[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Alex Desjardins [@PrimeTrading_](/creator/twitter/PrimeTrading_) on x 25K followers Created: 2025-07-16 20:22:07 UTC PF UPDATE 7/16 $ARM $ALAB $APP $NET $RDDT $CVNA $PLTR $BITX $ANET $AVGO $RKLB Hey guys! Market ST oversold in support seems to play out nicely, with price rejecting the 21dma-structure retest, MCO hooking-up, and VST breadth hooking-up from oversold. I'm really pushing myself to focus on price and setups and make abstraction of the extension. Liquid looks very solid, and setups are working, so I increased my exposure back to fully invested, with my usual -XXX% NER taken. It brings my Open Heat around 6%, which is within limit. I'll see tomorrow how things look, but that close was very strong and indicative of market being supported and buyers still stepping in aggressively. Like I said in the last few days, if this is a blow-off top / climatic move a bit like early 2020 recovery, you want to engage it and be exposed despite the market being high. It can always be higher, more extended, and more overbought. The reaction we see from support, along how the VIX and Credit Spreads rejected their declining 21dma-structure giving us clues that we're still in a risk-on market. Let's see tomorrow if this market can push higher and we can start trimming into strength. No margin here for me considering the market extension, but very good being fully invested again for a known and accepted risk. NEW: RDDT, ALAB, NET, ARM, APP TRIMMED: OUT: Cheers hagn!  XXXXX engagements  **Related Topics** [rklb](/topic/rklb) [avgo](/topic/avgo) [bitx](/topic/bitx) [pltr](/topic/pltr) [liquid](/topic/liquid) [vst](/topic/vst) [$rklb](/topic/$rklb) [$bitx](/topic/$bitx) [Post Link](https://x.com/PrimeTrading_/status/1945579721196196013)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Alex Desjardins @PrimeTrading_ on x 25K followers

Created: 2025-07-16 20:22:07 UTC

Alex Desjardins @PrimeTrading_ on x 25K followers

Created: 2025-07-16 20:22:07 UTC

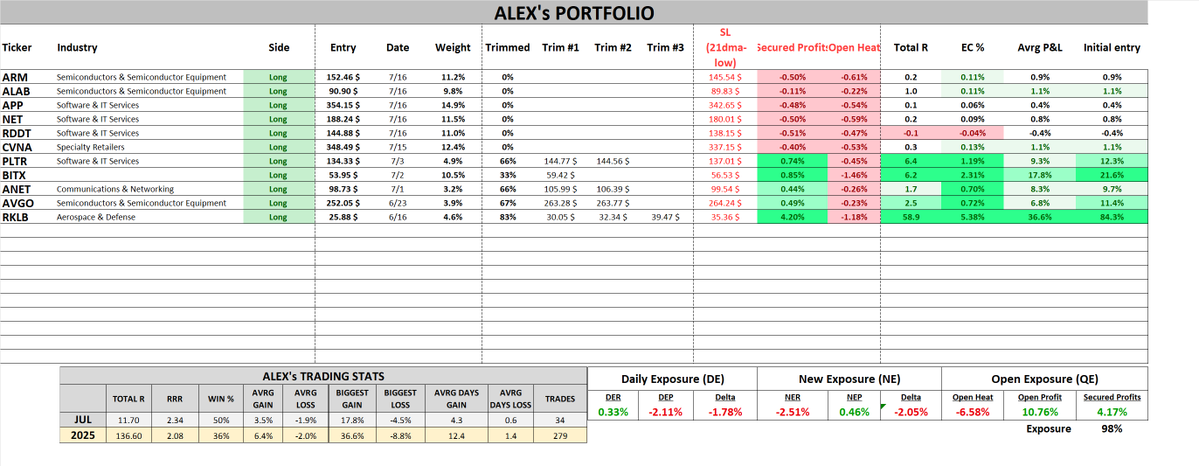

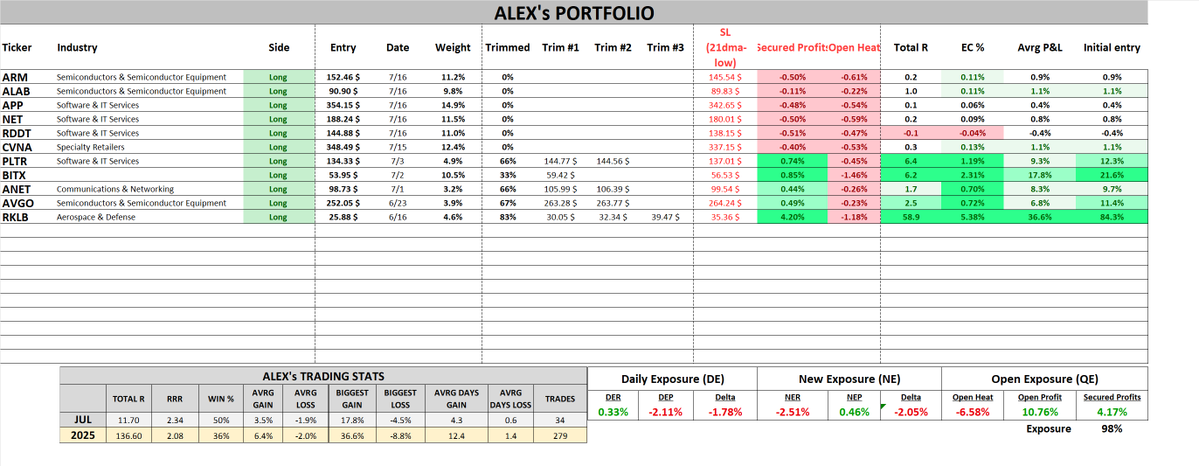

PF UPDATE 7/16 $ARM $ALAB $APP $NET $RDDT $CVNA $PLTR $BITX $ANET $AVGO $RKLB

Hey guys!

Market ST oversold in support seems to play out nicely, with price rejecting the 21dma-structure retest, MCO hooking-up, and VST breadth hooking-up from oversold. I'm really pushing myself to focus on price and setups and make abstraction of the extension. Liquid looks very solid, and setups are working, so I increased my exposure back to fully invested, with my usual -XXX% NER taken. It brings my Open Heat around 6%, which is within limit. I'll see tomorrow how things look, but that close was very strong and indicative of market being supported and buyers still stepping in aggressively.

Like I said in the last few days, if this is a blow-off top / climatic move a bit like early 2020 recovery, you want to engage it and be exposed despite the market being high. It can always be higher, more extended, and more overbought. The reaction we see from support, along how the VIX and Credit Spreads rejected their declining 21dma-structure giving us clues that we're still in a risk-on market.

Let's see tomorrow if this market can push higher and we can start trimming into strength. No margin here for me considering the market extension, but very good being fully invested again for a known and accepted risk.

NEW: RDDT, ALAB, NET, ARM, APP TRIMMED: OUT:

Cheers hagn!

XXXXX engagements