[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  arndxt [@arndxt_xo](/creator/twitter/arndxt_xo) on x 44.7K followers Created: 2025-07-16 18:16:06 UTC Revenue meta > Onchain volumes up > DEX printing > ve33 DEX value accruaI So, I believe we will see a ve33 DEX season soon and I am farming passive and massive income from Uniswap's $660M annualized feees. The first ve33 DEX on @unichain and the the scale here goes up to the only monopoly capturing all of Uniswap fees and all of that value flow back to $CATEX What stands out is how $CATEX deploys its veToken model with fees immediately accrue into the hands of veCATX holders on day X. This mirrors what @LynexFi executed successfully on Linea, now adapted for Unichain with faster cycle time and similar primitives. With @Catex_Fi, the mechanics kickstart immediately: • Epoch X voting begins Thursday • veCATX governs emissions from Day X • $UNI incentives and protocol rewards go live instantly Three elements make @Catex_Fi structurally interesting: 1.Voters shape emissions from day one, see outcome within Epoch X. This compresses the governance cycle and rewards decisiveness. 2.Incentives are funded by trading fees and $UNI allocations. This aligns LPs and voters around shared performance. giving emissions control to veCATX holders, it creates a programmable liquidity layer responsive to market needs. I got some $CATEX and If you’re evaluating what to do with your airdrop, here's my thoughts: → HODLing it yields nothing. → Active locking enables directional influence, emissions share, and compounding rewards from epoch.  XXXXX engagements  **Related Topics** [epoch](/topic/epoch) [tge](/topic/tge) [$catex](/topic/$catex) [uniswap](/topic/uniswap) [monopoly](/topic/monopoly) [$660m](/topic/$660m) [onchain](/topic/onchain) [meta](/topic/meta) [Post Link](https://x.com/arndxt_xo/status/1945548009502380426)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

