[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  MarketMaestro [@MarketMaestro1](/creator/twitter/MarketMaestro1) on x 27.5K followers Created: 2025-07-16 02:04:07 UTC $MP My Apr XX Post 👇 Make America Mine Again I agree with the views in this article. Rare earth element companies, as well as steel and aluminum companies, will benefit from the Trump administration in the long run. Seeking Alpha – MP Materials Is Just Getting Started Leo Nelissen Investment Group "Summary • MP Materials has long-term growth potential due to its unique position in the rare earth supply chain and geopolitical advantages. • The company’s vertically integrated model and strong ties with the U.S. government make it a critical player in terms of economic security and national defense. • Despite cyclical headwinds, MP Materials’ strong balance sheet and strategic partnerships position it well for future demand and potential growth. • I am highly optimistic about MP Materials and expect a multi-year uptrend supported by geopolitical dynamics and industrial restructuring efforts. Introduction Since President Trump’s “Liberation Day” press conference, it would be fair to say the country is in a trade war. Although the panic phase may be behind us, the U.S. and China are still locked in intense conflict. China instructed airlines to suspend deliveries of Boeing Company (BA) jets. Both countries have continued to raise tariffs against each other, sparking fears of a full-blown trade embargo. In this context, I’d like to share a screenshot from Google News. It perfectly illustrates the importance of having strong supply chains in a trade war. As you can see below, three weeks ago a report emerged that China had outpaced the U.S. in access to critical rare earth minerals and refining capacity. Then, two weeks later, China reportedly leveraged this advantage — causing MP Materials Corp. (NYSE: MP) shares to soar more than XX% in a single day. This is a perfect example of how geopolitics, supply chains, and macroeconomics (my three pillars of research) are interconnected. As a result, MP shares have risen XX% since the publication of my December X article titled “MP Materials: Mission Critical And Ready To Double.” This appears to be the start of a very long uptrend. I’m using this article to update my thesis. Trade Wars and Critical Minerals Rare earths have been a hot topic for years. A few months ago, they were part of the Ukraine negotiations. President Trump wanted a deal that would give the U.S. access to Ukraine’s commodity resources. At that time, Bloomberg created the chart below, which clearly shows China’s dominance in the sector. But that’s only a small part of the story. The issue isn’t just having the resources — China’s dominance in rare earth refining is even greater, refining about XX% of the world’s rare earth materials. Even though the U.S. is a global superpower, China has built a huge share in critical supply chains beyond rare earths over the past few decades: The U.S. losing its refining capacity to China is just one example of how America’s deindustrialization has benefited its main geopolitical rival. The U.S. has nearly stopped producing key products like container ships, certain pharmaceutical ingredients, and specialized machine tools — because it’s cheaper and more efficient to make them abroad, particularly in China. – WSJ As a result, while the U.S. produces about XX% of global rare earth supply, two-thirds of that volume is sent to China for refining. Even worse (for America), these resources are then turned into finished products in China. Applications that rely on these minerals include fighter jets, robotics, magnets, thermal control, high-resolution displays, and energy storage — all “mission critical” technologies. That’s why China may weaponize its dominance in a trade war. Last week, it did just that: New regulations now require Chinese exporters of certain critical rare earths — like dysprosium, key to magnet production — to get government approval. This gives Beijing the power to delay or block sales. These restrictions could also be used against U.S. allies like Japan, which is the world’s second-largest producer of rare earth magnets after China. – WSJ In a swift response, the U.S. reacted. Financial Times reported that the president plans to stockpile deep-sea critical metals in response to China. These potato-sized nodules, formed under high pressure over millions of years on the ocean floor, contain trace amounts of rare earth minerals along with nickel, cobalt, copper, and manganese — used in batteries, cables, and munitions. They could be added to existing federal crude oil and metal reserves. The U.S. is aiming to become self-sufficient in these critical minerals. The Trump administration pressured Ukraine into a minerals agreement, threatened to seize Greenland and annex Canada, and announced measures to boost domestic production. – Financial Times This is great news for MP Materials. Why MP Materials Is Still in a Great Position MP Materials doesn’t mine in the ocean. But that’s not a problem — the key takeaway from Financial Times is that America will start placing much greater importance on rare earths. Rare