[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Dt.Coca-Cola | 🪶/acc 🧙♂️,🧙♂️ [@0xFatih](/creator/twitter/0xFatih) on x 1165 followers Created: 2025-07-16 16:21:15 UTC Is $HUMA sustainable? Or is it Ponzinomics? There are millions of tokens in the crypto market. Many of these tokens are slowly falling to zero and being crushed by inflation after reaching billions of dollars in market cap. Many of these tokens are essentially legal Ponzi schemes. While they may appear successful in the short term due to unsustainable incentives and inflated numbers, they all eventually plummet to zero in the long run. Is the situation the same for @HumaFinance? Let’s compare it with similar projects; USUAL Token The USUAL project is similar to Huma Finance due to its relationship with stablecoins. Although $USUAL reached an all-time high of $1.64, it is currently trading at $XXXX. The high APYs provided by minting $USUAL at a rate of XXX% initially led to high emissions for $USUAL. Even if Usual were to reach the same market cap again, the token price would be $XXX. Usual's initial supply was only 300M. Unfortunately, the fuel for the XXX% APY given without generating income was the community. This is the best example of inflated income and statistics. Additionally, if you recall, GameFi and Move2Earn tokens during the 2021 bull run shared the same fate. Therefore, distributing income with printed tokens is not a logical model. So what makes Huma Finance and the $HUMA token different? Huma Finance and $HUMA Huma Finance is one of the few projects that generates real income. This income is tied to real-world transactions. The income generated from PayFi activities is redistributed to Liquidity Providers through Huma Finance. The distribution is not done by minting $HUMA tokens but by directly distributing the income as real yield. The APY is 10.5%. While other projects initially offer high interest rates for stablecoins, they later reduce these rates to ensure sustainability. Huma Finance, however, sustains and stabilizes this interest rate using income generated from real-world transactions. Here is a comparison of the interest rates offered by Bluechip projects to users. Additionally, Huma Finance facilitates transactions within the protocol using the $PST token. The $HUMA token is not used for high-inflation incentives. $HUMA is the utility token of the PayFi ecosystem formed around Huma Finance. In addition to active features such as governance, early access to pools, and WL from partners, it is expected that models such as increased APYs, revenue sharing, and buyback mechanisms will be implemented for $HUMA stakers in the future. Thus, $HUMA inflation is kept under control. Where does Huma Finance generate this revenue? Huma Finance focuses on TradFi, card payments, and cross-border payments. Huma Finance partner Arf achieves high volumes by rotating liquidity on Huma XXX times a year. This way, maximum revenue is generated with minimum liquidity, enabling sustainable APYs. This is why you cannot deposit funds into Huma Finance at any time. Liquidity is kept under control to ensure sustainable APY. Unused cash not used for inflated statistics does not burden Huma Protocol revenues. Co-founder @0xErbil states that protocol revenue could grow 20-30x with the right partnerships. This would place Huma Finance among the top XX most revenue-generating crypto projects. With a buyback program like HyperLiquid, Huma would transition into a fully deflationary system. Additionally, below you can see the token unlock schedules for the $HUMA token. The supply is fixed at 10B, and the initial circulation is 1.7B $HUMA. XX% of the supply is allocated to protocol incentives. The absence of token minting from thin air and the support of the $HUMA supply through revenues make investing in Huma with USDC akin to Bitcoin mining in 2011. Thank you for reading! I was truly impressed by Huma while writing this article. Our architects: @0xErbil @DrPayFi and the Huma community🫡  XXXXX engagements  **Related Topics** [market cap](/topic/market-cap) [huma](/topic/huma) [inflation](/topic/inflation) [$huma](/topic/$huma) [coins bsc](/topic/coins-bsc) [coins solana ecosystem](/topic/coins-solana-ecosystem) [Post Link](https://x.com/0xFatih/status/1945519104393379867)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Dt.Coca-Cola | 🪶/acc 🧙♂️,🧙♂️ @0xFatih on x 1165 followers

Created: 2025-07-16 16:21:15 UTC

Dt.Coca-Cola | 🪶/acc 🧙♂️,🧙♂️ @0xFatih on x 1165 followers

Created: 2025-07-16 16:21:15 UTC

Is $HUMA sustainable? Or is it Ponzinomics?

There are millions of tokens in the crypto market. Many of these tokens are slowly falling to zero and being crushed by inflation after reaching billions of dollars in market cap. Many of these tokens are essentially legal Ponzi schemes. While they may appear successful in the short term due to unsustainable incentives and inflated numbers, they all eventually plummet to zero in the long run. Is the situation the same for @HumaFinance? Let’s compare it with similar projects;

USUAL Token The USUAL project is similar to Huma Finance due to its relationship with stablecoins. Although $USUAL reached an all-time high of $1.64, it is currently trading at $XXXX. The high APYs provided by minting $USUAL at a rate of XXX% initially led to high emissions for $USUAL. Even if Usual were to reach the same market cap again, the token price would be $XXX. Usual's initial supply was only 300M. Unfortunately, the fuel for the XXX% APY given without generating income was the community. This is the best example of inflated income and statistics. Additionally, if you recall, GameFi and Move2Earn tokens during the 2021 bull run shared the same fate. Therefore, distributing income with printed tokens is not a logical model. So what makes Huma Finance and the $HUMA token different?

