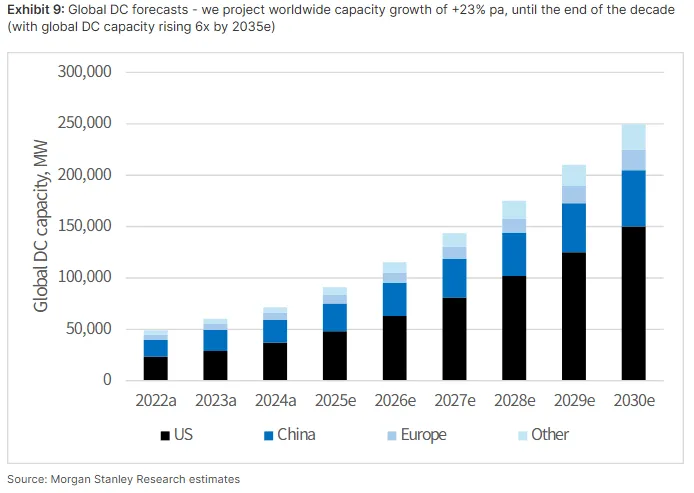

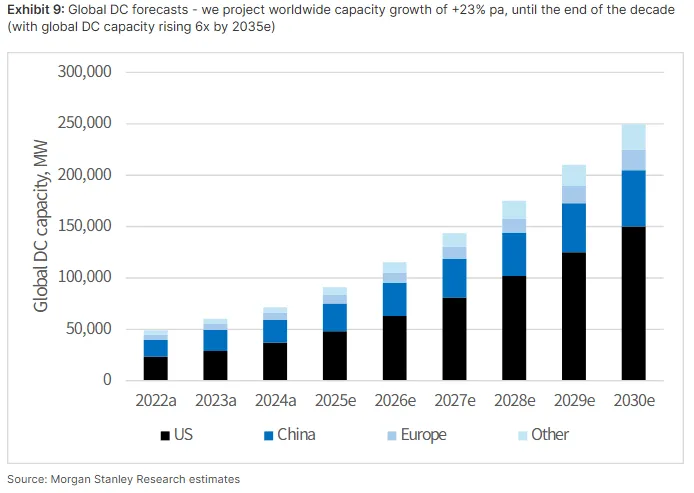

AI Drives High Growth in Global DC Construction, U.S. Remains Core, China and Middle East Accelerate Catch-Up

Global DC capacity is expected to grow by XX% annually until 2030, with the U.S. contributing over 60%, and projects like Stargate potentially adding 15GW. China's growth rate has increased to 16%, while Middle Eastern regions like the UAE and KSA are projected to grow X to X times. Europe, due to difficulties in obtaining approvals and green energy, is expected to lag but still holds potential.

Nuclear Power, Natural Gas, and Bitcoin Mining Farm Conversions Key to Future Energy Supply

As AI drives a multiple increase in energy consumption, nuclear power is becoming a focal point for energy supply. The U.S. has eased nuclear energy approval processes, with Three Mile Island restarting to power Microsoft, and Meta signing a 1.1GW nuclear power purchase agreement. New supercomputing centers in France also rely on the country's nuclear energy advantage.

AI Wave Drives Hyperscale Capital Expenditures, Some Companies Adjust Guidance Upward

Morgan Stanley expects capital expenditures by the four major cloud providers to grow by XX% year-over-year in 2025. Meta has raised its full-year Capex guidance to $64-72 billion, and Nvidia also noted continuous upward revisions in GB200 orders, with AI training and inference demand exceeding expectations. Billions of dollars in AI investments are continually being added in the Middle East.

Cross-Industry Beneficiaries Emerge, Multiple Regions and Sectors Poised for Structural Tailwinds

Morgan Stanley, through its global DC stock screening model, has identified relevant beneficiaries in X regions and X sectors, including real estate, infrastructure, industrial goods, utilities, energy, technology, and telecommunications. These will benefit from the long-term prosperity of DC investment and AI computing infrastructure construction.

XXXXX engagements

Related Topics compound coins energy investment coins ai morgan stanley stocks financial services