earths aren’t actually rare — they’re just very expensive to extract. The company operating the Mountain Pass mine is the only scaled rare earth mining firm in the U.S., with a mission to build a full end-to-end rare earth supply chain domestically. In a February investor/analyst presentation, the company updated its supply chain and highlighted its biggest advantage: a fully integrated supply chain from high-grade ore extraction at Mountain Pass to chemical processing, metal refining, and magnet production. The magnet plant in Fort Worth, Texas, is the first of its kind in the U.S., capable of producing sintered neodymium-iron-boron (NdFeB) magnets without any foreign input. According to the company, this facility — developed in partnership with General Motors Company (GM) — is designed to help re-shore EV supply chains. NdFeB is used across many supply chains. The company can also recycle rare earth scrap from magnet production and feed it back into upstream processes. Importantly, it also has the ability to scale up quickly: “We are producing XXXXX tons at this facility with GM as our core customer. Within the same four walls, we can double our production capacity. And from a fully vertically integrated perspective, combining our upstream and midstream output, we could be XX times larger.” – MP I also believe pricing will support the stock. Although aggressive efforts to find new mines may expand global supply, the supply-demand outlook remains favorable for the company. Despite some cyclical headwinds, demand remains strong. In its latest earnings call, the company announced new deals with the Department of Defense for NdPr and lanthanum and secured a major volume commitment from one of the top five global automakers. As a result, the company now supplies three of the top five non-Chinese automakers. This could incentivize more companies to shift production to the U.S. A stronger domestic supply chain would make it easier for the current administration to reposition automakers. The company also owns one of the world’s lowest-cost mines. This means that lower prices would hurt foreign competitors more than MP. If competitors shut down, MP could stabilize prices before it’s affected. MP also has a strong balance sheet with $XXX million in cash and short-term investments. On the debt side, it has $XXX million in long-term debt, most of which matures after 2029. The company is so confident in its balance sheet and business that it bought back X% of its shares since the beginning of 2024, despite the headwinds. Valuation is hard to judge — it depends on whether the U.S. and other countries can avoid a recession. If we experience a global cyclical recovery, especially if trade restrictions affect the flow of these materials, rare earth metals could see significant growth. According to FactSet data below, MP lost $XXXX per share last year. This year’s loss is expected to be $XXXX. The company is expected to become profitable again in 2026, with projected EPS of $XXXX by 2027. In my previous article, I applied a 30x multiple to reflect aggressive long-term growth. That currently implies a fair stock price of $XX — XX% above the current price. That’s my base case. In the longer term, I expect a major EPS expansion, as the company’s current capacity is far below its long-term potential and government initiatives may pull demand forward. I remain very bullish! Conclusion In a world where supply chains are increasingly weaponized, MP Materials is one of the few American companies in the right place at the right time. Thanks to its vertically integrated model, deep ties to the U.S. government, and unique role in rebuilding domestic rare earth capacity, I don’t consider this company just a speculative bet. It’s much more than that — it’s a long-term play on economic security, industrial restructuring, and national defense. The recent rally in the stock reinforces the importance of connecting geopolitical dots early — exactly what my research aims to do. That’s why I’m highly optimistic and believe this is just the beginning of a strong, multi-year uptrend. Risks to My Thesis MP is a highly volatile mining company. It is exposed to operational risks, pricing risks, geopolitical headlines, and demand risks. If you’re not looking for high-potential cyclical companies, do not buy MP Materials. Since I focus more on low-risk dividend stocks, I currently have no long position in MP." Technical Analysis: As you can see, around $27, there’s volume resistance, Fibonacci resistance, and supertrend resistance and it stalled right at this critical confluence. I agree with the views in the article. The kind of revolution Trump wants will lift companies like this and real production companies in America such as those in aluminum and steel over the long term. I expect continued upside in these types of companies for the long run.  XXXXX engagements  **Related Topics** [longterm](/topic/longterm) [investment](/topic/investment) [leo](/topic/leo) [donald trump](/topic/donald-trump) [united states](/topic/united-states) [$mp](/topic/$mp) [Post Link](https://x.com/MarketMaestro1/status/1945303399362101736)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

