[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  spacebyte ⛓ [@_thespacebyte](/creator/twitter/_thespacebyte) on x 24.2K followers Created: 2025-07-16 16:09:08 UTC DeFi today is rich in tools, protocols, and capital, but brittle in practice. And I'mma keep saying it, we don’t lack infrastructure! What we lack is flow. The ability to move through strategies without feeling like you’re solving a puzzle every time. Even the savviest users still juggle tabs, approvals, bridges, and browser refreshes just to chase a XX% yield. At some point, the mental transaction cost outweighs the financial return. And that’s where @Infinit_Labs steps in. But not as another interface, but as something more foundational: an execution layer that bridges the gap between insight and action. Let’s unpack what that actually means. i/ The Real UX Problem in DeFi Isn’t Design. It’s Execution We often talk about “DeFi UX” as a visual problem: buttons, dashboards, flows. But the harder truth is that DeFi’s core UX problem is transactional choreography. It’s not hard to understand what you’re supposed to do. It’s hard to do it safely, quickly, and repeatedly. Take something as simple as a leveraged ETH loop. In theory, it’s a 3-step process: X. Deposit LST into a lending market X. Borrow a stablecoin X. Swap back to $ETH and restake In practice, this often becomes: • Six UI hops • Four wallet approvals • Two bridge hops if you’re on the wrong chain • One misclick away from losing the entire loop This is the execution gap, and it’s what INFINIT is quietly building infrastructure to solve. ii/ What INFINIT Actually Does At its core, @Infinit_Labs turns plain language prompts into verifiable strategy execution. That’s a sentence that sounds buzzwordy until you break it down into the architecture. The full pipeline looks something like this: X. Prompt -> Agent Logic You describe the strategy in plain terms: “Loop wstETH on Aave, borrow $USDC, swap for $ETH, restake.” Behind the scenes, INFINIT’s agent swarm parses this into deterministic logic components: lending, borrowing, swapping, staking are tied to specific protocols and onchain functions. X. Logic -> Strategy Template These agents construct a modular template. Essentially a map of what the strategy needs to do. This isn’t code yet, but it’s structured. Parameterized. Simulatable. X. Template -> Simulation The entire flow is tested via simulation. No capital moves until gas estimates, slippage, protocol routes, and risk tolerances are verified. X. Simulation -> Execution Bundle Once verified, the strategy is compiled into a single, EVM-executable transaction using ERC-4337 and EIP-7702. All steps (across protocols and chains) are bundled, signed once, and executed atomically. iii/ Why It Matters? This architecture does more than reduce clicks. It reframes what’s possible in DeFi UX by solving composability at the execution layer. > Execution becomes programmable: You can define complex flows without writing smart contracts. > Strategies become shareable: KOLs, researchers, and funds can publish strategies as executable objects. Not PDFs, not threads, not Notion checklists. > Onchain activity becomes monetizable: If users adopt your strategy, you get paid per execution. It’s opt-in monetization with onchain attribution. In effect, @Infinit_Labs allows creators to publish “onchain workflows” units of logic that can be simulated, reused, remixed, and monetized. It’s GitHub for DeFi strategies, except every fork is an onchain transaction, and every star is an execution fee. iv/ My Closing Take This is what modular DeFi actually looks like: Clear intent in, bundled execution out. @Infinit_Labs turns friction into flow, and that changes who builds, who earns, and who stays.  XXXXXX engagements  [Post Link](https://x.com/_thespacebyte/status/1945516058502111495)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

spacebyte ⛓ @_thespacebyte on x 24.2K followers

Created: 2025-07-16 16:09:08 UTC

spacebyte ⛓ @_thespacebyte on x 24.2K followers

Created: 2025-07-16 16:09:08 UTC

DeFi today is rich in tools, protocols, and capital, but brittle in practice.

And I'mma keep saying it, we don’t lack infrastructure!

What we lack is flow. The ability to move through strategies without feeling like you’re solving a puzzle every time.

Even the savviest users still juggle tabs, approvals, bridges, and browser refreshes just to chase a XX% yield.

At some point, the mental transaction cost outweighs the financial return.

