[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Nick Research [@Nick_Researcher](/creator/twitter/Nick_Researcher) on x 18.7K followers Created: 2025-07-16 11:14:03 UTC ➥ How is a $1.2M protocol printing $2.27M/year in fees With zero emissions and no VC unlocks When I first saw @rezervemoney, I assumed it was another Olympus fork. Then I realized it was post-OHM ▸ Real yield from protocol fees (not dilution) ▸ Buyout staking = Harberger tax x DeFi ▸ Treasury buys BTC, floor price rises ▸ Stakers get all the fees, no middlemen The math just kept pulling me back ▸ $1.23M TVL ▸ $2.27M/year in protocol fees ▸ ~61% real yield to stakers ▸ No VC, no insiders, no fluff $RZR lets you set a buyout value for your stake You earn more if you price high, but someone can snipe your stake if it’s too low It’s weird, but it works  XXXXX engagements  **Related Topics** [all the](/topic/all-the) [has been](/topic/has-been) [token](/topic/token) [liquid](/topic/liquid) [tax bracket](/topic/tax-bracket) [staking](/topic/staking) [acquisition](/topic/acquisition) [$7733t](/topic/$7733t) [Post Link](https://x.com/Nick_Researcher/status/1945441797230281138)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Nick Research @Nick_Researcher on x 18.7K followers