MarketMaestro @MarketMaestro1 on x 27.5K followers

Created: 2025-07-16 02:04:07 UTC

MarketMaestro @MarketMaestro1 on x 27.5K followers

Created: 2025-07-16 02:04:07 UTC

$MP My Apr XX Post 👇

Make America Mine Again

I agree with the views in this article. Rare earth element companies, as well as steel and aluminum companies, will benefit from the Trump administration in the long run.

Seeking Alpha – MP Materials Is Just Getting Started

Leo Nelissen Investment Group

"Summary • MP Materials has long-term growth potential due to its unique position in the rare earth supply chain and geopolitical advantages. • The company’s vertically integrated model and strong ties with the U.S. government make it a critical player in terms of economic security and national defense. • Despite cyclical headwinds, MP Materials’ strong balance sheet and strategic partnerships position it well for future demand and potential growth. • I am highly optimistic about MP Materials and expect a multi-year uptrend supported by geopolitical dynamics and industrial restructuring efforts. Introduction Since President Trump’s “Liberation Day” press conference, it would be fair to say the country is in a trade war. Although the panic phase may be behind us, the U.S. and China are still locked in intense conflict. China instructed airlines to suspend deliveries of Boeing Company (BA) jets. Both countries have continued to raise tariffs against each other, sparking fears of a full-blown trade embargo. In this context, I’d like to share a screenshot from Google News. It perfectly illustrates the importance of having strong supply chains in a trade war. As you can see below, three weeks ago a report emerged that China had outpaced the U.S. in access to critical rare earth minerals and refining capacity. Then, two weeks later, China reportedly leveraged this advantage — causing MP Materials Corp. (NYSE: MP) shares to soar more than XX% in a single day. This is a perfect example of how geopolitics, supply chains, and macroeconomics (my three pillars of research) are interconnected. As a result, MP shares have risen XX% since the publication of my December X article titled “MP Materials: Mission Critical And Ready To Double.” This appears to be the start of a very long uptrend. I’m using this article to update my thesis.