And that’s where @Infinit_Labs steps in. But not as another interface, but as something more foundational: an execution layer that bridges the gap between insight and action.

Let’s unpack what that actually means.

i/ The Real UX Problem in DeFi Isn’t Design. It’s Execution

We often talk about “DeFi UX” as a visual problem: buttons, dashboards, flows.

But the harder truth is that DeFi’s core UX problem is transactional choreography.

It’s not hard to understand what you’re supposed to do. It’s hard to do it safely, quickly, and repeatedly.

Take something as simple as a leveraged ETH loop.

In theory, it’s a 3-step process:

X. Deposit LST into a lending market X. Borrow a stablecoin X. Swap back to $ETH and restake

In practice, this often becomes:

• Six UI hops • Four wallet approvals • Two bridge hops if you’re on the wrong chain • One misclick away from losing the entire loop

This is the execution gap, and it’s what INFINIT is quietly building infrastructure to solve.

ii/ What INFINIT Actually Does

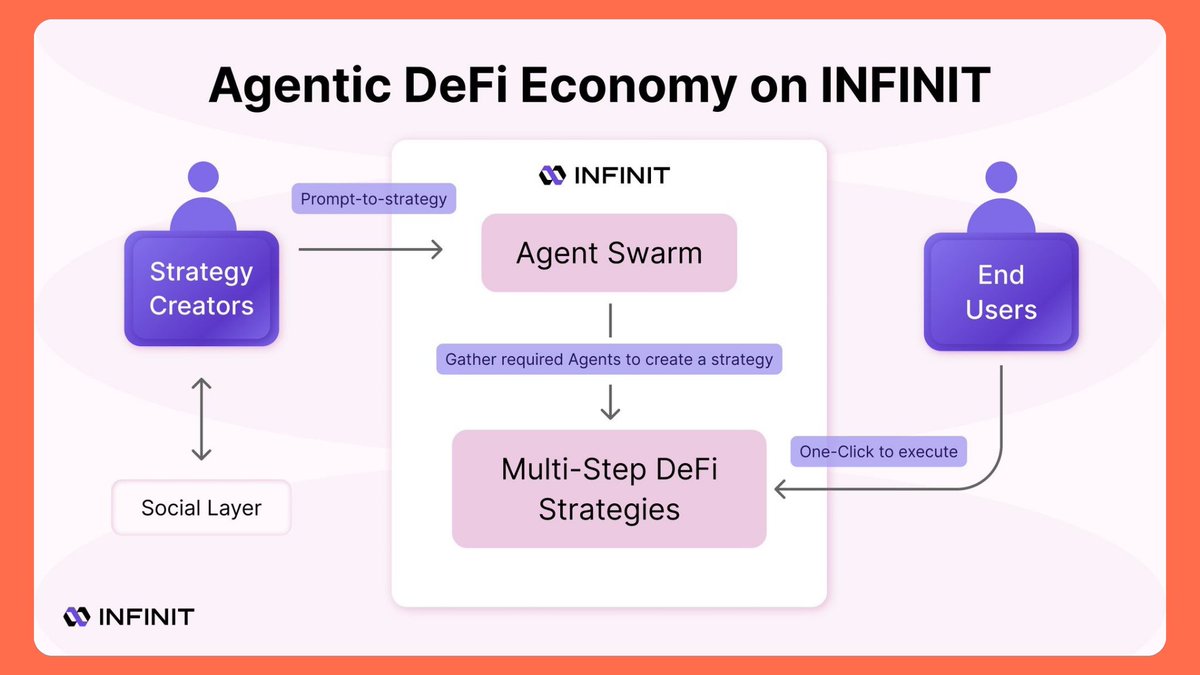

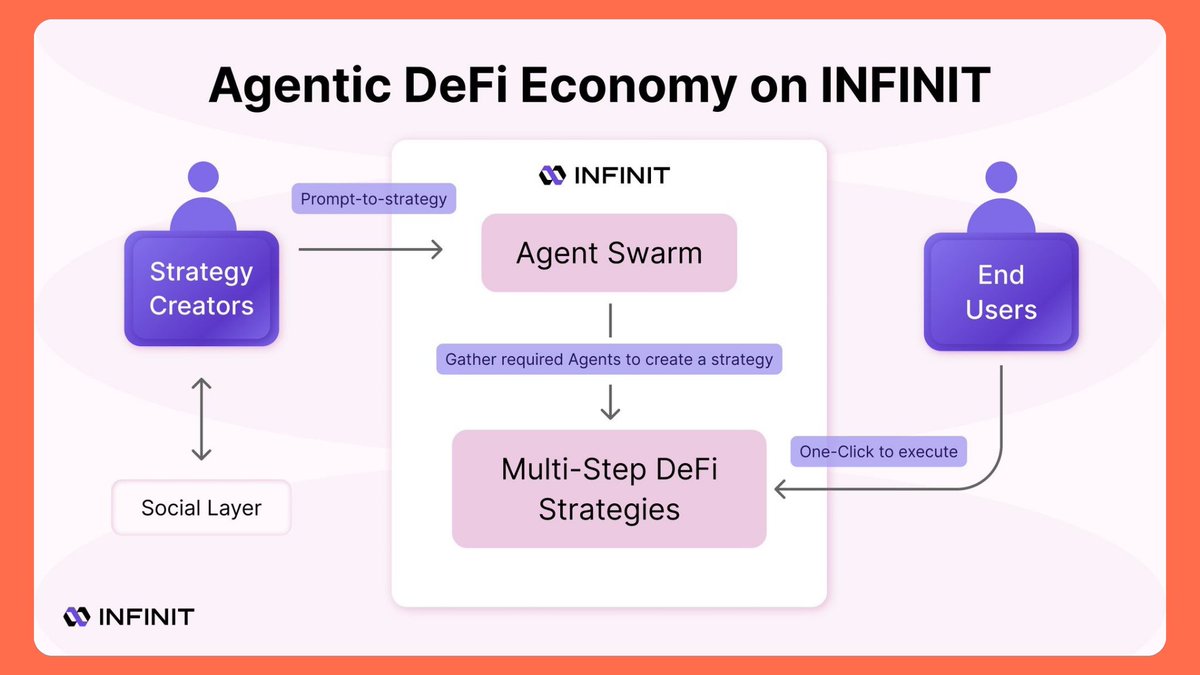

At its core, @Infinit_Labs turns plain language prompts into verifiable strategy execution. That’s a sentence that sounds buzzwordy until you break it down into the architecture.

The full pipeline looks something like this:

X. Prompt -> Agent Logic

You describe the strategy in plain terms: “Loop wstETH on Aave, borrow $USDC, swap for $ETH, restake.”

Behind the scenes, INFINIT’s agent swarm parses this into deterministic logic components: lending, borrowing, swapping, staking are tied to specific protocols and onchain functions.

