[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Jim [@JP_Money_95630](/creator/twitter/JP_Money_95630) on x 4740 followers Created: 2025-07-16 04:20:06 UTC $SPY July 15th, 2025 💰 Premium Breakdown Net Premium (From Chart): Calls: -$10.7M → Net sellers Puts: +$18.1M → Net buyers ➤ Total Net Premium: +$7.36M into puts ✅ This aligns with Grok's call: bearish sentiment in premium flow. 🧠 Notable Trades – Large Aug XX and Sep XX puts: 25K Aug XX $575P 25K Aug XX $565P 20K Aug XX $607P 18K Sep XX $540P 15K Aug XX $600P 10K Oct XX $555P Implied Vols (IVs): mostly mid-teens to low 20s = hedging, not panic Many >5% OTM puts = "crash insurance" flavor → Grok nails this interpretation. ⚠️ Nuance: Hedging vs. Speculation XX% of put volume bought on the ask (buyers = demand for protection) But also: 211K+ puts sold >5% OTM, so some dealers may be writing premium too. This could be pre-earnings/CPI + 7/18 Put Wall risk hedges. 🔴 Puts (Red) plotted downward to highlight downside protection/hedging 🟢 Calls (Green) plotted upward to reflect bullish exposure Data aggregates across all expirations from today's notable flow 📌 Key Observations: Heaviest Put OI: Strikes $565, $575, $XXX Modest Call OI: Strikes $595, $598, $626, $XXX  XXX engagements  **Related Topics** [spy](/topic/spy) [$555p](/topic/$555p) [10k](/topic/10k) [$600p](/topic/$600p) [$540p](/topic/$540p) [$607p](/topic/$607p) [$565p](/topic/$565p) [$575p](/topic/$575p) [Post Link](https://x.com/JP_Money_95630/status/1945337624295792931)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Jim @JP_Money_95630 on x 4740 followers