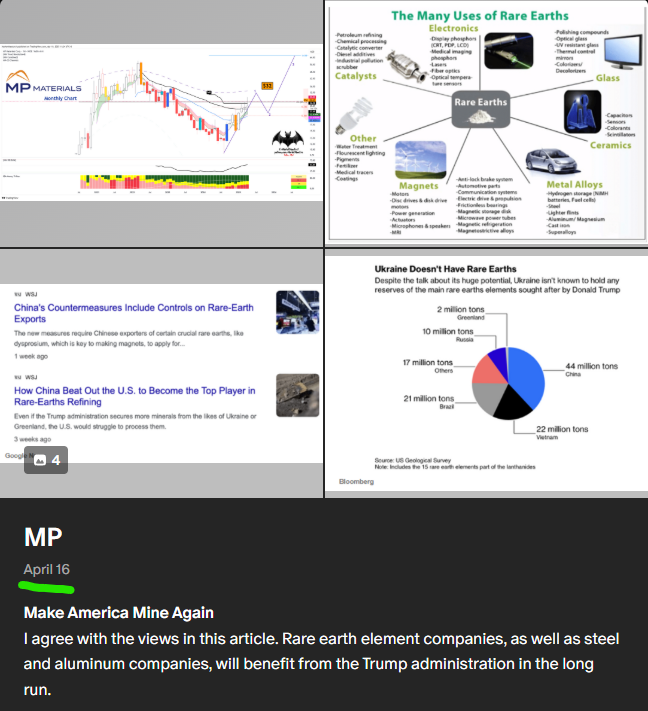

Trade Wars and Critical Minerals Rare earths have been a hot topic for years. A few months ago, they were part of the Ukraine negotiations. President Trump wanted a deal that would give the U.S. access to Ukraine’s commodity resources. At that time, Bloomberg created the chart below, which clearly shows China’s dominance in the sector. But that’s only a small part of the story. The issue isn’t just having the resources — China’s dominance in rare earth refining is even greater, refining about XX% of the world’s rare earth materials. Even though the U.S. is a global superpower, China has built a huge share in critical supply chains beyond rare earths over the past few decades: The U.S. losing its refining capacity to China is just one example of how America’s deindustrialization has benefited its main geopolitical rival. The U.S. has nearly stopped producing key products like container ships, certain pharmaceutical ingredients, and specialized machine tools — because it’s cheaper and more efficient to make them abroad, particularly in China. – WSJ As a result, while the U.S. produces about XX% of global rare earth supply, two-thirds of that volume is sent to China for refining. Even worse (for America), these resources are then turned into finished products in China. Applications that rely on these minerals include fighter jets, robotics, magnets, thermal control, high-resolution displays, and energy storage — all “mission critical” technologies. That’s why China may weaponize its dominance in a trade war. Last week, it did just that: New regulations now require Chinese exporters of certain critical rare earths — like dysprosium, key to magnet production — to get government approval. This gives Beijing the power to delay or block sales. These restrictions could also be used against U.S. allies like Japan, which is the world’s second-largest producer of rare earth magnets after China. – WSJ In a swift response, the U.S. reacted. Financial Times reported that the president plans to stockpile deep-sea critical metals in response to China. These potato-sized nodules, formed under high pressure over millions of years on the ocean floor, contain trace amounts of rare earth minerals along with nickel, cobalt, copper, and manganese — used in batteries, cables, and munitions. They could be added to existing federal crude oil and metal reserves.

The U.S. is aiming to become self-sufficient in these critical minerals. The Trump administration pressured Ukraine into a minerals agreement, threatened to seize Greenland and annex Canada, and announced measures to boost domestic production. – Financial Times This is great news for MP Materials. Why MP Materials Is Still in a Great Position MP Materials doesn’t mine in the ocean. But that’s not a problem — the key takeaway from Financial Times is that America will start placing much greater importance on rare earths. Rare earths aren’t actually rare — they’re just very expensive to extract. The company operating the Mountain Pass mine is the only scaled rare earth mining firm in the U.S., with a mission to build a full end-to-end rare earth supply chain domestically. In a February investor/analyst presentation, the company updated its supply chain and highlighted its biggest advantage: a fully integrated supply chain from high-grade ore extraction at Mountain Pass to chemical processing, metal refining, and magnet production. The magnet plant in Fort Worth, Texas, is the first of its kind in the U.S., capable of producing sintered neodymium-iron-boron (NdFeB) magnets without any foreign input. According to the company, this facility — developed in partnership with General Motors Company (GM) — is designed to help re-shore EV supply chains. NdFeB is used across many supply chains. The company can also recycle rare earth scrap from magnet production and feed it back into upstream processes. Importantly, it also has the ability to scale up quickly: “We are producing XXXXX tons at this facility with GM as our core customer. Within the same four walls, we can double our production capacity. And from a fully vertically integrated perspective, combining our upstream and midstream output, we could be XX times larger.” – MP I also believe pricing will support the stock. Although aggressive efforts to find new mines may expand global supply, the supply-demand outlook remains favorable for the company. Despite some cyclical headwinds, demand remains strong. In its latest earnings call, the company announced new deals with the Department of Defense for NdPr and lanthanum and secured a major volume commitment from one of the top five global automakers. As a result, the company now supplies three of the top five non-Chinese automakers. This could incentivize more companies to shift production to the U.S. A stronger domestic supply chain would make it easier for the current administration to reposition automakers. The company also owns one of the world’s lowest-cost mines. This means that lower prices would hurt foreign competitors more than MP. If competitors shut down, MP could stabilize prices before it’s affected. MP also has a strong balance sheet with $XXX million in cash and short-term investments. On the debt side, it has $XXX million in long-term debt, most of which matures after 2029. The company is so confident in its balance sheet and business that it bought back X% of its shares since the beginning of 2024, despite the headwinds. Valuation is hard to judge — it depends on whether the U.S. and other countries can avoid a recession. If we experience a global cyclical recovery, especially if trade restrictions affect the flow of these materials, rare earth metals could see significant growth. According to FactSet data below, MP lost $XXXX per share last year. This year’s loss is expected to be $XXXX. The company is expected to become profitable again in 2026, with projected EPS of $XXXX by 2027. In my previous article, I applied a 30x multiple to reflect aggressive long-term growth. That currently implies a fair stock price of $XX — XX% above the current price. That’s my base case. In the longer term, I expect a major EPS expansion, as the company’s current capacity is far below its long-term potential and government initiatives may pull demand forward. I remain very bullish!

