[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Aespann_jeans [@a1071364](/creator/twitter/a1071364) on x 13.1K followers Created: 2025-07-16 17:30:12 UTC Bang Si-hyuk Issue: Facts Summary Only (Judgment on Your Own) X. Bang Si-hyuk recommended that investors sell their shares, with three successful instances, citing delays in the IPO process.(However, the exact timing of when he recommended selling the shares is unknown.) - October 2018 (Stick Investment) - June 2019 (Easton No. 1) - November 2019 (Easton-Newmain No. 2) X. October 2018 (Stick Investment) The IPO was delayed by approximately two years (listed in October 2020), clearly indicating that the "IPO delay risk" existed. X. June 2019 (Easton No. 1) The June 2019 agreement contained no XX percent profit-sharing clause for Bang Si-hyuk. Instead, he signed a contract that left him shouldering the risk of having to buy the private-equity fund’s stake at a higher price if the IPO fell through. In short, it was a high-risk, zero-return deal that simply helped the original investors unload their shares. X. November 2019 (Easton-Newmain No. 2) A contract allocated XX% of the sale profits to Bang Si-hyuk, with a put option clause requiring him to repurchase shares at the principal plus a certain return if the IPO failed. The IPO succeeded within less than a year. This appears to be the primary focus of financial authorities’ scrutiny. X. At that time, HYBE was in a difficult situation to find external investors to purchase the shares of the initial investors, so eventually, an SPC established by HYBE executives emerged as the acquirer, and this simply means that Bang Si-hyuk bore all the risks. Moreover, in the June 2019 contract, Bang Si-hyuk took on only the risks without even a XX% profit clause. X. Due to the COVID-19 outbreak, the IPO was delayed by several months but ultimately succeeded without major issues. X. Given cases like Kakao Entertainment, which faced significant IPO delays or failures (e.g., multiple postponements since 2019, ultimately abandoned in 2025 for a sale), IPO success is not guaranteed. Thus, Bang Si-hyuk bore actual investment risks through the put options. X. Media claims that "HYBE told investors there was no listing plan" were proven false. On July 16, 2025, the Securities and Futures Commission (SFC) accused HYBE and confirmed that Bang Si-hyuk only indicated that "the listing could be delayed." X. Thus, HYBE’s consistent claims: - "We never stated there was no IPO plan." - "We informed investors of ongoing IPO preparations while focusing on attracting investment." were proven correct. XX. The financial authorities’ "one-strike out" system cannot be retroactively applied to the HYBE case. XX. Personal opinion: The SFC, finding it difficult to definitively establish charges and seeking to avoid responsibility, referred the case to the prosecution in a "let the prosecution decide" manner.  XXXXXX engagements  **Related Topics** [investment](/topic/investment) [ipo](/topic/ipo) [stocks](/topic/stocks) [bang](/topic/bang) [Post Link](https://x.com/a1071364/status/1945536456291656052)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Aespann_jeans @a1071364 on x 13.1K followers

Created: 2025-07-16 17:30:12 UTC

Aespann_jeans @a1071364 on x 13.1K followers

Created: 2025-07-16 17:30:12 UTC

Bang Si-hyuk Issue: Facts Summary Only (Judgment on Your Own)

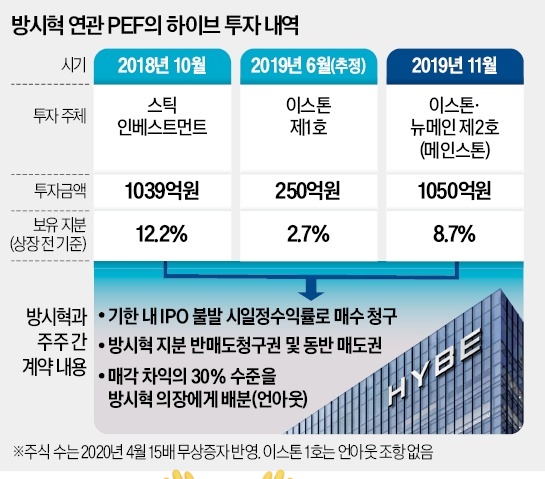

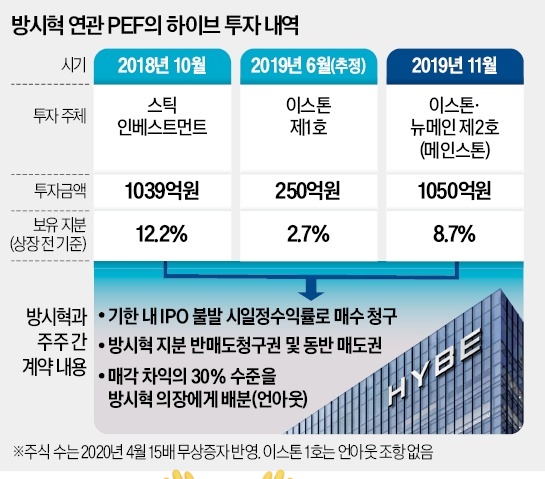

X. Bang Si-hyuk recommended that investors sell their shares, with three successful instances, citing delays in the IPO process.(However, the exact timing of when he recommended selling the shares is unknown.)

- October 2018 (Stick Investment)

- June 2019 (Easton No. 1)

- November 2019 (Easton-Newmain No. 2)

X. October 2018 (Stick Investment)

The IPO was delayed by approximately two years (listed in October 2020), clearly indicating that the "IPO delay risk" existed.

X. June 2019 (Easton No. 1)

The June 2019 agreement contained no XX percent profit-sharing clause for Bang Si-hyuk. Instead, he signed a contract that left him shouldering the risk of having to buy the private-equity fund’s stake at a higher price if the IPO fell through. In short, it was a high-risk, zero-return deal that simply helped the original investors unload their shares.

X. November 2019 (Easton-Newmain No. 2)

A contract allocated XX% of the sale profits to Bang Si-hyuk, with a put option clause requiring him to repurchase shares at the principal plus a certain return if the IPO failed. The IPO succeeded within less than a year. This appears to be the primary focus of financial authorities’ scrutiny.

X. At that time, HYBE was in a difficult situation to find external investors to purchase the shares of the initial investors, so eventually, an SPC established by HYBE executives emerged as the acquirer, and this simply means that Bang Si-hyuk bore all the risks. Moreover, in the June 2019 contract, Bang Si-hyuk took on only the risks without even a XX% profit clause.

X. Due to the COVID-19 outbreak, the IPO was delayed by several months but ultimately succeeded without major issues.

X. Given cases like Kakao Entertainment, which faced significant IPO delays or failures (e.g., multiple postponements since 2019, ultimately abandoned in 2025 for a sale), IPO success is not guaranteed. Thus, Bang Si-hyuk bore actual investment risks through the put options.

X. Media claims that "HYBE told investors there was no listing plan" were proven false. On July 16, 2025, the Securities and Futures Commission (SFC) accused HYBE and confirmed that Bang Si-hyuk only indicated that "the listing could be delayed."

X. Thus, HYBE’s consistent claims:

- "We never stated there was no IPO plan."

- "We informed investors of ongoing IPO preparations while focusing on attracting investment."

were proven correct.

XX. The financial authorities’ "one-strike out" system cannot be retroactively applied to the HYBE case.

XX. Personal opinion: The SFC, finding it difficult to definitively establish charges and seeking to avoid responsibility, referred the case to the prosecution in a "let the prosecution decide" manner.

XXXXXX engagements

Related Topics investment ipo stocks bang