Created: 2025-07-16 11:14:03 UTC

Nick Research @Nick_Researcher on x 18.7K followers

Created: 2025-07-16 11:14:03 UTC

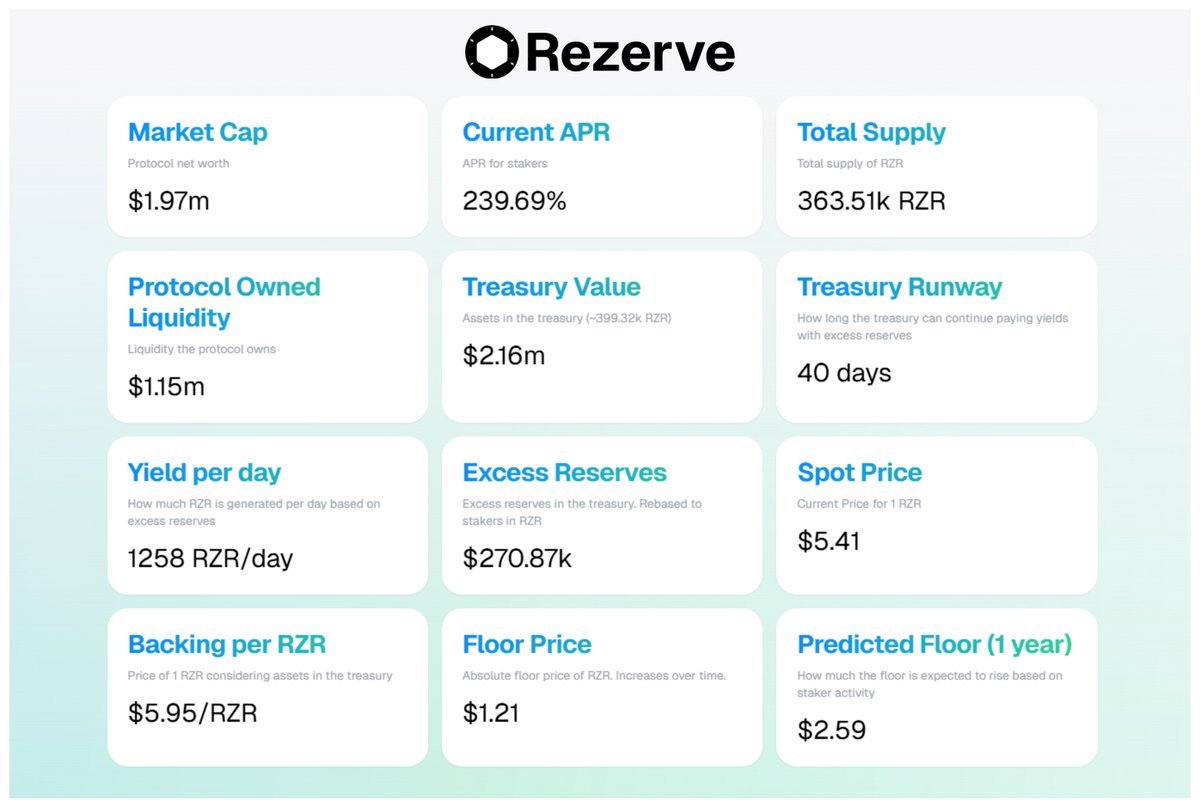

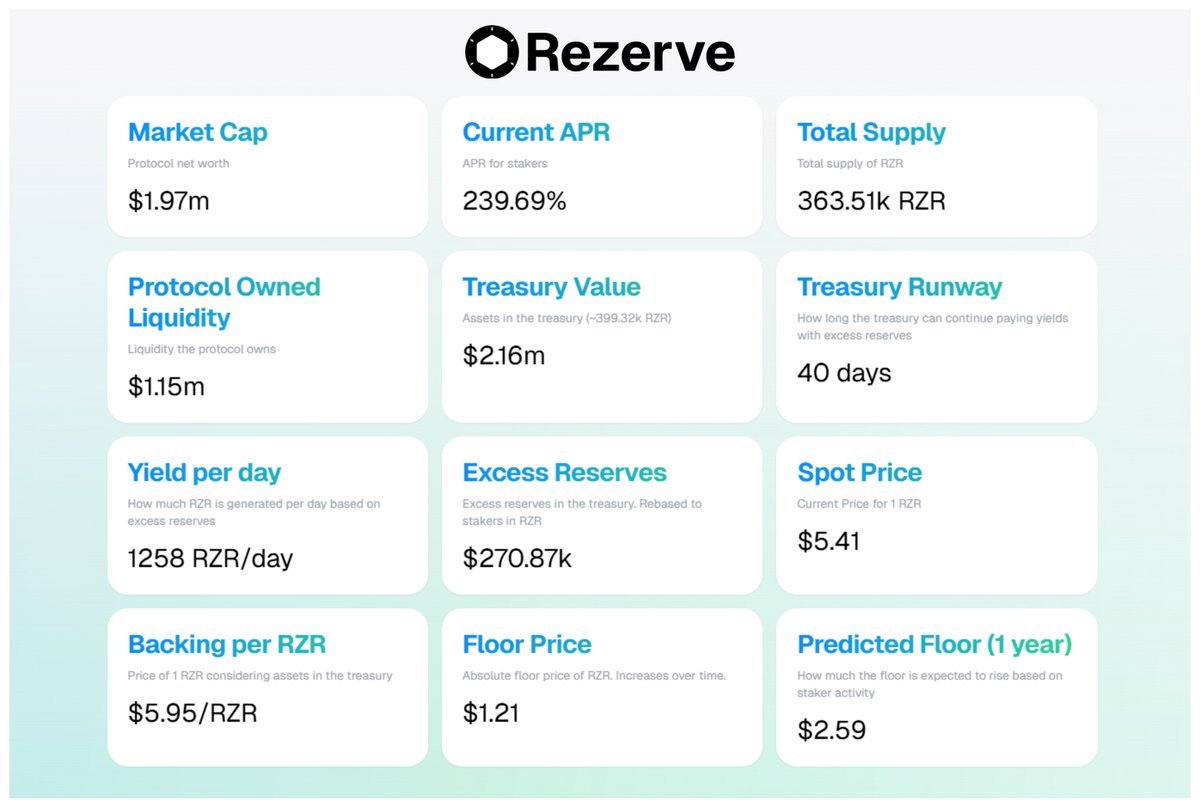

➥ How is a $1.2M protocol printing $2.27M/year in fees

With zero emissions and no VC unlocks

When I first saw @rezervemoney, I assumed it was another Olympus fork.

Then I realized it was post-OHM

▸ Real yield from protocol fees (not dilution) ▸ Buyout staking = Harberger tax x DeFi ▸ Treasury buys BTC, floor price rises ▸ Stakers get all the fees, no middlemen

The math just kept pulling me back

▸ $1.23M TVL ▸ $2.27M/year in protocol fees ▸ ~61% real yield to stakers ▸ No VC, no insiders, no fluff

$RZR lets you set a buyout value for your stake

You earn more if you price high, but someone can snipe your stake if it’s too low

It’s weird, but it works

XXXXX engagements

Related Topics all the has been token liquid tax bracket staking acquisition $7733t