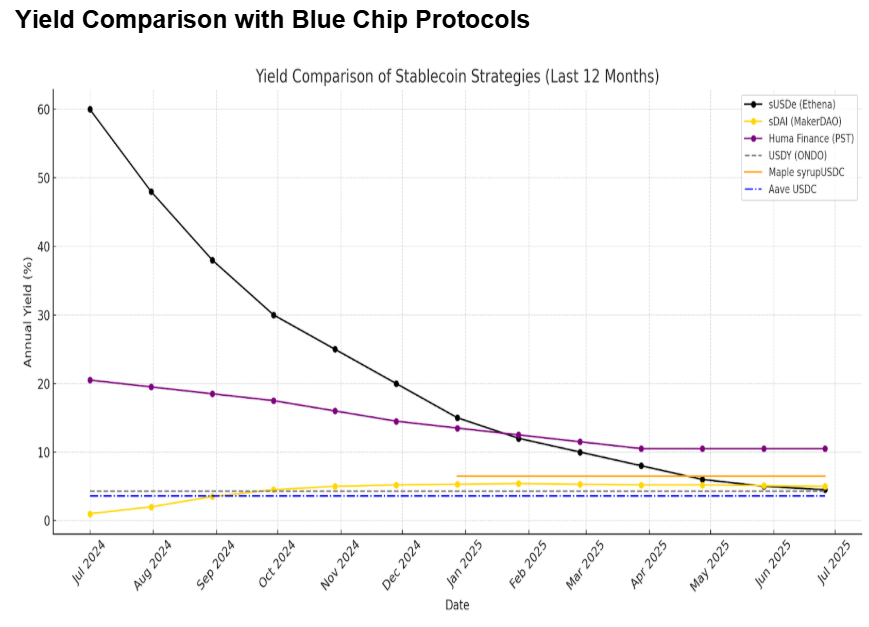

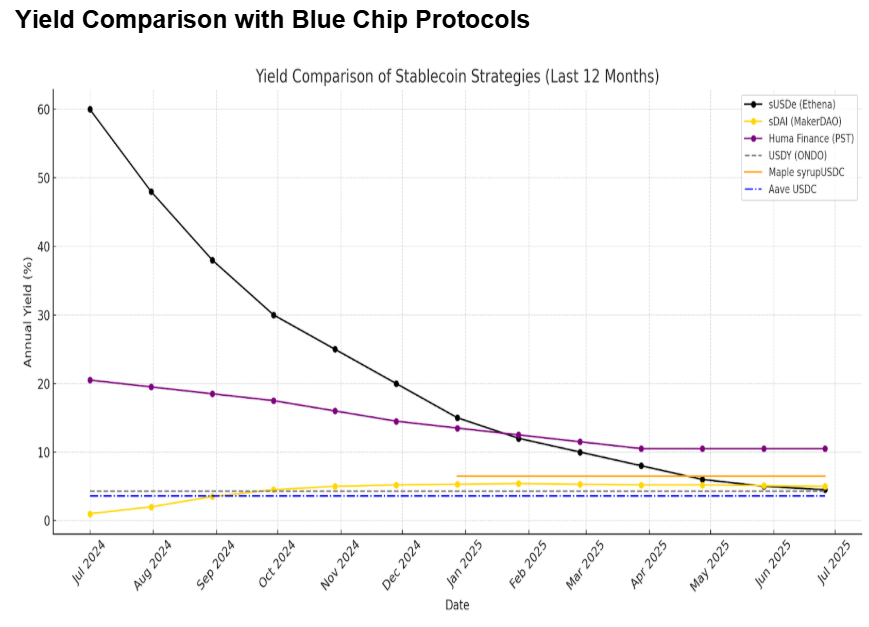

Huma Finance and $HUMA Huma Finance is one of the few projects that generates real income. This income is tied to real-world transactions. The income generated from PayFi activities is redistributed to Liquidity Providers through Huma Finance. The distribution is not done by minting $HUMA tokens but by directly distributing the income as real yield. The APY is 10.5%. While other projects initially offer high interest rates for stablecoins, they later reduce these rates to ensure sustainability. Huma Finance, however, sustains and stabilizes this interest rate using income generated from real-world transactions. Here is a comparison of the interest rates offered by Bluechip projects to users.

Additionally, Huma Finance facilitates transactions within the protocol using the $PST token. The $HUMA token is not used for high-inflation incentives. $HUMA is the utility token of the PayFi ecosystem formed around Huma Finance. In addition to active features such as governance, early access to pools, and WL from partners, it is expected that models such as increased APYs, revenue sharing, and buyback mechanisms will be implemented for $HUMA stakers in the future. Thus, $HUMA inflation is kept under control.

Where does Huma Finance generate this revenue? Huma Finance focuses on TradFi, card payments, and cross-border payments. Huma Finance partner Arf achieves high volumes by rotating liquidity on Huma XXX times a year. This way, maximum revenue is generated with minimum liquidity, enabling sustainable APYs. This is why you cannot deposit funds into Huma Finance at any time. Liquidity is kept under control to ensure sustainable APY. Unused cash not used for inflated statistics does not burden Huma Protocol revenues. Co-founder @0xErbil states that protocol revenue could grow 20-30x with the right partnerships. This would place Huma Finance among the top XX most revenue-generating crypto projects. With a buyback program like HyperLiquid, Huma would transition into a fully deflationary system.

Additionally, below you can see the token unlock schedules for the $HUMA token. The supply is fixed at 10B, and the initial circulation is 1.7B $HUMA. XX% of the supply is allocated to protocol incentives. The absence of token minting from thin air and the support of the $HUMA supply through revenues make investing in Huma with USDC akin to Bitcoin mining in 2011.

Thank you for reading! I was truly impressed by Huma while writing this article. Our architects: @0xErbil @DrPayFi and the Huma community🫡

XXXXX engagements

Related Topics market cap huma inflation $huma coins bsc coins solana ecosystem