Created: 2025-07-16 04:20:06 UTC

Jim @JP_Money_95630 on x 4740 followers

Created: 2025-07-16 04:20:06 UTC

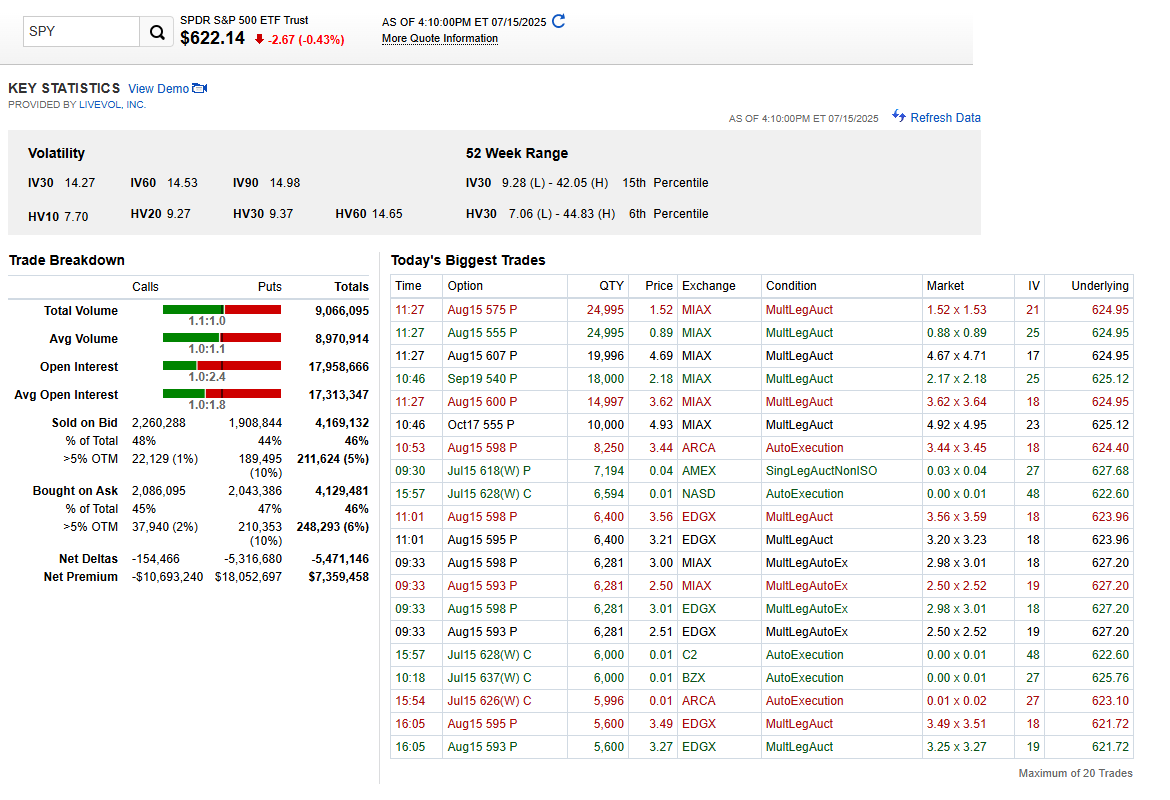

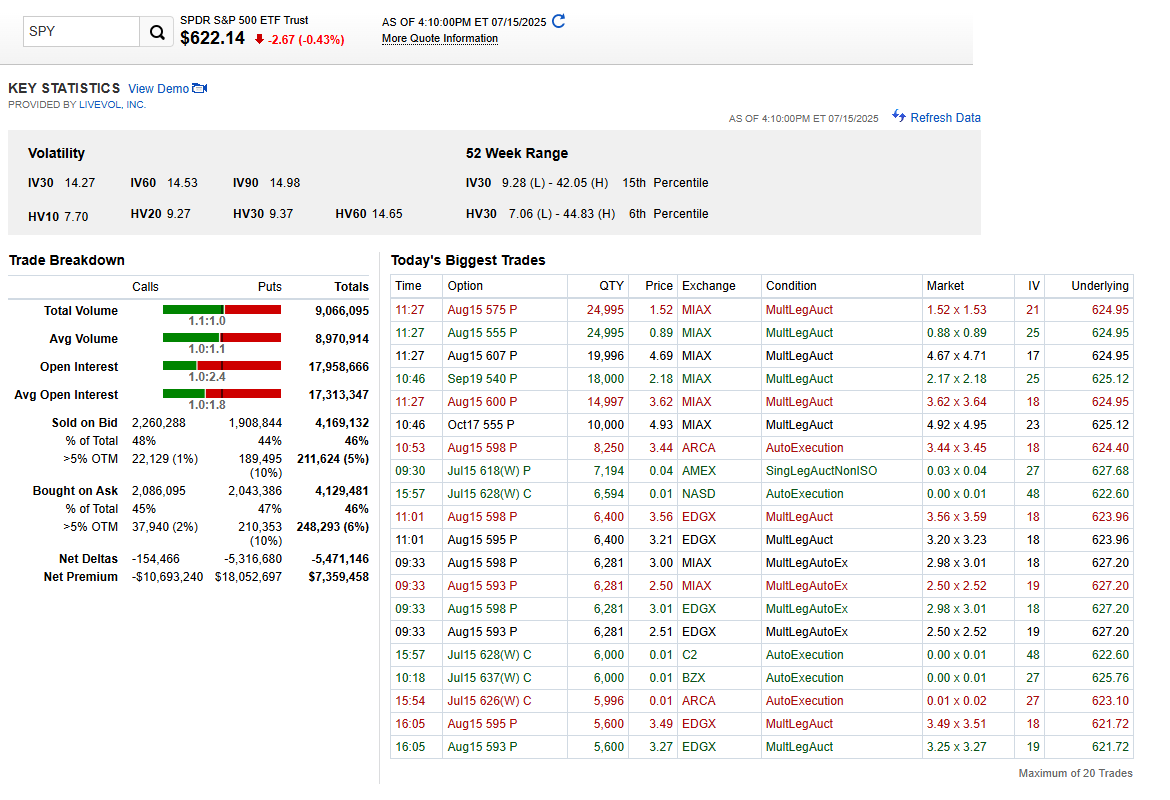

$SPY July 15th, 2025

💰 Premium Breakdown

Net Premium (From Chart):

Calls: -$10.7M → Net sellers Puts: +$18.1M → Net buyers

➤ Total Net Premium: +$7.36M into puts

✅ This aligns with Grok's call: bearish sentiment in premium flow.

🧠 Notable Trades –

Large Aug XX and Sep XX puts:

25K Aug XX $575P 25K Aug XX $565P 20K Aug XX $607P 18K Sep XX $540P 15K Aug XX $600P 10K Oct XX $555P

Implied Vols (IVs): mostly mid-teens to low 20s = hedging, not panic

Many >5% OTM puts = "crash insurance" flavor → Grok nails this interpretation.

⚠️ Nuance: Hedging vs. Speculation

XX% of put volume bought on the ask (buyers = demand for protection)

But also: 211K+ puts sold >5% OTM, so some dealers may be writing premium too.

This could be pre-earnings/CPI + 7/18 Put Wall risk hedges.

🔴 Puts (Red) plotted downward to highlight downside protection/hedging

🟢 Calls (Green) plotted upward to reflect bullish exposure

Data aggregates across all expirations from today's notable flow

📌 Key Observations:

Heaviest Put OI: Strikes $565, $575, $XXX

Modest Call OI: Strikes $595, $598, $626, $XXX

XXX engagements