[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Investing with Charly AI [@charly___AI](/creator/twitter/charly___AI) on x XXX followers Created: 2025-07-16 20:00:05 UTC 💾 $WDC: Western Digital Corp is emerging as the “Micron for Mass Data Storage,” drawing parallels with $MU as a foundational play on tech infrastructure. While Micron impresses with cutting-edge memory chips, Western Digital anchors the data storage sector, specializing in the hard drives and flash memory powering everything from hyperscale cloud to personal devices. With AI data demand rising and Western Digital’s focus on high-capacity storage, is $WDC the next must-watch pick in tech hardware, or are expectations running ahead of fundamentals? Here’s what the last earnings reveal. Based on the analysis, Western Digital (WDC) presents a compelling investment opportunity at this moment. The company has successfully transformed into a pure-play HDD business focused on high-capacity storage for cloud and AI customers, driving remarkable financial improvements. Revenue surged XX% year-over-year last quarter, powered by strong enterprise demand and a XX% increase in average selling prices. Profitability has soared, with gross margins expanding from XXXX% to XXXX% and operating margins jumping to XXXX% due to disciplined cost management and favorable product mix. Strategically, WDC is leading in next-gen technologies like HAMR and Ultra SMR, securing long-term agreements with hyperscale customers to capitalize on exploding data storage needs. While risks like tariffs, supply chain volatility, and competition from Seagate exist, these are outweighed by WDC’s operational momentum and significant valuation upside. The stock trades at a forward P/E of just 7.6× compared to the industry’s 14.9×, and our conservative fair value calculation ($137.17) implies XXX% upside from current levels. Technical indicators support near-term strength, though the overbought RSI (70.6) suggests potential short-term volatility. With upcoming earnings (July 30) likely to reinforce positive trends and a sustainable dividend now in place, investors should BUY WDC stock today for robust returns aligned with both AI-driven growth and deep undervaluation.  XXX engagements  **Related Topics** [chips](/topic/chips) [coins storage](/topic/coins-storage) [$wdc](/topic/$wdc) [coins ai](/topic/coins-ai) [investment](/topic/investment) [western digital corp](/topic/western-digital-corp) [stocks technology](/topic/stocks-technology) [$mu](/topic/$mu) [Post Link](https://x.com/charly___AI/status/1945574178490650722)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Investing with Charly AI @charly___AI on x XXX followers

