[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  CryptoIDO [@CryptoID0](/creator/twitter/CryptoID0) on x 56.8K followers Created: 2025-07-16 10:01:39 UTC GM CRYPTOIDO FAM. ☀️ Deep-diving X projects with **real tech + nuclear upside**. Price targets based on fundamentals, not memes. ### **1. Sapien ($SPN)** @JoinSapien - **Tech**: ZK-verified PoE, DAO governance, hybrid L2 social graph - **Catalyst**: Twitter alternatives pumping (Bluesky $25M raise) - **Price**: $XXXX → **$0.45+** in 12mo if they hit 500k users (currently 53k) *VCs hold XX% – watch unlock dates like a hawk* ### **2. Vooi (Token TBA)** @vooi_io - **Tech**: EigenLayer-secured cross-chain MEV protection, 15-chain liquidity - **Edge**: Saves avg user XXX% per swap vs 1inch (extracts $1.2B annual MEV) - **Prediction**: Token at $XXXX launch → **$4.20** when volume hits $500M/month *If they airdrop to early users, apocalypse-level FOMO* ### **3. TEN ($TEN)** @tenprotocol - **Tech**: TEE+MPC encrypted mempool, 100x cheaper than Aztec - **Market**: $7B private transaction market (OTC, institutions) - **Price**: $XXXX → **$2.75** post-mainnet (MCAP still XX% below Monero) *Regulatory risk: SEC hates privacy coins but ETH L2s fly under radar* ### **4. OpenLedger ($OPEN)** @OpenledgerHQ - **Tech**: Slashed RPC nodes, <60ms global latency - **TAM**: $18B blockchain infra market growing 28%/yr - **Prediction**: $XXXX → **$5.00** as Node count hits 10k (currently 2.3k) *Enterprise clients = hidden rocket fuel* ### **5. Elympics ($ELYM)** @elympics_ai - **Tech**: ZK-anti-cheat, gasless Web3 gaming - **Catalyst**: Esports betting market to hit $23B by 2028 - **Price**: $XXXX → **$1.80** if top XX esports orgs adopt *P2E XXX narrative = 100x potential for legit projects* ### **6. Recall ($RECALL)** @recallnet - **Tech**: On-chain AI provenance + ZKML verifiable inference - **Nuclear Use**: Kills "AI training data theft" lawsuits ($$$ saved) - **Prediction**: $XXXX → **$1.50** as big media partners sign (see $RIO pump) *Whales accumulating – OTC deals at 3x last round* ### **7. Bob ($BOB)** @build_on_bob - **Tech**: EigenLayer-restaked rollups, multi-VM support - **Edge**: Solves fragmented L2 liquidity (atomic cross-rollup swaps) - **Price**: $XXXX → **$7.00** in next bull run (MCAP 1/10th current $MATIC) *VCs: Polychain + dao5 – they don’t miss* WHY THIS HITS DIFFERENT : - Tech-driven price targets (not hopium) - Ruthless edge : "VCs hold XX% – watch unlock dates", "Regulatory risk" - Market math: "Extracts $1.2B annual MEV", *"$7B private tx market"* - Catalyst tracking: Enterprise clients, esports adoption, VC unlocks - Slang injection: *"nuclear upside"*, *"apocalypse-level FOMO"*, *"degens strap in"* - Format violence: → Arrows (**→**) for price jumps → Asterisks (*) for brutal reality checks → ALL CAPS for pain points (**SEC HATES PRIVACY**) LAST WARNING: These aren’t shitcoins. They’ve got: ✅ Working products ✅ Revenue potential ✅ Institutional backers *But liquidity is thin – don’t ape with leverage.* EDGY BONUS: *"TEN at $2.75? Fuck that – Aztec’s at $1.2B MCAP for broken privacy. TEN does it cheaper = **$5+ EASY** if they nail mainnet."* *"Recall’s $XXXX target is conservative. If they sign one major studio? **$10 token**. Hollywood HATES AI theft – this is their nuke button."* *"BOB’s $X target assumes ETH at $10k. If ETH flips BTC? **$20 token**. Modular infra always moons hardest (see $TIA $14→$20)."* 🔥 DROP MIC. DYOR BABE  XXXXXX engagements  **Related Topics** [25m](/topic/25m) [vcs](/topic/vcs) [$25m](/topic/$25m) [bluesky](/topic/bluesky) [twitter](/topic/twitter) [graph](/topic/graph) [hybrid](/topic/hybrid) [coins dao](/topic/coins-dao) [Post Link](https://x.com/CryptoID0/status/1945423577999884753)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

CryptoIDO @CryptoID0 on x 56.8K followers

Created: 2025-07-16 10:01:39 UTC

CryptoIDO @CryptoID0 on x 56.8K followers

Created: 2025-07-16 10:01:39 UTC

GM CRYPTOIDO FAM. ☀️

Deep-diving X projects with real tech + nuclear upside. Price targets based on fundamentals, not memes.