Conclusion In a world where supply chains are increasingly weaponized, MP Materials is one of the few American companies in the right place at the right time. Thanks to its vertically integrated model, deep ties to the U.S. government, and unique role in rebuilding domestic rare earth capacity, I don’t consider this company just a speculative bet. It’s much more than that — it’s a long-term play on economic security, industrial restructuring, and national defense. The recent rally in the stock reinforces the importance of connecting geopolitical dots early — exactly what my research aims to do. That’s why I’m highly optimistic and believe this is just the beginning of a strong, multi-year uptrend. Risks to My Thesis MP is a highly volatile mining company. It is exposed to operational risks, pricing risks, geopolitical headlines, and demand risks. If you’re not looking for high-potential cyclical companies, do not buy MP Materials. Since I focus more on low-risk dividend stocks, I currently have no long position in MP."

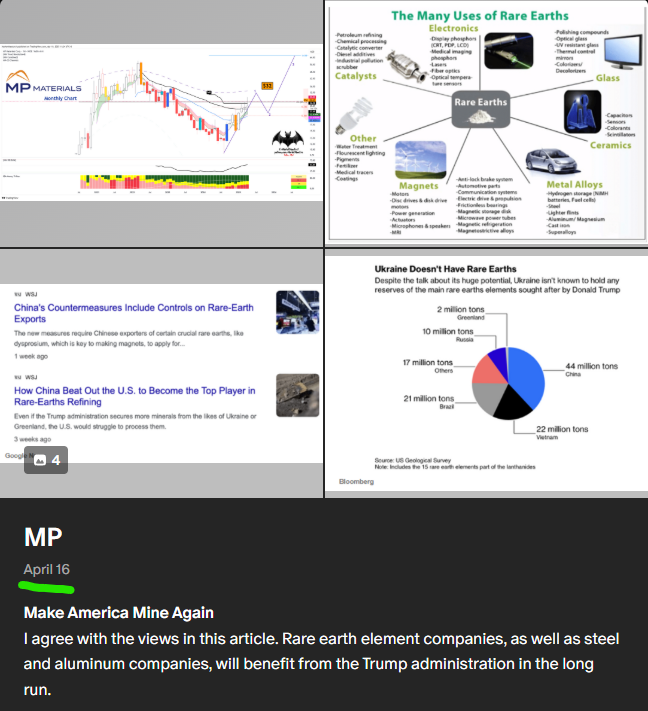

Technical Analysis:

As you can see, around $27, there’s volume resistance, Fibonacci resistance, and supertrend resistance and it stalled right at this critical confluence. I agree with the views in the article. The kind of revolution Trump wants will lift companies like this and real production companies in America such as those in aluminum and steel over the long term. I expect continued upside in these types of companies for the long run.

XXXXX engagements

Related Topics longterm investment leo donald trump united states $mp