[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Stephen Cohen [@q_xvx_](/creator/twitter/q_xvx_) on x 7741 followers Created: 2025-07-16 13:00:47 UTC $DARE Good opportunity, buy! Quantitative rating: Buy Positive factors: Clinical progress: DARE's Ovaprene (non-hormonal monthly contraceptive product) Phase X trial interim results are positive (July 14), showing good safety and tolerability, no new safety issues, boosting the stock price (July XX pre-market up XXX% to $7.64). Financial support: On July 11, it received $X million in non-dilutive funding, with a total of $XXXX million (total commitment of $XX million) to support the development of DARE-LARC1 (smart contraceptive implant), and the platform can also be used for obesity and metabolic diseases. Strategic cooperation: On June 4, it cooperated with Rosy Wellness (a female health application covering XXXXXXX users) to promote Sildenafil Cream, and it is expected to achieve revenue in Q4 2025. Trading volume: On July 14, the trading volume surged by X million shares, indicating high interest from retail investors and institutions. Risk factors: High volatility: It rose to $XXXXX (+309%) before the market opened on July 14, but quickly fell back, indicating strong speculation. Financial status: Revenue in 2024 is only $XXXXX (down XXXXX% year-on-year), net loss is $XXXX million (down XXXXX% from 2023), but it is still not profitable, with cash reserves of $XXXX million, and the speed of burning money needs to be paid attention to. Regulatory risks: Sildenafil Cream (for female sexual dysfunction) requires FDA approval, and the regulatory path is uncertain. Technical indicators: The short-term moving average is bullish (50-day moving average of $2.42), but the long-term moving average (2.79) forms resistance, and the RSI is high (overbought risk)  XXX engagements  **Related Topics** [$dare](/topic/$dare) [Post Link](https://x.com/q_xvx_/status/1945468656223432849)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Stephen Cohen @q_xvx_ on x 7741 followers

Created: 2025-07-16 13:00:47 UTC

Stephen Cohen @q_xvx_ on x 7741 followers

Created: 2025-07-16 13:00:47 UTC

$DARE Good opportunity, buy!

Quantitative rating: Buy

Positive factors:

Clinical progress: DARE's Ovaprene (non-hormonal monthly contraceptive product) Phase X trial interim results are positive (July 14), showing good safety and tolerability, no new safety issues, boosting the stock price (July XX pre-market up XXX% to $7.64).

Financial support: On July 11, it received $X million in non-dilutive funding, with a total of $XXXX million (total commitment of $XX million) to support the development of DARE-LARC1 (smart contraceptive implant), and the platform can also be used for obesity and metabolic diseases.

Strategic cooperation: On June 4, it cooperated with Rosy Wellness (a female health application covering XXXXXXX users) to promote Sildenafil Cream, and it is expected to achieve revenue in Q4 2025.

Trading volume: On July 14, the trading volume surged by X million shares, indicating high interest from retail investors and institutions.

Risk factors:

High volatility: It rose to $XXXXX (+309%) before the market opened on July 14, but quickly fell back, indicating strong speculation.

Financial status: Revenue in 2024 is only $XXXXX (down XXXXX% year-on-year), net loss is $XXXX million (down XXXXX% from 2023), but it is still not profitable, with cash reserves of $XXXX million, and the speed of burning money needs to be paid attention to.

Regulatory risks: Sildenafil Cream (for female sexual dysfunction) requires FDA approval, and the regulatory path is uncertain.

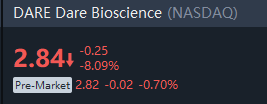

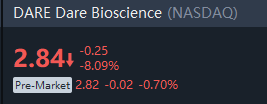

Technical indicators: The short-term moving average is bullish (50-day moving average of $2.42), but the long-term moving average (2.79) forms resistance, and the RSI is high (overbought risk)

XXX engagements

Related Topics $dare