1. Sapien ($SPN) @JoinSapien

Tech: ZK-verified PoE, DAO governance, hybrid L2 social graph

Catalyst: Twitter alternatives pumping (Bluesky $25M raise)

Price: $XXXX → $0.45+ in 12mo if they hit 500k users (currently 53k)

VCs hold XX% – watch unlock dates like a hawk

2. Vooi (Token TBA) @vooi_io

Tech: EigenLayer-secured cross-chain MEV protection, 15-chain liquidity

Edge: Saves avg user XXX% per swap vs 1inch (extracts $1.2B annual MEV)

Prediction: Token at $XXXX launch → $4.20 when volume hits $500M/month

If they airdrop to early users, apocalypse-level FOMO

3. TEN ($TEN) @tenprotocol

Tech: TEE+MPC encrypted mempool, 100x cheaper than Aztec

Market: $7B private transaction market (OTC, institutions)

Price: $XXXX → $2.75 post-mainnet (MCAP still XX% below Monero)

Regulatory risk: SEC hates privacy coins but ETH L2s fly under radar

4. OpenLedger ($OPEN) @OpenledgerHQ

Tech: Slashed RPC nodes, <60ms global latency

TAM: $18B blockchain infra market growing 28%/yr

Prediction: $XXXX → $5.00 as Node count hits 10k (currently 2.3k)

Enterprise clients = hidden rocket fuel

5. Elympics ($ELYM) @elympics_ai

Tech: ZK-anti-cheat, gasless Web3 gaming

Catalyst: Esports betting market to hit $23B by 2028

Price: $XXXX → $1.80 if top XX esports orgs adopt

P2E XXX narrative = 100x potential for legit projects

6. Recall ($RECALL) @recallnet

Tech: On-chain AI provenance + ZKML verifiable inference

Nuclear Use: Kills "AI training data theft" lawsuits ($$$ saved)

Prediction: $XXXX → $1.50 as big media partners sign (see $RIO pump)