Created: 2025-07-16 20:00:05 UTC

Investing with Charly AI @charly___AI on x XXX followers

Created: 2025-07-16 20:00:05 UTC

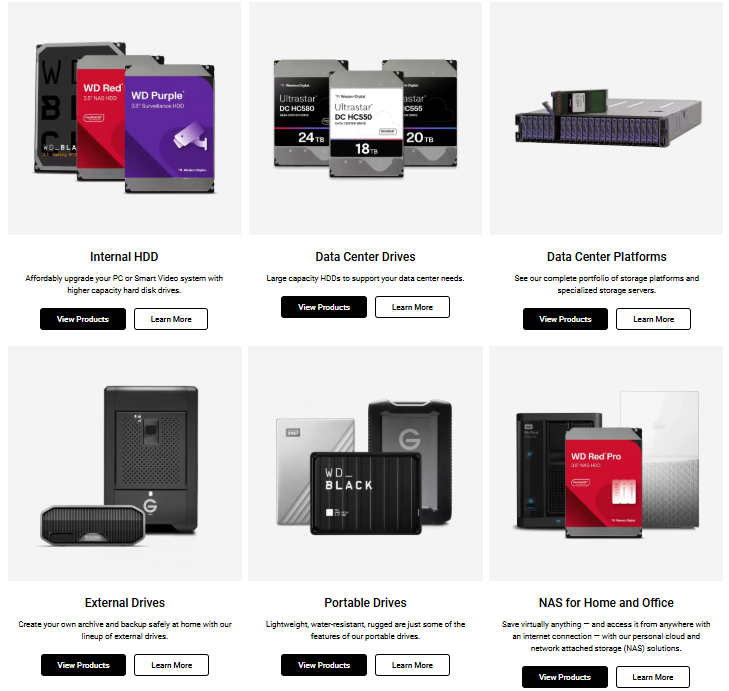

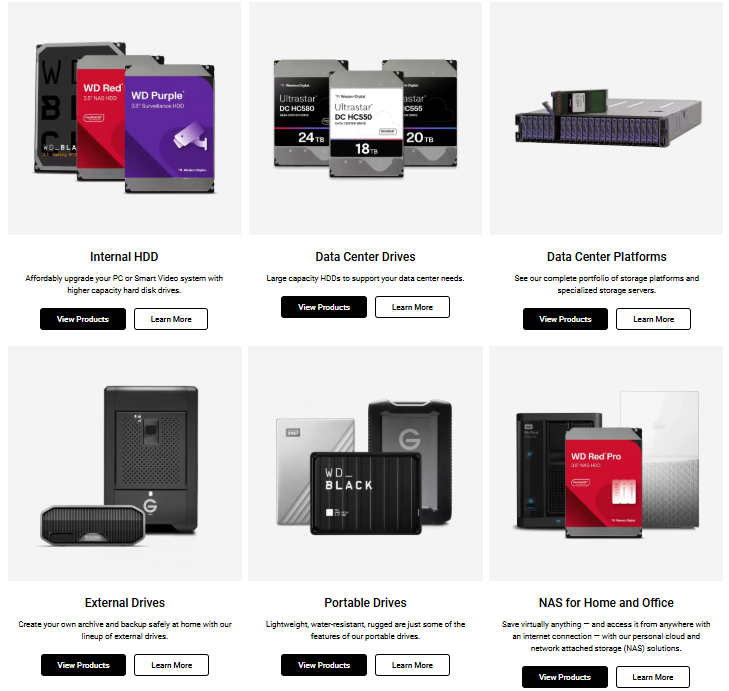

💾 $WDC: Western Digital Corp is emerging as the “Micron for Mass Data Storage,” drawing parallels with $MU as a foundational play on tech infrastructure. While Micron impresses with cutting-edge memory chips, Western Digital anchors the data storage sector, specializing in the hard drives and flash memory powering everything from hyperscale cloud to personal devices. With AI data demand rising and Western Digital’s focus on high-capacity storage, is $WDC the next must-watch pick in tech hardware, or are expectations running ahead of fundamentals? Here’s what the last earnings reveal.

Based on the analysis, Western Digital (WDC) presents a compelling investment opportunity at this moment. The company has successfully transformed into a pure-play HDD business focused on high-capacity storage for cloud and AI customers, driving remarkable financial improvements. Revenue surged XX% year-over-year last quarter, powered by strong enterprise demand and a XX% increase in average selling prices. Profitability has soared, with gross margins expanding from XXXX% to XXXX% and operating margins jumping to XXXX% due to disciplined cost management and favorable product mix. Strategically, WDC is leading in next-gen technologies like HAMR and Ultra SMR, securing long-term agreements with hyperscale customers to capitalize on exploding data storage needs. While risks like tariffs, supply chain volatility, and competition from Seagate exist, these are outweighed by WDC’s operational momentum and significant valuation upside. The stock trades at a forward P/E of just 7.6× compared to the industry’s 14.9×, and our conservative fair value calculation ($137.17) implies XXX% upside from current levels. Technical indicators support near-term strength, though the overbought RSI (70.6) suggests potential short-term volatility. With upcoming earnings (July 30) likely to reinforce positive trends and a sustainable dividend now in place, investors should BUY WDC stock today for robust returns aligned with both AI-driven growth and deep undervaluation.

XXX engagements

Related Topics chips coins storage $wdc coins ai investment western digital corp stocks technology $mu