[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Bankless [@BanklessHQ](/creator/twitter/BanklessHQ) on x 318.3K followers Created: 2025-07-16 13:50:58 UTC Ethereum’s Blue Money Pivot Ethereum is quietly shedding its utility-token past. @the_defi_report’s Q2 analysis shows while protocol revenue and onchain fees may be down, ETH is consolidating as a store of value — less gas, more gospel. Here are X takeaways from the report on Ethereum’s shift from activity layer to monetary asset.👇 ~~ Analysis by @davewardonline ~~ 1️⃣ Institutions Are Accumulating ETH Over the last quarter, ETH entered institutional balance sheets through two main vectors: ETFs and corporate treasuries. ➢ ETH ETFs: AUM rose XX% QoQ to 4.1M ETH (3.4% of supply), the largest increase since tracking began. Fidelity’s FETH led inflows. ➢ Corporate Treasuries: Holdings surged XXXXX% to 1.98M ETH. @SharpLinkGaming added 216K ETH (some bought directly from the Ethereum Foundation), @BitDigital_BTBT added 100.6K. XX entities now hold ETH in treasury. @fundstrat, chair of @BitMNR, said ETH is a “stablecoin play,” suggesting firms may stake ETH to operate their own stablecoins — adding a new institutional demand vector. This mirrors early Bitcoin adoption — ETFs and corporate treasuries aren’t using ETH for gas or DeFi, but holding it as a macro asset, reducing circulating supply and recasting ETH as long-term value storage. 2️⃣ Capital Is Rotating Into ETH & Out of CEXs ETH continues migrating from liquid venues into passive, strategic holdings — consistent with store-of-value behavior. ➢ CEX Balances: ETH on exchanges fell 7%, likely moving to cold storage, staking, or custody accounts — supported by a rise in percent staked. ➢ Smart Contracts: ETH in contracts dropped X% to XX% of supply, suggesting a shift from DeFi toward staking, ETFs, or reallocations. Circulating supply rose just XXXX% in Q2, despite a return to net inflation. The report compares this to “dollar hoarding” — ETH held as value, not spent. 3️⃣ Staking Grows as Passive Yield Staking frames ETH as a yield-bearing asset — and continues growing. ➢ Staked ETH: Up X% to 35.6M ETH (29.5% of supply), a new high. Despite lower fee revenue, issuance rewards averaged XXXXX ETH/day, yielding 3.22%. ➢ Reward Composition: XX% of validator rewards came from issuance, not fees — reinforcing ETH’s role as a productive, fee-independent asset. ETH now behaves more like a yield-bearing treasury instrument than a speculative token. Staking is the mechanism transforming Ethereum into a monetary network. 4️⃣ Monetary Dilution Returns Net inflation is back — but the report views this as maturity, not weakness. ➢ Issuance Up: ETH issuance rose 2%, while burn fell 55%, pushing net dilution to XXXX% annualized — a one-year high. ➢ Onchain Yield Down: Real yield dropped 28%, and cost to produce $X of revenue rose 58%. Despite this, ETFs and staking pools kept absorbing ETH. Founder @JustDeauIt sees echoes of early Bitcoin cycles, where holders endured dilution for network security. ETH’s XX% issuance-driven yield mirrors monetary systems where scheduled inflation funds network operation. Holding through dilution is a hallmark of store-of-value behavior. 5️⃣ Ethereum L1 = Settlement Layer Ethereum’s base layer is shifting from transactional engine to capital base and final settlement layer. ➢ L2 Dominance: Daily L2 transactions outpace L1 by 12.7x; active addresses by 5x; high-activity contracts by 5.7x; DeFi velocity by 7.5x. ➢ L1 Capital Anchoring: Despite this, L1 TVL rose 33%. Real-world assets on Ethereum grew XX% QoQ to $7.5B, led by tokenized Treasuries (+58%) and Commodities (+24%). Ethereum is mirroring traditional finance — L2s execute, L1 settles. ETH is the reserve asset anchoring this system. -- Together, these trends reframe ETH less as a utility token and more as a sovereign bond — yield-bearing, hoardable, and core to the system it underwrites.  XXXXX engagements  **Related Topics** [onchain](/topic/onchain) [protocol](/topic/protocol) [money](/topic/money) [ethereum](/topic/ethereum) [coins layer 1](/topic/coins-layer-1) [Post Link](https://x.com/BanklessHQ/status/1945481284681134420)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Bankless @BanklessHQ on x 318.3K followers

Created: 2025-07-16 13:50:58 UTC

Bankless @BanklessHQ on x 318.3K followers

Created: 2025-07-16 13:50:58 UTC

Ethereum’s Blue Money Pivot

Ethereum is quietly shedding its utility-token past.