arndxt @arndxt_xo on x 44.7K followers

Created: 2025-07-16 18:16:06 UTC

arndxt @arndxt_xo on x 44.7K followers

Created: 2025-07-16 18:16:06 UTC

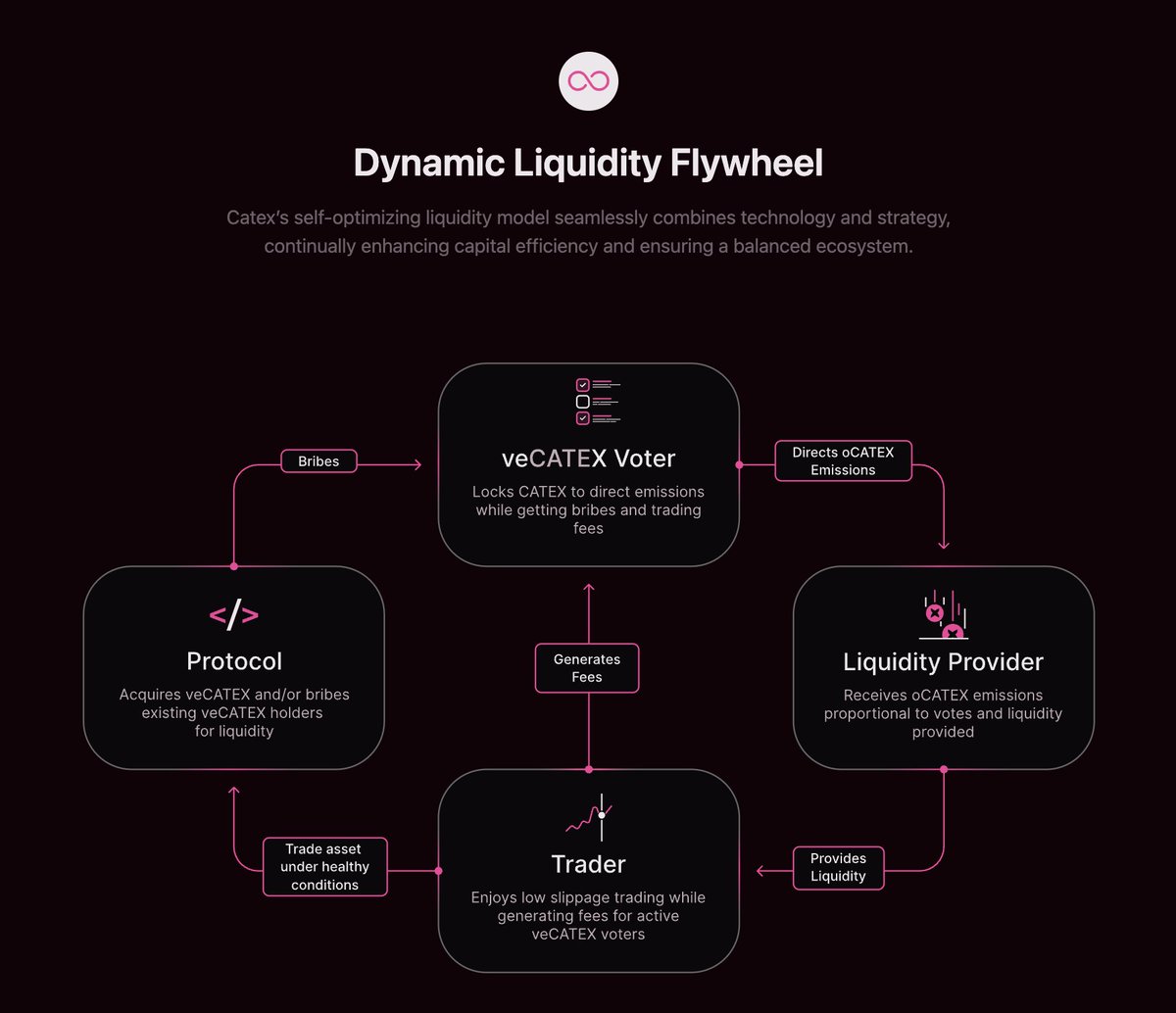

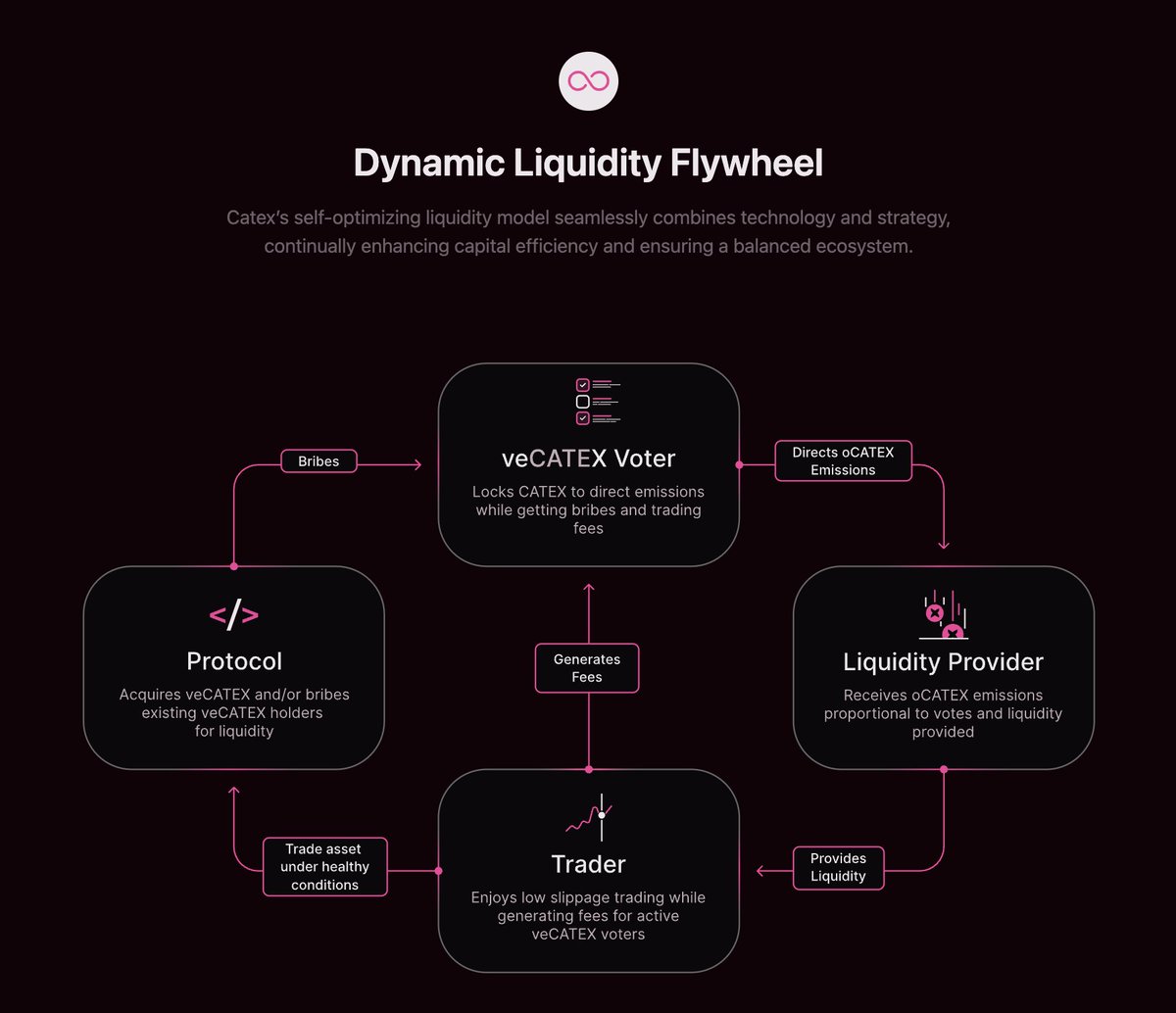

Revenue meta > Onchain volumes up > DEX printing > ve33 DEX value accruaI

So, I believe we will see a ve33 DEX season soon and I am farming passive and massive income from Uniswap's $660M annualized feees.

The first ve33 DEX on @unichain and the the scale here goes up to the only monopoly capturing all of Uniswap fees and all of that value flow back to $CATEX

What stands out is how $CATEX deploys its veToken model with fees immediately accrue into the hands of veCATX holders on day X.

This mirrors what @LynexFi executed successfully on Linea, now adapted for Unichain with faster cycle time and similar primitives.

With @Catex_Fi, the mechanics kickstart immediately: • Epoch X voting begins Thursday • veCATX governs emissions from Day X • $UNI incentives and protocol rewards go live instantly

Three elements make @Catex_Fi structurally interesting: 1.Voters shape emissions from day one, see outcome within Epoch X. This compresses the governance cycle and rewards decisiveness. 2.Incentives are funded by trading fees and $UNI allocations. This aligns LPs and voters around shared performance. giving emissions control to veCATX holders, it creates a programmable liquidity layer responsive to market needs.

I got some $CATEX and If you’re evaluating what to do with your airdrop, here's my thoughts: → HODLing it yields nothing. → Active locking enables directional influence, emissions share, and compounding rewards from epoch.

XXXXX engagements

Related Topics epoch tge $catex uniswap monopoly $660m onchain meta