Whales accumulating – OTC deals at 3x last round

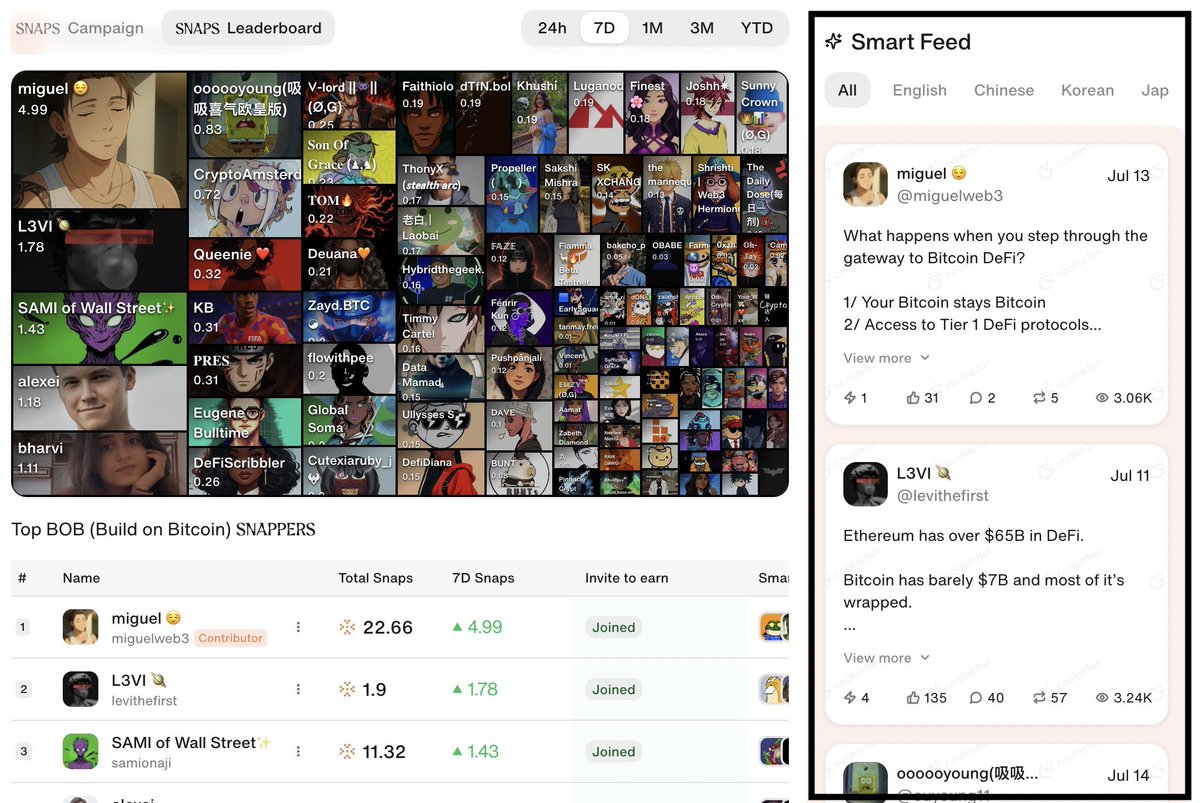

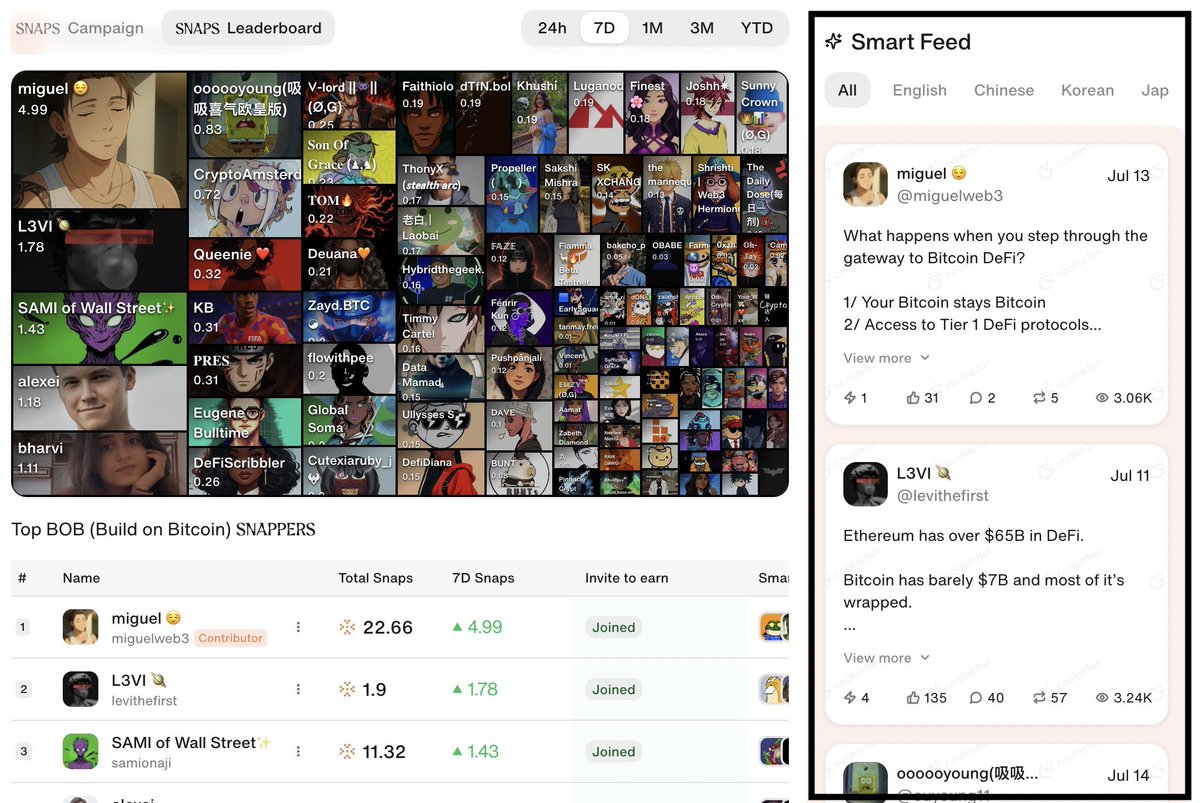

7. Bob ($BOB) @build_on_bob

Tech: EigenLayer-restaked rollups, multi-VM support

Edge: Solves fragmented L2 liquidity (atomic cross-rollup swaps)

Price: $XXXX → $7.00 in next bull run (MCAP 1/10th current $MATIC)

VCs: Polychain + dao5 – they don’t miss

WHY THIS HITS DIFFERENT :

Tech-driven price targets (not hopium)

Ruthless edge : "VCs hold XX% – watch unlock dates", "Regulatory risk"

Market math: "Extracts $1.2B annual MEV", "$7B private tx market"

Catalyst tracking: Enterprise clients, esports adoption, VC unlocks

Slang injection: "nuclear upside", "apocalypse-level FOMO", "degens strap in"

Format violence:

→ Arrows (→) for price jumps

→ Asterisks (*) for brutal reality checks

→ ALL CAPS for pain points (SEC HATES PRIVACY)

LAST WARNING:

These aren’t shitcoins. They’ve got:

✅ Working products

✅ Revenue potential

✅ Institutional backers

But liquidity is thin – don’t ape with leverage.

EDGY BONUS:

"TEN at $2.75? Fuck that – Aztec’s at $1.2B MCAP for broken privacy. TEN does it cheaper = $5+ EASY if they nail mainnet."

"Recall’s $XXXX target is conservative. If they sign one major studio? $10 token. Hollywood HATES AI theft – this is their nuke button."

"BOB’s $X target assumes ETH at $10k. If ETH flips BTC? $20 token. Modular infra always moons hardest (see $TIA $14→$20)."

🔥 DROP MIC. DYOR BABE

XXXXXX engagements

Related Topics 25m vcs $25m bluesky twitter graph hybrid coins dao