X. Logic -> Strategy Template

These agents construct a modular template. Essentially a map of what the strategy needs to do. This isn’t code yet, but it’s structured. Parameterized. Simulatable.

X. Template -> Simulation

The entire flow is tested via simulation. No capital moves until gas estimates, slippage, protocol routes, and risk tolerances are verified.

X. Simulation -> Execution Bundle

Once verified, the strategy is compiled into a single, EVM-executable transaction using ERC-4337 and EIP-7702. All steps (across protocols and chains) are bundled, signed once, and executed atomically.

iii/ Why It Matters?

This architecture does more than reduce clicks.

It reframes what’s possible in DeFi UX by solving composability at the execution layer.

Execution becomes programmable: You can define complex flows without writing smart contracts.

Strategies become shareable: KOLs, researchers, and funds can publish strategies as executable objects. Not PDFs, not threads, not Notion checklists.

Onchain activity becomes monetizable: If users adopt your strategy, you get paid per execution. It’s opt-in monetization with onchain attribution.

In effect, @Infinit_Labs allows creators to publish “onchain workflows” units of logic that can be simulated, reused, remixed, and monetized.

It’s GitHub for DeFi strategies, except every fork is an onchain transaction, and every star is an execution fee.

iv/ My Closing Take

This is what modular DeFi actually looks like: Clear intent in, bundled execution out. @Infinit_Labs turns friction into flow, and that changes who builds, who earns, and who stays.

XXXXXX engagements