@the_defi_report’s Q2 analysis shows while protocol revenue and onchain fees may be down, ETH is consolidating as a store of value — less gas, more gospel.

Here are X takeaways from the report on Ethereum’s shift from activity layer to monetary asset.👇

~~ Analysis by @davewardonline ~~

1️⃣ Institutions Are Accumulating ETH

Over the last quarter, ETH entered institutional balance sheets through two main vectors: ETFs and corporate treasuries.

➢ ETH ETFs: AUM rose XX% QoQ to 4.1M ETH (3.4% of supply), the largest increase since tracking began. Fidelity’s FETH led inflows.

➢ Corporate Treasuries: Holdings surged XXXXX% to 1.98M ETH. @SharpLinkGaming added 216K ETH (some bought directly from the Ethereum Foundation), @BitDigital_BTBT added 100.6K. XX entities now hold ETH in treasury.

@fundstrat, chair of @BitMNR, said ETH is a “stablecoin play,” suggesting firms may stake ETH to operate their own stablecoins — adding a new institutional demand vector.

This mirrors early Bitcoin adoption — ETFs and corporate treasuries aren’t using ETH for gas or DeFi, but holding it as a macro asset, reducing circulating supply and recasting ETH as long-term value storage.

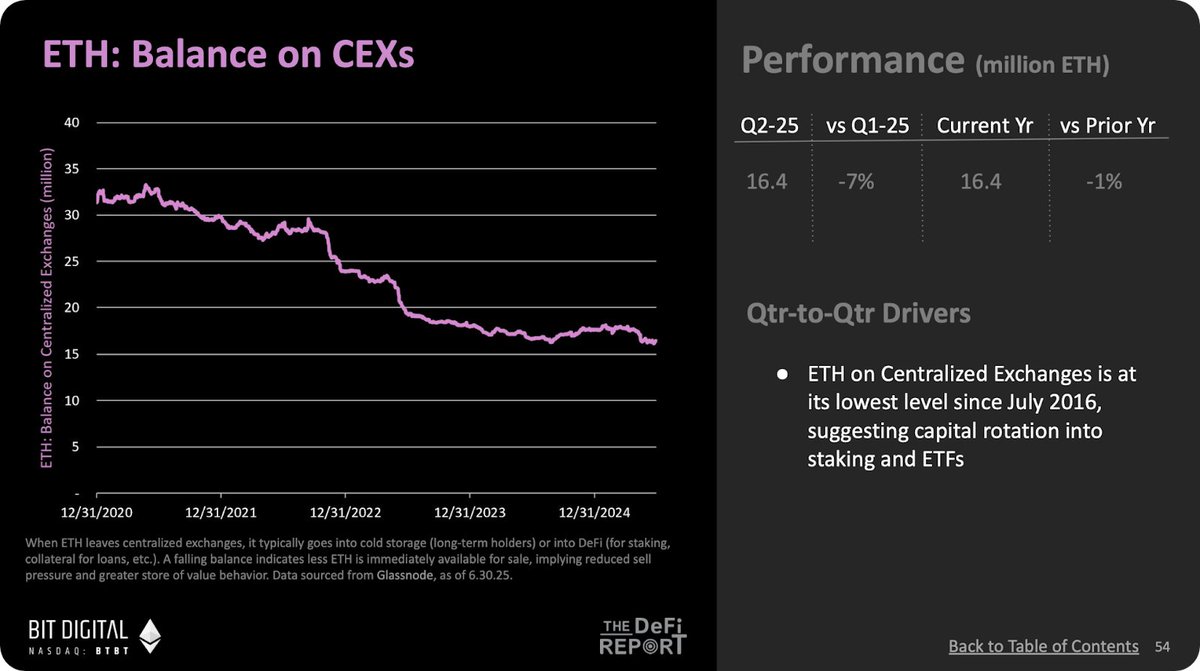

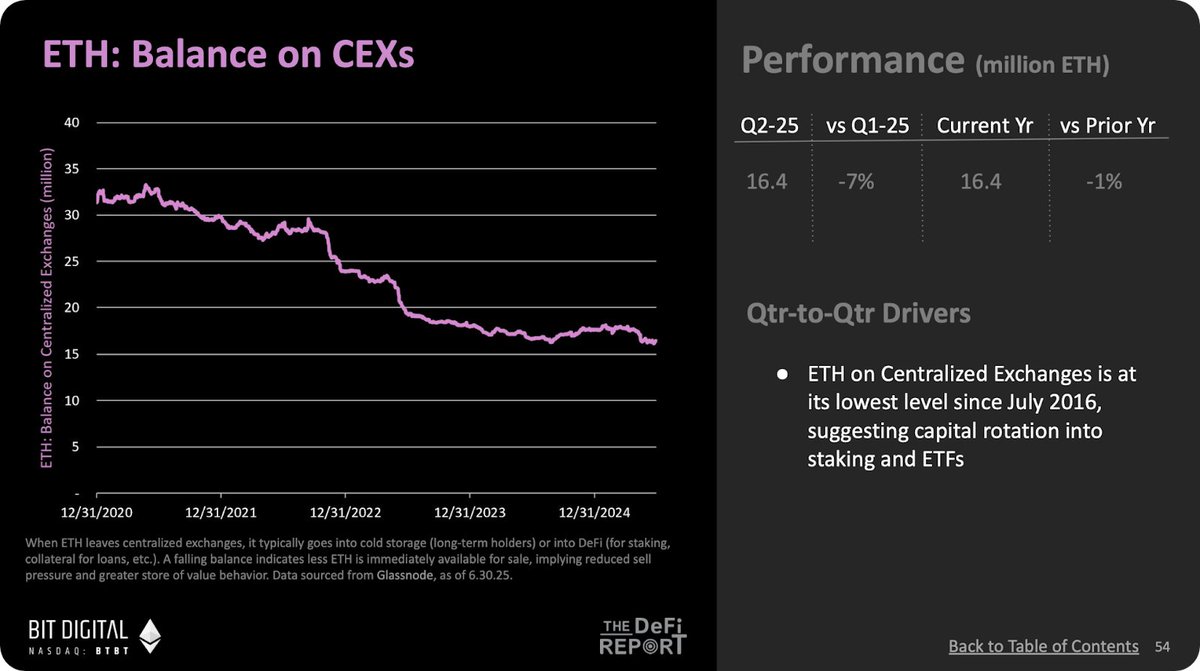

2️⃣ Capital Is Rotating Into ETH & Out of CEXs

ETH continues migrating from liquid venues into passive, strategic holdings — consistent with store-of-value behavior.

➢ CEX Balances: ETH on exchanges fell 7%, likely moving to cold storage, staking, or custody accounts — supported by a rise in percent staked.

➢ Smart Contracts: ETH in contracts dropped X% to XX% of supply, suggesting a shift from DeFi toward staking, ETFs, or reallocations.

Circulating supply rose just XXXX% in Q2, despite a return to net inflation. The report compares this to “dollar hoarding” — ETH held as value, not spent.

3️⃣ Staking Grows as Passive Yield

Staking frames ETH as a yield-bearing asset — and continues growing.

➢ Staked ETH: Up X% to 35.6M ETH (29.5% of supply), a new high. Despite lower fee revenue, issuance rewards averaged XXXXX ETH/day, yielding 3.22%.

➢ Reward Composition: XX% of validator rewards came from issuance, not fees — reinforcing ETH’s role as a productive, fee-independent asset.

ETH now behaves more like a yield-bearing treasury instrument than a speculative token. Staking is the mechanism transforming Ethereum into a monetary network.

4️⃣ Monetary Dilution Returns

Net inflation is back — but the report views this as maturity, not weakness.

➢ Issuance Up: ETH issuance rose 2%, while burn fell 55%, pushing net dilution to XXXX% annualized — a one-year high.

➢ Onchain Yield Down: Real yield dropped 28%, and cost to produce $X of revenue rose 58%.

Despite this, ETFs and staking pools kept absorbing ETH. Founder @JustDeauIt sees echoes of early Bitcoin cycles, where holders endured dilution for network security.

ETH’s XX% issuance-driven yield mirrors monetary systems where scheduled inflation funds network operation. Holding through dilution is a hallmark of store-of-value behavior.

5️⃣ Ethereum L1 = Settlement Layer

Ethereum’s base layer is shifting from transactional engine to capital base and final settlement layer.

➢ L2 Dominance: Daily L2 transactions outpace L1 by 12.7x; active addresses by 5x; high-activity contracts by 5.7x; DeFi velocity by 7.5x.

➢ L1 Capital Anchoring: Despite this, L1 TVL rose 33%. Real-world assets on Ethereum grew XX% QoQ to $7.5B, led by tokenized Treasuries (+58%) and Commodities (+24%).

Ethereum is mirroring traditional finance — L2s execute, L1 settles. ETH is the reserve asset anchoring this system.

--

Together, these trends reframe ETH less as a utility token and more as a sovereign bond — yield-bearing, hoardable, and core to the system it underwrites.

XXXXX engagements

Related Topics onchain protocol money ethereum coins layer 1